Growth in Retirees

30 Jan. 2018 | Comments (1)

As more and more baby-boomers reach traditional retirement age, one would expect to see a real increase in the number of retirees. While seemingly intuitive, this assumption potentially ignores other factors involved, especially with retirement financial preparedness having suffered greatly in recent decades. In this blog, we show that growth in the number of new retirees has increased and is expected to remain at a relatively high level.

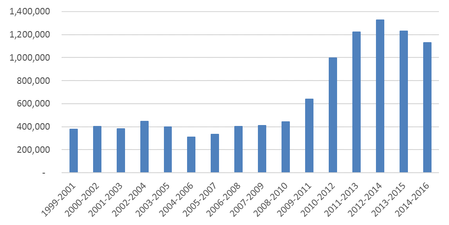

The first baby-boomers reached 65 in 2011, with growth in the number of new Americans self-identifying as “retired” appearing to reflect just that. From 2010-2012, the average annual net increase in the number of retirees rose to a much higher level compared to the decade prior. Growth accelerated as residents of America’s largest generation (of its time) continued to enter retirement age, peaking in 2012-2014.

Figure 1: Net Increase in Retired Population

Three-year moving average of the annual change in the number of retirees

Source: Current Population Survey; calculations by The Conference Board

Note: The percent of respondents reported as retired from the Current Population Survey (CPS) was multiplied by the civilian noninstitutional working age population estimates to get the number of retirees each year. The annual net change in the number of retirees was then calculated as a three-year moving average.

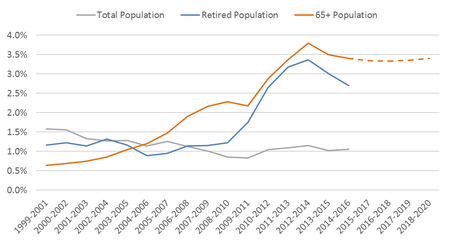

While the timeline of aging baby-boomers appears to align with more retirees, the overall trend in the retired population may not directly reflect population growth for those of traditional retirement age. Poor economic conditions, including the drop in housing and stock prices during the 2008 recession, likely affected many older Americans’ decision to enter retirement. Shown in Figure 2, growth in the number of residents 65 and older rises during the recession while growth in the number of retirees remains flat. Research from the Center for Retirement Research at Boston College[1] describe the effect falling housing prices and additional borrowing debt had on household retirement security during this period. Home value accounts for a large share of wealth for lower and middle-income households. As a result, falling housing prices had a strong negative impact on retirement preparedness, likely forcing many to delay their retirement. This may help explain why growth in the 65 and older population exceeded growth in retired population during this period.

Figure 2: Percent Change in Retired Population

Three-year moving average of the annual percent change in the total, 65 and older, and retired

Note: Dotted-line represents projections

Source: Current Population Survey, Haver Analytics

As the economic outlook improved post-recession with rising housing and stock prices, along with improvement in labor market conditions, many Americans that delayed their retirement during the recession, still entered within a few years. This influx of new retirees could have increased growth in the retired population enough to reach a rate similar to the 65 and older population. After 2009-2011, changesin growth rates for both the retired population and 65 and older population improve at a similar pace. Increased value in retirement assets could certainly have played a role, but it’s unclear whether this trend of similar growth will continue. After 2013-2015, growth rates for the retired population and 65 and older population begin to diverge. One possible explanation is a slowed influx of new retirees that had previously delayed their retirement. As mentioned earlier, many workers that delayed their retirement during the recession may have entered within a few years after 2008, leading the retiree growth rate to parallel the 65 and older population. Now that this influx is likely slowing, a disparity between typical retirement age and actual retirements is becoming more apparent. The aging workforce will increase the number of Americans eligible to retire, but some will delay, causing the retired population to grow a bit slower. Growth projections for the 65 and older population indicate that growth in retirees will certainly remain high, but perhaps not at the same level.

There has been a clear rise in the number of new retirees in recent years that has helped lower the unemployment rate and has contributed to the tightening of the US labor market. This trend is all but certain to continue for more than a decade as baby boomers continue to reach traditional retirement age, implicating many American businesses. Unforeseen retirements can potentially expose employers to operational and skill gaps, based on the company’s labor force demographics. Combined with turnover rates and a tightening labor market, employers may be left scrambling to attract new talent to fill vacancies. Businesses able to anticipate retirement growth among their staff can help mitigate the potential impacts of an aging workforce.

[1] Alicia Munnell, Wenliang Hou, Geoffrey Sanzenbacher, How Much Does Housing Affect Retirement Security? Center for Retirement Research at Boston College, September 2016.

-

About the Author:Agron Nicaj

Agron Nicaj is a former Associate Economist with The Conference Board’s Help Wanted OnLine (HWOL)© and Labor Markets programs. He was responsible for the production and analysis of the HWOL…

1 Comment Comment Policy

Agron, I am looking at Figure 2 and I am confused by the recession explanation. Figure 2 shows that the initial sharp drop in retirements to 65+ population (the cross-over) happened in the 2004-2006 average. This is years before the depth of the recession, no? Matter a fact, the Case-Shiller index peeks mid-2006.

Also, from that initial drop, I see a continued increase in retired population, granted much slower than the number of people reaching 65+. S&P 500 didn't drop until 2008. Maybe I am missing the impact looking at the two lines individually.

Interesting stuff! I think it is very interesting to look at the reveal preferences of 65+ as they approach their older years. Clearly the rate of retirement is changing over time.