Euro Area Outlook for 2022 and 2023: Why the Recession Risk Is Overrated

Insights for What’s Ahead

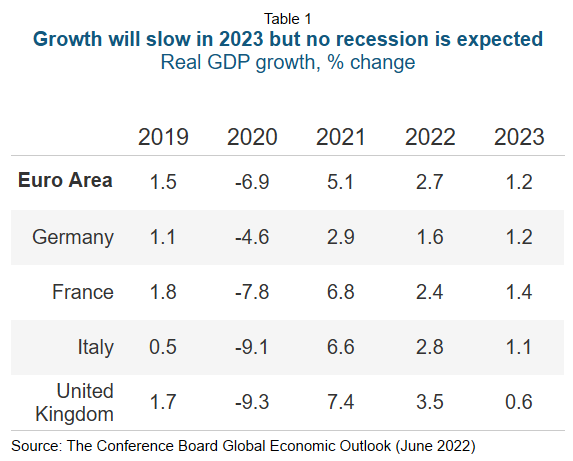

- GDP in the Euro Area will most likely continue to expand in the second half of 2022 and in 2023 escaping a recession despite the headwinds generated by the Russian invasion of Ukraine. The Conference Board forecast for GDP growth is 2.7 percent in 2022 and 1.2 percent in 2023. A tight labor market could trigger labor productivity gains in 2023, which would lead to a longer-term gain for the region’s economy.

- Downside risks have increased since the start of the war in Ukraine in February. Higher-than-expected inflation could negatively influence business and household spending. Central bank tightening in response to inflation opens the door to potential monetary policy mistakes and excessive pressure on sovereign debt. However, there are pockets of strengths in the economy, such as a strong labor market and corporate signals to continue investing.

- Given the state of the economy, companies have an important decision to make: let geopolitical uncertainty postpone investment decisions and suspend hiring or use the shock on energy prices to double down on innovation to reduce dependency and invest to increase production capacity within the region.

Why Some Expect a Recession in the Euro Area in 2022

The war in Ukraine led to a rapid deterioration of the Euro Area economic outlook. As a result, The Conference Board downgraded estimates for growth for 2022 and 2023. Before the war, GDP growth in the Euro Area was expected to approach 4 percent in 2022, but the latest forecast has it at 2.7 percent.1 Sure enough, so far GDP has kept expanding in 2022. In the first quarter, it grew by 0.6 percent versus the previous quarter.2 The question is whether it will continue to do so.

The case for a possible recession in Europe relies on two arguments: 1) inflation hitting households’ consumption decisions; and 2) a new set of supply bottlenecks resulting from the war in Ukraine.

High inflation may hurt consumption, particularly among low-income households. Inflation is running very hot, with consumer price inflation at 8.1 percent y/y in May and producer prices at 37 percent y/y in April (latest data available). These are record-breaking numbers since the creation of the euro in 1999. While a large part of this is due to the energy price shock, core inflation (inflation excluding energy and food) is also increasing and in May was at 3.8 percent—well above the 1.1 average annual pace of increase over the last decade. The weakening of the euro versus the dollar over the last year has added to inflationary pressures by making imports more expensive, particularly energy imports which are usually priced in dollars. Soaring inflation increases the risk of slower growth for three reasons: First, producers may find it increasingly unprofitable to keep production lines going. Second, consumers may cut back on spending as their purchasing power erodes. Finally, surging inflation brings the risk of a sharp and sudden tightening of monetary policy and accompanying recession closer.

A new set of supply chain bottlenecks hurts the Euro Area’s manufacturing sector. Before the war in Ukraine began, Europe was already facing severe supply chain disruptions, many related to the pandemic, as shortages of raw materials, slow delivery times, and mounting labor shortages were constraining output. Although lower input prices and faster delivery times in early 2022 pointed to some ease in supply disruptions, the war has exacerbated those bottlenecks and created new ones. Disruptions in shipments due to closed ports and airspaces affected by the war, a resurgence of truck driver shortages, and elevated container shipping rates are examples of the supply challenges the Euro Area is facing. Lockdowns in major cities in China in April and May added to disruptions. Moreover, the fact that Russia and Ukraine are major exporters of key commodities used in manufacturing adds fuel to the fire. Global commodity prices have soared to decade-highs and are more volatile than ever. Unless supply challenges ease again, industrial output in the Euro Area is likely to suffer.

