-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

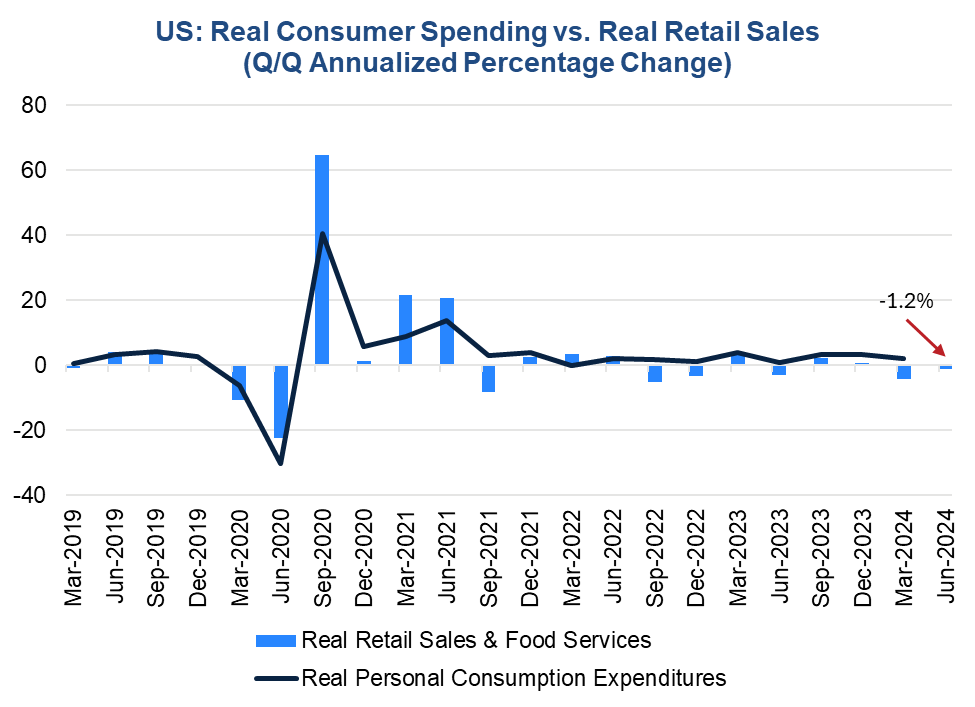

Nominal retail sales edged up by 0.1 percent in May following a 0.2 percent decline in April. Real retail sales (i.e., sales adjusted for inflation) also rose by 0.1 percent in May after a dramatic 0.5 percent decline in April. Nonetheless, real retail sales over the April-May span were down 1.2 percent annualized from Q1, suggesting consumer spending, especially on goods, continued to be weak in Q2. Figure 1. Real Retail Sales Point to Weak Q2 2024 Real Consumer Spending Sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board. Total nominal retail sales rose slightly in May largely due to a 0.8 percentage point pop in motor vehicle and parts dealer sales. Autos were up 0.8 percent and parts rose by 1.2 percent. Excluding motor vehicles and parts, sales dipped by 0.1 percent in the month. The dip reflected a 0.4 percent decline in food services and drinking places. This category has fallen in nominal terms for three out of the last five months. Sales for building materials fell by 0.8 and gasoline station sales declined by 2.2 percent. Retail control, which excludes volatile gasoline, motor vehicle, and building material store sales, as well as food and drinking places, rose by 0.4 percent in May after declining by 0.5 percent in the prior month. Sales increased at electronics, clothing, health care and personal care, sporting goods, general merchandise, nonstore retailer, and miscellaneous stores. Sales were down at furniture and grocery stores. Why Are Retail Sales Slowing? Still, real sales were only up modestly in May and were down 1.2 percent annualized from Q1, revealing continued reduction in consumer demand. Retail sales are fading as consumers continue to shift away from spending on goods. Slower real wage growth, depleted excess savings, and rising credit card debt are dampening consumption in general. Elevated interest rates (i.e., for financing), high prices, and rising insurance premiums (e.g., for autos) are weighing on goods purchases, in particular. Consumers have indicated reduced demand for big ticket items in The Conference Board Consumer Confidence Survey over much of the last 12 months, and the caution is now evident in weaker goods spending. Additionally, consumers are still concerned about the price levels of nondurable goods like food and energy, which are significantly higher than they were pre-pandemic, even though the rate of increase has slowed. In Q1 2024, consumers largely purchased services and goods spending fell. Consumers Planning to Alter Services Consumption Today’s retail sales report also showed a 0.4 percent decline in nominal restaurant and bar sales. After adjusting for inflation, real spending at these establishments were likely even lower. This bodes poorly for services consumption in Q2. The Conference Board Consumer Confidence Survey also reveals that even among services, consumers are intending to cut back on discretionary services (e.g., out of home entertainment) in favor of necessary services (e.g., health care, car insurance). Consumers are also trading down in the types of services they purchase. For example, consumers are more willing to pay for cheaper streaming services than go to the movies. Implications for the Fed Weaker consumer spending is all according to the Fed’s plan: cool economic activity and thereby inflation, hopefully without inducing a recession. We believe Q2 and Q3 real GDP growth will be anemic (between 0% and 1% q/q annualized). Still a recession is unlikely because businesses are still generally willing to hold on to their best talent. Against this backdrop, we anticipate that slower real GDP growth and inflation, plus a relatively healthy labor market will enable the Fed to cut interest rates twice this year – potentially at the November and December meetings. Indeed, only a slight majority of FOMC participants desired one cut at the June meeting, with others mostly anticipating two cuts.Trusted Insights for What’s Ahead®

Consumers Souring on Spending

Retail Control Increase Barely Offsets Declines in Services and Volatile Goods

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025