The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major economies around the world.

LEI for India Ticked Up in March

Latest Press Release

Updated: Tuesday, April 22, 2025

For Release 11:00 AM ET, April 17, 2025

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

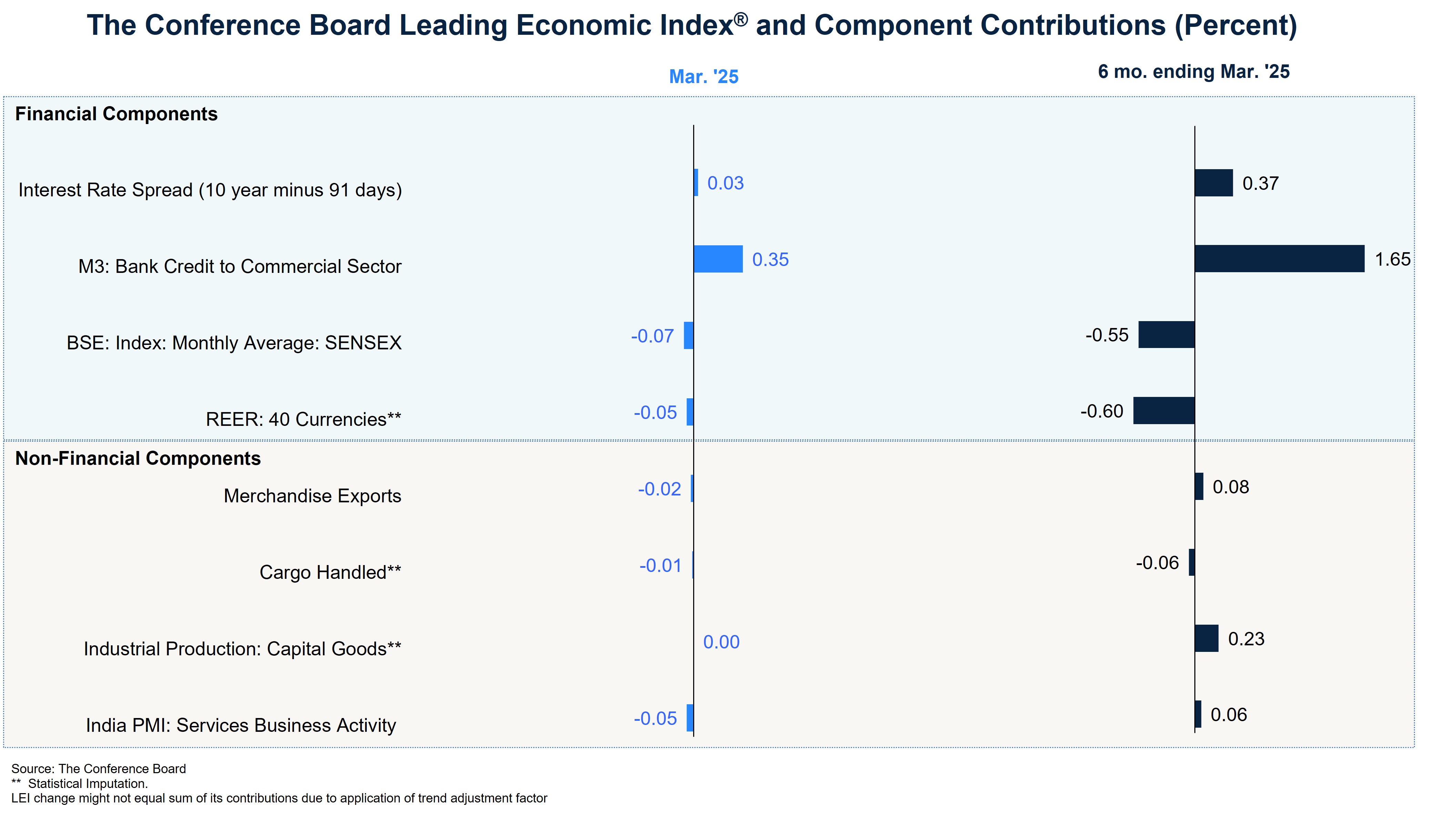

The Conference Board Leading Economic Index®(LEI) for India increased by 0.1% March 2025 to 158.7 (2016=100), after decreasing by 0.1% in February. Overall, the LEI grew by 0.5% over the six-month period from September 2024 to March 2025, half the 1.0% growth over the previous six-month period between March and September 2024.

The Conference Board Coincident Economic Index® (CEI) for India increased by 3.8% in March 2025 to 147.7 (2016=100), partially recovering after the steep drop of 6.8% in February. The Index expanded by 2.6% over the past six-month period ending in March 2025, a much faster rate than the 0.9% growth over the previous six months.

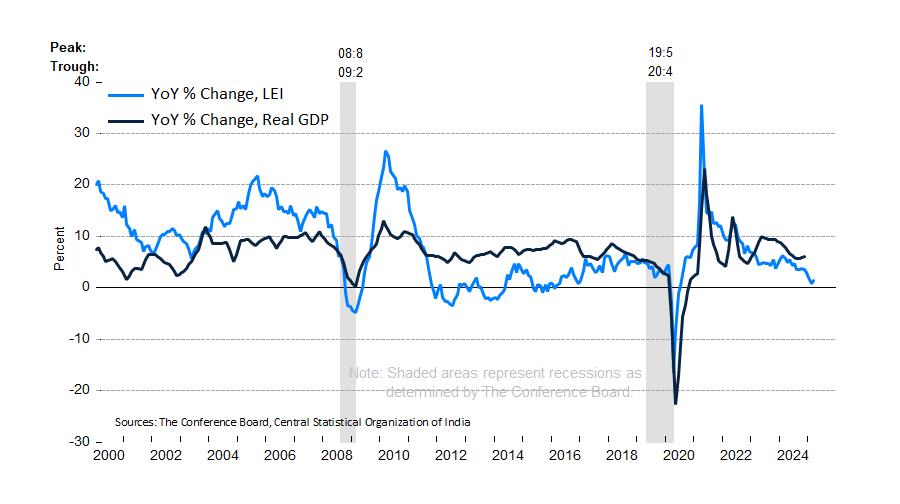

“The LEI for India ticked up in March,” said Malala Lin, Economic Research Associate, at The Conference Board. “The marginal gain reflects continued improvements in money supply and the interest rate spread, which offset the negative contributions from the other LEI components. Both the six-month and annual growth rates picked up slightly in March, however, they have not recovered all the lost momentum since October of 2024. These sluggish growth rates for the LEI may indicate economic challenges in the near-term. In line with this, The Conference Board currently forecasts that India’s real GDP will moderate after a strong Q1 and slow to 5.9% growth in 2025 from 6.6% in 2024.”

The next release is scheduled for Thursday, May 22, 2025, at 9 A.M. ET.

The India LEI has been relatively flat for over a year

Increases in M3 and interest rate spread only slightly offset declines in the remaining components

The LEI annual growth rate ticked up in March but remained on a downward trend

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for India

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around eight months.

The eight components of the Leading Economic Index® for India are:

- Interest Rate Spread

- BSE: Index: Monthly Average: SENSEX

- REER: 40 Currencies

- M3: Bank Credit to Commercial Sector

- Merchandise Exports (deflated by Wholesale Price Index)

- Cargo Handled

- Industrial Production: Capital Goods

- India PMI: Services Business Activity

The three components of the Coincident Economic Index® for Indiaare:

- Industrial Production

- Total Imports (deflated by Wholesale Price Index)

- Vehicle Sales, Passenger Vehicles

To access data, please visit: https://data-central.conference-board.org/

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org