The Case Against a Recession in the Euro Area in 2022H2: A Strong Labor Market and Corporate Investment Intentions

Despite declining consumer confidence and new supply chain struggles, the Euro Area economy will escape a recession. The case against a recession is based on three arguments: the initial business reaction to the shock, a stronger-than-expected outlook for investment among European CEOs, and a healthy labor market.

Growing headwinds notwithstanding, business activity in the Euro Area remains resilient amid the war in Ukraine. Composite Purchasing Managers’ Index (PMI), a monthly indicator of business activity, has been steadily above the 50-point threshold since the start of the war in Ukraine, signaling moderate expansion of business activity in the region. At the sectoral level, activity in services gathered pace in recent months as COVID-19 related restrictions eased further across Europe. Challenged by war-related production hiccups and lockdowns in China, the manufacturing sector lost some momentum. Still, the manufacturing PMI remained above 50 between February and May. Overall, strong PMI numbers in 2022 point to robust economic growth in the Euro Area, as pent-up demand for services offsets the weaknesses faced by activity in manufacturing. In fact, the composite PMI signal is consistent with rolling quarterly GDP growth in the 1 percent range up through May, which would be a step up from the 0.6 percent in the first quarter (see Chart 1).

The European economy entered the latest shock with a strong labor market. The European labor market entered 2022 on very strong footing. The unemployment rate reached an all-time low of 6.8 percent in April (equivalent to 11 million unemployed workers), while the number of employed in the first quarter of 2022 was well beyond prepandemic levels. Buoyant demand for goods during the recovery from the pandemic, and more recently services as restrictions ease further, pushed managers’ hiring intentions to all-time highs. The war in Ukraine has added some uncertainty to the employment outlook, particularly in the manufacturing sector. Nonetheless, with vacancies unfilled and hiring expectations lingering at historic highs, the European labor market is likely to remain robust in coming months.

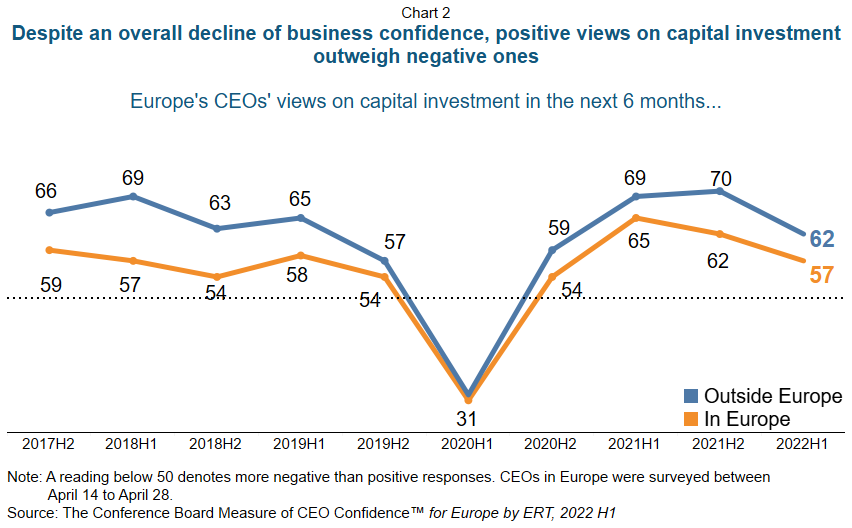

European CEOs signal intent to continue investing. Compared to 2021 H2, European CEO expectations for capital investment deteriorated in 2022 H1 (see Chart 2). Still, the indicator remained above 50, meaning that positive views regarding investment over the short run outweigh negative views. Several factors may explain such results. Some companies may be reluctant to revise investment plans unless there are further drastic changes in the landscape. Other businesses may invest to accelerate their efforts to reduce dependency on Russian energy, expand capacity within Europe, and build a stronger basis for the use of recycled materials.

