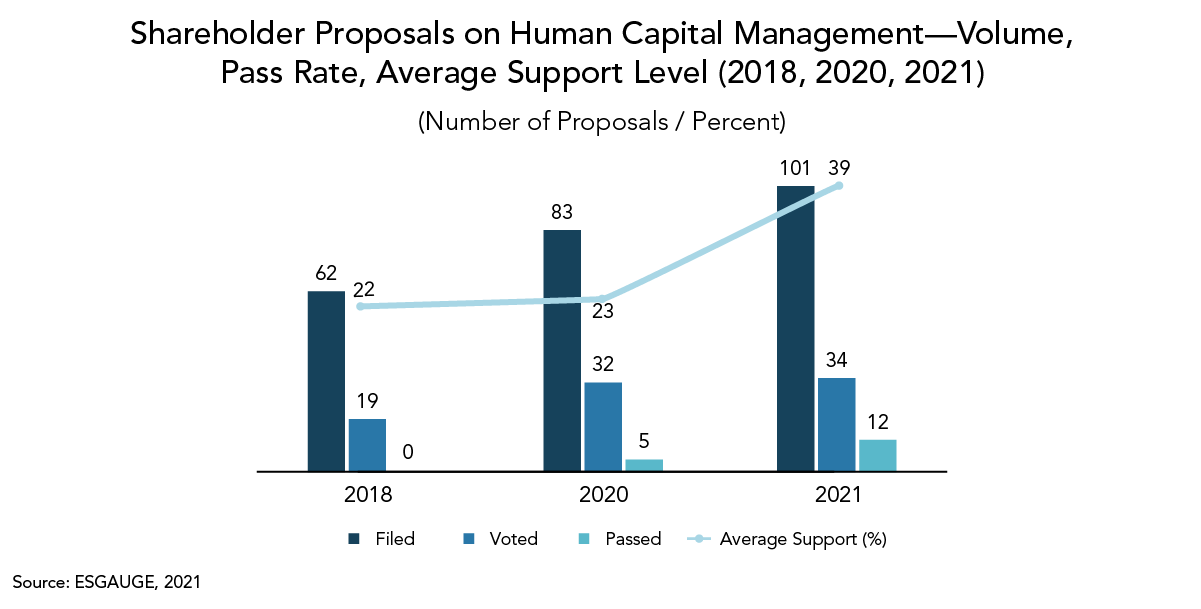

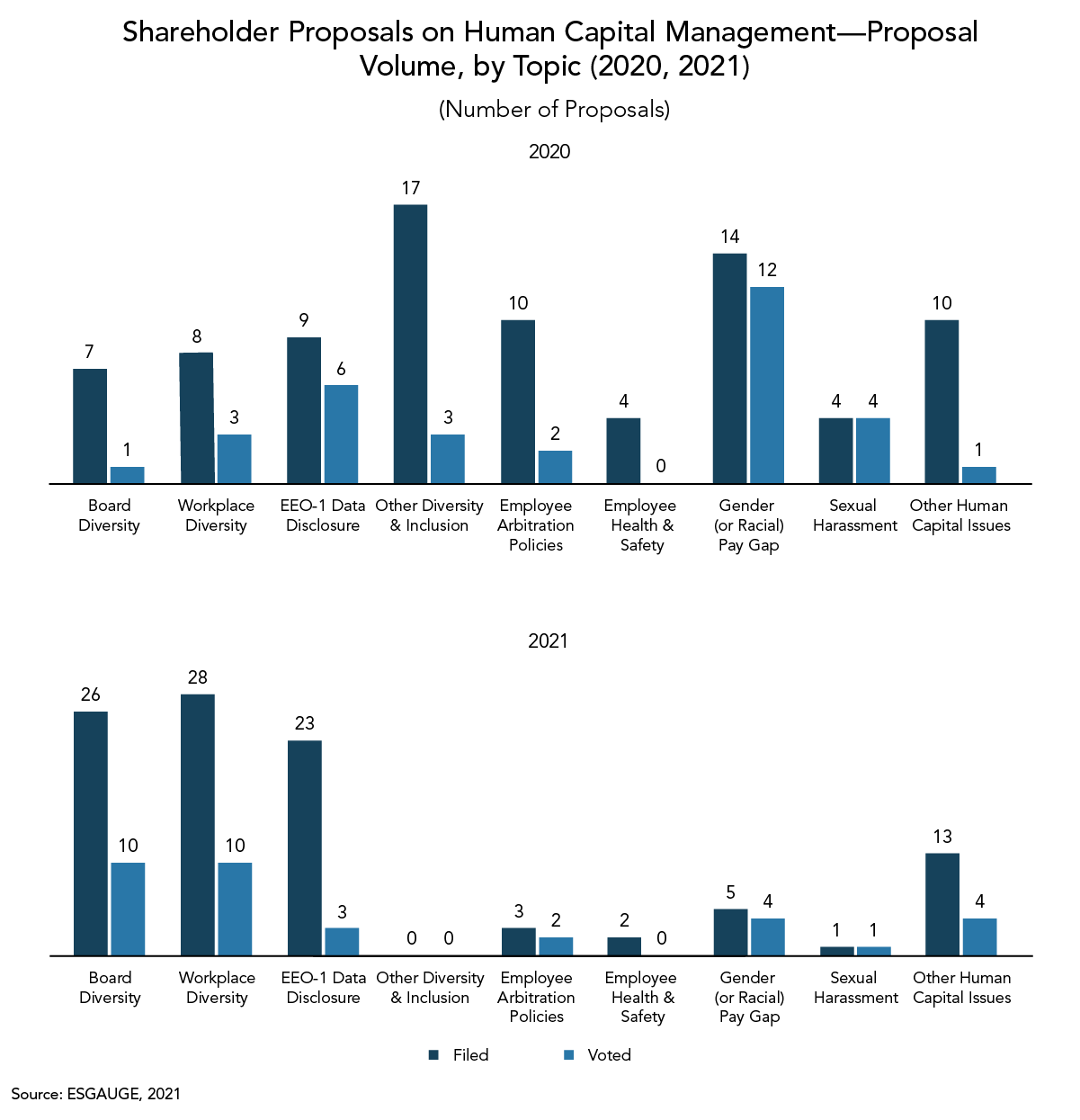

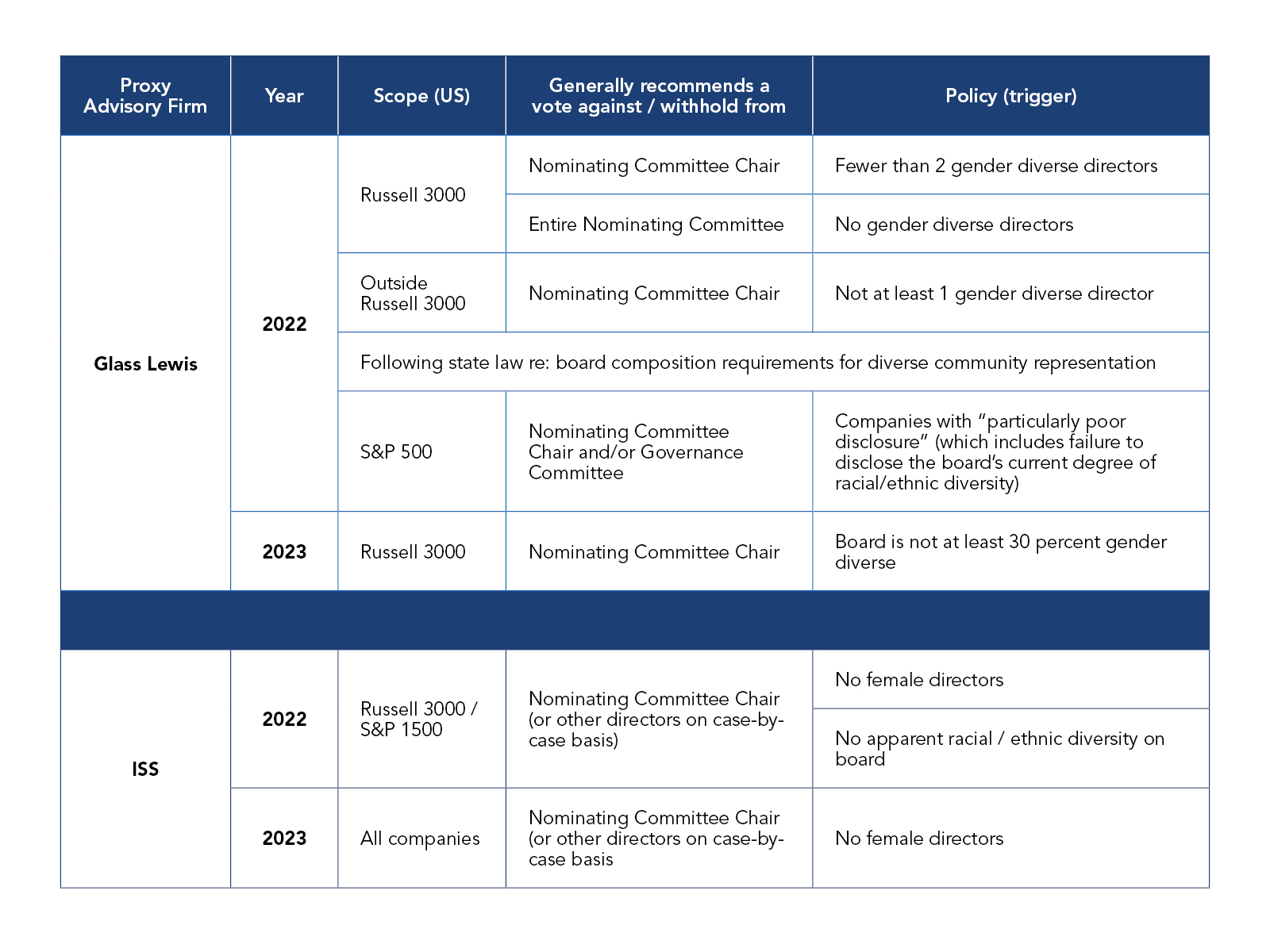

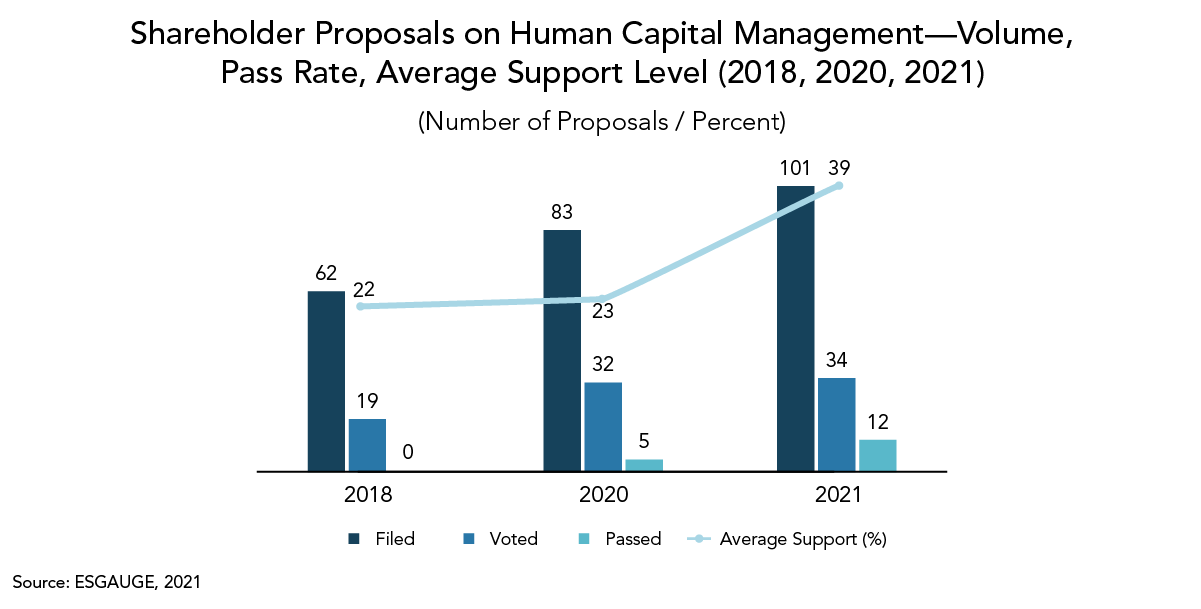

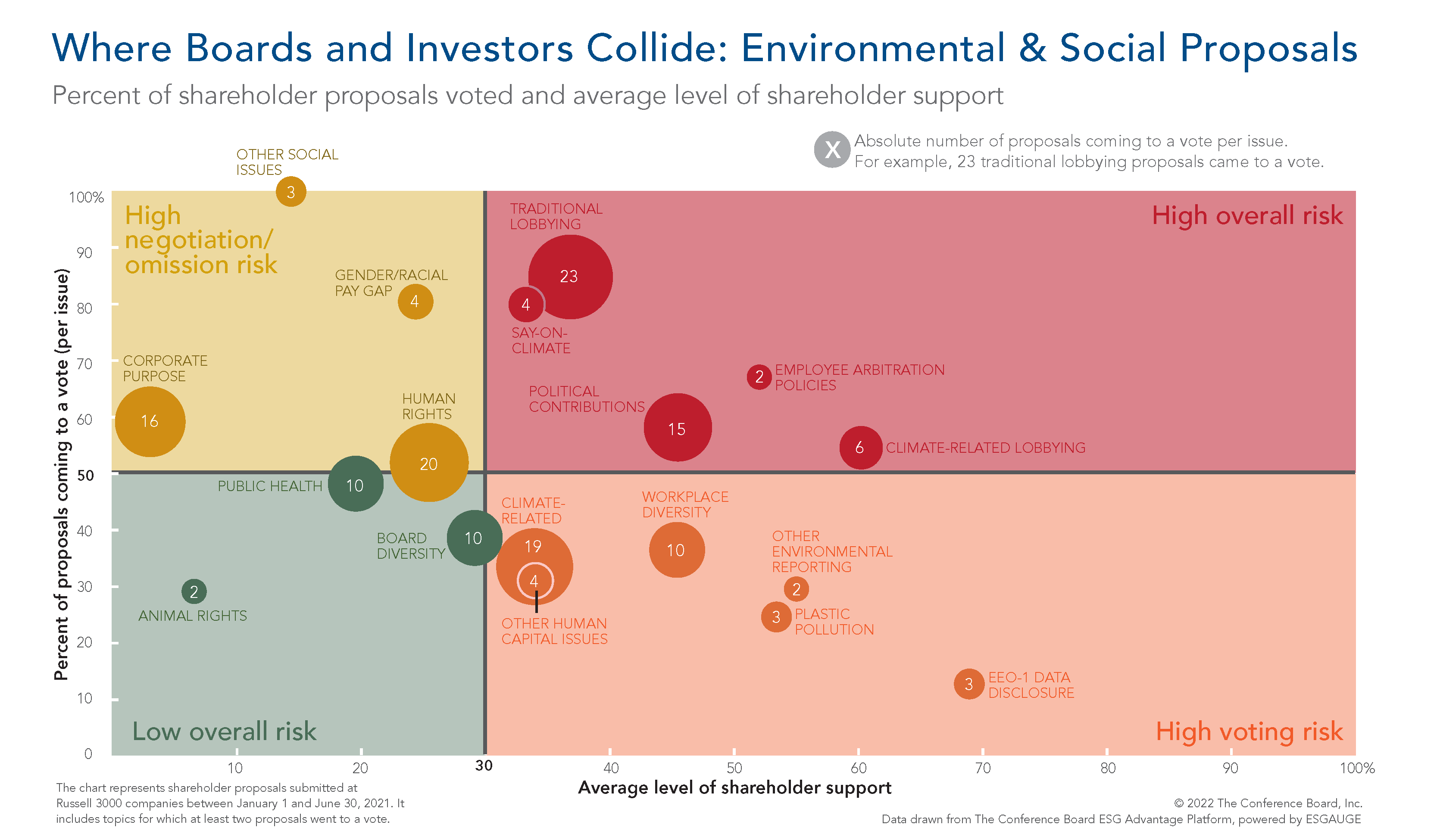

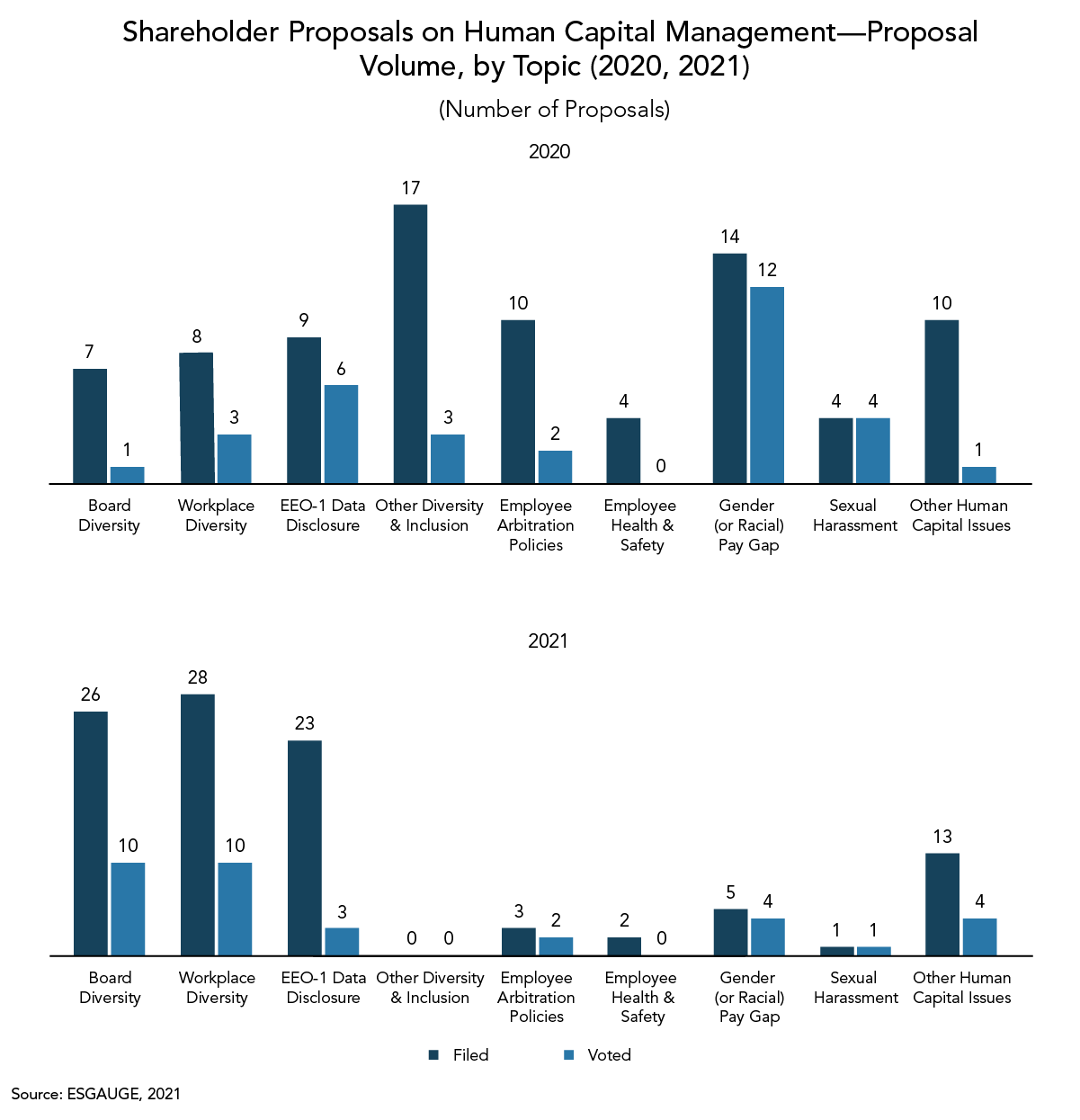

During the first half of 2021, shareholders filed 101 HCM proposals in the Russell 3000, 18 more than in the same period in 2020.1 Notable was the focus on diversity: shareholders filed 77 diversity-related proposals, 36 more than in 2020. By comparison, they filed fewer proposals on employee arbitration policies (3 in 2021 versus 10 in 2020), employee health & safety (2 in 2021 versus 4 in 2020), gender or racial pay gap (5 in 2021 versus 14 in 2020), and sexual harassment (1 in 2021 versus 4 in 2020).2

While the number of filed HCM proposals grew, relatively fewer such proposals came to a vote compared to 2020, indicating success in omitting or reaching a negotiated resolution on most—but not all—HCM proposals. In the first half of 2021, 34 HCM proposals were voted on (34 percent of all HCM proposals filed), versus 32 proposals in 2020 (39 percent of proposals filed).

