Retail sales stumbled in December

18 Jan. 2023 | Comments (0)

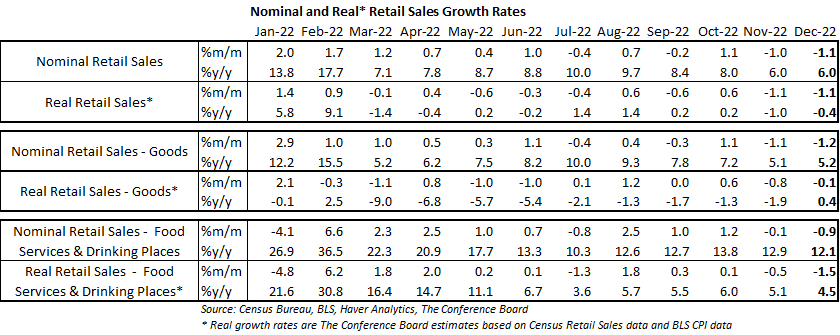

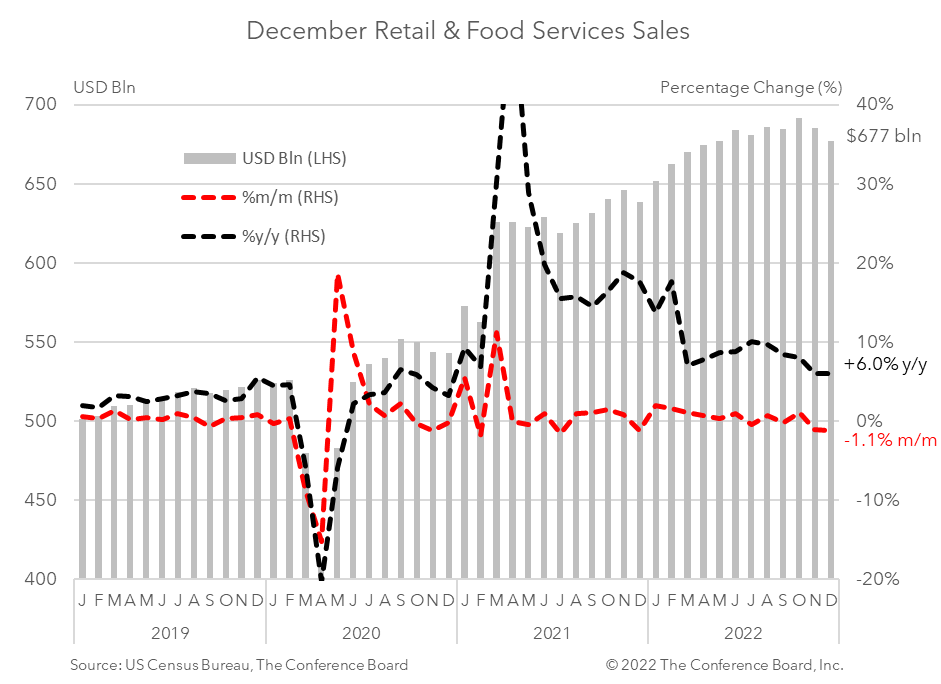

Retail sales stumbled in December, closing out the holiday season on a weak note. Sales fell 1.1 percent month-over-month, but were up 6.0 percent from a year earlier in nominal terms. While auto sales fell for a second month, spending at department stores and at gas stations led the decline in December. Even when adjusting for inflation, which was roughly flat month-over-month in December, sales dropped 1.1 percent.* Looking ahead, we expect consumer spending to continue to contract as the US economy slips into recession early this year.

Our GDP forecast for Q4 2022 is consistent with this weaker data. We assume that overall real consumer spending (Personal Consumption Expenditures, or PCE) will contract by 0.5 percent month-over-month in December, vs. the contraction of 1.1 percent in real retail sales. Note that retail sales fail to capture consumer spending on many services – which have been performing better than spending on goods. Thus, December PCE shouldn’t be quite as weak as December Real Retail Sales. We expect Q4 2022 consumer spending to come in at about 2.7 percent quarter-over-quarter annualized and overall GDP to expand by about 1.9 percent.

Consumer demand for goods slipped in December — falling by 1.2 percent from the previous month in nominal terms. Spending on motor vehicles and parts fell by 1.2 percent in December from November, while retail sales excluding motor vehicles and parts also fell by 1.2 percent. Spending at gasoline stations fell 4.6 percent for the month on lower crude oil prices. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) fell 0.7 percent from the previous month. Online sales at non-store retailers fell 1.1 percent in December. When adjusting goods spending for CPI inflation the real growth rate was about -0.1 percent from the previous month.*

Meanwhile, spending at food services and drinking places fell -0.9 percent month-over-month, vs. -0.1 percent in November. However, after adjusting for CPI inflation the real growth rate was about -1.5 percent from the previous month.*

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy