Possible Freight Rail Strike Would Upend Supply Chain

13 Sep. 2022 | Comments (0)

A U.S. freight rail strike could begin on Friday, September 16th at the end of a 60-day cooling off period if railroads and union labor do not come to an agreement. In anticipation of a possible shutdown, freight railroads this week are halting acceptance and transport of hazardous cargo. Tentative agreements have been reached with a majority of labor unions, however the two remaining unions who have not agreed to a deal represent half of the nation’s rail workers—and so any strike would have a widespread effect, wreaking havoc on the supply chain and furthering inflationary pressures. All seven Class 1 railroads, short line rail companies, and even passenger rail in the U.S. would be affected. If unions strike more than 7,000 trains would be idle, impacting 40% of the nation’s long-distance freight movement across all industries. Since World War II only 12 days have been lost to U.S. rail strikes, and none in the last 30 years, as Congress has the power to quickly pass back-to-work legislation, per the Railway Labor Act. Main sticking points of negotiation are reportedly about workers’ ability to take time off, not wage increases. Railroad companies are experiencing crew shortages, putting engineers and conductors on call seven days per week. In addition, unions oppose railroads’ plans to cut crews from two-people down to one.

Insights for What’s Ahead

- If a strike occurs, Congress is likely to intervene very quickly—as it did during the last rail strike in 1992 when the work stoppage only lasted two days. The 1992 strike began with just one union representing CSX Transportation employees stopping work and resulted in a national shutdown, due to the interconnectedness of the system.

- The Association of American Railroads (AAR) projects that a nationwide railway strike could cost the economy $2 billion a day, in a report released last week. AAR’s analysis updates data from a 1992 Federal Railroad Administration econometric study. The short 1992 strike was estimated at the time to cost $1 billion a day in lost wages and industry productivity.

- There is little businesses can do to prepare for a strike, other than call on Congress to take immediate action, as the only viable alternative mode is long-haul trucking. This would require an additional 467,000 trucks per day, according to AAR, and there is a current shortage of 80,000 drivers, according to the American Trucking Associations, as well as trucking equipment. In addition, many heavy commodities are not truck friendly, and such modal pivots take time.

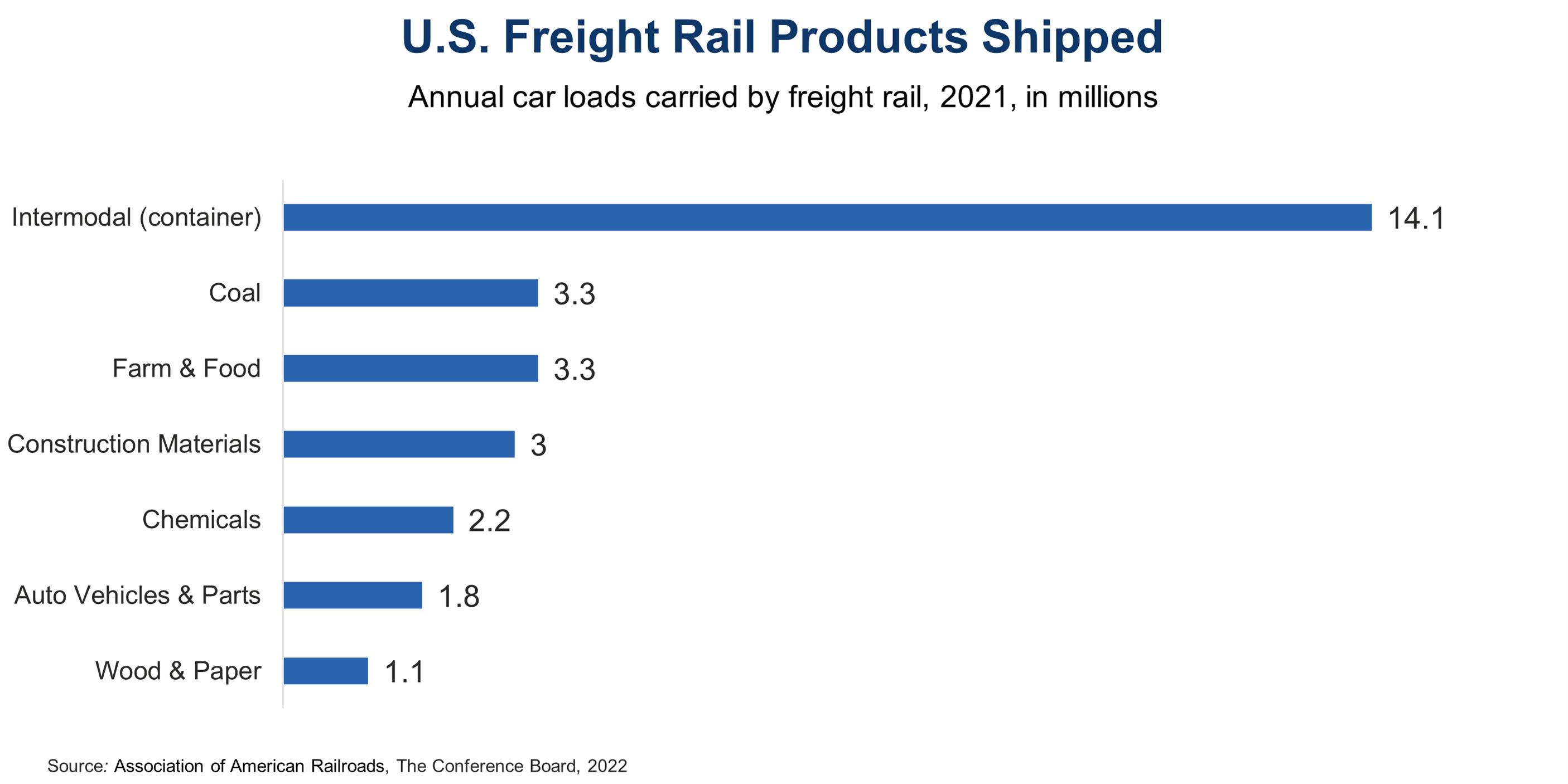

- Industries that would be most impacted are intermodal (container) shipping, coal, agriculture/food, chemicals, paper/lumber, and automotive. Intermodal shipping relates to nearly all industries, including most consumer goods. Freight rail carries more than 14 million intermodal container units per year, connecting to ports and truck depots, with most carrying consumer products.

- Passenger rail service in the U.S. would be impacted, as freight railroads own and maintain nearly 97% of the tracks on Amtrak’s 22,000-mile system.

-

About the Author:Erin McLaughlin

Erin McLaughlin is a Senior Economist at The Conference Board in the Economy, Strategy and Finance (ESF) Center. Within ESF, Erin focuses on a new area of TCB research: Energy, Infrastructure & En…

0 Comment Comment Policy