| |

Spotlight on EEO-1 data disclosure

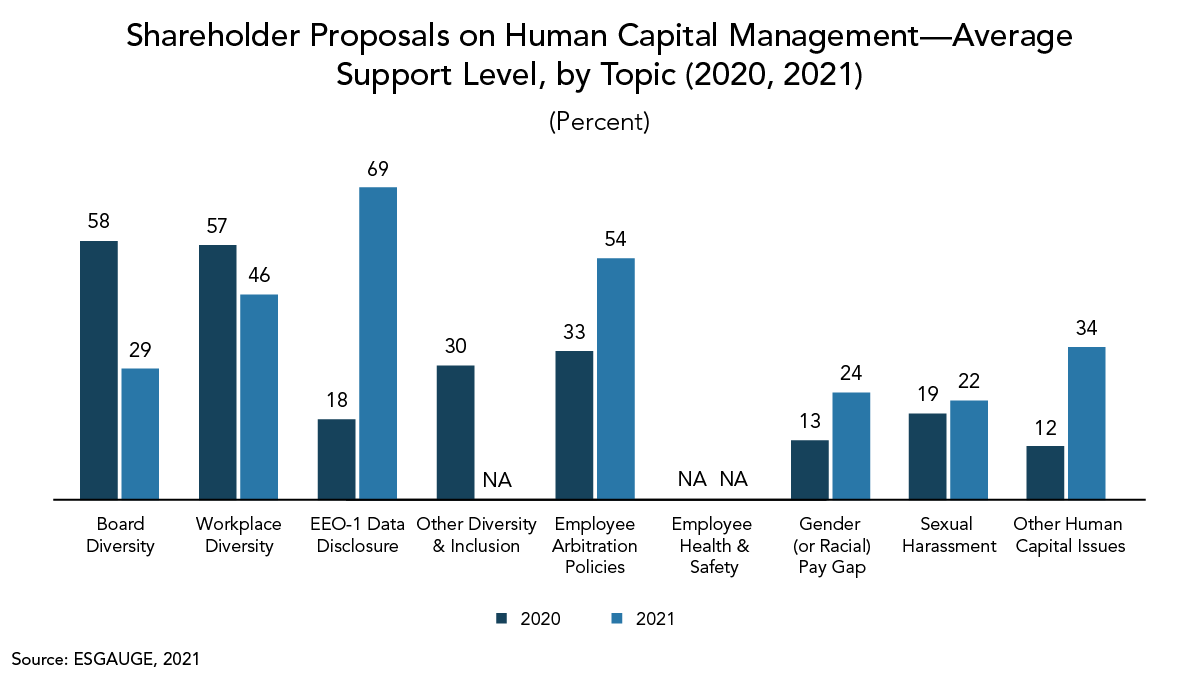

Proposals on EEO-1 data disclosure (the Employment Information Report) saw high levels of withdrawal in 2021, as more companies found that the benefits of disclosing (or promising to disclose) information on their workforce's gender, race, ethnicity, and job tier makeup outweighed the risks associated with publicly disclosing this information. Companies that chose the path of disclosure have cited the favorable reaction from major institutional investors and from employees who appreciate the transparency about this information. The companies that disclosed EEO-1 data often did so with caveats, noting that the EEO-1 framework doesn’t provide a complete picture of workforce diversity.

|

|

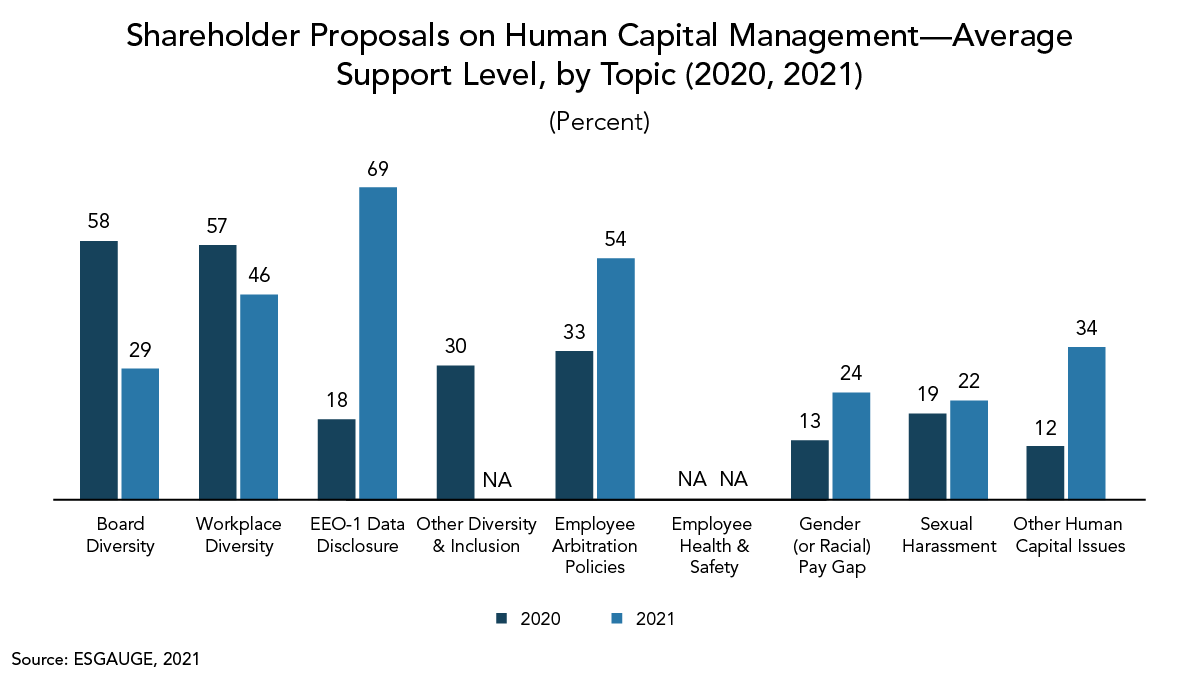

Of the HCM proposals that came to a vote, more received majority support than in previous years—and some topics received average majority support for the first time. In the first half of 2021, support for HCM proposals averaged 39 percent compared to 23 percent in 2020. Moreover, in 2021, 12 out of 34 HCM proposals (35 percent) received majority support, compared to 5 of 32 proposals (16 percent) in 2020, and 0 of 19 proposals in 2018. Proposals on EEO-1 data disclosure and employee arbitration policies received average majority support for the first time (69 percent and 54 percent, respectively). Other HCM proposals also received significant support in the examined period, ranging from 46 percent (workplace diversity) to 22 percent (sexual harassment).

Many investors will continue to advocate for more HCM disclosure through engagement and shareholder proposals, especially since any new SEC rules on HCM disclosure will take effect after the 2022 proxy season. EEO-1 data disclosure, workplace diversity, and employee arbitration will continue to be major discussion topics given the success of such proposals in 2021.

