Inflation intensified in January but spending cooled

29 Feb. 2024 | Comments (0)

Consumer spending was muted in January and progress on inflation stalled in the month. Personal incomes spiked, but after accounting for inflation and taxes there was no gain in real disposable personal income. PCE inflation data showed a worrisome intensification, but the Fed has warned that the path to its 2% inflation target would be lumpy and bumpy. We continue to believe this target will be achieved this summer and that the Fed will begin to cut rates starting in June.

Highlights

Collectively, these data showed an economy that cooled somewhat as it struggles to slay inflation. Following robust holiday spending, inflation adjusted consumer spending was muted in January. This occurred despite a spike in nominal personal income, which shot up due to increases in government social benefits (large social security COLA adjustments) and gains on assets. However, after adjusting for inflation and taking out taxes the gain in real personal disposable incomes was flat for the month. Meanwhile, personal savings rates remained depressed and personal interest payments on non-mortgage debt continued to rise – eroding consumer spending power. We continue to expect that US consumers will have to pull back on spending as they rebalance their priorities on spending, savings, and debt.

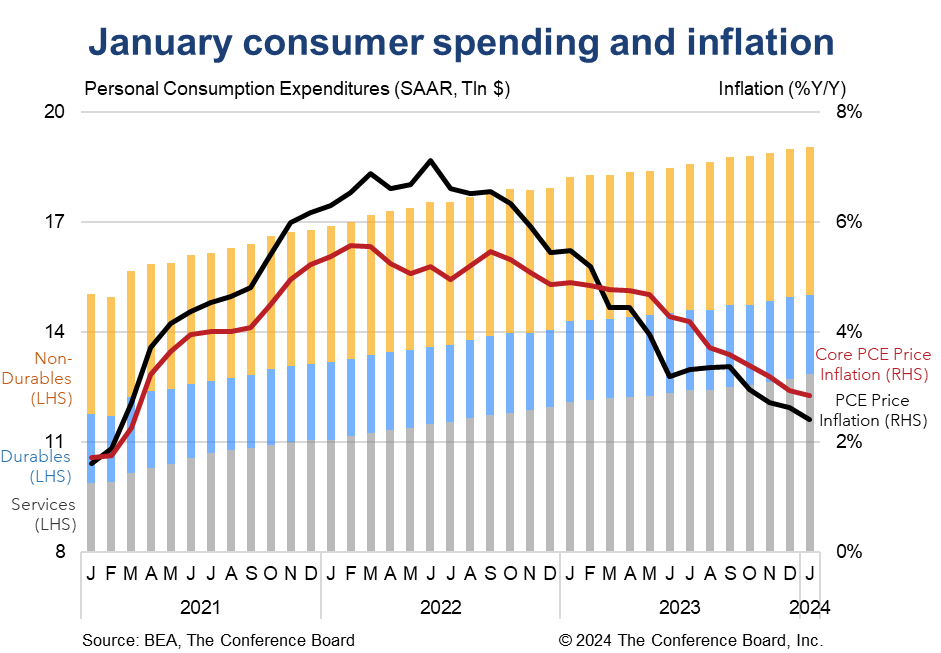

On inflation, the January PCE deflators came is as expected – hotter. While both the headline and core inflation readings ticked down in year-on-year terms, the pickup in the month-on-month trend is concerning. Specifically, the core PCE deflator, which excludes volatile food and energy prices, rose by 0.4% m/m. This was the hottest reading since January 2023. Federal Reserve Chair Powell has said that the path to the Fed’s 2% inflation target would be “lumpy and bumpy” and he appears to be right. We continue to believe that the Fed will meet its inflation goal this summer and begin to lower interest rates in June.

Inflation

Headline PCE price inflation slowed to 2.4% y/y in January, vs. 2.6% y/y in December while core PCE price inflation (which excludes food and energy) slowed to 2.8% y/y, vs. 2.9% y/y. On a month-over-month basis, headline PCE inflation increased to 0.3% from 0.1% and core PCE inflation rose to 0.4% from 0.1%. Prices for goods fell 0.2% m/m and services rose 0.6% m/m. Food prices rose 0.5% m/m, but energy prices fell 1.4% m/m. Among services, housing, food, and financial services inflation spiked, as did other services like hotels, clothing, and personal care.

Incomes

Overall personal income rose by 1.0% m/m (in nominal terms) in January, vs. 0.3% m/m in December. When factoring in inflation, the real month-over-month growth rate was 0.7% m/m. In year-over-year terms, real personal income rose 2.4% in January, vs. 2.1% in December. Meanwhile, real disposable personal income (which is personal income less taxes) rose by 0.0% m/m, vs. 0.2% m/m in December. Finally, the savings rate rose to 3.8% from 3.7% of disposable personal income.

Interest Payments

Personal interest payments (PIP), which represent nonmortgage interest paid by households, rose 1.8% m/m in January, vs. 0.1% m/m in December. However, in year-over-year terms these payments are up 38% (vs. a peak of 66.5% y/y in June 2023). Consumer’s growing reliance on debt, and specifically credit card debt, and the surge in interest rates over the last two years are responsible for these gains. As of January, PIP accounted for 2.8% of overall Disposable Personal Income. Rates this high have not been seen since 2007.

Spending

Personal consumption expenditures rose by 0.2% m/m (in nominal terms) in January, vs. 0.7% m/m percent in December. Spending on services rose by 1.0% m/m while spending on goods fell 1.2% m/m. After accounting for inflation, real consumer spending was down 0.1% m/m in January with spending on services rising 0.4% m/m and spending of goods falling 1.1% m/m.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy