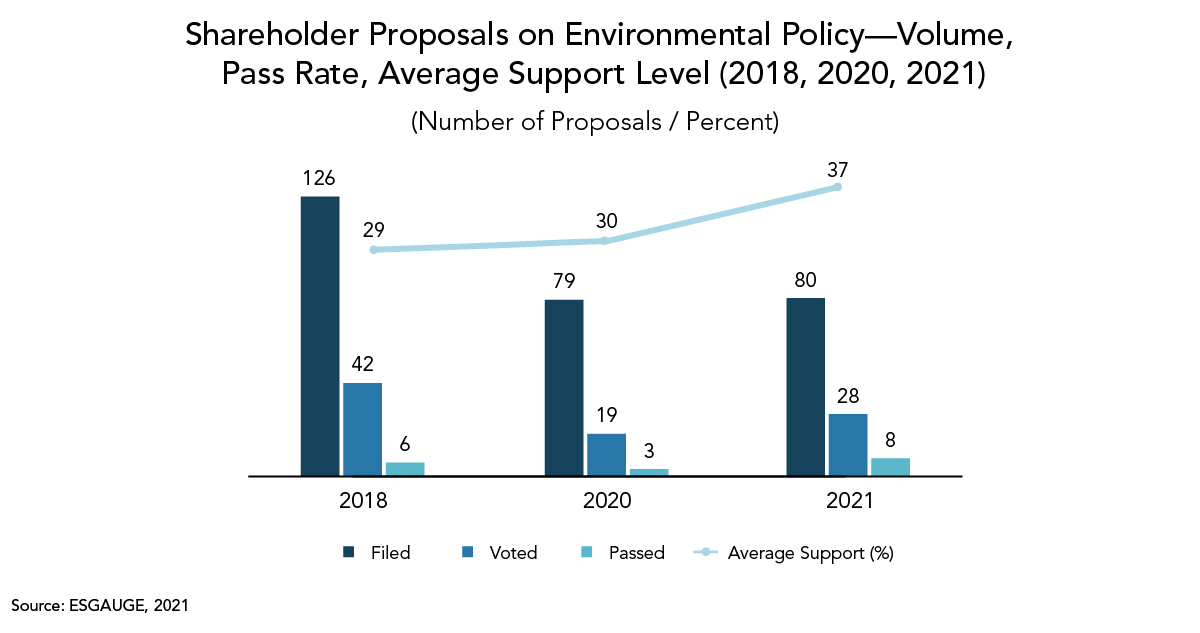

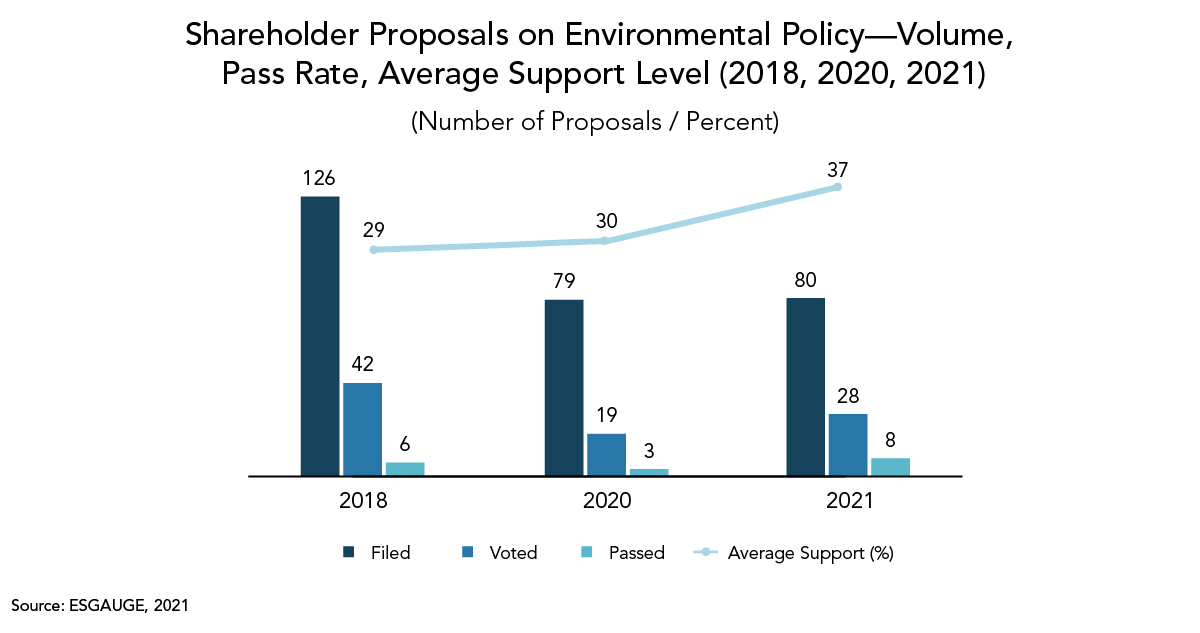

The number of environmental proposals filed in the first half of 2021 (80) remained steady compared to the same period in 2020 (79).1 The number of such proposals voted on rose to 28 in 2021, up from 19 in 2020, but it remains lower than environmental proposals filed (126) and voted on (42) in 2018.