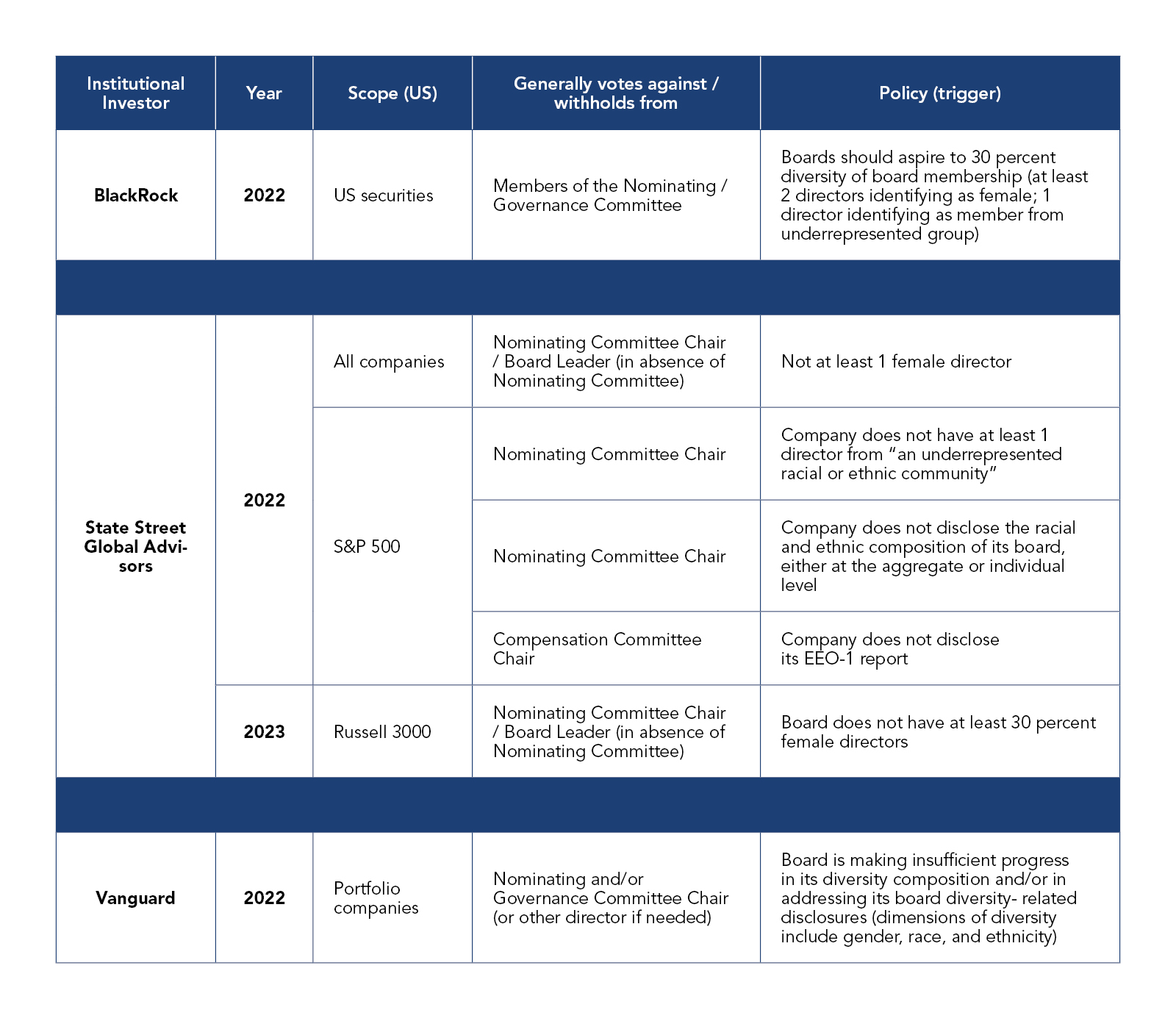

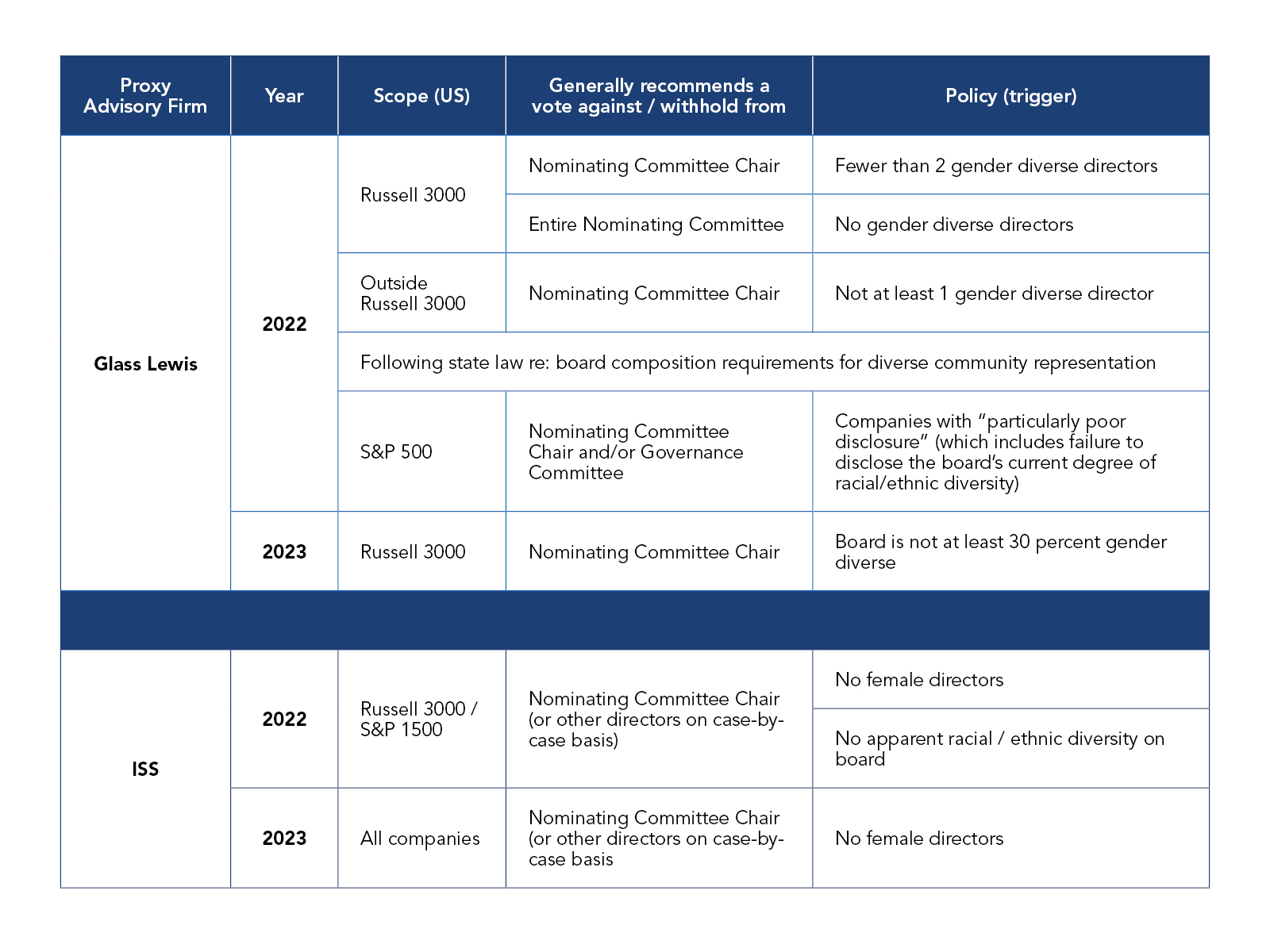

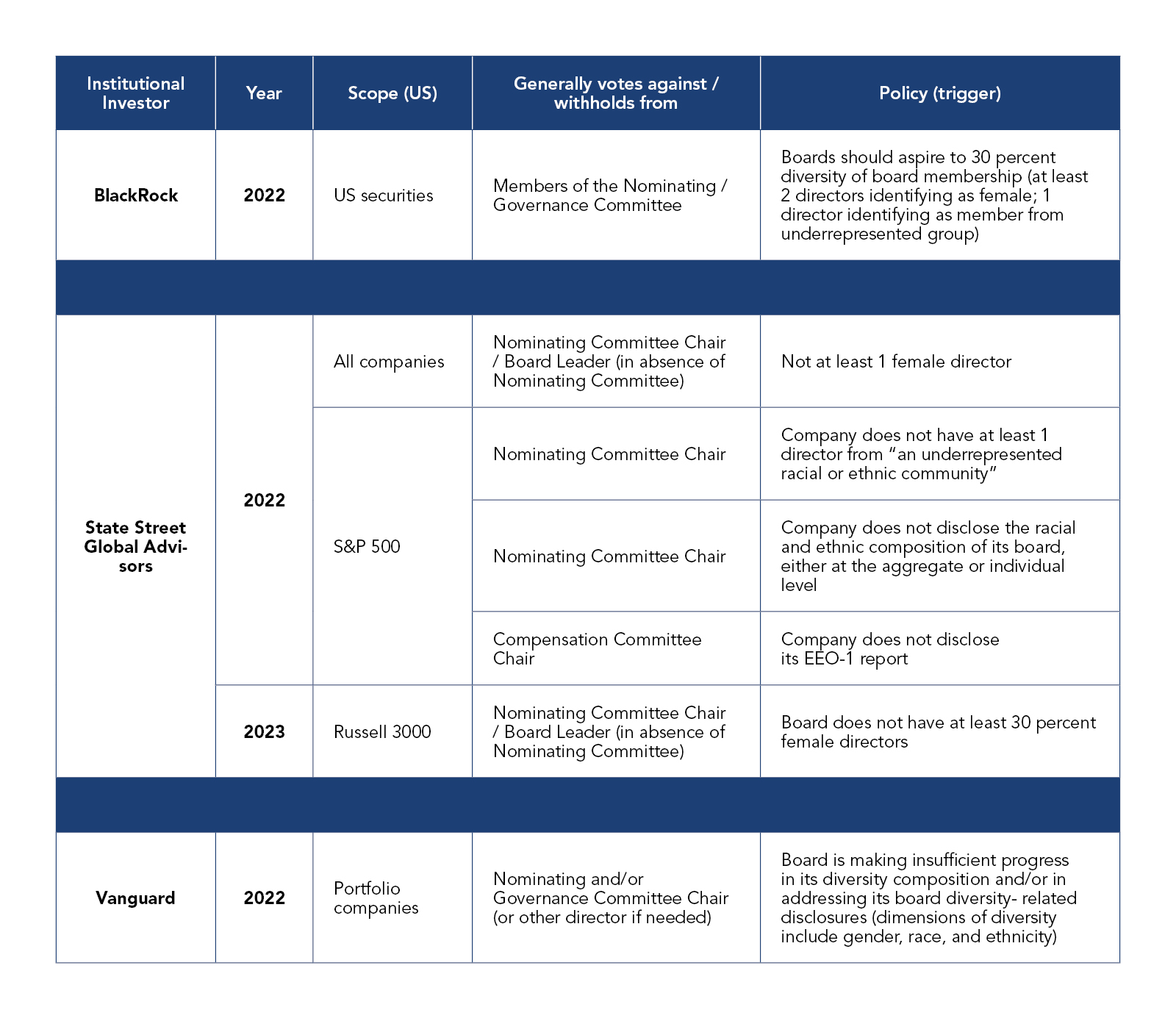

Additionally, companies should anticipate a greater push on board diversity and expect this will increasingly spill over into director elections, as proxy advisors and investors continue to make their proxy voting guidelines relating to issues such as board diversity more stringent.3