The Euro Area Outlook for 2023: Sufficient Demand and a Surprise in Productivity Growth will Come to the Rescue

On the demand-side the Euro Area economy looks more robust than what the shock from the Russian invasion of Ukraine may suggest. Corporate investment may increase to react to the need to find alternative energy sources, increase capacity within the region and find new solutions to overcome supply chain bottlenecks. Rising inflation will reduce household consumption, but a strong labor market and wage increases may dampen the effect. Finally, the export sector may benefit from a weak euro and from the expected post-lockdown recovery in China. On the supply side, the tight labor market may raise productivity growth, providing an extra boost to the economy. The Conference Board estimate for real GDP growth in 2023 in the Euro Area is 1.2 percent, above the estimated potential growth of about 1 percent for the next decade.

Two external factors constitute major risks that can negatively influence the European outlook in the second half of 2022 and in 2023.

- Monetary policy tightening could harm growth without curbing inflation. The European Central Bank will start increasing interest rates in July 2022. The move is controversial because a large portion of European inflation is ‘imported’ as the region has very limited domestic energy resources. By increasing interest rates, the ECB risks slowing the economy without solving the inflation problem adding pressure to highly indebted economies by increasing the cost of debt. Notices of policy rate changes have already increased the risk premiums of highly indebted sovereigns, like Italy. The ECB announcement on June 15th declaring the intention to develop a “new anti-fragmentation instrument” sent an important signal about the will to prevent undue pressure on weaker economies.

- Geopolitical tensions in Europe cannot be ignored. The risk of escalation of the war in Ukraine should not be underestimated. This could happen both in cyberspace and the real world. For example, a possible attack close to Ukraine’s borders against an EU/NATO member state (e.g., Poland or the Baltic countries) could expand the war beyond Ukraine’s borders. Another risk would be Russia’s use of tactical nuclear weapons, something that would also increase the likelihood of NATO reaction. The launch of large-scale cyberattacks targeting critical infrastructure or shutting-down private networks is another way that Russia could step up its aggressive actions. Russia halting gas exports to Europe is also a threat. EU leaders’ decision on May 30th to ban almost 90 percent of Russian oil imports by the end of 2022 could trigger a retaliatory move by Russia. The European Commission estimates that under such a severe scenario, GDP growth in the Euro Area would more than halve in 2022 compared to the current forecast.

Appendix: The Outlook for Major European Economies

United Kingdom: Brexit comes to the surface again. At first glance, the UK economic outlook looks relatively similar to the Euro Area. Both economies recovered from the pandemic-induced losses at similar speed, and both inflation and labor market tightness are at historic highs. However, beneath the high-level similarities lurk three important differences:

- Core inflation is much higher in the UK than in the Euro Area. In April, core inflation (excluding energy and food) accounted for almost two-thirds of headline inflation of 7.8%, while in the Euro Area core inflation in April was responsible for a third of the 7.4% inflation rate. This is partly the result of faster wage growth in the UK, leading to more price increases in service sector activities.

- Brexit reduced the capacity of the economy through the loss of workers, subdued investment since 2016, and downsized the markets to which British companies can send their exports.3 Breaking from the European Single Market is resulting in the economy reaching the limits of its capacity faster.

- The Bank of England started increasing interest rates much earlier than European Central Bank. Where the ECB has been able to afford to hold off on rate rises until July 2022, the Bank of England has been raising them since the end of 2021. Since December 2021, the Bank of England has raised rates five times with 25 basis points hikes, bringing the official bank rate to 1.25 percent, above prepandemic levels. More rate hikes are expected as inflation in the UK is projected to be the highest among large mature economies.