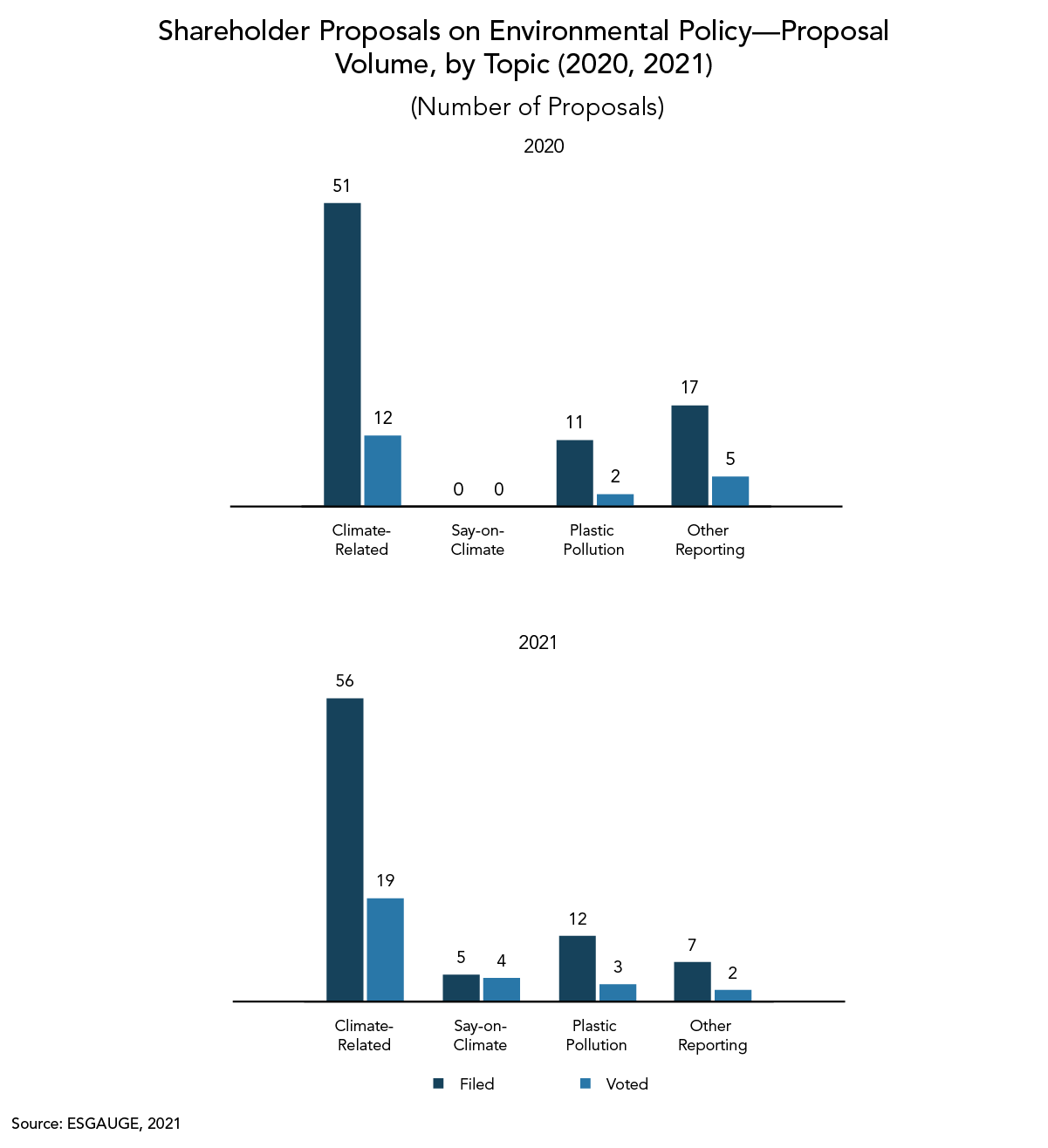

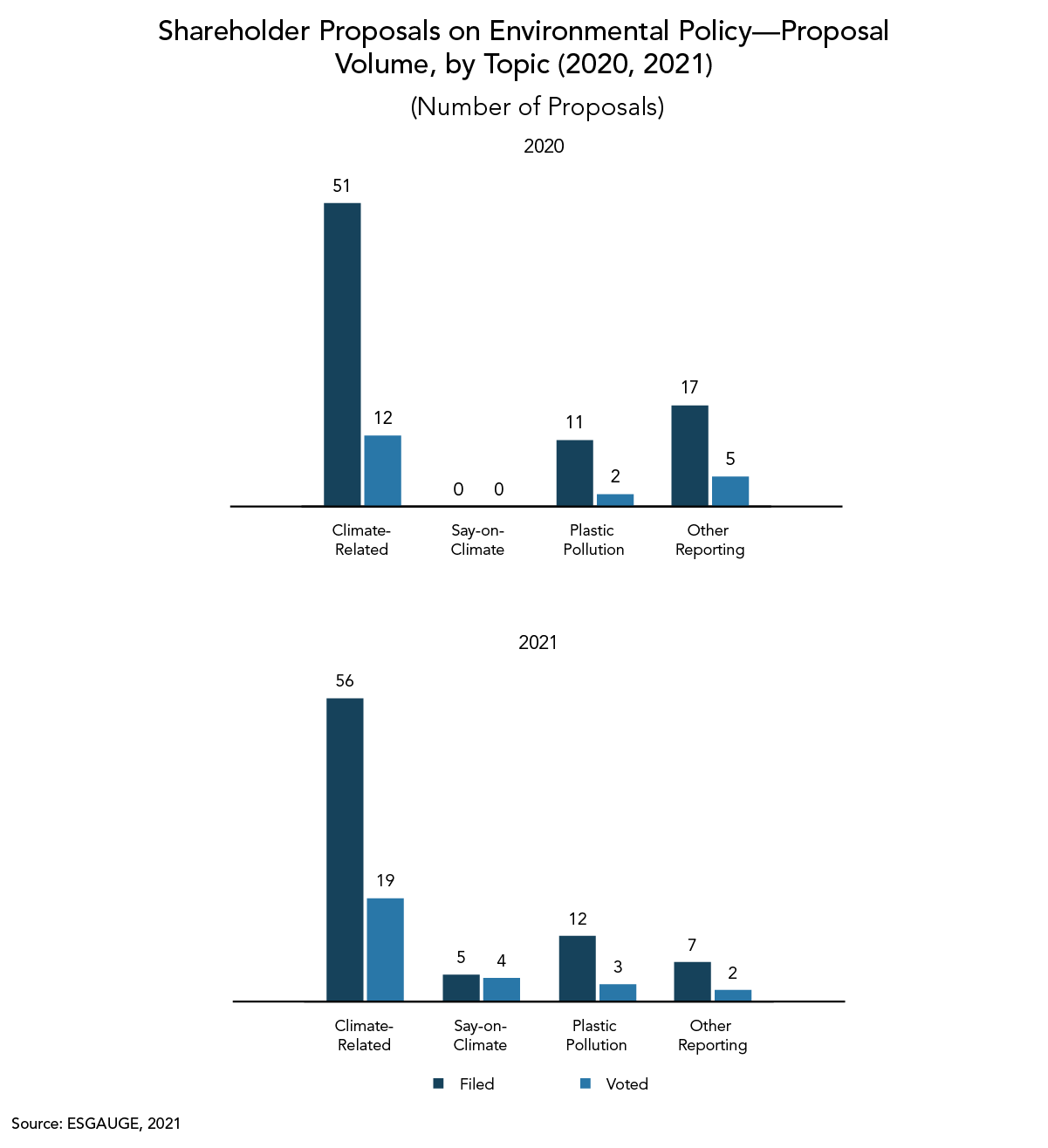

While the overall number of environmental proposals remained fairly flat, relatively more of such proposals in 2021 focused on climate change (climate-related and say-on-climate proposals) rather than on other environmental issues compared to 2020. In the first half of 2021, 76 percent of all filed, and 82 percent of all voted, environmental proposals focused on climate, up from 65 percent of filed and 63 percent of voted proposals in 2020. Other environmental proposals asked for reports on topics such as plastic packaging / pollution, water use, deforestation, and oil and gas exploration and production in the Arctic.2

New in 2021 was the “say-on-climate” shareholder proposal (not to be confused with the say-on-climate management proposal), generally asking companies to publish a climate action plan and to put it to an annual nonbinding shareholder vote.3 Five of such proposals were filed and four were voted on in the examined period. Shareholder proposals on plastic packaging / pollution were up modestly, from 11 filed and 2 voted in 2020, to 12 filed and 3 voted in 2021.

