PCE Shows Consumers Stocking Up ahead of Potential Tariffs

31 Jan. 2025 | Comments (0)

Consumer spending ended 2024 on a strong note, while inflation picked up, confirming our expectation that the Fed will remain firmly on hold in coming months.

Trusted Insights for What’s Ahead®

- Recent stickiness in inflation readings above the Fed’s 2-percent target suggest patience on the part of the Fed regarding further interest rate cuts.

- Robust growth in spending in December and upward revisions to November data suggest there was some pulling forward of growth from 2025.

- Nevertheless, inflation-adjusted after-tax income growth was positive confirming that consumer finances remain healthy and will likely continue to drive economic growth this year.

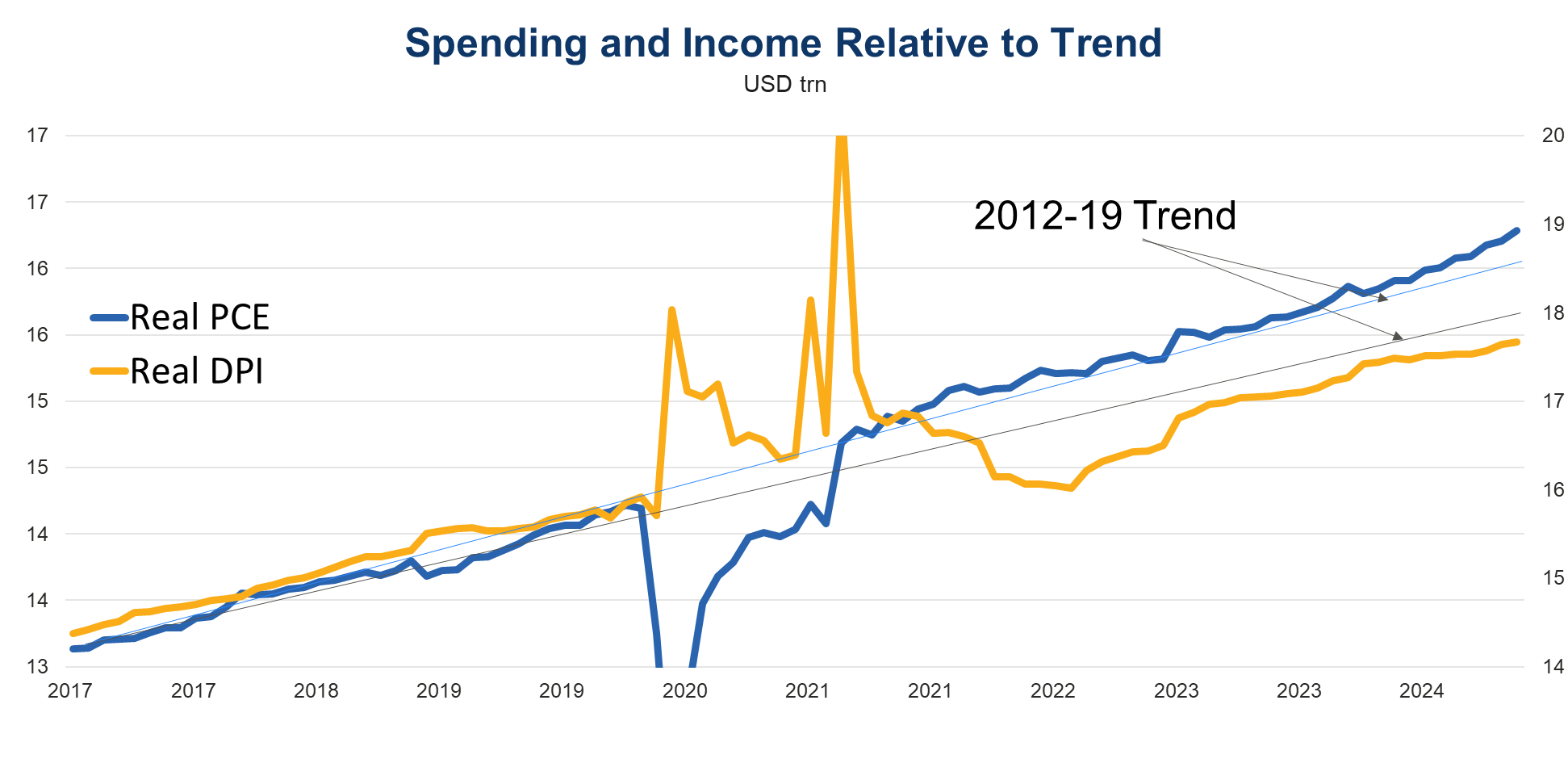

Figure 1. Spending Remains Elevated Relative to Trend

Sources: Bureau of Economic Analysis and The Conference Board.

Report Highlights

The Bureau of Economic Analysis revealed that total Personal Consumption Expenditure (PCE) deflator inflation rose in December, while both core and market-based core inflation gauges remained unchanged year-over-year. Meanwhile, nominal household income continued to grow faster than inflation, while consumers spent at a faster rate at year-end pushing the savings rate to a two-year low.

The composition of goods spending suggests consumers were likely stocking up ahead of anticipated price increases due to potential tariffs. This in turn may borrow growth from future strength.

Underlying inflation stalls

The total PCE price index rose by 0.3 percent month-over-month in December after increasing by 0.1 percent in November. Core PCE, which excludes food and energy from the total, rose slightly by 0.2 percent month-over-month, up from 0.1 percent prior. On a year-over-year basis, total PCE inflation picked up to 2.6 percent in December from 2.4 percent in November, while core PCE remained unchanged at 2.8 percent for a third consecutive month.

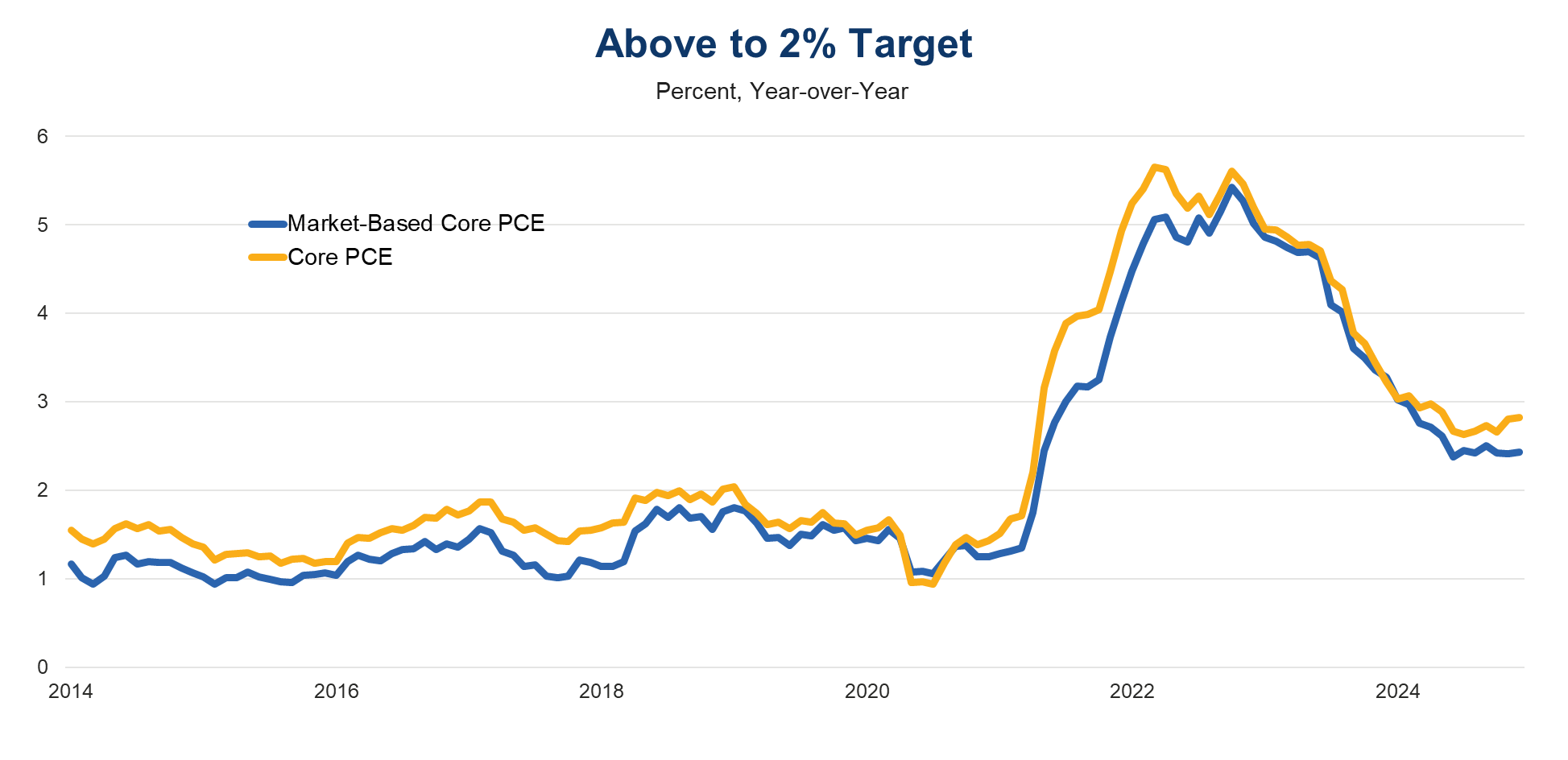

Inflation measures for prices that are easily measured and those that are estimated remain above the Fed’s 2% inflation target. Market-based core PCE, the index which measures directly observed prices (as opposed to imputed prices such as some housing and financial services costs) remained unchanged at 2.4 percent for a fourth month in a row (Figure 2). The recent stickiness in observed prices further supports our expectations for a prolonged pause with respect to policy rates.

Figure 2. Core Inflation Stuck above 2% Inflation Target

Sources: Bureau of Economic Analysis and The Conference Board.

