Global Outlook Downgraded as Recession Probabilities Rise

27 Jun. 2022 | Comments (0)

Downgrading the Global Outlook as Recession Probabilities Rise

Further Downgrades to Global Outlook

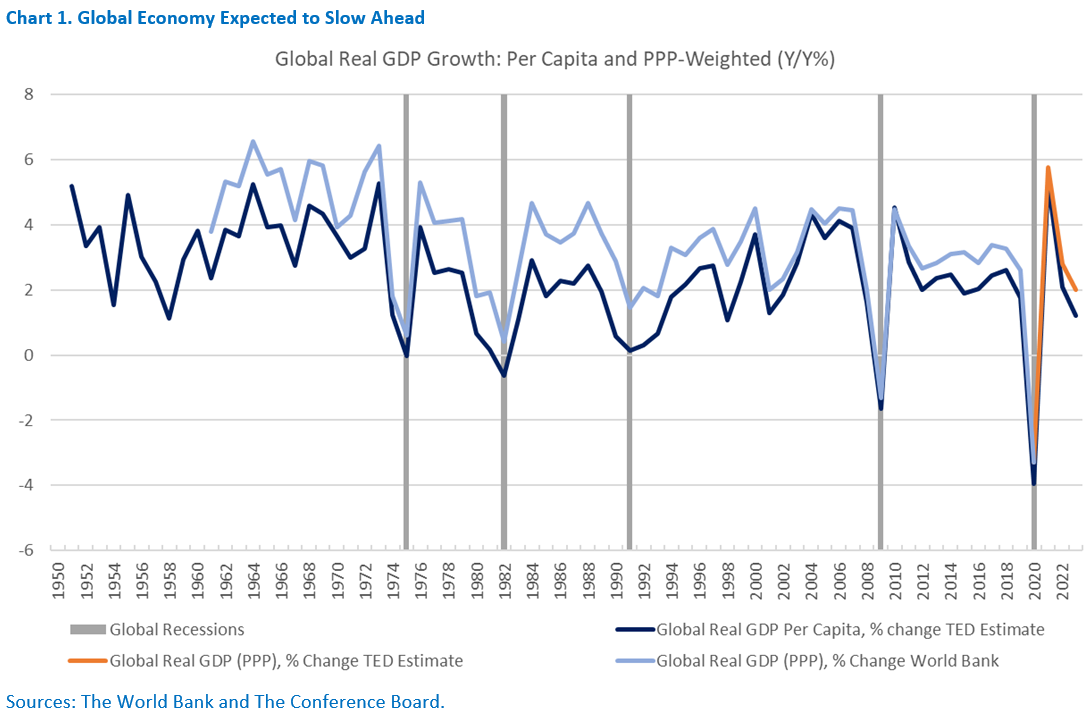

The Conference Board now forecasts global GDP growth of 2.8 percent for 2022 and 2 percent for 2023. This is a downgrade of 0.1ppt and 0.3ppt in 2022 and 2023, respectively. The global growth environment has rapidly deteriorated in recent months most notably with the ongoing war in Ukraine, persistent inflation and tightening global financial conditions. While a global recession is not in our baseline scenario, the global economy is likely to move ever closer to recessionary territory (Chart 1). A global recession is defined as global GDP growth well below 2 percent or negative global per capita income growth. In the postwar period this occurred only five times: in the late 70s, early 80s, early 90s, during the global financial crisis of 2008/09 and during the pandemic recession. The Conference Board forecasts global income to grow by 1.2 percent in 2023, well below the average of the last decade but it will not contract (see The Conference Board Global Economic Outlook).

US Recession Now Likely

The Conference Board forecasts that US economic growth will slow over the course of this year and that a shallow recession will occur in late 2022 and early 2023. This downgrade to our outlook is associated with persistent inflation and rising hawkishness by the Federal Reserve. The periods immediately before and after the recession are likely to exhibit stagflationary characteristics. Stagflation is a period of very low growth and high inflation (see The Conference Board Economic Forecast for the US Economy).

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global …

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

-

About the Author:Klaas de Vries

The following is a bio of a fomer employee/consultant Klaas de Vries is a Senior Economist with The Conference Board. He closely follows developments in the global economy and researches the structur…

0 Comment Comment Policy