| |

Shareholders and proxy advisory firms divided on say-on-climate proposals

Investors and proxy advisory firms have been divided on their approach to shareholder say-on-climate proposals. ISS has adopted a new case-by-case approach toward such proposals. Glass Lewis has expressed concern that say-on-climate votes “provide a rubber stamp for climate strategies that are out of alignment with broader climate goals” and could be “interpreted as sign-off on nuanced aspects of a company’s strategy.” Glass Lewis indicated it would therefore “generally recommend against shareholder proposals requesting that companies adopt a policy that provides shareholders with an annual say-on-climate vote on a plan or strategy.” However, it will (potentially refine and) codify its approach prior to the 2022 proxy season.

|

|

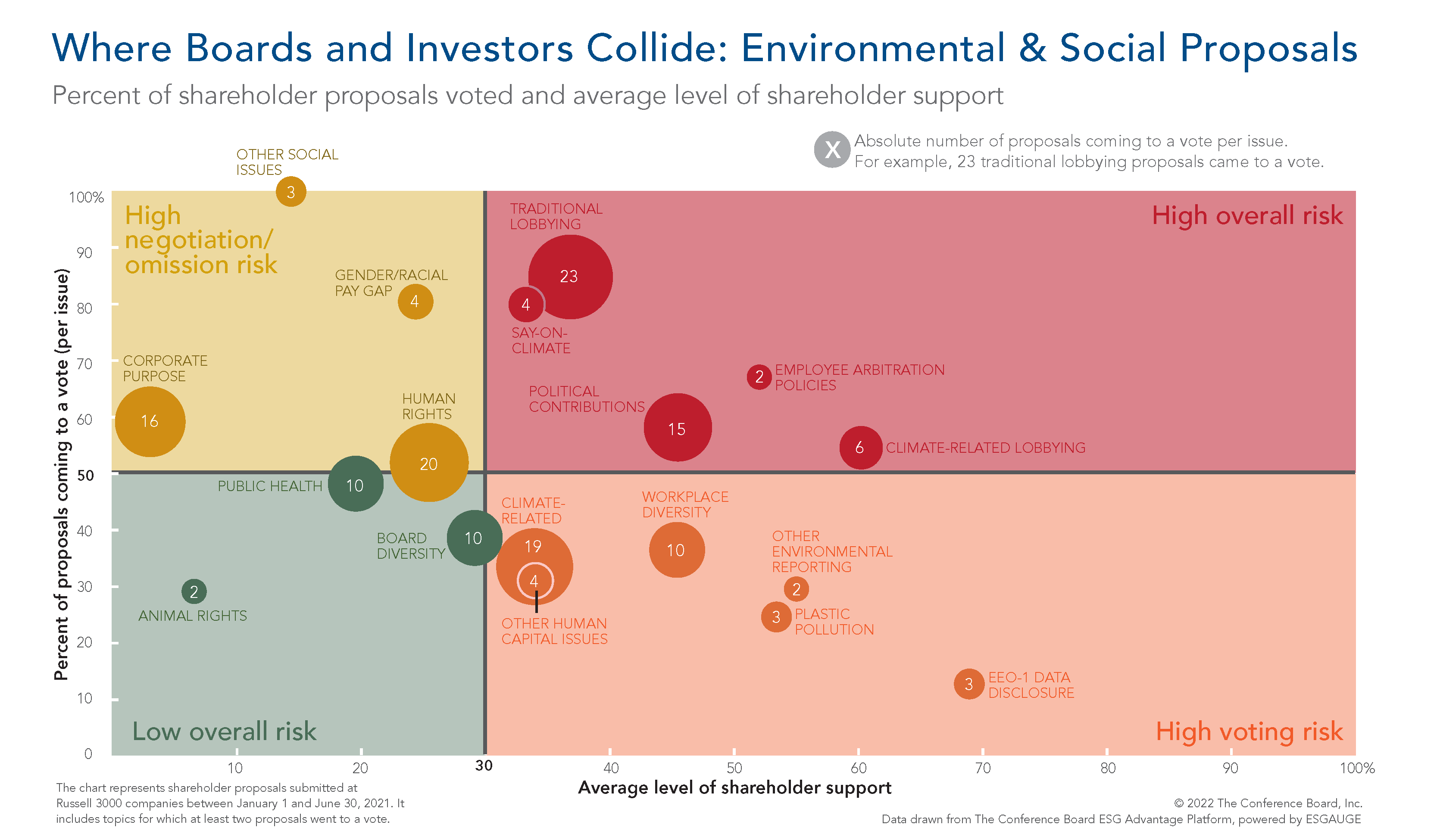

While companies of all types are facing scrutiny for their environmental records, there is still a strong connection between the type of shareholder proposal and the company’s underlying business.

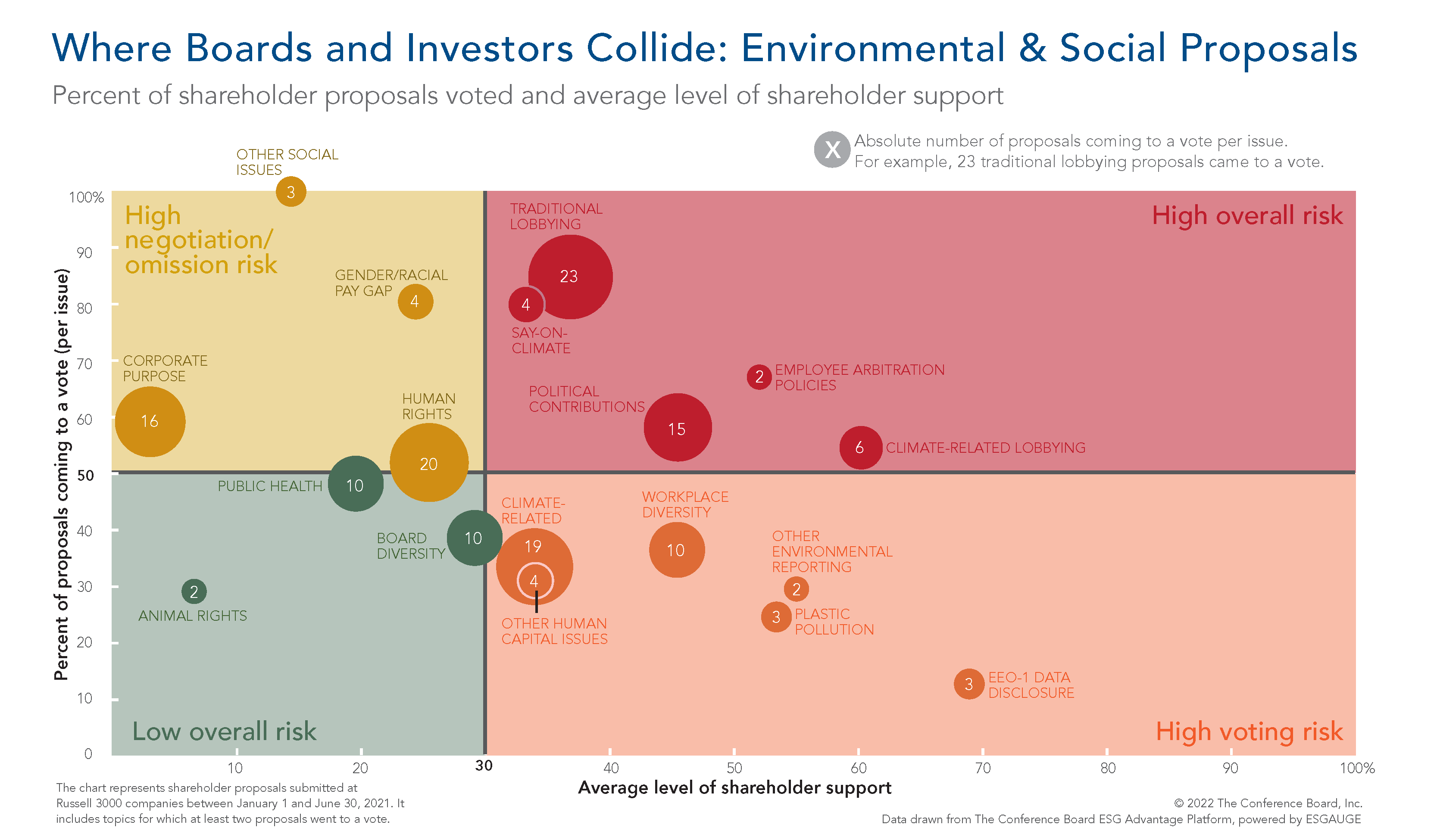

Environmental proposals overall: In the first half of 2021, companies in the energy, consumer staples, and utilities sectors received almost half (48 percent) of all proposals filed on environmental policy, and more than half (57 percent) of all such proposals were voted at these companies. The proposals that received majority support were at companies in the energy, industrials, consumer staples, consumer discretionary, and materials sectors.

