March Retail Sales Rise, but Inflation Undermines Impact

14 Apr. 2022 | Comments (0)

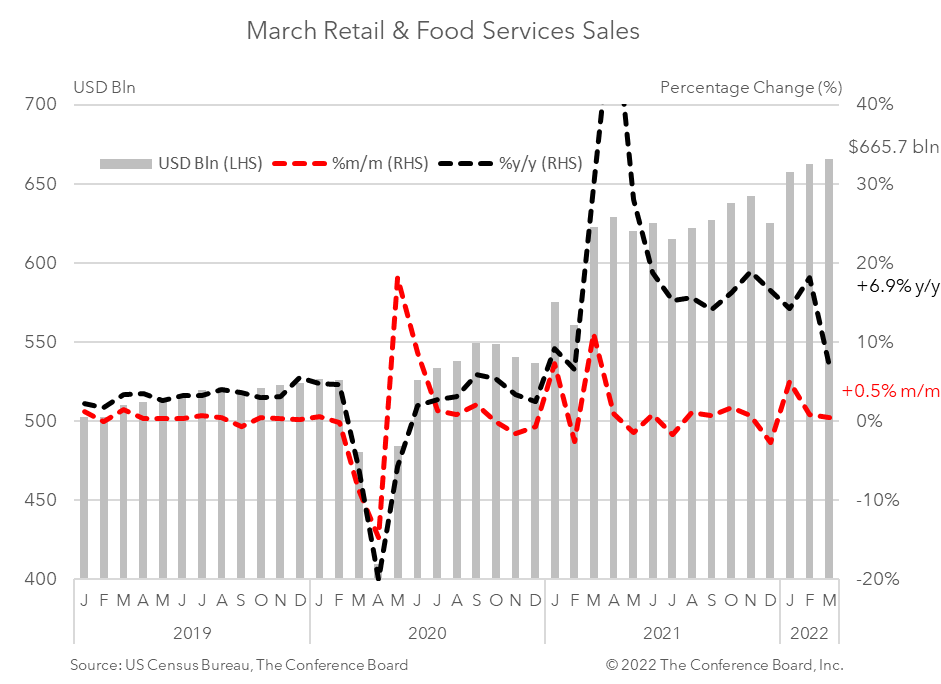

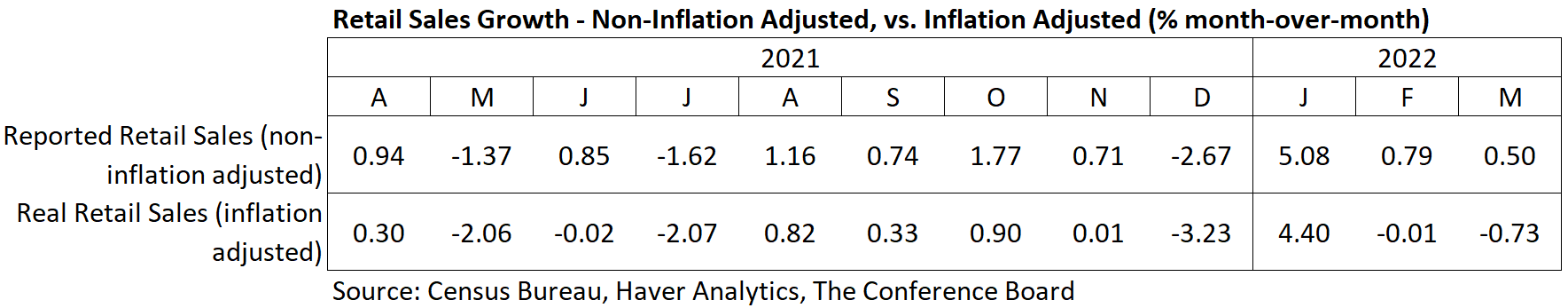

Retail spending in March rose by $3.3 billion to $665.7 billion for the month—up 0.5 percent from the previous month and up 6.9 percent from a year earlier. Adjusted for CPI inflation, which clocked in at another 40-year high in March, sales were down 0.7 percent month-over-month. This is the second consecutive month of weakness in real retail sales.

In non-inflation adjusted terms, spending at food services and drinking places was the primary driver of growth in March—rising 1.0 percent from the previous month. Falling COVID-19 cases bolstered consumers’ willingness to reengage in-person services. Looking forward, we expect spending at food service and drinking places to continue to strengthen over the coming months.

Meanwhile, demand for goods rose more modestly in March— rising just 0.4 percent from the previous month. Spending on motor vehicles and parts fell 1.9 percent in March from February, while retail sales excluding this important category rose by 1.1 percent month-over-month. Spending at gasoline stations rose 8.9 percent for the month as crude oil prices surged. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) were down 0.1 percent from the previous month. Spending at non-store retailers dropped 6.4 percent in March after falling 3.5 percent in February. These internet-based retailers saw a 21.2 percent pop in January due to consumer angst about in-person shopping in the midst of the Omicron wave.

We expect consumer spending growth to continue to pivot toward in-person services as worries about COVID-19 abate. However, this also likely means less outsized spending on goods. Additionally, we anticipate that high inflation—driven by rising energy and food prices related to the Ukraine Crisis and lingering supply chain disruptions amid the pandemic— will erode much of these gains in real terms. We expect real consumer spending to slow from 7.9 percent year-over-year in 2021 to 2.8 percent in 2022. This will limit overall economic growth in 2022.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy