-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

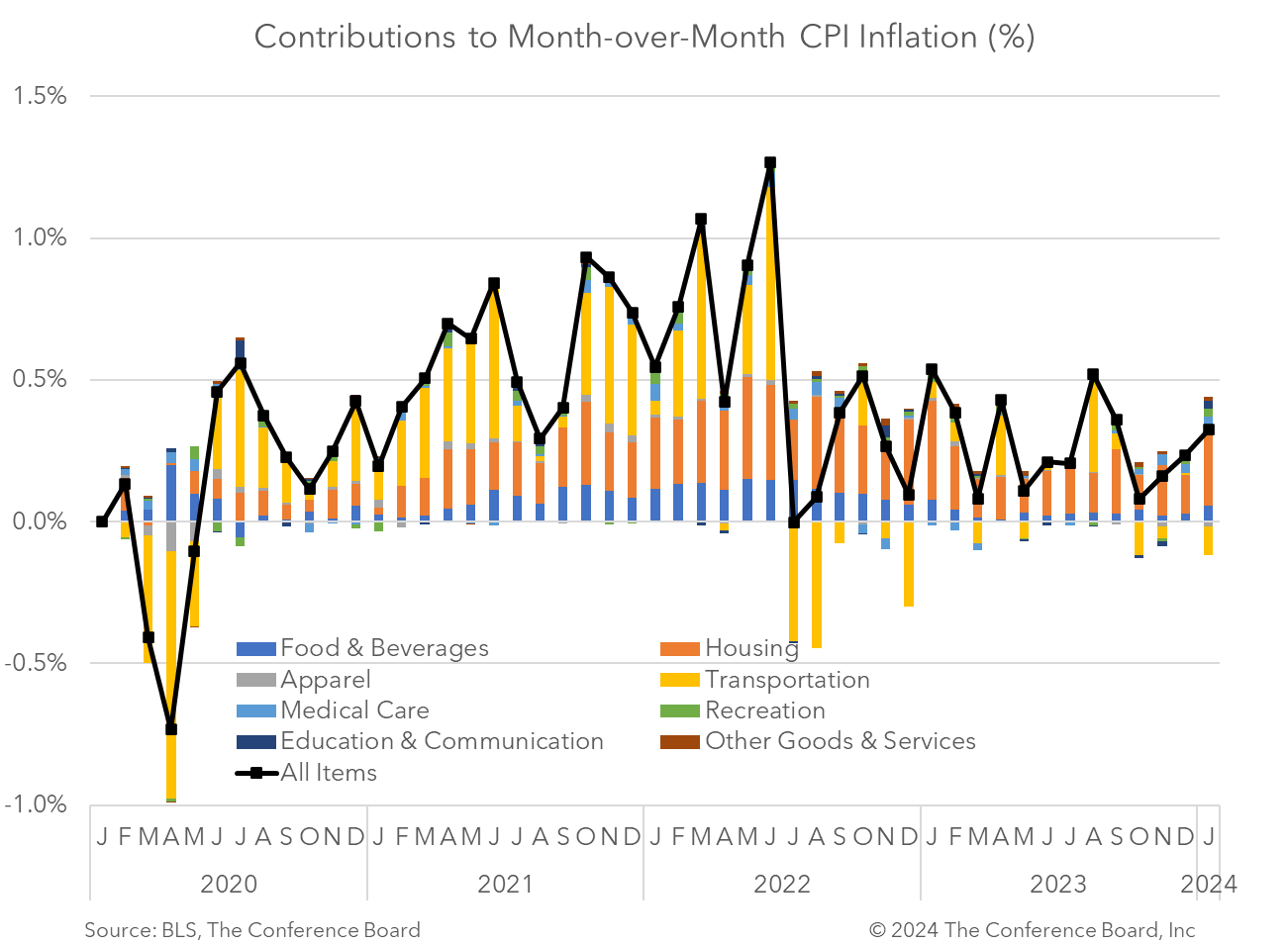

The January Consumer Price Index (CPI) showed that inflation rose by 3.1% from a year earlier, vs. 3.4% in December and 6.4% at the beginning of 2023. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.9% in January from a year earlier, vs. 3.9% y/y in December and 5.6% y/y at the beginning of 2023. While year-on-year price inflation was tame, prices rose more than expected on a month-on-month basis. Headline CPI rose 0.3% m/m (vs. 0.2% in Dec) and core CPI rose 0.4% m/m (vs. 0.3% in Dec). Federal Reserve Chair Powell has noted that the path to the Fed’s 2% inflation target would be ‘lumpy and bumpy’ and we agree. While headline inflation rates have fallen dramatically since earlier in 2023, this reading does show a bump in month-on-month terms. Shelter prices continued to be one of the primary drivers of inflation and picked up again slightly in January. However, in year-on-year terms, shelter prices continued to slow. We expect shelter prices to gradually cool in 2024 and to bring additional relief to CPI. Today’s data provide a preview of the PCE deflator – the Fed’s preferred measure for guiding policy – later this month. Given what the CPI signals for the PCE deflator and Fed Chair Powell’s previous statements, the Federal Reserve will likely hold rates steady at the conclusion of the March FOMC meeting. However, as inflation rates continue to slow over the next several quarters we expect the Fed to begin cutting rates starting in June. Provided that inflation settles around 2 percent before the end of the year, which is our forecast, we should see steady rate cuts of 25 basis point at subsequent FOMC meetings that push the Fed Funds rate to nearly 4% by year end. Further interest rate reductions are expected in early 2025. Core CPI rose by 0.4% m/m and 3.9% y/y, vs. November’s 0.3% m/m and 3.9% y/y. According to the BLS, the core CPI was overwhelmingly driven by shelter, but motor vehicle insurance, recreation, personal care, and medical care prices also played a role.

DATA DETAILS

Headline CPI rose by 0.3% month-on-month and 3.1% y/y, vs. December’s 0.2% m/m and 3.4% y/y. Month-on-month shelter prices continued to rise in January, contributing more than two-thirds of the all items increases, according to the Bureau of Labor Statistics (BLS). However, in year-on-year terms shelter price increases continued to moderate. While food prices continued to rise for the month, energy prices slid due to a large decline in gasoline prices.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025