-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

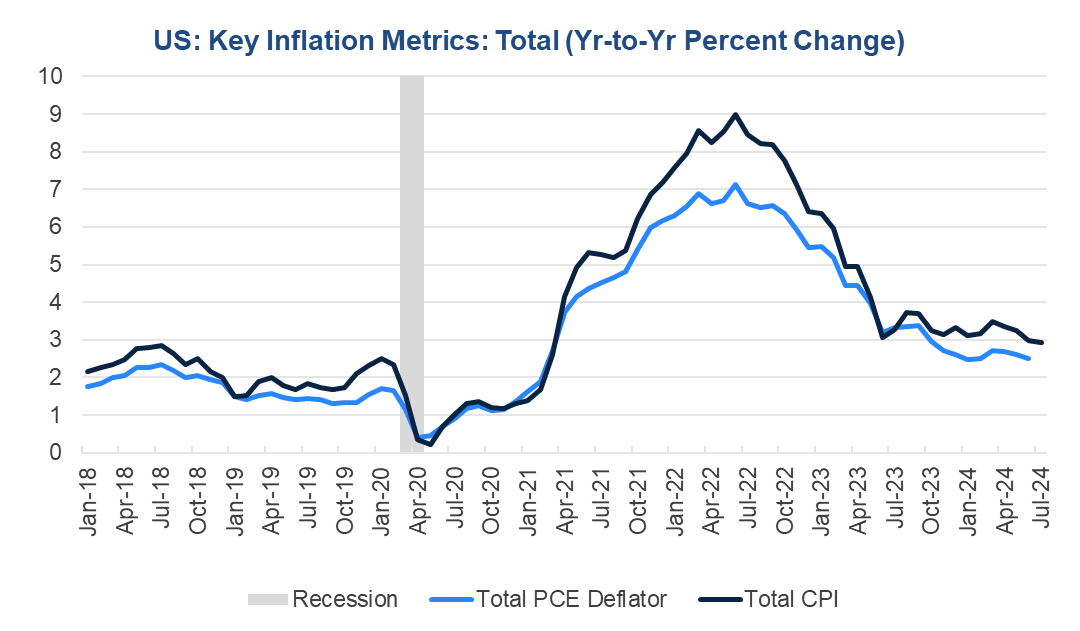

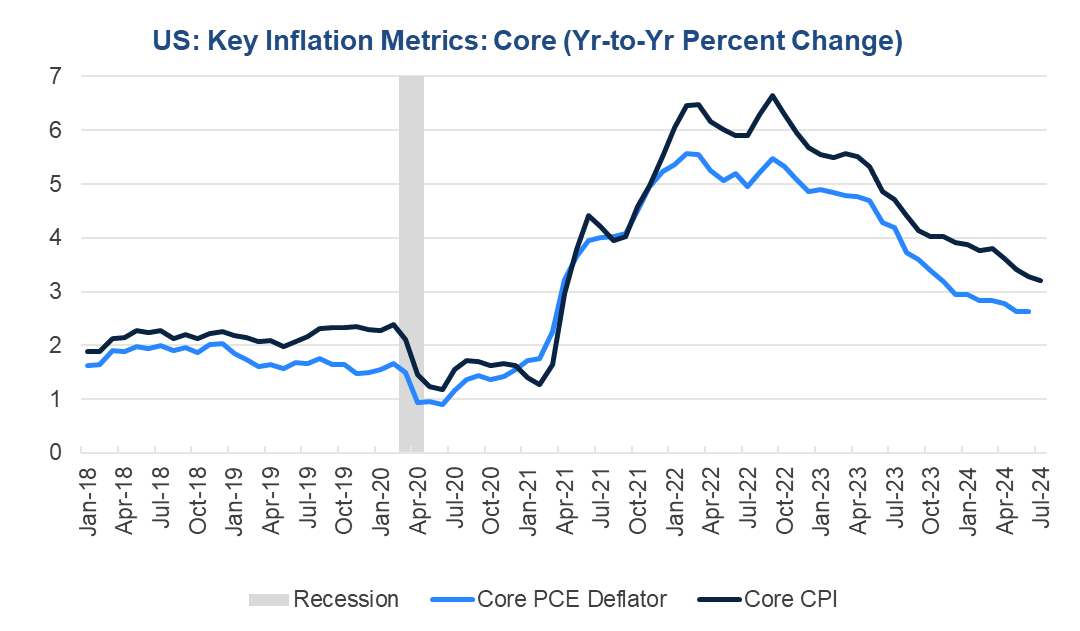

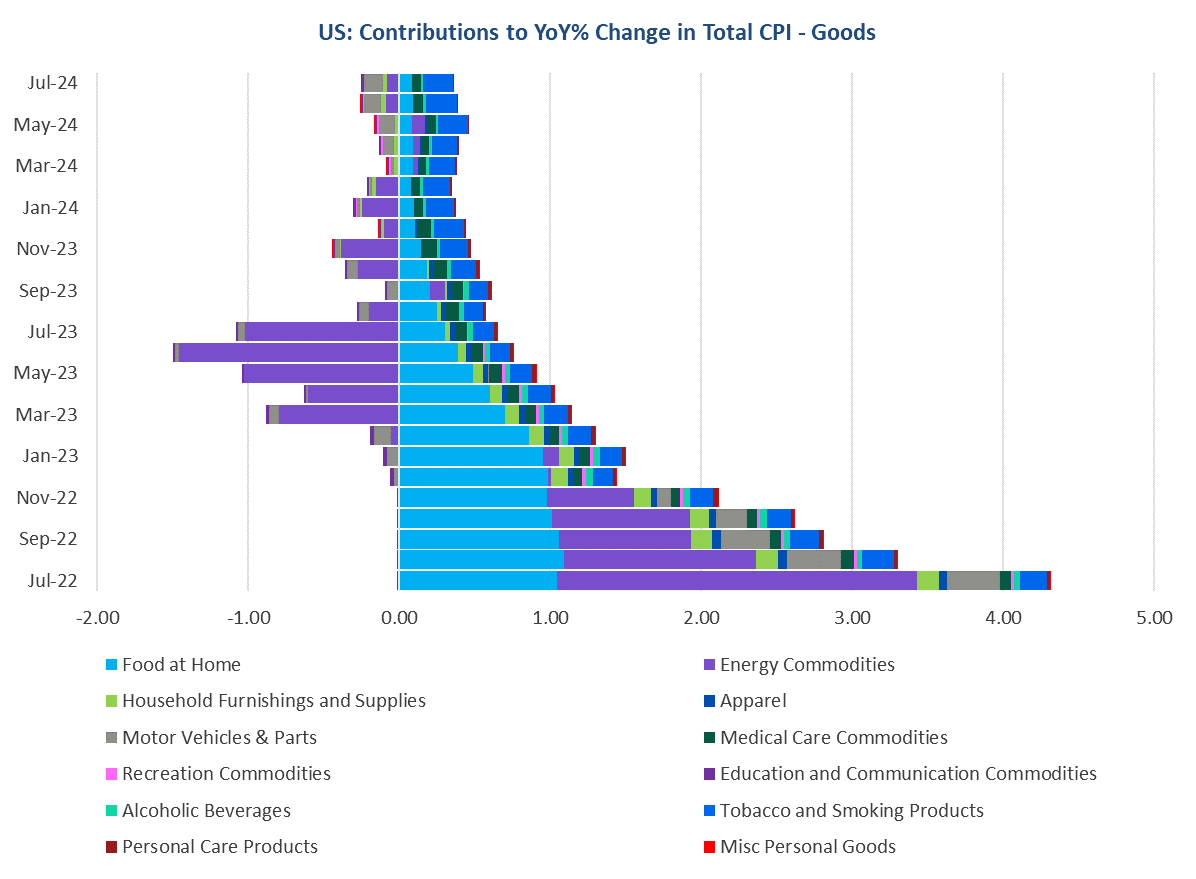

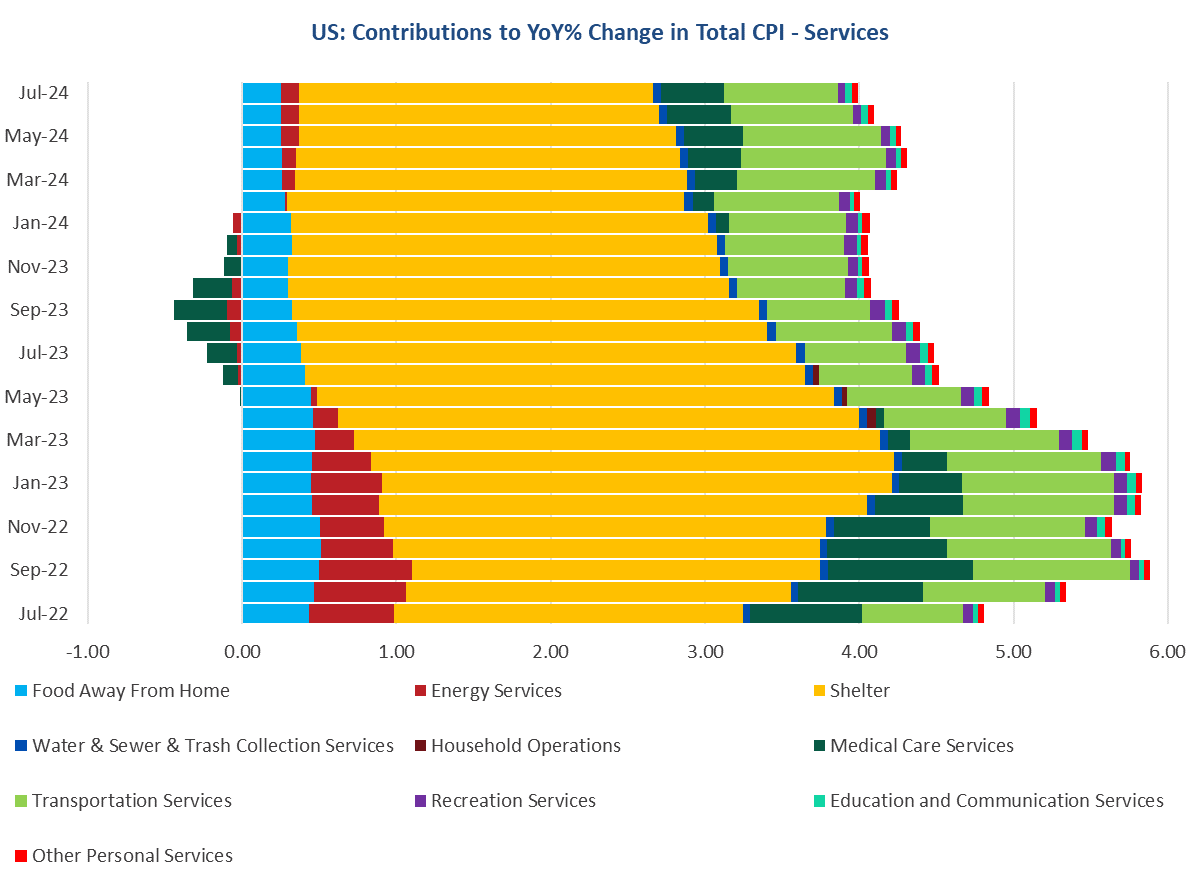

Total and core Consumer Price Index (CPI) inflation continued to cool in July, supporting the narrative of a first Fed rate cut in September. While the Fed focuses on the Personal Consumption Expenditure (PCE) deflator, the CPI often portends the direction of the PCE inflation gauges, which will be released later this month. Trusted Insights for What’s Ahead® Figure 1. CPI portends slower PCE inflation in July Total CPI rose by 0.2 percent month-over-month in July but slowed from 3.0 percent year-over-year to 2.9 percent. This is significantly lower than the peak of 9 percent year-over-year reached in June 2022. Meanwhile, core inflation, which is total less food and energy, also rose by 0.2 percent in the month, but slowed year-over-year from 3.3 percent to 3.2 percent. Figure 2. Core CPI inflation cooled as well, portending slower core PCE inflation On a year-over-year basis, food and tobacco are mainly driving CPI good prices higher, but this is largely being offset by declines in prices for autos and energy commodities. Figure 3. Goods price inflation components are largely offsetting Source: Bureau of Labor Statistics and The Conference Board. Hence, it is still the case that services are driving most CPI inflation on a year-over-year basis. The largest contributor is housing costs, but those are slowly shrinking consistent with past cooling in home prices. Nonetheless, medical services and transportation services price increases are still notable drivers of services inflation. Figure 4. Services price inflation cooling as shelter costs ease Source: Bureau of Labor Statistics and The Conference Board.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025