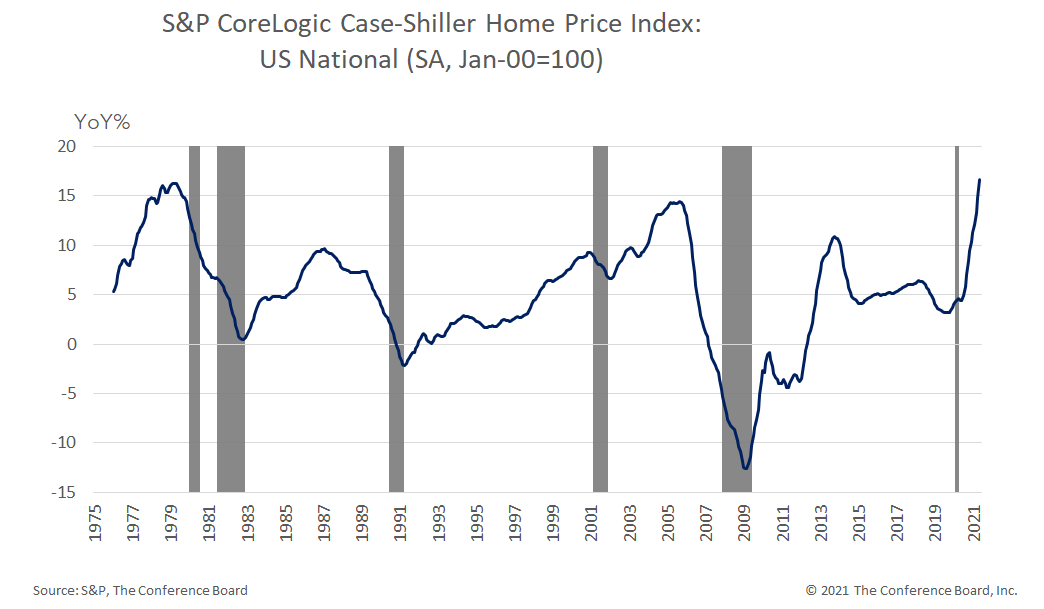

August 17, 2021 | Chart

According to the S&P CoreLogic Case-Shiller Home Price Index (HPI), existing single-family home prices rose by 16.6 percent from a year ago, exceeding the mid-2000s’ housing bubble peak. The home price run-up reflects a confluence of pandemic-induced factors, and also structural demographic events. These drivers caused a surge in demand for homes, following more than 15 years of housing underinvestment. The combined forces of rock-bottom interest rates, remote work, and millennial families drove household formations (e.g., moving to a new home or apartment away from parents or roommates) to an all-time high, according to the Census Bureau. Stimulus checks from the federal government probably also helped provide funds for making down payments.

Rising housing demand has driven home prices to historic highs last seen in the mid-1970s and mid-2000s, ahead of major recessions. However, while home price rises may be peaking, it is unlikely that cooling housing activity would trigger another Great Recession–type event. Financially fit home buyers and mortgage-market guardrails should help prevent another full-blown housing crisis. Unlike the 2005–07 housing boom and bust, most new mortgages are fixed-rate mortgages, as opposed to adjustable-rate mortgages, which were more prevalent 15 years ago. Most new home buyers have higher credit scores and more income compared to the subprime borrowers of the 2005–07 housing bubble. Underwriting standards are also significantly stricter now compared to the mid-2000s’ bubble.

To read more about “US Housing: Boom-Bust Redux? – Why the US Will Avoid Another Housing Crisis” in our recent report please visit our website (link)

July 27, 2022 | Newsletters & Alerts