-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

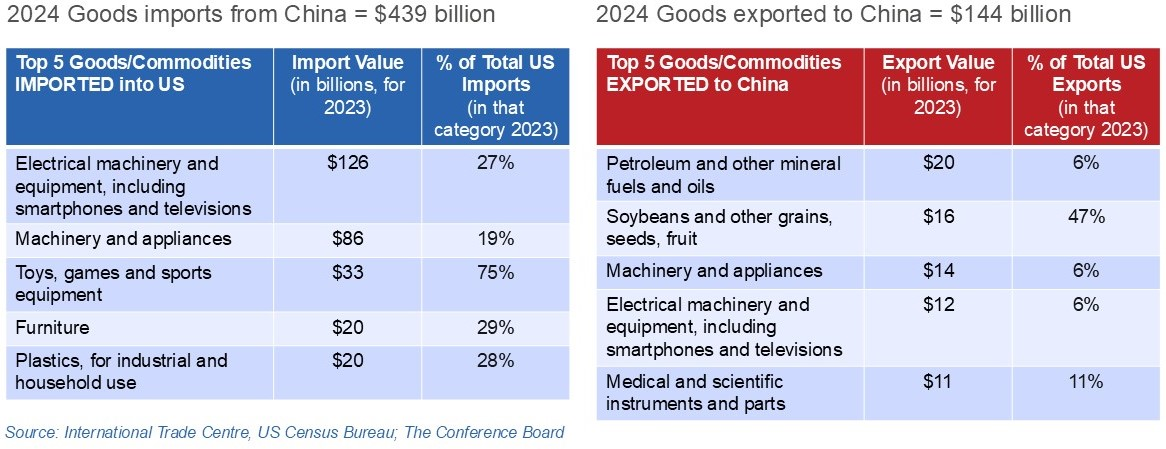

The US trade war with China escalated this week, with the US setting a tariff rate of 125% on goods imported from China, effective April 9. China retaliated, announcing 84% tariffs on goods it imports from the US. Why China is important: China is a leading trading partner of the US, and 14% of imported goods (measured by value) are sourced from China. US total goods trade with China stood at an estimated $582 billion in 2024, with a trade deficit of $295 billion, which is 5.8% greater than 2023. US goods exports to China in 2024 totaled $144 billion, down 2.9% from 2023. US goods imports from China in 2024 totaled $439 billion, up 2.8% from 2023. It is notable that US trade with China has declined over the past six years, down 12% since 2018. The TCB take: Consumer prices will escalate. With bilateral tariff rates between 80-125%, it is certain costs will be passed onto consumers. The leading goods imported from China include electrical items (e.g. smartphones and televisions), as well as machinery and appliances, toys, furniture, and plastics, including components of automobiles. For four of the top five product types imported from China, more than a quarter of those products imported into the US are from China (see table below). US farmers to be hit hard: A whopping 47% of US soybeans and related agriculture products exported by the US went to China. This is a downward trend, as China has increasingly turned to Brazil and other countries in recent years. These new tariffs could drastically reduce China’s dependence on US soybeans, and cripple that agricultural sector, which is primarily in Illinois, Iowa, Minnesota, and Indiana. The Administration and lawmakers are reportedly discussing farm aid in light of these retaliatory tariffs.US-China Trade Hinges on Electronics, Soybeans

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

Reciprocal Tariffs Will Weaken US and Global Economies

April 03, 2025

Cutting Discretionary Spending to Offset Higher Prices

March 28, 2025

Auto Makers Hit a Tariff Speedbump

March 27, 2025

Administration acts with Congress to reverse methane fee

March 25, 2025

Charts

The proliferation of easy-to-use generative AI requires that policymakers and business leaders each play an important role.

LEARN MORECharts

A hyperpolarized environment, diminished trust in our nation’s leaders.

LEARN MOREIN THE NEWS

Erin McLaughlin: How policy uncertainty may exacerbate infrastructure chall…

March 19, 2025

IN THE NEWS

Erin McLaughlin discusses the latest on tariff policy

March 14, 2025

IN THE NEWS

Alex Heil: Tariff uncertainty weighs on consumers, markets

March 10, 2025

IN THE NEWS

Steve Odland: Tariffs to cost U.S. manufacturers $144 billion annually

February 03, 2025

PRESS RELEASE

CED Maps Out 2025 Policy Plan for New President and Congress

January 23, 2025

IN THE NEWS

If the election is contested again in November, will corporate leaders push…

October 21, 2024