Navigating sustainability reporting frameworks

28 Nov. 2018 | Comments (0)

The last two decades have seen tremendous growth in nonfinancial reporting by companies, driven in large part by increased pressure from stakeholders for greater transparency on companies’ environmental and social impacts. Faced with this pressure to report on a wide range of issues – including greenhouse gas emissions, climate risk, board diversity, and gender pay gap – companies have been turning to sustainability reporting frameworks to help guide their nonfinancial reporting efforts. These frameworks can be especially useful given the lack of uniform regulations on nonfinancial reporting (nonfinancial reporting is required in some countries, including across the EU, but remains a predominantly voluntary practice across much of the world).

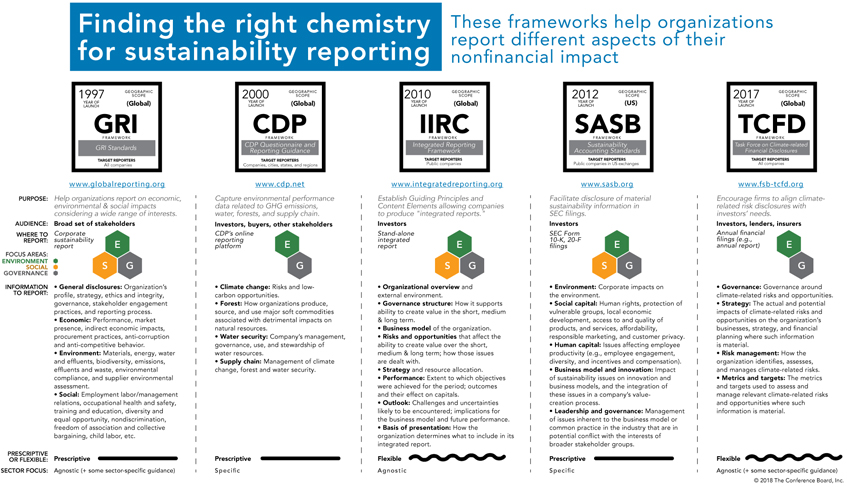

However, the variety of sustainability reporting frameworks can be daunting. For companies embarking on the practice of nonfinancial reporting, it can be challenging to discern between the various frameworks and understand the purpose behind each framework. To ease this process, The Conference Board developed a comparison table of some of the leading sustainability reporting frameworks. The table highlights various characteristics of these frameworks, including:

Purpose: What is the intended purpose of the framework? For example, CDP aims to capture companies’ environmental performance data, whereas the TCFD guidelines are intended to encourage companies to align their climate-related risk disclosures with investors’ needs. By contrast, the IIRC’s Integrated Reporting Framework is more broadly aimed at helping companies produce “integrated reports”.

Audience: For whom are the frameworks intended, and how are they meant to access the reported information? For example, the GRI Standards are meant for a broad set of global stakeholders (e.g., investors, customers, suppliers, employees, local communities) who are likely to consume the information through a company’s sustainability or annual report. By comparison, SASB’s primary audience is US investors, and the intent is for the information to be reported in US Securities and Exchange Commission (SEC) filings.

Focus areas: What are the main issues each framework aims to cover? Are the frameworks focused on environmental, social, or governance (ESG) issues? CDP, for example, focuses primarily on data related to environmental performance, including climate change, forests, water security, and supply chain. The TCFD guidelines are more narrowly focused on climate-related risks, while the GRI Standards cover a wide range of impacts across the three ESG pillars (including issues related to human rights, diversity, health and safety, corruption, and biodiversity, just to name a few).

While the comparison table is by no means exhaustive (there are other very useful reporting frameworks, and we recognize it is impossible to capture all the characteristics and subtleties of each framework), the table is meant to provide a simple guide for companies struggling to make sense of the dynamic and evolving landscape of reporting frameworks. We hope this serves as a useful tool as part of your sustainability reporting journey.

The comparison table can be viewed below and can also be accessed on this page.

-

About the Author:Thomas Singer

The following is a biography of former employee/consultant Thomas Singer is a former principal researcher in corporate leadership at The Conference Board. His research focused on corporate social res…

0 Comment Comment Policy