Climate-related proposals (including say-on-climate): More than half of climate-related proposals filed (53 percent) and voted (65 percent) were at companies in the energy, industrials, and utilities sectors—and some companies, especially in the energy sector, received tailored climate-related shareholder proposals that went well beyond proposals filed with other (large) companies. Successful proposals at those companies aimed at reduction of Scope 3 emissions and reporting on the Net Zero by 2050 scenario. Indeed, investors expect companies in carbon-intensive industries to commit to net zero rather than climate neutrality, and to provide plans (not just announce goals) to reduce Scope 2 and 3 emissions.4

Plastic packaging / pollution proposals: Similarly, companies in the consumer staples, materials, and consumer discretionary sectors received all proposals filed and voted on relating to plastic packaging / pollution in 2021. And this trend is likely to continue, as demonstrated by the proposal on plastic packaging that was voted on at Tyson Foods' shareholder meeting on February 10.

With investors intensifying their focus on climate change and the transition to a net zero economy, companies in all industries should expect more specific shareholder proposals on climate and other environmental issues (e.g., water use, plastic packaging / pollution, waste, deforestation) that could include their supply chain.5 In 2021, the say-on-climate proposal with the most support (37 percent) was at Charter Communications, a telecommunications firm. And a proposal that Costco, a company in the consumer staples sector, adopt short-, medium-, and long-term science-based greenhouse gas (GHG) emissions reduction targets for its full value chain came to a vote in January 2022 and received 67 percent support.

