2024 Salary Increase Budgets Stay Elevated

21 Sep. 2023 | Comments (0)

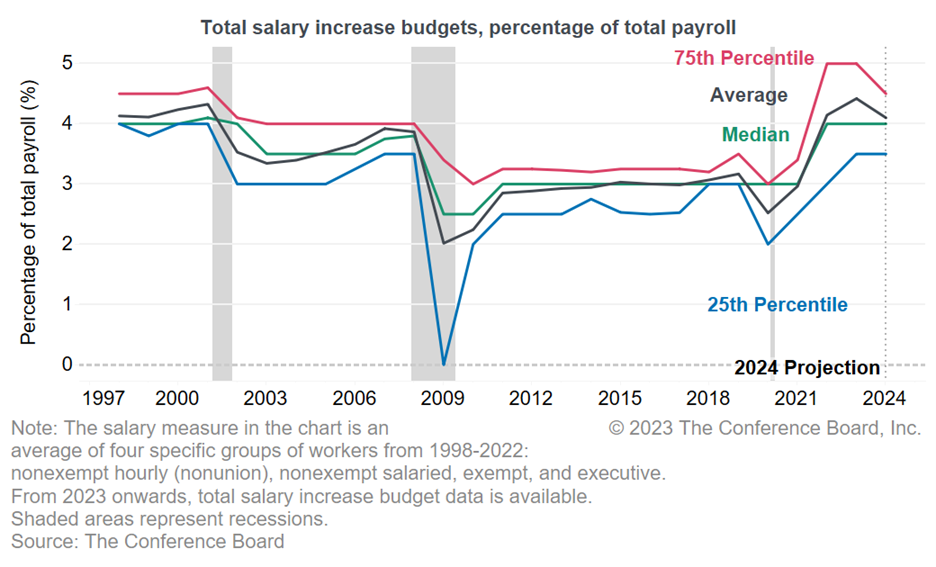

The Conference Board 2023–2024 US Salary Increase Budget Survey finds that US employers raised their total salary increase budgets for 2023 by 4.4 percent, the highest increase since 2001. Total salary increase budgets are projected to rise by 4.1 percent for 2024, on average, a small step down compared to 2023, but still elevated compared to prepandemic increases in salary budgets (see Chart 1).

INSIGHTS FOR WHAT’S AHEAD

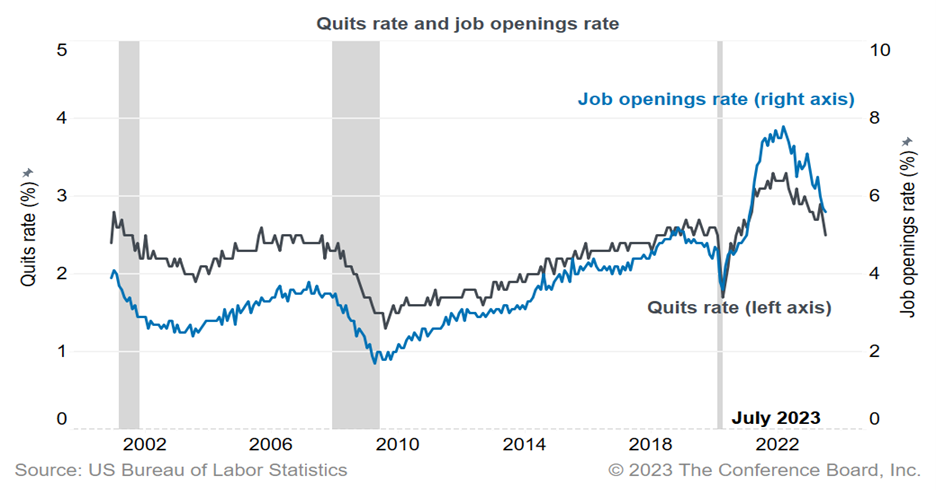

Wage growth will continue decelerating but remain above prepandemic levels in 2024. The labor market, while still very tight, is loosening with job openings gradually declining and fewer workers switching jobs than any time since February 2020 (Chart 2). The Conference Board forecasts that GDP growth will slow in the coming months and will turn negative in early 2024 leading to a short and shallow recession. With a shrinking economy, fewer companies will expand their workforce, yielding less competition for workers and reduced pressure to increase wages compared to the last three years.

