Fed holds rates steady, but says cuts are on the horizon

31 Jan. 2024 | Comments (0)

Insights for What’s Ahead

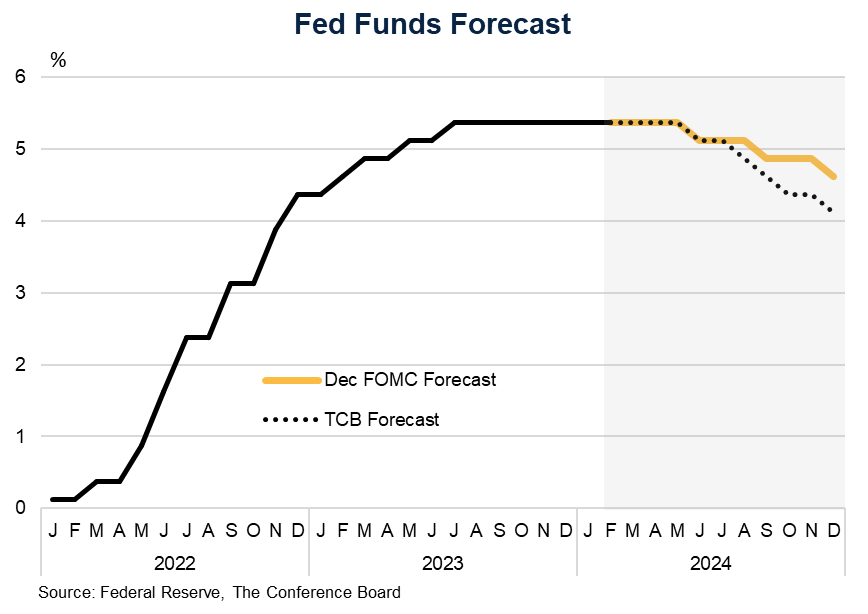

- As expected, the Federal Open Market Committee (FOMC) kept interest rates steady at their January 31 meeting, but positioned itself to start lowering rates in the future. However, Chair Powell said cuts were unlikely to come at the conclusion of the FOMC’s March meeting. We think the first cut will come in June 2024.

- While Chair Powell said the economy is in a “good situation” broadly, he does not believe that the Fed has achieved a soft landing yet. He said that he expects economic growth to moderate and has for some time.

- Since launching its tightening campaign in early 2022, the Fed has reduced its security holdings by $1.3 trillion. While the runoff will continue as planned in the short term, the Fed will discuss its balance sheet policies in greater depth at the March FOMC meeting.

Highlights

On the economy, Chair Powell said that growth was “solid to strong” in 2023 but that he expects it to moderate. Overall, he sounded pleased about developments in the labor market, which he described as softening but strong. Powell said that the 12 month inflation rate remains well above where it needs to be, but that it has slowed substantially over the last six months. He stated that the Fed is confident that inflation is moving toward 2%.

Even with this progress the Fed is not ready to begin scaling back tight monetary policy. Chair Powell said that the decision to begin making cuts is highly consequential and the Fed is in “risk management” mode. The Fed is concerned that loosening policy too soon or too quickly could hamper additional progress on inflation or even reverse it. Indeed, the FOMC statement said that the Fed needs “greater confidence that inflation is moving sustainably toward 2 percent” before it begins to make cuts.

On timing, no clear guidance was provided about when policy will begin to loosen. The Fed remains data dependent, per Powell. However, he did say that it is unlikely that the FOMC would decide to cut rates at its next meeting in March. Powell also said that the Fed’s balance sheet runoff would continue, but that an “in-depth discussion” of the balance sheet would occur at the next meeting.

Today’s actions were unanimously approved by the members of the Federal Open Market Committee.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy