The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major economies around the world.

The LEI for France Improved in February

Latest Press Release

Updated: Friday, April 18, 2025

For Release 9:30 AM ET, April 18, 2025

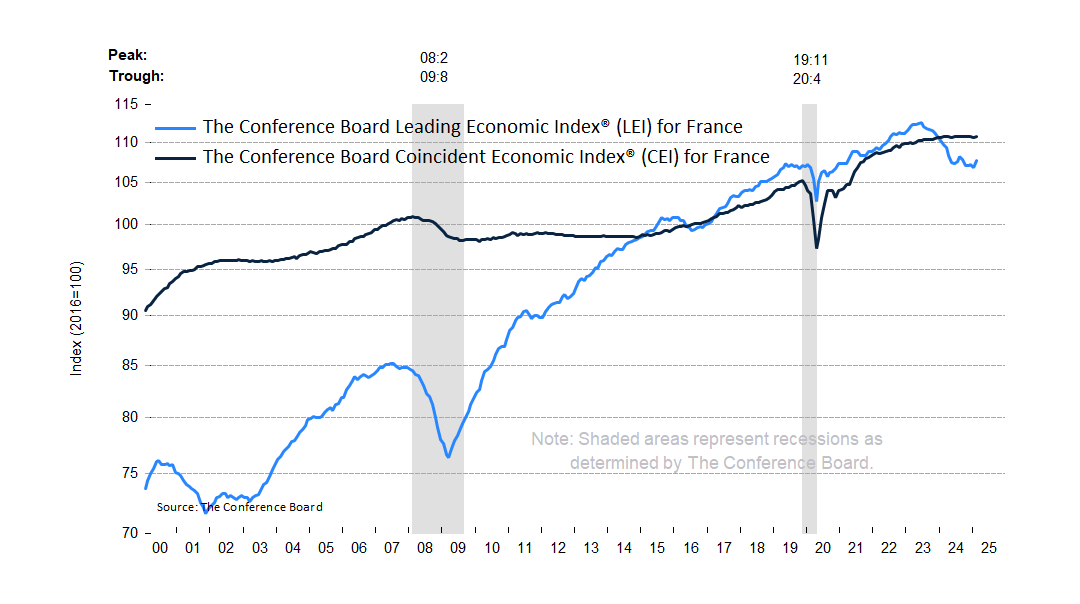

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

The Conference Board Leading Economic Index® (LEI) for France increased by 0.7% in February 2025 to 107.7 (2016=100), after decreasing by 0.3% in January. The France LEI contracted by 0.5% over the six-month period between August 2024 and February 2025, about a third of the 1.4% decline over the previous six-month period.

The Conference Board Coincident Economic Index® (CEI) for France ticked up by 0.1% to 110.7 (2016=100) in February 2025, reversing a 0.1% decline in January. Nevertheless, over the six-month period between August 2024 and February 2025, the CEI for France decreased by 0.1%, reversing the 0.1% increase over the previous six-month period between February and August 2024.

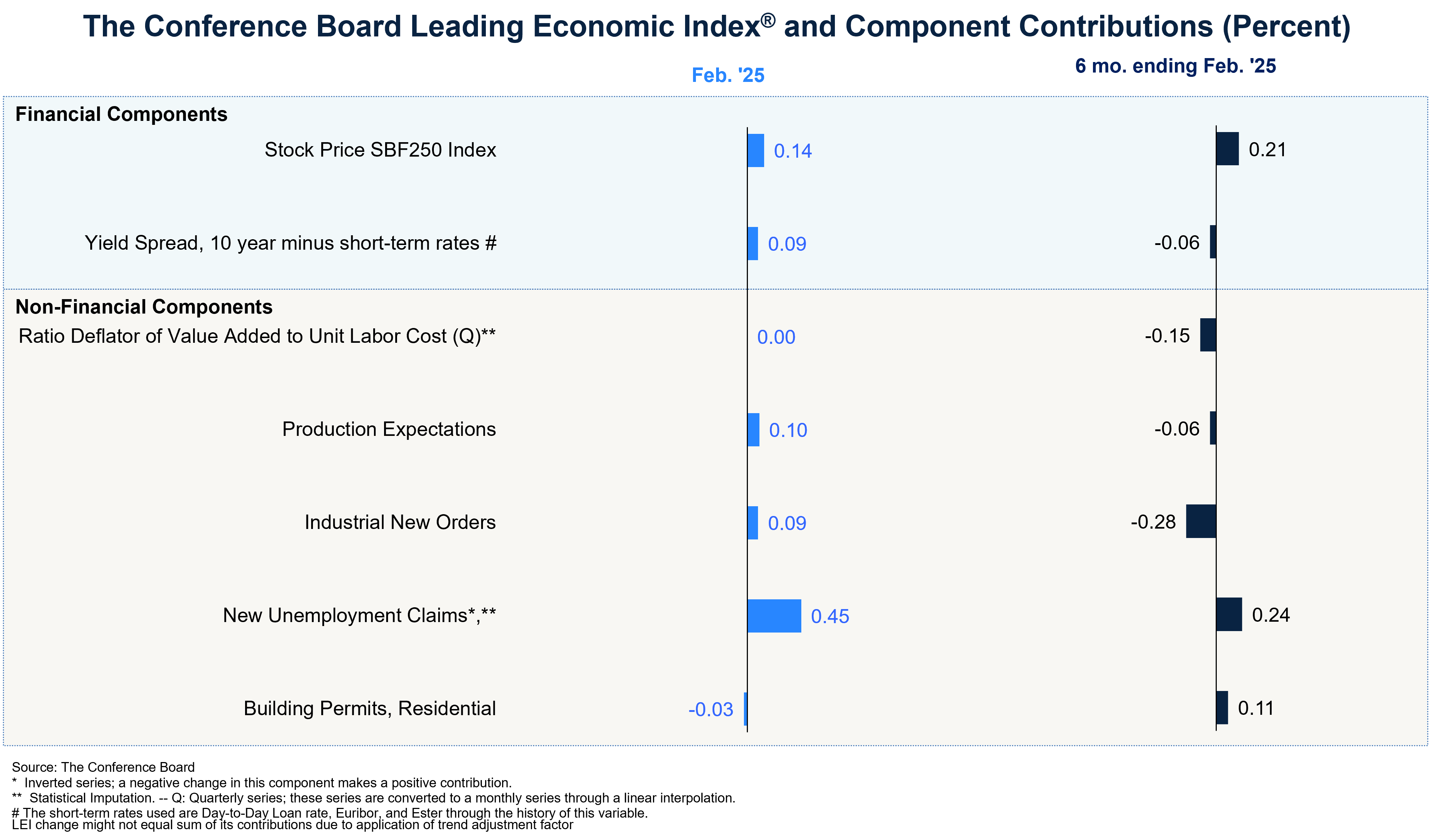

“The France LEI improved in February, reversing the weakness in the last quarter of 2024 and beginning of 2025,” said Allen Li, Associate Economist at The Conference Board. “Notably, six of the seven components of the LEI contributed positively including a drop-off in new unemployment claims, a rise in stock prices, and a pick-up in production expectations. A modest decline in the building permits component was the only drag on the Index. The monthly improvement may reflect some temporary easing of economic and political uncertainties in February. Still, over the past 6 months, weaknesses among LEI’s components remained widespread, warning of risks to economic growth. Against the background of renewed political turmoil, mounting fiscal pressures, tariffs, a still weak business sentiment and slower global growth, The Conference Board currently forecasts France GDP growth to slow to 0.5% in 2025 from 1.1% in 2024.”

The next release is scheduled for Friday, May 16, 2025, at 9:30 A.M. ET.

The France LEI improved in February

Only the building permits component of the France LEI weakened slightly in February

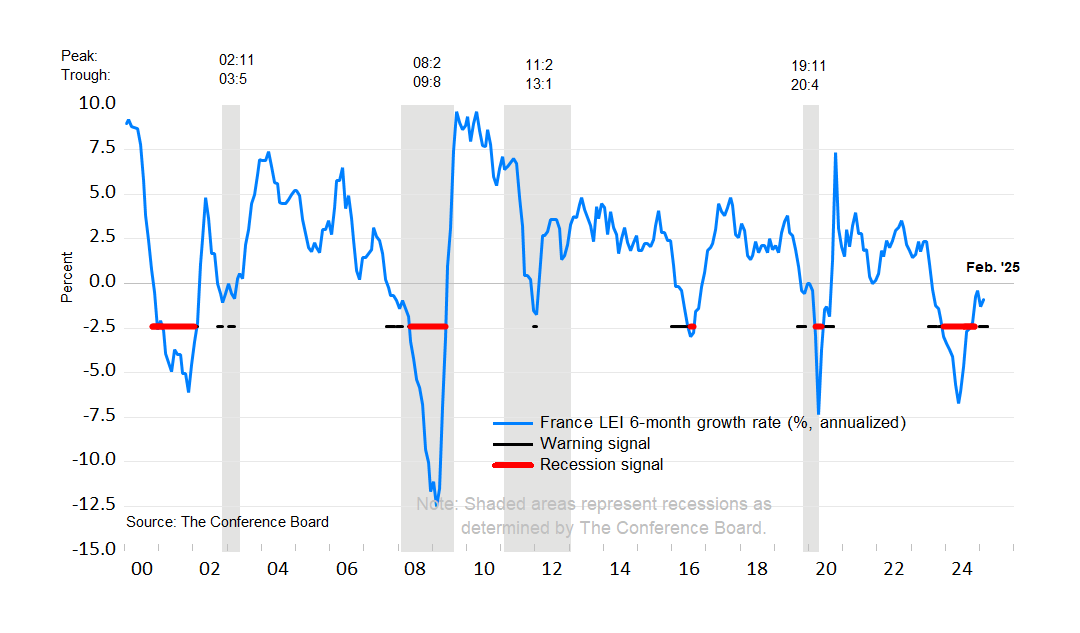

Warning signals to economic growth remain

NOTE: The chart illustrates the so-called 3Ds–duration, depth, and diffusion–for interpreting a downward movement in the LEI. Duration refers to how long the decline has lasted. Depth denotes the size of decline. Duration and depth are measured by the rate of change of the index over the most recent six months. Diffusion is a measure of how widespread the decline is among the LEI's component indicators—on a scale of 0 to 100, a six-month diffusion index reading below 50 indicates most components are weakening.

The 3Ds rule signals an impending recession when: 1) the six-month diffusion index lies at or below 50, shown by the black warning signal lines in the chart; and 2) the LEI's six-month rate of decline falls below the threshold of −4.1%. The red recession signal lines indicate months when both criteria are met simultaneously—and thus that a recession is likely imminent or underway.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for France

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The seven components of Leading Economic Index® for France are:

- Yield Spread

- Stock Prices

- Building Permits

- New Unemployment Claims

- Industrial New Orders

- Production Expectations

- Ratio P/L Cost

The four components of the Coincident Economic Index® for France are:

- Industrial Production

- Personal Consumption

- Employment (Private sector)

- Wages and Salaries

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org