Fed Policy Reaction - FOMC Participants Blink

16 Jun. 2021 | Comments (0)

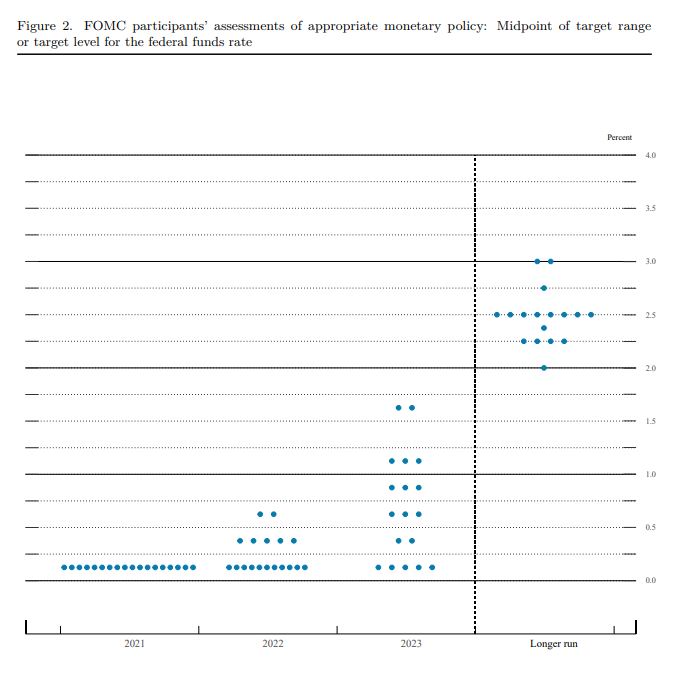

Fed officials accelerated expectations of rate hikes amid robust, albeit heavily policy supported, GDP growth and a strengthening labor market. The “dots plot” now anticipates two rate hikes by the end of 2023 from none back in March. The conditions of “substantial further progress” towards the employment and inflation mandates remain unmet in the FOMC’s view, meaning there was no discussion of scaling back Large-Scale Asset Purchases (LSAP or Quantitative Easing (QE)). Still, the cracks in the FOMC’s façade were potentially forming at Wednesday’s June FOMC meeting regarding growing concerns about inflation and the possibility of beginning discussions about tapering near term.

Unsurprisingly, FOMC participants raised their expectations for both US GDP growth (in 2021) and inflation (in 2021 and 2022) in the Summary of Economic Projections (SEP), reflecting robust economic growth and rising prices for both goods and services. Participants still continue to believe that most upward inflationary pressures are transitory, and, we presume, should fade once households return to a more balanced diet of goods and services consumption. Still Chair Powell stated in the post-statement press conference that prices have risen “notably” and may remain elevated with uncertain timing of when inflation gauges will cool.

Indeed, likely mounting concerns about overheating and rising long-term consumer inflation expectations, the latter of which Powell noted, prompted an upward shift in the “dots plot” of forecasts for when the first rate hike is to take place. The median expectation is for two hikes in 2023 from none in the last meeting. In total, 13 participants anticipated hikes by end 2023 and seven by end 2022. This is all against a backdrop of roughly 7.6 million jobs still not reclaimed from nonfarm payrolls, and a variety of labor market indicators that still show labor market slack for various demographic groups, including women, Black and Latino workers, the less educated, and the lower skilled. Potentially, the advent of severe labor shortages and the possibility that all jobs may not be recouped amid a pandemic-wave of retirements means the Fed believes that it is closer to achieving its employment mandate.

Powell stated that the FOMC needs more time to receive data regarding achievement of the “substantial further progress” for beginning LSAP tapering. Still, markets largely expect that tapering will occur before rate hikes, with a 6-month lead time between taper announcement and the start of actual reduction in purchases. While rate hikes still remain in the distant future according to the FOMC SEP, the timing of LSAP tapering likely has moved up for some participants, given the shift in expectations for rate hikes. The minutes of Wednesday’s meeting will be crucial to see for gauging if the Fed is really on the cusp of a taper announcement or not.

See FOMC statement here. See SEP here.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

0 Comment Comment Policy