Employers recognize the uncertainties ahead having lived through the recruitment and retention difficulties over the last three years. While total salary increase budgets are projected to rise by another 4.1 percent on average, the majority acknowledge their salary increase budgets are not yet firm for 2024. The 4.0 percent median remains the same as 2023, but the average dropped to 4.1 from the 4.4 percent actual 2023 budgets.

Companies may slow hiring new employees in the coming months, reducing the pressure to provide aggressive salary offers. Companies are opting to carefully manage compensation and staffing plans to retain their existing workforce, rather than resort to further layoffs amid concerns about future challenges in hiring after the economy recovers from a short recession. Consequently, the impact of an economic downturn on wages is expected to be limited. The highest salary increase budgets are projected to be much lower in 2024 compared to 2023, the 75th percentile dropped from 5.0 percent to 4.5 percent. However, median salary increase budget growth is expected to remain at an elevated rate of 4 percent, the same as in 2022 and 2023.

We will continue to see more companies taking a mixture of approaches to address changing labor markets and fluctuating economic conditions. To address highly sought after skills, some employers are taking special actions such as accelerating the timing of raises and adding off-cycle increases. At the same time, some companies, possibly expecting financial challenges ahead, are controlling costs by delaying the effective date of planned increases. A small percentage of companies are freezing actions for selected groups of employees: 6.3 percent of companies reported freezing increases for executive employees, 1.8 percent for exempt employees, 1.4 percent for non-exempt salaried employees, and 1 percent of non-exempt hourly salaried workers.

