-

Email

Linkedin

Facebook

Twitter

Copy Link

Loading...

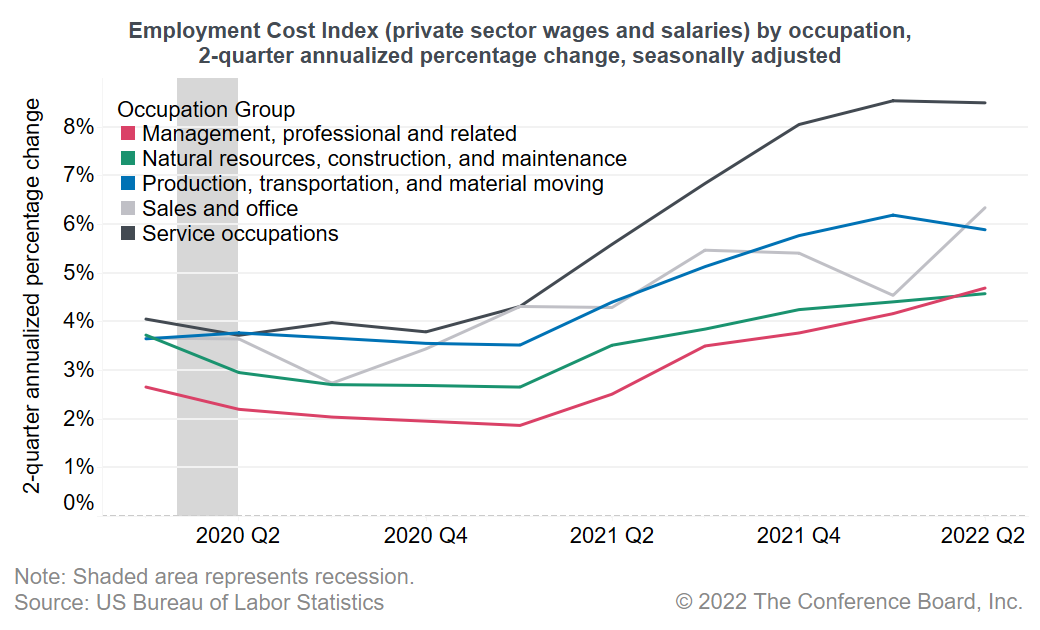

Wage growth continues to be strong and is accelerating further. The Employment Cost Index for Q2 2022 shows that wages and salaries for private industry workers increased by 5.8 percent at a 2-quarter annualized rate, up from 4.9 percent in in the previous 2-quarters. Wages and Inflation continue to rise and momentum has not stopped. Wages have not grown this fast since the mid-1980s and this is a big uptick compared to a year ago when wages increased 4.3 percent at a 2-quarter annualized rate. Labor shortages are the main reason for strong pay increases. Additionally, fast growth in prices and wages feed into each other. Wide differences in wage growth exist across jobs. Wages for manual services workers (e.g., food services, cleaning, personal care, healthcare support) grew at 8.1 percent at a 2-quarter annualized rate, much faster than 5.0 percent for management and professional workers (e.g., computer, engineering, science, legal, finance) (See Chart). While labor markets are tight across the entire economy, labor shortages are especially severe for manual labor and manual services workers. While wage growth is still strong today, in 2023 pay increases could possibly decelerate. Amid strong inflation and Fed interest rate hikes, the economy is expected to slow over the coming months and possibly enter a short and mild recession by the end of this year and into early 2023. Even though so far, the labor market has been rapidly adding new jobs to the economy (on average 375,000 over the last 3 months), we expect the labor market to cool in reaction to slowing economic activity. As a result, employers would be hiring less which would then result in diminished recruitment challenges and reduced pay increases. Commentary on today’s U.S. Bureau of Labor Statistics Employment Cost Index

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025

February Jobs Report Hints at Growing Uncertainty

March 07, 2025

Q4 ECI Wage Deceleration Slows

February 07, 2025

Stability Underneath January’s Noisy Jobs Report

February 07, 2025

Robust Job Gains Close 2024

January 10, 2025

November Job Gains Rebound from Disruptions

December 06, 2024

Charts

Wage inequality continues downward trend in quarter 2 of 2023

LEARN MORECharts

Recent hikes in quits rates indicate retention difficulties across all industries, but have nearly approached pre-pandemic levels

LEARN MORECharts

Decline in office and administrative support work suggests certain tasks and skills have been replaced by automation

LEARN MORECharts

CEOs are having trouble filling positions as the unemployment rate drops lower

LEARN MORECharts

Non-union wages are growing faster than union wages

LEARN MORECharts

This index identifies the risk of future labor shortages for specific occupations.

LEARN MORECharts

Labor shortages and the tightening of labor markets have led companies to lower education requirements when recruiting.

LEARN MORECharts

The rapid rise in job openings to historic highs coupled with increasingly more workers quitting is leading to severe labor shortages, especially in leisure & hospita…

LEARN MORECharts

There has been a large increase in the share of office job ads that mention remote work since before the pandemic.

LEARN MOREPRESS RELEASE

Why the World Is Running Out of Workers

August 13, 2024

PRESS RELEASE

Report: As US Economy Grapples with Nearly 11 Million Unfilled Jobs, Immigr…

March 21, 2023

PRESS RELEASE

Difficulty Finding and Retaining Office Workers Skyrockets

May 05, 2022

PRESS RELEASE

CED Report Outlines Ways to Tackle Ongoing Labor Shortages

April 20, 2022

PRESS RELEASE

Tepid Job Gains Highlight Hiring Difficulties

June 04, 2021

PRESS RELEASE

Report: As COVID-19 Recedes, Labor Shortages Return as a Key Challenge for …

May 28, 2021