Details of Consumer Spending Reveal Change in Behavior Ahead of Tariffs

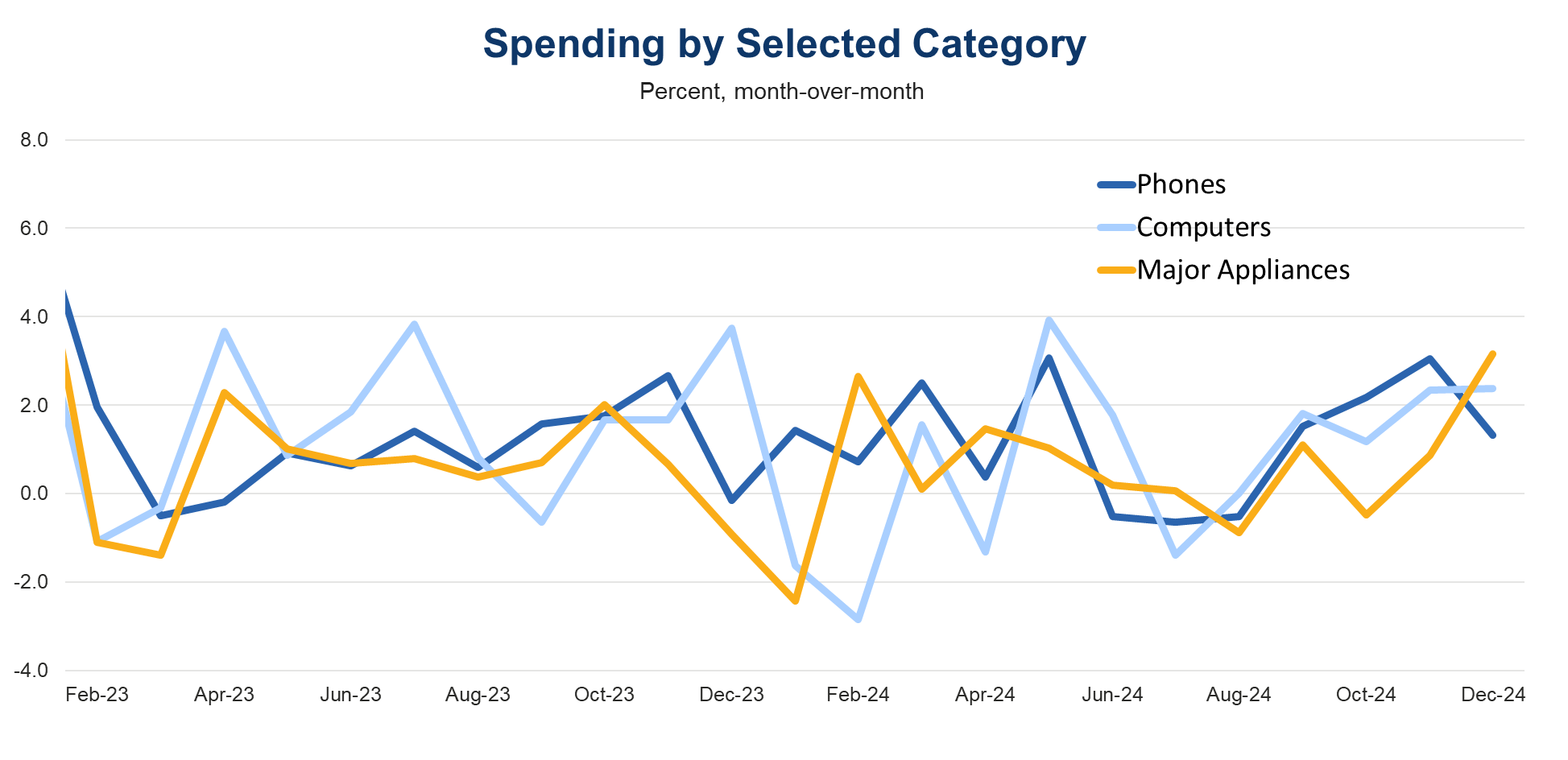

Nominal consumer spending jumped by 0.7 percent month-over-month in December on the back of an upwardly revised 0.6 percent gain in November (previously estimated at 0.4 percent). Real spending rose by 0.4 percent in December after a 0.5 percent increase in November. The details revealed robust increases in durable goods spending, namely in household appliances, computers and phones (Figure 3).

Figure 3. Stocking Up

Sources: Bureau of Economic Analysis and The Conference Board.

Wage Growth Remains Solid

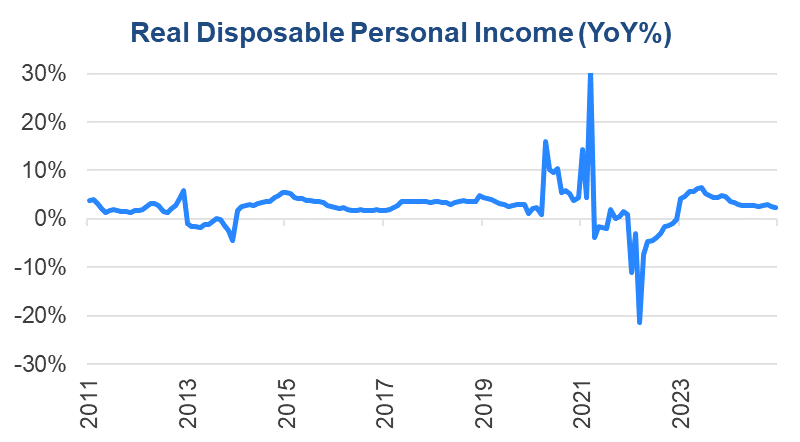

Nominal personal income grew by 0.4 percent in December, up from 0.3 percent prior. Wages and salaries growth remained solid at 0.4 percent on the back of 0.5 percent prior. Real disposable personal income (i.e., inflation-adjusted income after taxes) growth remains positive, although on a year-over-year basis it continues to normalize to a more sustainable pace, consistent with pre-covid norms. (Figure 4). As the normalization process continues, in line with our expectations, growth in personal spending will likely decelerate as well as the year progresses.

Figure 4. Spending Elevated Relative to Income

Sources: Bureau of Economic Analysis and The Conference Board.

-

About the Author:Yelena Shulyatyeva

Yelena Shulyatyeva is a Senior US Economist for The Conference Board Economy, Strategy & Finance Center, where she focuses on analyzing macroeconomic developments in order to better understand the…

0 Comment Comment Policy