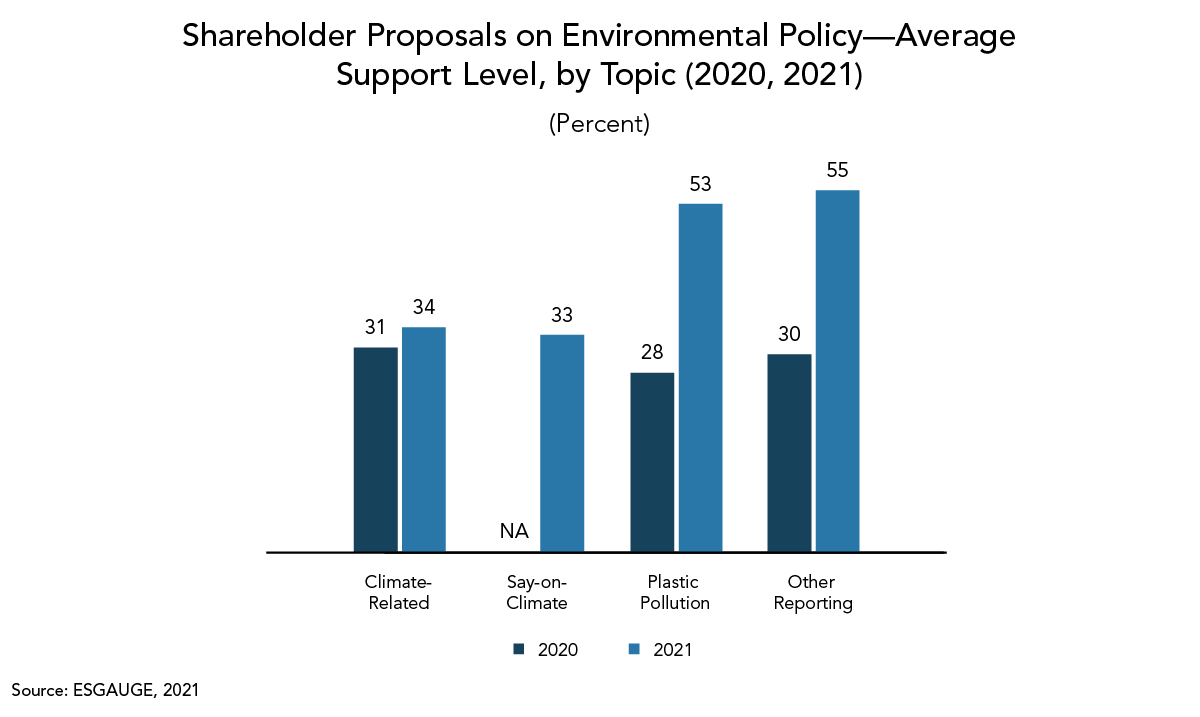

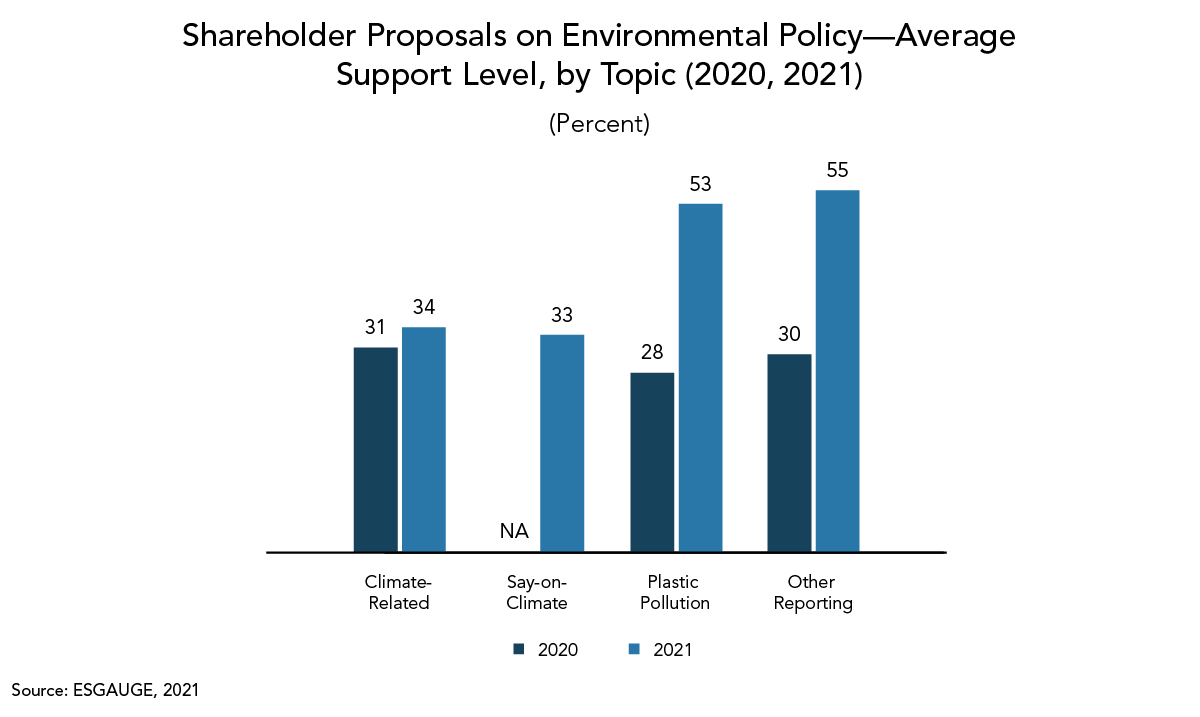

Support for environmental proposals (including climate-related proposals) that came to a vote in the first half of 2021 reached record levels, averaging 37 percent compared to 30 percent in 2020. Additionally, 8 out of 28 voted environmental proposals (or 29 percent) received majority support, compared to 3 out of 19 proposals (16 percent) in 2020. And proposals on plastic pollution and environmental (other than climate-related) reporting received majority support for the first time.

Companies were less able to omit or reach a negotiated compromise on environmental proposals in 2021 than they had been in 2020: 35 percent of filed environmental proposals came to a vote, compared to 24 percent in 2020. Compromise was especially difficult to achieve on say-on-climate proposals, with 4 out of 5 proposals coming to a vote.

Shareholder activism on environmental issues will likely continue beyond shareholder proposals in 2022, especially after the landmark proxy fight against ExxonMobil, in which Engine No.1 won three director seats with the goal of, among other things, implementing more forceful decarbonization strategies. A critical element in this proxy battle was the direct link between the environment and long-term value creation, which garnered support from major index funds—who are supporting activist investors on environmental and social (E&S) issues when value and values align. The fight underscores the need for boards to cultivate relationships with long-term investors over time, build credibility, and respond to their concerns.

Other tactics, such as vote-no campaigns against directors, are also likely to increase in volume and shareholder support, as proxy advisors and investors are updating their proxy voting guidelines and adopting policies to hold directors accountable for what they perceive to be ineffective oversight of environmental, social & governance (ESG) issues, especially when it comes to climate change.

How CEOs and boards can defuse environment-related shareholder activism

To decrease the risk of big “A” activism, CEOs and boards may want to consider:

Offering more comprehensive—and if possible forward-looking and quantitative—disclosures of the company's governance, strategy, and risk mitigation efforts regarding environmental issues, including a capital expenditure program that is in line with its GHG reduction commitments.

Gauging how biodiversity loss and deforestation affect, or can be affected by, their supply chain, and evaluating if water risks are causing exposure.

- Realize that the financial cost of inaction can significantly outweigh the cost of mitigation.6

Enhancing climate-related performance and disclosures to demonstrate responsiveness to investors’ concerns (even when not yet in line with peers or with Paris Agreement emissions reduction targets, strengthened at the UN Climate Change Conference of the Parties (COP26) in Glasgow in late 2021).7

- Through shareholder engagement and company disclosures, boards can convey they are taking investors’ concerns seriously and provide plans (not just announce targets) to reduce Scope 2 and 3 emissions.

| |

Navigating the ever-increasing complexity of ESG reporting

Pressure on ESG disclosure from stakeholders, including investors and proxy advisory firms ISS and Glass Lewis, isn’t going away. But disclosure, whether on climate, human capital management (HCM), or other E&S issues, is easier said than done. Companies need to decide what to report and why, and who their audience is. For investors, elements of good disclosure and engagement include:

- Organization. The ability to find the same data every year, labeled the same way, to populate investors’ analyses.