Increasing expectations on board diversity

| |

Emerging topic: racial equity and/or civil rights audit

Keep an eye on racial equity/civil rights audit proposals in 2022; these proposals ask companies to commission an independent audit to assess potential racial bias throughout their internal and external business practices. In 2021, eight of these proposals were filed and voted on—indicating that it was difficult to negotiate a withdrawal—and they received a relatively high 32 percent average support. In 2022, investors may see these proposals as a way to gauge the success of a firm’s diversity, equity & inclusion (DEI) practices, especially at firms that made commitments following the death of George Floyd.

Indeed, this topic is subject to more proxy advisory and investor scrutiny:

- ISS has codified its approach and will vote case by case on proposals asking a company to conduct an independent racial equity and/or civil rights audit, taking into account six factors, including whether the company has issued a public statement related to its racial justice efforts in recent years or has committed to internal policy review; whether it has engaged with affected communities, stakeholders, and civil rights experts; and whether the company has been the subject of recent controversy, litigation, or regulatory actions related to racial inequity or discrimination.

- State Street Global Advisors will vote for racial equity/civil rights audit proposals at companies that don’t disclose the board’s process for overseeing risks related to racial equity and/or civil rights as described above, have no plan in place to address these risks, and/or cannot identify the relevant risks. State Street will, however, vote against such proposals at companies that clearly and publicly articulate 1) the board’s process for overseeing risks related to racial equity and/or civil rights (e.g., committee responsible; frequency of discussions, etc.); 2) the specific risks that the board oversees related to the impact of a company’s products, practices, and services on underrepresented communities inside and outside the organization; and 3) the company’s plan and processes to mitigate these risks. State Street will abstain on proposals at companies that have a stated and specific commitment to improving board oversight of racial equity and/or civil rights risks as described above, and to identifying and managing relevant risks.

- New York State Comptroller Thomas P. DiNapoli and the state’s pension fund recently announced the submission of shareholder proposals requesting an independent audit of companies’ practices related to racial equity. The fund has refiled the proposal at Amazon, where 44 percent of shareholders supported it last year. Other investors, including Trillium Asset Management, have filed shareholder proposals on the topic, one of which is scheduled for a vote at Apple’s annual shareholder meeting in March 2022.

|

|

How CEOs and boards can get ahead of the curve on HCM concerns

CEOs and boards can take several steps to address these concerns and lower the likelihood of HCM shareholder proposals succeeding by:

Developing and adopting a board-approved HCM strategy that is integrally tied to the business strategy and specifies a blueprint for taking the company from the workforce it has today to the one it needs in the years to come.

- This process will involve identifying the main areas where the company’s workforce drives business success, evaluating the firm’s current capabilities in those key areas, assessing the broader trends and competitive environment for talent, setting clear goals, and choosing metrics to report progress.

Clarifying and codifying the board’s role as it pertains to HCM—and ensuring the board demonstrates its own commitment in this area, particularly through long-term director succession planning that prioritizes director skill sets and capabilities while at the same time enhancing board diversity, which should provide enough lead time to identify, recruit, and onboard directors with the appropriate diversity of thought, experience, and background.4

- When it comes to HCM, boards have various levers, including the selection, promotion, and compensation of management; approval of workforce policies; review of key disclosures; and general oversight and advisory powers. Deploying these levers in a concerted manner is vital.

- Governance guidelines, as well as committee charters and policies, should reflect the ways directors oversee and engage in HCM. Governance documents often don’t keep pace with the good practices companies already have in place.

Increasing board diversity through the director search process (e.g., by adopting the “Every Other One” strategy that sets a target of recruiting women for one of every two board seat openings, as well as by defining search criteria based not on job title but on a set of skills and experiences), and by adopting or more strictly adhering to policies that foster board refreshment (e.g., reducing overboarding, lowering average tenure of directors, not making exceptions to a mandatory retirement policy).5

- To meet investors’ increasing demands for board diversity, boards should aim for gender parity and substantial minority representation on their boards.

Consistently communicating the company’s HCM story—beyond diversity—through various channels (10-K, proxy, ESG or stand-alone HCM reports, and website) and via shareholder engagement.6

**********

This brief is part of a suite of seven reports: 2022 Proxy Season Preview and Shareholder Voting Trends (2018-2021). Visit conferenceboard.esgauge.org/shareholdervoting to access and manipulate our data online.

[1] The data and figures in this report and all six supplemental briefs represent shareholder proposals submitted at Russell 3000 companies in the first half of 2021, 2020, and 2018. About 90 percent of shareholder meetings at Russell 3000 companies take place in the first half of the year, and this cutoff point also allows easy comparisons with our prior-year shareholder voting benchmarking reports.

[2] For a description of all shareholder proposal topics, visit our Online Dashboard and go to Using This Dashboard > Glossary > Shareholder Proposal Subjects.

[3] In 2020, only one proposal on board diversity went to a vote, compared to 10 in 2021, which explains the lower level of average support for board diversity in 2021. The board diversity proposals that passed in 2021 had support levels ranging from 91 percent to 65 percent.