Headquartering Talent

25 Mar. 2019 | Comments (0)

Headquarters location decisions are among the most important key executives make. With modern telecommunications infrastructure, firms have broad discretion about where to locate a headquarters capable of supervising far flung domestic and global operations. Access to talent is therefore a key consideration, firms locate where there is a sufficiently large labor force of workers in occupations important for a headquarters’ function.

This analysis uses online job ads to explore the distribution of corporate headquarters by metropolitan areas and to consider some of the reasons why so many of these jobs are concentrated in a few of the largest metropolitan areas.

How do we identify the headquarter for each company, using online job ads?

The Conference Board Help Wanted OnLine® (HWOL) Data Series provides a unique window into the distribution of jobs associated with company headquarters. Online job postings are categorized by industry, occupation, and location. To identify the headquarters for each company we used the following procedure:

1) Created a sample of about 100 large employers across key industries whose headquarters locations were known to us.

2) For these companies, identify a list of 24 occupations that are disproportionally concentrated in the headquarters city.

3) We then find, for each company in our dataset, the city with the highest share of these 24 occupations. We assume that the company’s headquarters is located in this city.

The following were chosen as headquarters occupations:

- Public Relations and Fundraising Managers

- Treasurers and Controllers

- Lawyers

- Compensation and Benefits Managers

- Financial Managers, Branch or Department

- Compensation, Benefits, and Job Analysis Specialists

- Marketing Managers

- Financial Analysts

- Paralegals and Legal Assistants

- Management Analysts

- Market Research Analysts and Marketing Specialists

- Executive Secretaries and Executive Administrative Assistants

- Auditors

- Instructional Coordinators

- Human Resources Specialists

- Public Relations Specialists

- Transportation Managers

- Training and Development Managers

- Computer and Information Systems Managers

- Property, Real Estate, and Community Association Managers

- Managers, All Other

- Human Resources Managers

- Compliance Managers

- Purchasing Managers

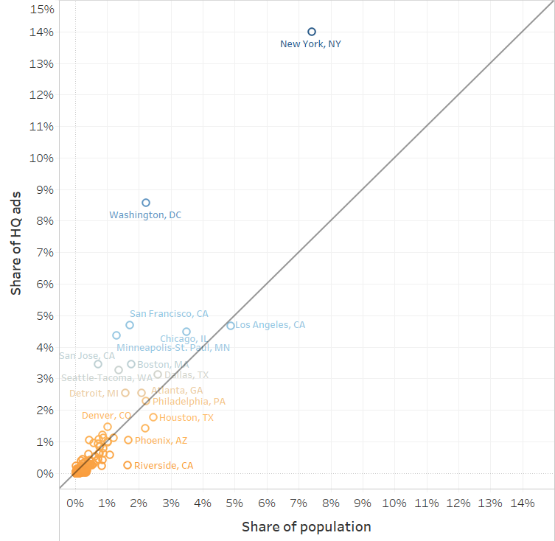

We then analyze the number of headquarters in each MSA and calculate for each MSA the number of jobs in that location which companies located there posted for this set of occupations. We call these “HQ jobs.” The first key driver of location choice is population size. The scatterplot below shows the share of HQ jobs and population for metropolitan areas. There is a strong relationship between the size of an MSA and the share of HQ job postings in that MSA. However, many of the largest metropolitan areas like New York, Minneapolis and Washington contain a larger share of HQ jobs than population alone would suggest. The 261 smallest metros, containing 25 percent of US population, account for just 8.8 percent of HQ job postings. In contrast, the 11 largest metros contain 33 percent of US population and 51 percent of HQ job postings.

Further, some large metropolitan areas, like Los Angeles; Chicago; Dallas; and Houston, attract a smaller share of HQ job postings than population alone would suggest. What other factors are key determinates of HQ job posting locations?

HQ jobs are concentrated in the largest metropolitan areas

Sources: The Conference Board Help Wanted OnLine® (HWOL), American Community Survey

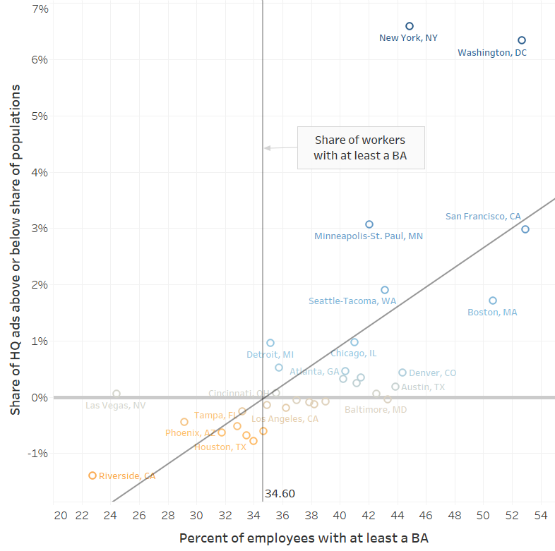

It is hardly a surprise that workers in HQ occupations tend to be disproportionately well educated. According to 2017 CPS data, while only 37.0 percent of all employees have graduated from college, 61.5 percent of workers in the headquarters occupations have done so[1]. Therefore, access to a highly educated employee pool is a key determinant of firm headquarters location as many recent high-profile firm headquarter choice decisions demonstrate.

Cities that are among the most well educated tend to attract a disproportionate share of headquarters jobs. For example, Washington, New York, San Francisco, and Minneapolis all have a far higher percentage of college educated workers than the national average. In contrast, Los Angeles, Houston, and Phoenix all have college education shares near or below the 34.6 percent national average and as a result account for a smaller share of HQ jobs relative to their populations. An exceptionally well-educated workforce is a stronger draw for firms making headquarters location decisions than one more typical of the population.

MSAs with the best educated workforces attract a disproportionate share of HQ jobs

Sources: The Conference Board Help Wanted OnLine® (HWOL), American Community Survey

As the Amazon HQ competition illustrated though, many factors beyond access to talent influence headquarters selection. Transportation factors ranging from walkability, to public transportation and airport access, play a role. Local income, property and corporate taxes do as well.

Our upcoming research will estimate trends in HQ location choices. We will evaluate how key headquarters location variables are shifting and what impact those changes may have on future headquarters location decisions by firms.

[1] Executive secretaries, transportation managers, and property managers are the only occupations for which fewer than 50 percent of employees are college graduates.

-

About the Author:Brian Schaitkin

The following is a biography of former employee/consultant Brian Schaitkin is a former Senior Economist in U.S. Economic Outlook & Labor Markets at The Conference Board. He is part of a team work…

0 Comment Comment Policy