Our investment in societal initiatives

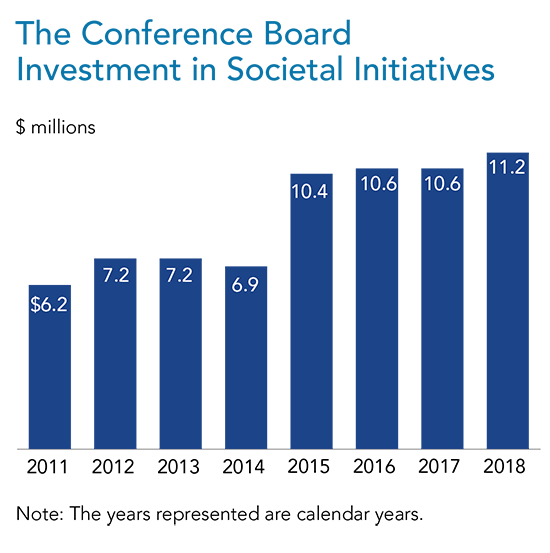

Over the last three years, The Conference Board has invested more than $32 million in societal initiatives, including $11.2 million in 2018 alone. These investments support a wide range of activities—from our published economic indicators, which are influential in public policy circles worldwide, to our portfolio of reports, meetings, webcasts, and councils, which are devoted to helping top companies meet their social obligations. The significant increase in our investments during the last four years stems from the 2015 merger between The Conference Board and the Committee for Economic Development.

This report summarizes our work as thought leaders for member organizations and the broader business community in several important areas, including sustainability, corporate philanthropy, social responsibility, education, diversity and inclusion, and sustainable capitalism, among others.

Sustainability

Sustainability is a key focus area of our research, peer learning, and leadership development activities. The insights produced by these efforts help executives develop, implement, and benchmark programs in the pursuit of business strategies that create long-term value and positive impact. Last year, we released more than a dozen reports covering a broad range of corporate sustainability issues relevant to companies in different regions:

Total Impact Valuation: Overview of Current Practices examines the emerging practice of total impact valuation, where leading companies are quantifying and monetizing their economic, social, and environmental impacts to provide a holistic view of their societal impact. The report examines the methodologies used by companies to shed light on this complex field that could play an important role in the future of company reporting.

Sustainable Procurement: Lessons from Leading Companies features case studies on how companies can successfully embed sustainability into the supply chain. The report examines how business leaders can embrace sustainable procurement practices as a way of managing business risks, achieving cost savings through material efficiency gains, enhancing their brand reputation, and managing suppliers more effectively. We also released a publicly available self-assessment tool to help company leaders evaluate their sustainable procurement programs.

Sustainability Practices: 2018 Edition identifies key trends in corporate disclosure of environmental and social practices, including atmospheric emissions, water consumption, biodiversity policies, labor standards, human rights practices, and charitable and political contributions. This edition is the sixth update to our benchmarking analysis first launched in 2012. The report is complemented by an interactive benchmarking tool providing data for over 90 environmental and social practices covering more than 5,000 companies in 23 countries, spanning Asia-Pacific, Europe, and North America.

In addition to these key reports, we also released several reports as part of our Sustainability Matters series. These reports examined timely topics such as circular economy regulation in Europe, CSR activities in India, the proliferation of ESG rating and ranking initiatives, developments in environmental regulation in China, and emerging sustainability reporting guidelines and frameworks. We also published a publicly available comparison table of leading sustainability reporting frameworks. The table highlights key characteristics of these frameworks, including their intended purpose, target audience, focus areas, and geographic scope.

Many of the topics mentioned above were featured in our Sustainability blog and in a series of webcasts throughout the year. These and other topics were also discussed among members of our 13 sustainability-related councils, including Sustainability Council I—Strategy & Implementation, Sustainability Council II—Innovation & Growth, Chief EH&S Officers’ Council, the European Corporate Responsibility and Sustainability Council, the Sustainable & Socially Responsible Purchasing Council, and the China Corporate Responsibility and Sustainability Council.

Throughout the year, we also convened four meetings of the external advisory board for The Conference Board Sustainability Institute. Among other priorities, the advisory board is tasked with ensuring our research continues to meet the needs of our members and society.

Corporate Citizenship and Philanthropy

As the world becomes hyper-connected, interactions with society are a critical component of business success. At The Conference Board, we document and analyze trends and best practices in corporate giving, employee volunteering, and strategic community engagement.