The Conference Board estimates UK GDP growth reaching 3.5% this year, before slowing severely to 0.6% in 2023.

Germany: Manufacturing under stress. Europe’s largest economy expanded modestly in Q1 2022, by 0.2 percentage points, compared to the previous quarter. High input prices exacerbated further by the war in Ukraine and supply disruptions, worsened by the strict lockdowns in China, exacted a significant toll on Germany’s production output and capabilities. For example, production of transport equipment, the backbone of Germany’s industry, is 25 percentage points below its prepandemic level. If the war in Ukraine continues, then headwinds to manufacturing are unlikely to abate, weighing negatively on the country’s economic growth in coming quarters. Historically high inflation, which is eroding households’ real incomes, also puts downward pressure on growth prospects. Even investments, Germany’s main contributor to output growth in Q1, could take a powerful hit if geopolitical tensions between Russia and much of the rest of Europe worsen. Amid heightened uncertainty and a handful of headwinds that hopefully will not worsen, we estimate the German economy to grow modestly in 2022, at 1.2 percent. Meanwhile, improvements in the inflation outlook and easing of supply disruptions could unfold some time in H2 2022, keeping growth in 2023 below to its long-term average of 1.5 percent.

France: A dynamic service sector will support growth. Following a strong recovery from the pandemic shock, the French economy entered 2022 on a weak footing. Elevated uncertainty, initially around the severe spread of the COVID-19 Omicron variant at the start of the year and then the war in Ukraine, weighed negatively on private consumption. However, the economic situation in Q2 is expected to improve. The complete lifting of pandemic-related restrictions will boost services spending. Undoubtedly, elevated inflation adds risks to the consumption outlook. Nevertheless, the measures the French government adopted to temper energy price rises will help cool off inflationary pressures in coming months, thus keeping domestic demand afloat. Amid lower inflation expectations, a dynamic services sector and relatively robust activity in manufacturing activity is likely to pick up in coming quarters, with the French economy expanding by 2.4 percent in 2022, and by 1.4 percent in 2023.

Italy: Regained trust will support the outlook in the next quarters. In Q1 2022, Italy reached its prepandemic output levels, after expanding by 0.1 percent quarter-over-quarter. As Europe’s second largest Russian energy importer, price hikes in natural gas and oil have resulted in soaring inflation. Spiking costs are hindering industrial output and sending overall inflation to highs not seen in decades. Despite this short-term upheaval, the overall sentiment on the Italian economy has improved since the arrival of Mario Draghi as Prime Minister. Trusted political leadership combined with incoming EU funding from the NextGenEU program seems to have ended years of stagnation in Italy. Looking ahead, the main challenge for the Italian economy will be the pressure on risk premiums on government debt resulting from ECB interest rate hikes. Should the risk of a sovereign debt crisis not materialize, we expect growth momentum to remain stagnant in Q2, before picking up again in the second half of the year, also driven by high tourist activity in summer months. Upbeat hiring expectations across all sectors and a labor force that still has room to expand will also help improve consumption. Overall, we expect the Italian economy to expand by 2.8 percent in 2022, and 1.1 percent in 2023.

(1) This number may however be somewhat flattering given a relatively high carry-over effect of 2 percent. That means, if there would be no growth in all quarters this year, in other words the level of output of the last quarter of 2021 would remain unchanged for the rest of this year, the annual growth rate for 2022 would still be 2 percent.

(2) However, the Euro Area growth figures for Q4 of 2021 and Q1 2022 are heavily skewed by swings in Irish GDP data. Euro Area GDP excluding Ireland grew by 0.5 percent in Q4 2021 and 0.3 percent in the first quarter of this year.

(3) Investment in the UK grew by only 2% since 2016, versus 21% in the Euro Area. Figures are based on real Gross Fixed Capital Formation, comparing the Q4 2019 value with the 2016 average.

(4) OECD economic outlook June 2022.