For Release 9:30 AM ET, March 14, 2025

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

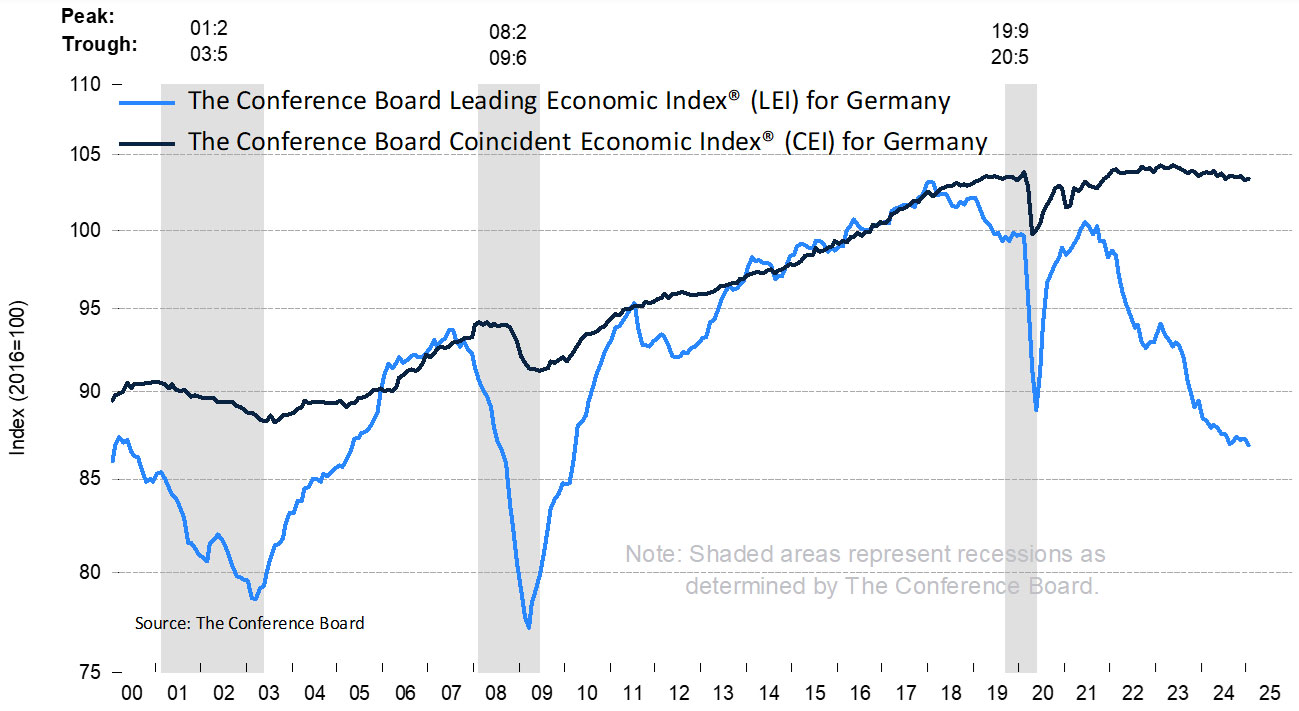

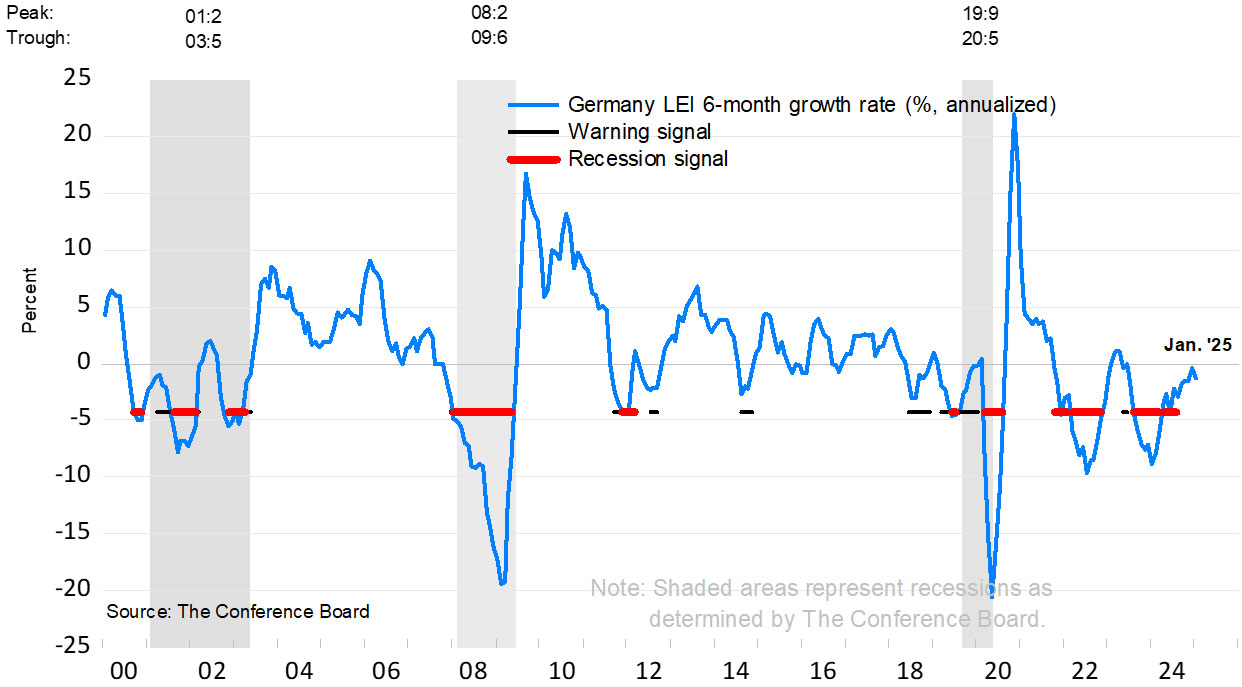

The Conference Board Leading Economic Index® (LEI) for Germany declined by 0.5% in January 2025 to 86.9 (2016=100), after inching up by 0.1% in December 2024. During the six-month period between July 2024 and January 2025, the LEI for Germany contracted by 0.7%, still an improvement from the 1.1% contraction over the previous six-month period, from January to July 2024.

