-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

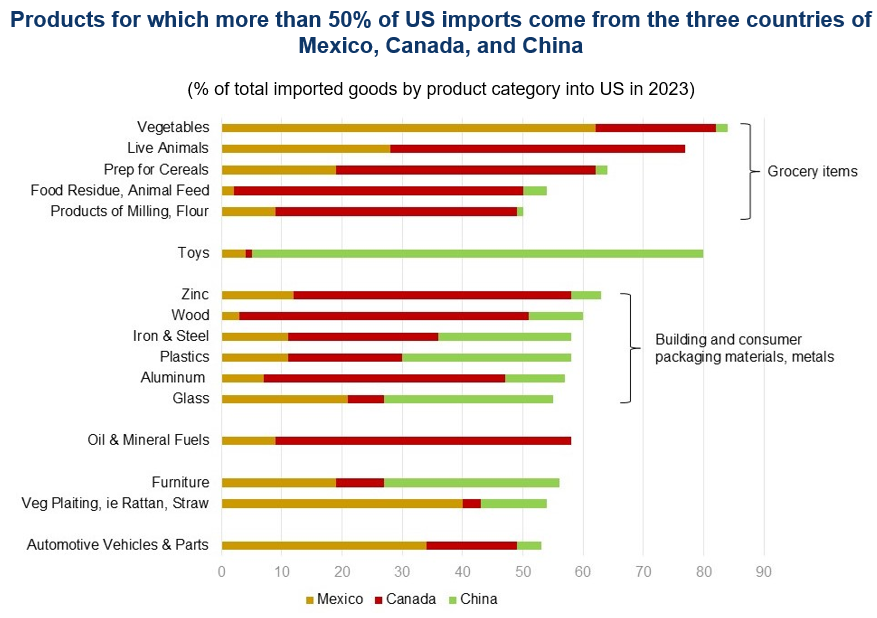

Levies were originally planned to start February 4, before the White House postponed the Mexico and Canada tariffs for 30 days. Canadian energy imports are expected to face a lower 10% rate. Bracing for impact: These tariffs impact a wide variety of US consumer and business goods. Together, goods from Canada, Mexico, and China make up 41% of US imports. The tariffs will have a significant impact on US grocery items, consumer packaging and building materials, automotive vehicles and parts, electronics, and manufacturing inputs including critical minerals. The US manufacturing industry has been bracing for tariffs, and the monthly Manufacturing ISM Report on Business released this week shows a contraction in the New Orders Index, as well as a surge in its Prices Index, now at its highest point since June 2022. An increase in prices is expected—at least in part—to be passed on to consumers. Growth and inflation fallout: The combined effects of the initially stated tariffs—25% each on Mexico and Canada, and 10% on China—could result in a 0.9 percentage point cut to US real GDP growth after four quarters, as well as a potential 0.6 percentage point rise in US inflation over four quarters. They will also lower GDP growth in the targeted economies. (For complete analysis, see our report US Tariff Plan Would Cut GDP Growth, Swell Inflation.) The Administration cited the need to invoke the International Emergency Economic Powers Act due to perceived threats posed by drugs and individuals entering the US illegally from these countries as the reason for the tariffs. The TCB take: Businesses should consider identifying alternatives for products and inputs—however, companies need to consider that this is a highly fluid situation and a schedule of reciprocal tariffs on the US’s 200+ trading partners is expected to be announced within the next couple of months. This has translated into a highly uncertain environment regarding the altering of supply chains.Tariffs on Three Largest US Trading Partners will Weaken Growth

Expect weaker economic growth in the US and for its three leading trading partners as 25% tariffs on goods imported from Mexico and Canada go into effect today. Additional 10% tariffs on China are also being implemented.

Members of The Conference Board get exclusive access to Trusted Insights for What’s Ahead® through publications, Conferences and events, webcasts, podcasts, data & analysis, and Member Communities.

Retail Sales Show Consumers Stock Up ahead of Tariffs

April 16, 2025

US Seeks Shipbuilding Revival, Muting of China Dominance

April 14, 2025

March CPI May Hint at Consumer Pullback as Tariffs Rise

April 10, 2025

The US-China Trade War Escalates

April 09, 2025

Charts

The proliferation of easy-to-use generative AI requires that policymakers and business leaders each play an important role.

LEARN MORECharts

A hyperpolarized environment, diminished trust in our nation’s leaders.

LEARN MOREIN THE NEWS

Erin McLaughlin: How policy uncertainty may exacerbate infrastructure chall…

March 19, 2025

IN THE NEWS

Erin McLaughlin discusses the latest on tariff policy

March 14, 2025

IN THE NEWS

Alex Heil: Tariff uncertainty weighs on consumers, markets

March 10, 2025

IN THE NEWS

Steve Odland: Tariffs to cost U.S. manufacturers $144 billion annually

February 03, 2025

PRESS RELEASE

CED Maps Out 2025 Policy Plan for New President and Congress

January 23, 2025

IN THE NEWS

If the election is contested again in November, will corporate leaders push…

October 21, 2024