- Context. Providing context around disclosure and the reasons why companies disclose certain metrics; being straightforward about why the company doesn’t disclose some metrics.

- Data. Narrative is important, but unlike other stakeholders, investors are looking to get away from reports that are primarily about pictures of employees volunteering. Some companies are skipping the traditional report and replacing it with web portals that provide data and some context. This approach avoids instantly dating the report, and it spares users the need to wade through 80 pages of information.8

Investors, who tend to focus on uniformity, are increasingly looking for evidence that companies are migrating to a common framework. Yet the alphabet soup of ESG reporting frameworks makes this a challenging exercise for many companies.

According to a recent report by The Conference Board, companies can expect some greater alignment among ESG reporting frameworks but will likely have to deal with multiple, competing reporting frameworks for the foreseeable future.9 In light of that, our guide, “Navigating Sustainability Reporting Frameworks,” is intended to help CEOs and their management teams steer a course through the sustainability reporting landscape to determine what frameworks best meet the company’s needs. The piece offers five questions to determine which sustainability frameworks best meet the needs of the company:

- Is your company subject to any reporting requirements?

- What are you aiming to achieve with the framework?

- What frameworks are most relevant for your industry?

- Does the framework address your company’s most material issues?

- Who are your intended audiences?

Different reporting frameworks target different audiences. For example, SASB and TCFD are primarily geared toward investors.

Indeed, for climate-related disclosures, State Street Global Advisors sees disclosure aligned with relevant SASB standards as a minimum and expects all companies in its portfolios to offer public disclosures in accordance with the four pillars of the TCFD framework: 1) Governance; 2) Strategy; 3) Risk Management; and 4) Metrics and Targets. BlackRock also asks companies to disclose the identification, assessment, management, and oversight of sustainability-related risks in accordance with the four pillars of TCFD and to publish investor-relevant, industry-specific, material metrics and rigorous targets, aligned with SASB or comparable sustainability reporting standards. And ISS will recommend against incumbent directors—usually the appropriate committee chair—of companies that are significant GHG emitters in cases where the company doesn’t disclose this according to the TCFD and doesn’t have quantitative GHG emissions reduction targets covering at least a significant portion of the company’s direct emissions.

|

|

**********

This brief is part of a suite of seven reports: 2022 Proxy Season Preview and Shareholder Voting Trends (2018-2021). Visit conferenceboard.esgauge.org/shareholdervoting to access and manipulate our data online.

[1] The data and figures in this report and all six supplemental briefs represent shareholder proposals submitted at Russell 3000 companies in the first half of 2021, 2020, and 2018. About 90 percent of shareholder meetings at Russell 3000 companies take place in the first half of the year, and this cutoff point also allows easy comparisons with our prior-year shareholder voting benchmarking reports.

[2] For a description of all shareholder proposal topics, visit our Online Dashboard and go to Using This Dashboard > Glossary > Shareholder Proposal Subjects.

[3] In 2021, say-on-climate shareholder proposals sought a vote on climate plans at future annual meetings, rather than requesting a vote on the firm’s climate plan at the 2021 annual meeting—as was the case with the management proposals.

[4] For a lexicon on climate-related definitions, see: “Journey to Net Zero: Key Words You Need to Know.”

[5] See, for example, BlackRock’s “Larry Fink’s 2022 Letter to CEOs,” State Street Global Advisors’ “CEO’s Letter on Our 2022 Proxy Voting Agenda,” and Vanguard’s “Proxy Voting Policy for U.S. Portfolio Companies.”

[6] Thomas Singer, “Sustainability Disclosure Practices: 2022 Edition,” The Conference Board, January 2022.

[7] The central goal of the COP21 Paris Agreement is to “strengthen the global response to the threat of climate change” by holding the increase in the global average temperature to well below 2°C above preindustrial levels and pursuing efforts to limit the temperature increase to 1.5°C. The COP26 Glasgow Climate Pactreaffirms this goal and its resolve to pursue efforts to limit the temperature increase to 1.5°C.

[8] Thomas Singer, “Telling Your Sustainability Story: Practical Guide 4: Dealing With Regulations, Reporting Frameworks, and ESG Rating Firms,” The Conference Board, August 2021.