May retail sales showed continued strength

15 Jun. 2023 | Comments (0)

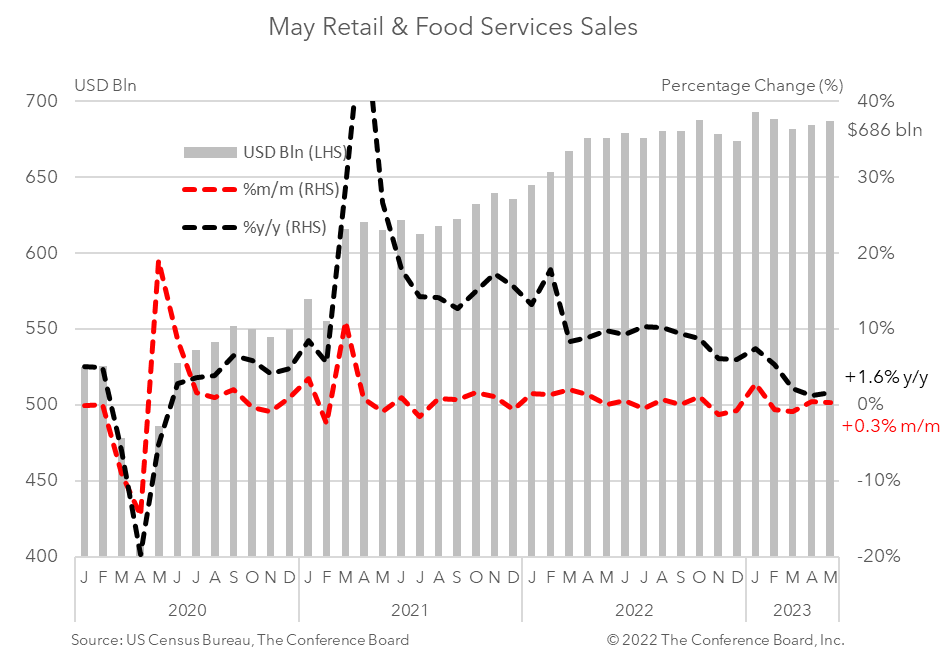

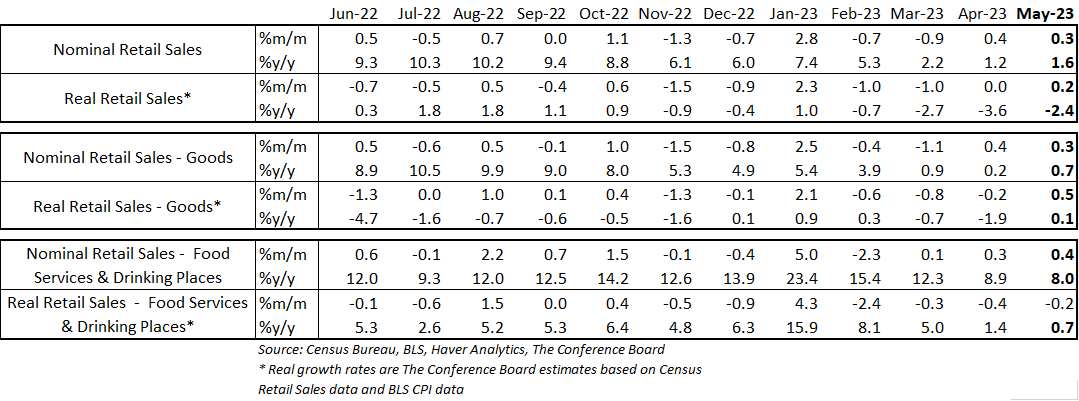

Retail sales rose in May in both nominal and real terms. Total sales rose by 0.3 percent month-over-month, well above the consensus expectation of -0.2 percent. Adjusted for inflation, sales were up 0.2 percent.*

These data show continued momentum in consumer spending. Following back to back negative readings in February and March we now have two consecutive months of gains. When adjusting these data by CPI inflation, the growth rate drops somewhat but continues to show positive momentum. These readings are consistent with our Q2 2023 GDP forecast of 0.6 percent. Consumers are benefiting from wage gains associated with tight labor markets and resisting headwinds emanating from high inflation and interest rates. Additionally, excess savings from the pandemic period have fortified household balance sheets—although these savings are dwindling. We expect US consumer spending to begin to buckle over the summer period and for US GDP to slip into negative territory starting in Q3 2024.

Consumer demand for goods rose 0.3 percent in May from the month prior in nominal terms. Spending on motor vehicles and parts rose by 1.4 percent in May from April, while retail sales excluding motor vehicles rose by just 0.1 percent. Spending at gasoline stations fell 2.6 percent from the month prior due to weaker oil prices. Building materials sales rose by 2.2 percent. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.2 percent from the previous month. When adjusting goods spending for CPI inflation, the real growth rate was about 0.5 percent from the previous month.*

Meanwhile, spending at food services and drinking places rose by 0.4 percent month-over-month in May. After adjusting for CPI inflation the real growth rate was about -0.2 percent from the previous month.*

* Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy