Press Release

Research Sheds Light on Weak Wage Growth in the United States

2019-11-14

The factors behind weak wage growth remain a hotly contested issue among economists. But a new analysis from The Conference Board provides a significant piece to the puzzle.

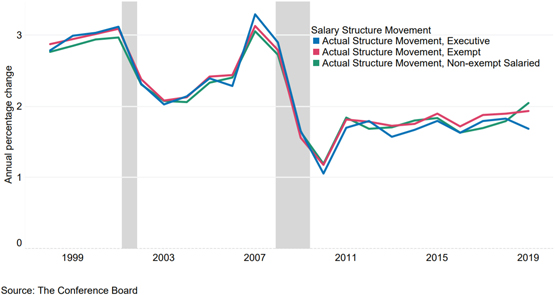

Ever since the aftermath of the Great Recession, U.S. companies have largely refrained from raising their salary increase budgets. The findings come from The Conference Board’s long-running Salary Increase Budget Survey, which gauges compensation executives about their salary plans for the year ahead. While salary increase budgets did experience an uptick in 2019, they remain well below prerecession rates.

Salary increase budgets remain well below prerecession rates

Average actual salary increase budget, percent change from previous year, by category, 1998 to 2019

“Weak inflation and low cost-of-living adjustments are partly contributing to stagnant salary increase budgets, which explains why existing workers, as opposed to new hires, haven’t seen their wallets thicken to the extent many expected,” said Gad Levanon, Head of the Labor Market Institute at The Conference Board.

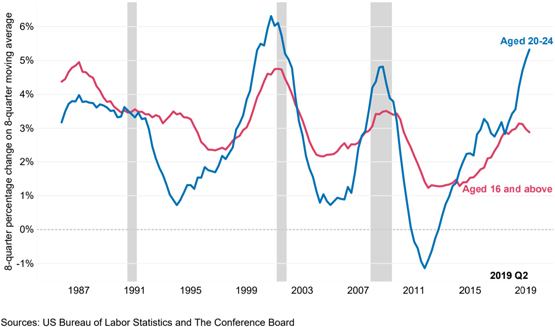

Companies Spend Generously on Recruiting New Hires, But Moderately on Retaining Existing Workers

As the analysis points out, in recent years, amid a tight labor market, companies have committed substantial sums to recruiting new hires. As a result, the wages for younger workers – a proxy for new hires – have risen sharply.

Wages for younger workers – a proxy for new hires – have risen sharply

Wages for workers aged 20-24 and 16 and above, last 8 quarters versus the 8 preceding quarters, annualized percentage change, 1985Q4 to 2019Q2

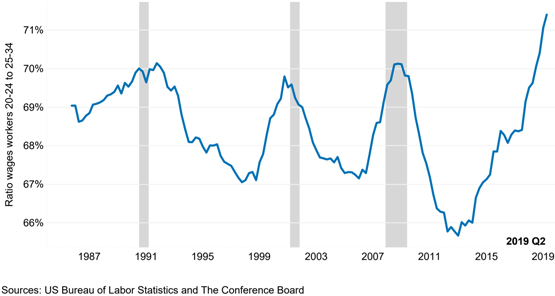

Historic Pay Compression

The analysis also reveals that the imbalance between spending on new hires and existing workers has resulted in historic pay compression. For example, the gap between the wages of 20-24-year-olds and 25-34-year-olds recently declined to its smallest size in 36 years.

The wage gap between new and existing workers is at its smallest in 36 years.

Ratio of the wages of workers 20-24 years of age versus those of workers 25-34 years of age, 8-quarter moving average. 1985Q4 to 2019Q2

“With various pay transparency tools and websites at their disposal, existing workers have greater insight these days into what their colleagues who just came on board are earning,” said Frank Steemers, Associate Economist at The Conference Board. “If current workers perceive the salaries of new entrants as unreasonable compared to their own, companies can either brace for higher turnover or take steps to retain them, including raising their compensation.”

Media can contact The Conference Board for a copy of the full report.

About The Conference Board

The Conference Board is the member-driven think tank that delivers trusted insights for what’s ahead. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org

For further information contact:

Joseph DiBlasi

781.308.7935

JDiBlasi@tcb.org

Carol Courter

1 212 339 0232

CCourter@tcb.org