-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

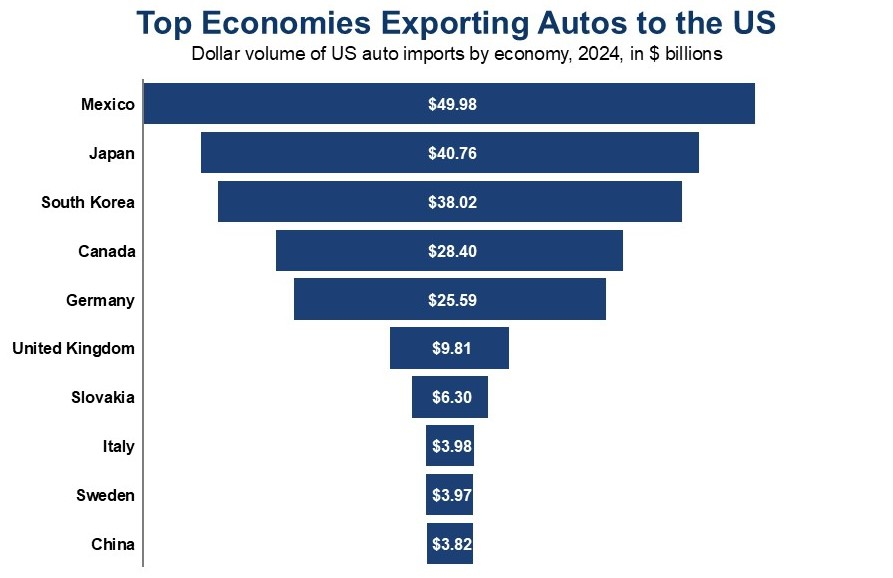

US imports of automobiles and automotive parts will face a 25% tariff beginning April 3, according to a proclamation by the White House on Wednesday, March 26. This new policy escalates a growing trade war between the US and its largest trading partners. Further tariff notices are expected from the White House on April 2, with the announcement of “reciprocal” tariffs aimed to shrink US trade deficits on a country-by-country basis. Tariffs will be on fully assembled vehicles and parts: The initial automotive tariffs will target fully assembled vehicles. The scope will expand on May 3 to include automobile parts, such as engines, transmissions, powertrain components, and electrical systems. Mexico and Canada will not be exempt from tariffs: However, there will be some preferential treatment under the US–Mexico–Canada Agreement (USMCA) for “US content” included as parts within the total automobile; 25% tariffs would be placed on non-US content from Canada and Mexico. The Administration expects to develop a plan to deal with parts that cross the borders of the three countries multiple times. It is typical for US car companies to develop and assemble automotive parts in plants across North America. Some notable models from US automakers finish assembly in Mexico and Canada, including Chevrolet Silverado pickup trucks and the Jeep Compass. The TCB take: Yes, prices will go up. Automakers and industry analysts say the combination of tariffs and a shift to more domestic US manufacturing will raise automobile prices. One recent analysis expects prices for North American–assembled automobiles to increase by $5,000 to $12,200 each, while vehicles imported from Europe and Asia could see prices climb by $3,000. Luxury Italian sports car maker Ferrari quickly announced that it would raise prices by 10% on some models in response to US levies. Besides Italy, which ranks eighth as a source of US auto imports, the trading partners outside of North America to be most impacted by tariffs include Japan, South Korea, and Germany. (See chart below.) Source: Tradeimex and The Conference Board

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Charts

The proliferation of easy-to-use generative AI requires that policymakers and business leaders each play an important role.

LEARN MORECharts

A hyperpolarized environment, diminished trust in our nation’s leaders.

LEARN MOREIN THE NEWS

Erin McLaughlin: How policy uncertainty may exacerbate infrastructure chall…

March 19, 2025

IN THE NEWS

Erin McLaughlin discusses the latest on tariff policy

March 14, 2025

IN THE NEWS

Alex Heil: Tariff uncertainty weighs on consumers, markets

March 10, 2025

IN THE NEWS

Steve Odland: Tariffs to cost U.S. manufacturers $144 billion annually

February 03, 2025

PRESS RELEASE

CED Maps Out 2025 Policy Plan for New President and Congress

January 23, 2025

IN THE NEWS

If the election is contested again in November, will corporate leaders push…

October 21, 2024