-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

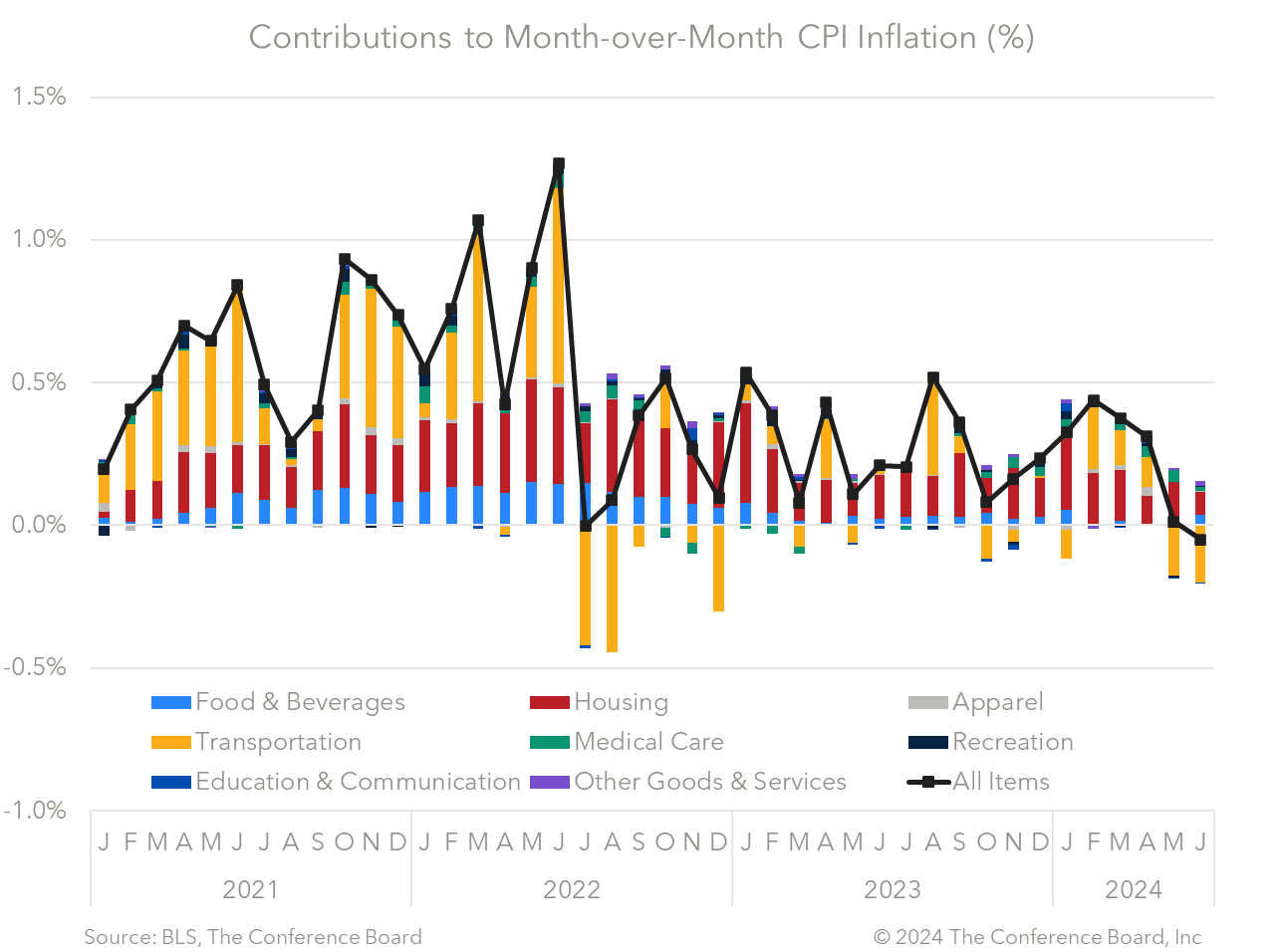

The June Consumer Price Index (CPI) showed that inflation rose 3.0% from a year earlier, vs. 3.3% in May and a peak of 9.1% in June 2022. Meanwhile, core CPI, which excludes volatile food and energy prices, rose by 3.3% from a year earlier, vs. 3.4% y/y in May and a peak on 6.6% y/y in September 2022. Following hotter-than-expected inflation in Q1 2024, May and June CPI data show that the US economy has reengaged the encouraging disinflationary trend seen in 2023. While falling gasoline prices helped drive the overall monthly growth rate into negative territory, cooling was seen across many other CPI components as well. Goods inflation fell by 0.4% from the month prior, and stubborn services inflation cooled to 0.1%. Shelter prices, which have been a major contributor to inflation in recent years, rose just 0.2% m/m. This was the smallest increase in nearly three years and is sign that more relief in this critical category may lie ahead. While core CPI has slowed to 3.3% y/y, core ex-shelter prices has slowed to just 1.8% y/y. Today’s data will be very welcomed by the Fed, which will meet at the end of July to discuss monetary policy. However, we do not believe that rate cuts are imminent. The Fed’s June Summary of Economic Projections called for a single 25 bps rate cut this year, vs. our call for two (in November and December). While June’s CPI data are consistent with our more doveish Fed Funds forecast, a September cut will require more reports like this one. We are not convinced, as yet, that this will occur. Core CPI rose by 0.1% m/m and 3.3% y/y, vs. May’s 0.2% m/m and 3.4% y/y readings. This month’s 0.1% m/m reading was the smallest m/m growth rate reported since August 2021. The shelter index, which has been one of the primary drivers of inflation in recent years, increased just 0.2% m/m – also the smallest increase since August 2021.

DATA DETAILS

Headline CPI fell by 0.1% m/m and rose by 3.0% y/y, vs. May’s 0.0% m/m and 3.3% y/y readings. Gasoline prices fell by 3.8% from the month prior more than offsetting an increase in shelter prices. According to the BLS, indexes that increased m/m included: shelter (0.2%), medical care (0.2%), food (0.2%), and apparel (0.1%). Meanwhile, indexes that declined m/m included: energy commodities (-3.7%), energy services (-0.1%), new vehicles (-0.2%), used vehicles (-1.5%), and transportation services (-0.5%). Used vehicles are now down 10.1% from a year ago.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025