-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

March CPI might have provided a hint of what to expect in the coming months as a broader set of tariffs impact the economy. Rising goods prices may limit discretionary spending. In March, potentially some initial pass-through of tariffs on imports from China into apparel and furniture prices were offset by sharp declines in discretionary travel-related services prices.

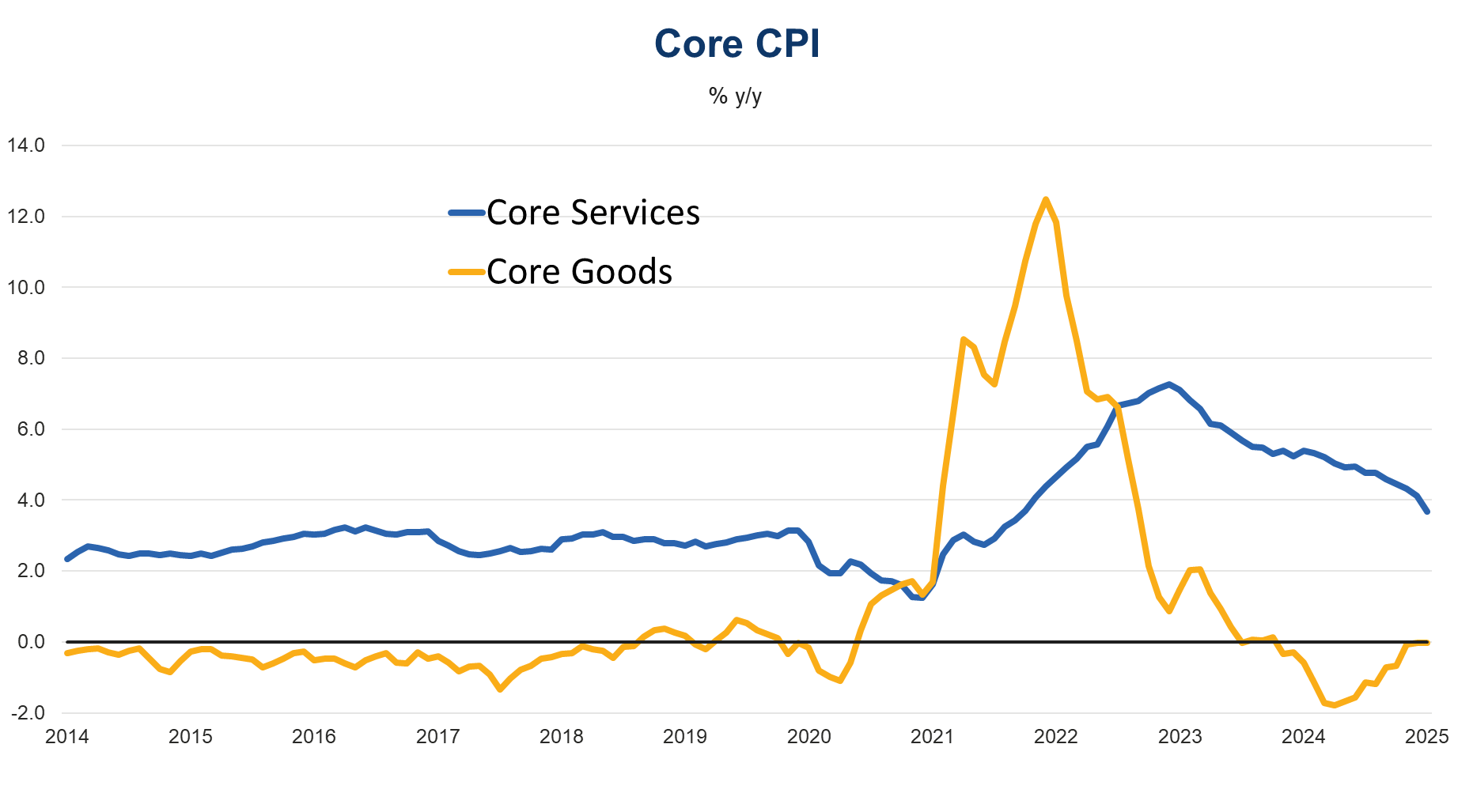

Figure 1. Service Price Growth Slows

Sources: Bureau of Labor Statistics, Haver Analytics, The Conference Board.

Uncertainty with respect to what extent tariffs will impact inflation suggests the Fed will likely remain on hold in the coming months, but may cut interest rate later this year as demand slows and the labor market deteriorates.

Rising prices in Q2 and Q3 will likely weigh on demand. Reduced spending will likely lead companies to cut prices, which will limit the rise in inflation later this year.

We project both Headline and Core PCE inflation, which CPI feeds into, to stabilize at around 3% y/y going into 2026. The Conference Board estimates tariffs may substantially lower GDP growth and raise inflation.

Figure 2. Goods Prices Dec

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

The US-China Trade War Escalates

April 09, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025