Last year, we celebrated 75 years as a leader in the field of corporate philanthropy insights. Our work in this realm dates back to 1943, during the depths of the Second World War. At that time, The Conference Board began documenting trends and best practices in corporate contributions, generating a record that became a bi-annual, and later, an annual report on corporate contributions. Over the years, our work has expanded to cover a broad range of related topics including sustainability, impact measurement, employee volunteering, and strategic community engagement.

In more recent years, The Conference Board established the Institute on Corporate Citizenship and Philanthropy. The institute comprises three Councils, including the CSR Council, Philanthropy & Engagement, and the Global CSR & Philanthropy Council. Council members include business leaders in the area of corporate citizenship. The Institute’s work on social impact measurement further supports member organizations in their efforts to create citizenship initiatives that add value to both business and society.

Among other activities, The Conference Board produces the annual Corporate Philanthropic Practice Conference and its Giving Thoughts Research Series. The Giving Thoughts Series addresses trending corporate citizenship and philanthropy topics, including pro bono service from the corporate and nonprofit perspective, business risk in the context of social media, and the role of corporate foundations.

We also publish an Institute Blog, featuring essays by business leaders and experts on issues such as disaster relief, purpose and impact, global CSR communications, value creation, and CEO activism. Beginning in 2017, The Conference Board partnered with Americans for the Arts to examine trends in business support and employee engagement for the arts. The annual survey draws on more than 130 responses from companies of all sizes that participate in arts-related corporate philanthropy, employee engagement, volunteer programs, or sponsorships.

Last year, we also announced a new partnership with Mission Measurement to track and benchmark social outcomes. This annual report will provide information regarding the efficacy rates of social outcomes and their costs. In future years, the data will provide insights into, among other things, the overall contribution of corporate philanthropy to creating social outcomes, which industries fund certain outcomes, and which companies are moving the needle the most in certain social areas.

Our Marketing and Communications Center continues to tackle the fake news and disinformation problem through thought leadership articles, including “Symptoms, Causes, and Solutions to Silicon Valley’s Disinformation Problem.” We also held a joint council meeting of the Corporate Social Responsibility Council, the Philanthropy and Engagement Council, and the Global CSR and Philanthropy Council to discuss the corporate response to disasters.

Each year, our Excellence in New Communications Awards honor projects that use social and digital media to advance community-focused projects, such as the Virginia Office of the Attorney General’s efforts to tackle gun violence and gang crime, or the Local Initiatives Support Coalition’s tool to provide resources to those seeking to expand existing charter schools or establish new ones.

Corporate Governance

Last year, we held a series of webcasts on Dysfunctional, Abusive Behavior in the Workplace: What Organizations, Boards & Senior Leaders Can Do. This webcast series examined how the failure of organizational culture can lead to toxic behaviors and what companies can do to ensure a safe environment. We partnered with two leading organizations for this webcast, including Employment Learning Innovations, Inc., an award-winning company at the forefront of this issue and cited by the US Equal Employment Opportunity Commission (EEOC) in its 2016 Study on Workplace Harassment and Cleary Gottlieb Steen & Hamilton, an international law firm.

We also published a report series on The Job of the Corporate Director. At first glance, the answer may seem obvious. However, in recent years, the range of expectations for doing the job well has widened. We examined how different stakeholders view this role in a series of more than ten reports based on roundtables with different groups: proxy advisors, directors, investors, hedge funds, academics, the Delaware bar, media, corporate secretaries, and regulators. We asked each group to consider how the role of the director has evolved, what the current range of expectations is, and where gaps in understanding have resulted in conflict. Our goals are to provide direction to corporate directors and foster a common understanding among market participants of how to view the job of the corporate director.

Our study on CEO Succession Practices: 2018 Edition, developed in collaboration with Heidrick & Struggles, annually documents and analyzes CEO succession events of S&P 500 companies, updating a historical database first introduced in 2000.

CEO and Executive Compensation Practices: 2018 Edition documents trends in senior management compensation. It benchmarks elements of compensation packages and the features of short-term and long-term incentive plans, provides details on shareholder advisory votes on executive compensation (say-on-pay), and outlines practices on board oversight of compensation design. The rise of stock awards continues and is countered by declines of annual bonuses in the Russell 3000, base salaries in the S&P 500, and stock options in both indices.