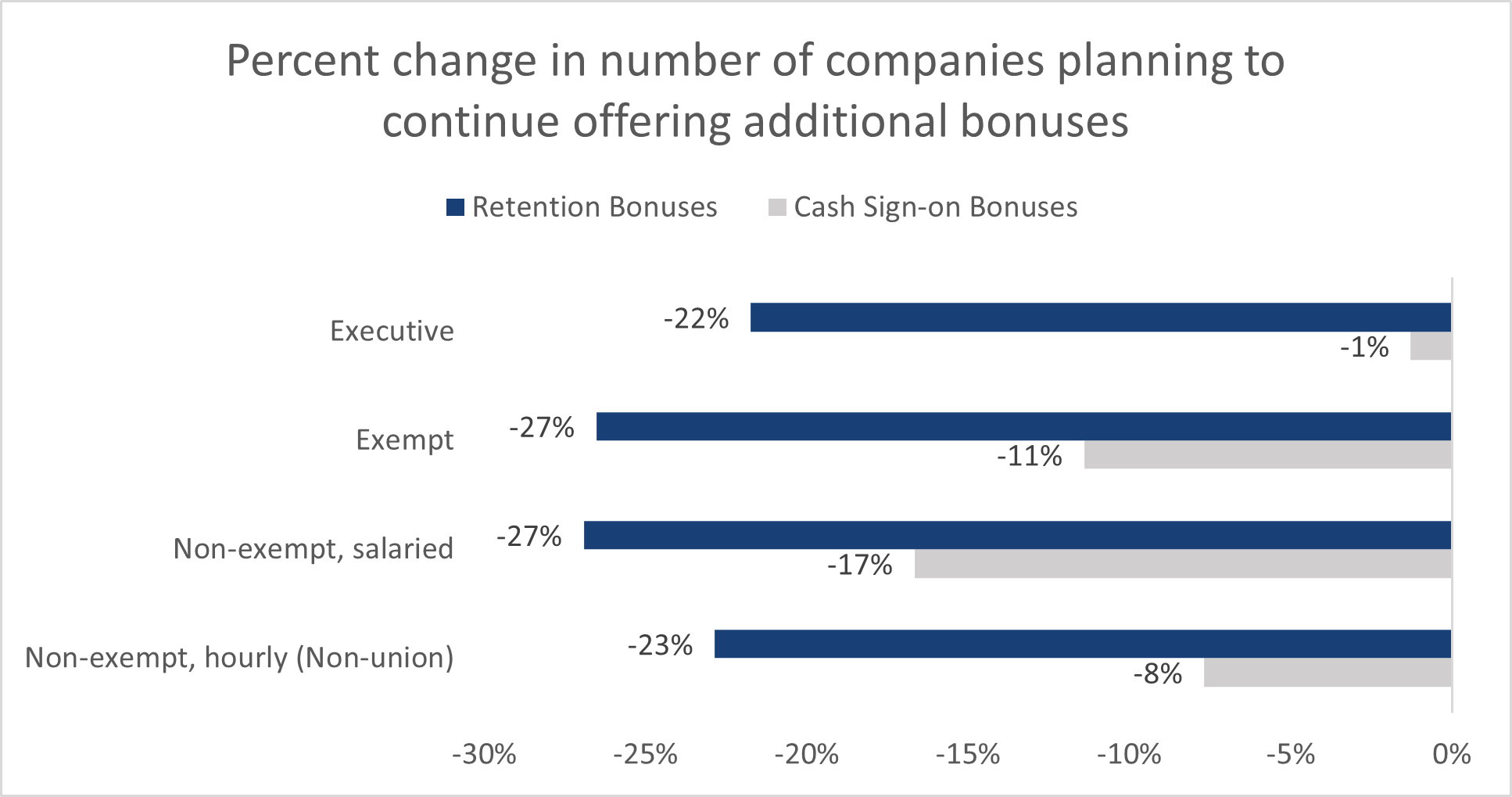

Salary increase budgets alone do not tell the full story. Employers plan to continue using other levers to address recruitment and retention challenges in 2024. In addition to base pay increases, employers are utilizing other vehicles in delivering competitive compensation to address economic uncertainty and employee priorities. Survey respondents report they plan to use sign-on bonuses and retention awards, albeit at a reduced rate. However, companies are continuing to expand inclusion of employees in short-term incentive plans and increase investment in recognition programs as they are also important levers. Nonetheless, with the declining number of job opportunities, we do not expect workers to change jobs as frequently as in the last three years, easing the need to use certain special compensation elements aggressively.

Labor shortages and robust wage growth are expected to be a long-term challenge for employers as the population continues to age. Our US economics team continues to anticipate a short and shallow recession in the US. Once the recession is over, firms will once again face labor shortages driven by long term demographic trends impacting the US labor market. Those trends including an aging population, low fertility, below replacement level immigration and stagnant labor force participation among youth and women. These factors will likely place upward pressure on wages, causing employee compensation to grow faster than experienced in the last decade.

CHART 1: Total Salary Increase Budgets for 2024 are projected to stay elevated compared to prepandemic levels

CHART 2: Workers have fewer outside opportunities. Job openings are declining whereas voluntary quits are back to February 2020 levels

Results from the Salary Increase Budgets survey are in line with other labor market data and show that whereas labor markets are still very tight, there are signs of loosening. Employment is still growing but at a reduced rate. Workers continue to switch to better jobs but are having a harder time finding a position that pays them significantly higher. Companies still face challenges attracting and retaining talent, but fewer companies are planning higher budgets as reported in 2023.

Companies are planning fewer special monetary actions to attract and retain talent. Employers report that while they will continue using other levers that do not increase base pay, such as sign-on and retention bonuses that are not part of the increase budget, fewer will continue special actions added for 2022-23 into 2024. The number of employers using additional retention bonuses to keep employees is expected to continue to decline in 2024 (Chart 3). This is in line with the decline in voluntary quits among workers. Similarly, employers are using sign-on bonuses more selectively. However, while reducing reliance on sign-on bonuses and retention awards, companies are continuing to increase investments in recognition programs in 2024 to engage employees.

CHART 3: Fewer companies plan to use special cash sign-on and retention bonuses in 2024 compared to those introduced in 2023 as labor market tightness loosens.

ABOUT THE US SALARY INCREASE BUDGET SURVEY

Since 1985, The Conference Board has been surveying compensation executives with its annual Salary Increase Budget Survey. The survey asks about two main components of compensation: salary increase budget and salary structure movement. This year, 409 organizations completed the survey fielded between June 21 and July 17, 2023. Data were requested for four employment categories: nonexempt hourly (non-union), nonexempt salaried, exempt, and executive. The analysis provided is based on the results of the survey, including zero increases.

Salary increase budget—Refers to the pool of money that an organization dedicates to base pay increases (base salary or hourly rates) for the year. It is generally represented as a percentage of payroll; the salary increase budget is calculated using a predetermined total percentage of base pay (excluding overtime, bonuses, etc.). The budget is generally the total amount allocated for all merit or performance increases to individual employees, as well as other pay increases.

Short-term incentives—For the purposes of this survey, short-term incentives includes regular individual or group cash incentives or bonuses covering a period of one year or less. It does not include spot awards, sales commissions, stock awards, and other recognition awards.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

-

About the Author:Lisa Hunter

Lisa Hunter is a Senior Fellow and Program Director at The Conference Board. She leads the Compensation II and Executive Compensation II Councils, several Total Rewards-related conferences…

0 Comment Comment Policy