The Russian invasion of Ukraine and Western sanctions won’t go unnoticed in the oil market

February 25, 2022 | Chart

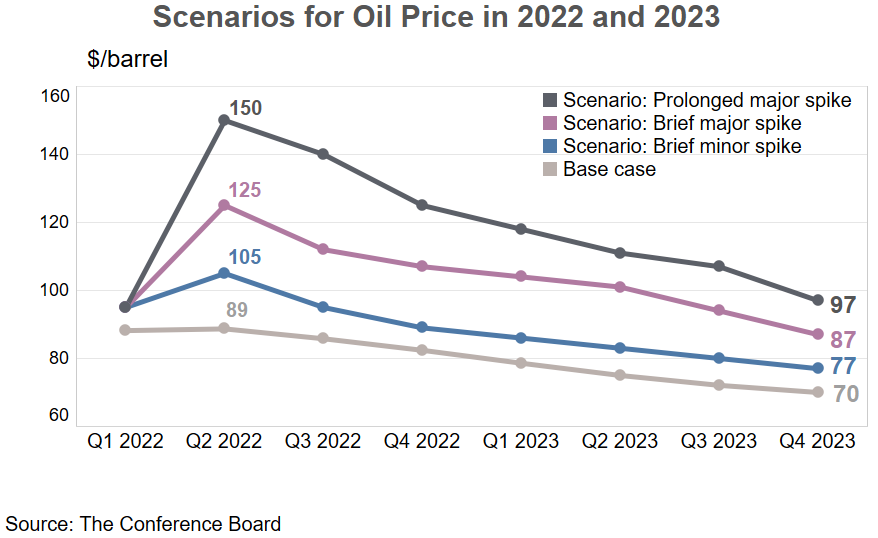

Uncertainty and volatility cloud more than ever the oil market. 2021 ended with low global oil inventory levels, a fragile market balance and heightened geopolitical tensions, yet the probabilities of a Russian military invasion of Ukraine seemed low. On February 24th 2022, the full invasion scenario became a reality. How will the conflict impact oil prices? We elaborate three scenarios in light of ongoing developments and possible sanctions by the EU, US and other NATO members.

- Oil Scenario 1 – Strict sanctions are imposed on Russia in reaction to the invasion – however US and EU shield the oil market by not sanctioning Russian exports. This requires no intervention from major oil producers like the US and OPEC. This will result in a brief minor spike in oil prices.

- Oil Scenario 2 – As Russia refuses to retreat and intensifies its aggression on Ukraine, Russian exports are sanctioned and OPEC+ is dissolved during the second quarter of 2022. The US will then intervene by releasing barrels from its reserves, and OPEC and Iran will try to fill the gap. Oil prices will go through a brief major spike, with oil prices reaching 125$ per barrel during the second quarter of 2022. US, other OECD countries and OPEC will collectively pump more barrels to balance the market.

- Oil Scenario 3 – Gas pipelines from Russia to Ukraine are jeopardized as a result of intense military shelling in addition to the Russian exports sanctions, resulting in a prolonged major spike. In this scenario of steep and prolonged disruption, oil prices could reach a record level of 150$ per barrel. The declining global spare oil capacity will limit the effectiveness of OPEC and OECD support of the oil market.