Our report on Corporate Board Practices: 2018 India Edition reviews public disclosures of board composition, governance practices, and remuneration granted to executives by Indian publicly traded companies in the NIFTY 500 index. The NIFTY 500 index comprises the largest 500 companies, by capitalization, listed on the National Stock Exchange of India (NSE). According to the most recently released NSE statistics, the NIFTY 500 index represents about 95.2 percent of the free float market capitalization of the stocks listed on the NSE.

Interest in and adoption of integrated reporting regarding a company’s business model and strategy for value creation over the short, medium, and long term has grown rapidly in recent years. However, since no universally accepted framework for integrated reporting yet exists, and it is still largely a voluntary practice, market practices in preparing “integrated reports” and norms are still evolving. The Conference Board Governance Center, in collaboration with PwC, convened a cross-functional working group, consisting of corporate external reporting executives (financial, sustainability, and attorneys), investors, and service providers to discuss the current and desired state of integrated reporting. The working group meets on a quarterly basis to explore trends in corporate reporting, emerging standards, and stakeholder expectations.

Public Policy

The Committee for Economic Development of The Conference Board (CED) is a nonprofit, nonpartisan, business-led public policy organization that delivers well-researched analysis and reasoned solutions to our nation’s most critical issues. Running through all CED research and outreach initiatives is its commitment to sustainable capitalism—the notion that addressing the economic system’s challenges through a nonpartisan lens will ultimately strengthen the system for all.

Throughout 2018, CED advanced solutions to significant economic and educational challenges facing the nation. During the year, we unveiled important research, shared our recommendations with national news outlets and elected officials, engaged business leaders across states, and hosted policy discussions throughout the country.

Fiscal responsibility remained a priority as the national debt continued to increase. CED published Time to Face Up, an analysis with bipartisan, long-term solutions for constraining the proliferating debt. The report was supplemented with our Debt 101 Series, a set of policy briefs and podcasts that addressed various aspects of the national debt, including its primary drivers, for the younger (especially Millennial) generations. Along with the series, CED produced a webcast on the urgency of addressing the national debt.

Early childhood education long has been central to CED’s research and outreach. At our Fall Policy Conference in November, we launched Business Champions for the Advancement of Early Childhood Education, which is intended to engage executives nationwide to promote high-quality early learning opportunities for all children. CED also created a clearinghouse of resources that business leaders, policymakers, and other advocates can use to strengthen the quality of early learning and care.

In the workforce readiness domain, CED issued a study on how high school students can transition effectively into the workforce. The research was a culmination of a year-long study, in which parents and business leaders in various parts of the country came together to discuss workplace demands and aspirations for the nation’s graduates. CED also developed a feasibility study to expand early learning in Mecklenburg County, North Carolina. As a result of our efforts, over 550 4-year-olds have been enrolled in the county’s new pre-K program as of last fall.

CED continued promoting awareness around gender diversity through its Advancing Women in Corporate Leadership initiative. Led by our Business Champions, these executives participated in podcasts and spotlights that addressed best practices in moving more women to the top levels of leadership. As part of this effort, CED presented research on female CEO succession in conjunction with Korn Ferry before 100 CHROs in New York at The Conference Board CHRO Conference last fall.

In the area of money in politics, CED’s latest analysis, Solving the Problem of Partisan Gerrymandering, shed light on unfair redistricting practices. CED’s Money in Politics Subcommittee Co-Chairs, including trustees Robert Kueppers, Nathan Owen Rosenberg, and Jane Sherburne, authored essays for both national and local publications on how best to prevent abuses in the current system. Experts from the Campaign Legal Center, Trevor Potter and Paul M. Smith, explained the need to fix broken redistricting practices in a CED webcast. CED received a new grant from the Thornburg Foundation to enlist the support of Research & Polling, Inc. to conduct and release a poll of business leaders in New Mexico in January 2019 on issues related to ethics, public financing of elections, and open primaries.

Our Spring and Fall Policy Conferences convened leaders from business, academia, and government to consider issues at the forefront of national economic and educational priorities. Following the Spring Policy Conference, CED and The Conference Board celebrated their respective 75th and Centennial anniversaries with a special dinner featuring Ambassador Susan Schwab and former Senator Joe Lieberman as keynote speakers. As part of the Fall Policy Conference, CED honored Thomas J. McInerney, president and CEO of Genworth Financial, Inc., with the Leadership in the Nation’s Interest Award.