The Conference Board Coincident Economic Index® (CEI) for Germany inched up by 0.1% in January 2025 to 103.4 (2016=100), after a 0.3% decline in December 2024. Over the six-month period between July 2024 and January 2025, the CEI for Germany was unchanged, a still positive turn from the 0.3% contraction over the previous six-month period.

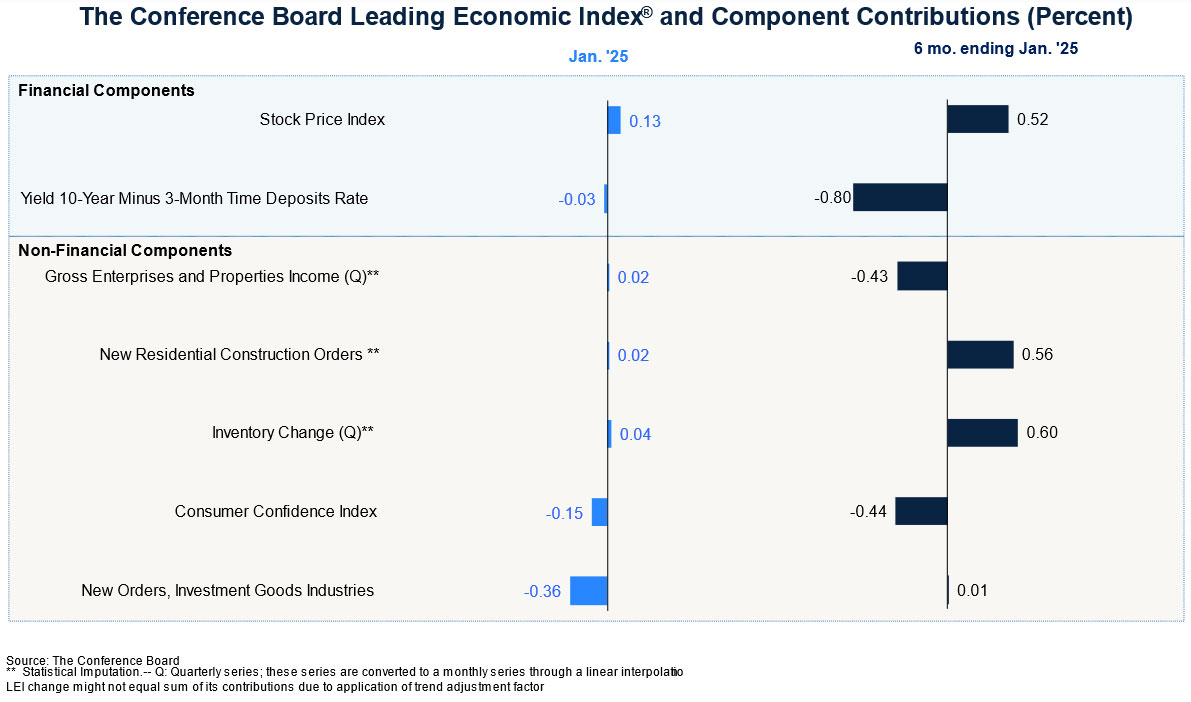

“The LEI for Germany declined in January,” said Allen Li, Associate Economist at The Conference Board. “A significant negative contribution from new orders for investment goods and consumer confidence weighed on the index in the first month of the year. This likely reflected policy uncertainties preceding the February general elections as well as concerns about trade tensions with the United States. However, the Index is still showing some improvements from early 2024 lows, suggesting lessened headwinds to economic growth ahead. The Conference Board currently projects the German economy to stagnate in early 2025, but to develop into a sluggish recovery, with real GDP reaching just 0.1% for the year.”

The next release is scheduled for Friday, April 11, 2025, at 9:30 A.M. ET.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for Germany

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The seven components of Leading Economic Index® for Germany are:

The four components of the Coincident Economic Index® for Germany are:

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org

With graph and summary table

March 14, 2025

PRESS RELEASE

LEI for Australia Unchanged in February

April 16, 2025

PRESS RELEASE

LEI for the UK Decreased in February

April 15, 2025

PRESS RELEASE

LEI for Brazil Ticked Up in March

April 15, 2025

PRESS RELEASE

The LEI for Germany Increased in February

April 11, 2025

PRESS RELEASE

LEI for South Korea increased in February

April 10, 2025

PRESS RELEASE

LEI for Spain Rose in February

April 10, 2025

All release times displayed are Eastern Time

Charts

Recession and growth trackers are analytical tools to visualize where the economy is and where it is headed.

LEARN MORE

Business & Economics Portfolio

March 31, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Report

The Evolving Economic Outlook for Europe

July 10, 2024 11:00 AM ET (New York)

Is a Global Recession on the Horizon?

July 13, 2022 11:00 AM ET (New York)