Building on our tradition of promoting exemplary leadership, CED’s annual Distinguished Performance Awards Dinner in New York honored six business leaders who have led their companies and communities with distinction. The 2018 honorees: Ellen R. Alemany, chairwoman and CEO of CIT Group; Michele Buck, president and CEO of The Hershey Company; Greg Case, CEO of Aon; Emanuel “Manny” Chirico, chairman and CEO of PVH Corp.; Beth Mooney, chairman and CEO of KeyBank; and Julie Sweet, CEO of Accenture North America.

In the coming year, CED will publish a book on smarter regulation practices covering all industries. The book incorporates CED’s policy recommendations across its regulation policy portfolio and makes the case for how and why efficient and effective regulation can increase prosperity. We also will produce research on various topics including immigration, workforce development, and regulatory reform.

Global Economy

Each year, a portion of The Conference Board societal investments supports our economic research. Our indexes, forecasts, and projections help business leaders, policymakers, and practitioners understand and anticipate economic shifts and developments that have a significant impact on society. Our economic data and thought leaders are regularly featured in major media outlets, including Bloomberg, CNBC TV, the Financial Times, Wall Street Journal, MarketWatch, NPR, and others.

The Conference Board produces several barometers of consumer and business confidence, including the widely quoted Consumer Confidence Index®. We also provide economic indicators for the world’s major economies. The Conference Board Leading Economic Index® is published in 12 countries and the Euro Area, which together represent more than two-thirds of global GDP.

The Conference Board® Global Consumer Confidence Index is the latest addition to The Conference Board’s portfolio of economic indicators. The index is based on responses from over 32,000 online consumers in 64 markets throughout Asia-Pacific, Europe, Latin America, the Middle East and Africa, and North America. This new index series represents an important expansion of the global coverage of our economic indicators program, providing information to members and the public on consumer expectations worldwide.

In addition to high-frequency economic information, The Conference Board provides several large datasets with global metrics, including productivity. The Conference Board Total Economy DatabaseTM features international comparisons of the trends and sources of economic growth and productivity, including data for more than 120 countries on levels and growth rates of GDP, labor productivity, employment, and hours worked, which are available to the public. We also provided a new update of industry-level productivity measures for European economies commissioned by the European Commission.

The Conference Board Global Economic Outlook provides projections for short- and medium-term growth measures for the world economy. The Global Economic Outlook includes 11 major regions and individual estimates for 33 mature and 32 emerging-market economies—the main results of which are available to the public. We held two press briefings on the global economy for domestic and foreign media organizations based in the New York area.

After three years of preparatory work, The Conference Board opened a new research center in Kuwait last fall. The Conference Board Gulf Center for Economics and Business Research will serve the Gulf region, especially the countries of the Gulf Cooperation Council which include Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and United Arab Emirates. The purpose of the Center is to conduct and publish quantitative economic and business research related to the Gulf region; collaborate with the policy, business, and research communities in the region; connect those communities with our global network; and transition knowledge to business, government, and research organizations across the region to strengthen the capabilities for economic development purposes. The Center, which is headquartered in Kuwait, has been funded for the first three years by the Kuwait Foundation for the Advancement of Sciences and the Kuwait Banking Association. The Center is managed by a local leadership, which over the next three years will build a business membership model so that it can operate on a self-sustained basis after 2021.

We also completed phase one of our Future of Innovation project, publishing a series of reports on the Signposts of Innovation, whichculminated in the publication of Metrics for Innovation Leaders: Using Metrics to Drive Better Outcomes. CEOs see not having an innovation measurement framework as an important obstacle to future innovation. The Signposts of Innovation framework is designed to help executives in evaluating and planning innovation strategies and activities.

Throughout the year, our Global Economy Center Blog continued to feature insights and analysis on trending economic issues from senior thought leaders. Covered topics include innovation, digital transformation, the outlook for emerging markets and employment, among others.

Finally, in addition to The Conference Board Economics Watch® program, which features a monthly outlook for the United States, Europe, and emerging markets, we continued our “Window On” webcast series on hot topics. We held virtual panel discussions on a wide range of subjects, including trade, taxes, Brexit, and the disruptive effects of digital technology. The “Window On” program is publicly available.

China

Supported by long-term experience in China, The Conference Board provides extensive research and insights on economic, policy, and regulatory developments that affect business and the communities. One of the six focal topic areas for our China Center is sustainability as a value driver. We host an array of convenings in China and conduct primary research on high-priority ESG topics defined by members. Our tenet: sustainability concepts and methods that work in China will work everywhere.

Our 2018 study, China and the UN Sustainable Development Goals: Policy Priorities and Business Strategies examines the approaches Chinese policy makers are adopting to implement those goals (SDGs). Companies, through their commercial and sustainability activities, have a crucial role to play in realizing the UN Sustainable Development Goals. Because of China’s sheer size across all measures, including population, production, consumption, energy use, and carbon footprint, the global success of the 2030 Agenda will depend significantly on successes achieved in China and with China internationally. Many of China’s most pressing domestic policy priorities—chief among them poverty alleviation and pollution control—are highly aligned with the goals set in the 2030 Agenda, and China has a vested interest in achieving permanent and continuous improvements in these areas.

But for most businesses in China, including foreign firms, directly addressing the SDGs is unchartered territory. The information and analysis in our report will help companies understand and prioritize the SDGs in the context of China’s ongoing and new development policy priorities. We explain why it is so crucially important for China’s leadership to engage on many of the issues underpinning the SDGs, and why it makes good business sense for foreign firms to do likewise. We examine the approaches Chinese policy makers are adopting to implement the SDGs in China, describe the specific focus areas targeted for each of the 17 SDG goals, and identify the government resources that companies can utilize. Our work aims to help businesses identify the high-impact points of engagement in China, where available resources and know-how, commercial interests, and sustainability priorities align with the SDGs.

Labor Markets

The labor market conditions in which each company operates affect not only recruiting but also retention, compensation, productivity, profits, and engagement.

Reversing a decades-long trend in the US jobs market, companies are now having a more difficult time finding blue-collar workers than white-collar workers. Our new analysis forecasts that growing blue-collar labor shortages will continue in 2019 and beyond. Companies can expect growing shortages in several sectors, including transportation, health care support, manufacturing, agriculture, mining, and construction. In addition to increasing wages, companies may have to expand their pools of potential workers, which the report addresses by highlighting recent trends in recruiting.

Growing blue-collar labor shortages result from converging demographic, educational and economic trends in the US economy. As the US population attains more education, the group of working-age individuals with a bachelor’s degree has grown, while the number of those without one has shrunk. Moreover, the baby boomer generation, a segment of the workforce that once held many blue-collar jobs, continues to retire in droves. Only adding to the challenge, millions of non-college graduates have left the labor force due to disability since the mid-1990s. And while the pool of blue-collar workers has shrunk, the demand for their services has continuously grown since the 2008 financial crisis.

Over the next decade, the extent of the challenges caused by blue-collar labor shortages will depend largely on three factors: To what extent employers can further automate blue-collar jobs; how many additional individuals are brought back into the labor force; and, how many workers move into blue-collar jobs from other parts of the labor market.

While recruiting and retaining talent poses a growing challenge for employers, the picture looks brighter for those on the other side of the equation – the employees. Our latest survey of U.S. workers found increased satisfaction with wages and growth opportunities. With more job opportunities available, employees can settle into jobs that suit them better.

In terms of labor market metrics, The Conference Board Employment Trends Index® and The Conference Board Help Wanted OnLine™ Index provide critical information on supply and demand aspects of the U.S. labor market in the short-term. Our International Labor Comparisons program provides data on the labor force, wages and compensation, and productivity and unit labor costs that enable business, academic researchers, and policymakers to assess the relative health of labor markets worldwide and the competitiveness of manufacturing sectors across 38 countries.

Diversity and Inclusion

A successful business strategy should embrace the value of differences—within an organization, among its partners, and throughout the evolving global workforce.

In 2018, The Conference Board published Defining and Measuring Inclusion: Using Metrics to Drive Progress, identifying the challenges companies face in trying to measure something that, unlike diversity, is largely subjective. Based on definitions compiled from companies, D&I leaders, subject-matter experts and research, this report identifies the common elements and proposes a comprehensive definition and framework that companies can use or adapt as needed. The report describes common measurement dilemmas and provides examples of both qualitative and quantitative approaches to assessing inclusion and gauging progress over time. The report also includes practical recommendations for defining and measuring inclusion and how to use those insights to drive behavior change.

Conclusion

Each of the activities detailed in this report exemplifies our efforts to help the world’s leading corporations thrive at the intersection of business performance and societal advancement.

Aligning our efforts with our members’ priorities is critical to achieving this dual mission. Ensuring that our efforts are effective and have an impact—on the business community and on society—is an aspiration that we endeavor to meet each year.

We hope this report is helpful in describing our work and that it offers those who benefit from our programs an opportunity to consider how our work could be improved further.

We encourage readers to explore the work of The Conference Board in these areas in greater depth on our website: www.conferenceboard.org