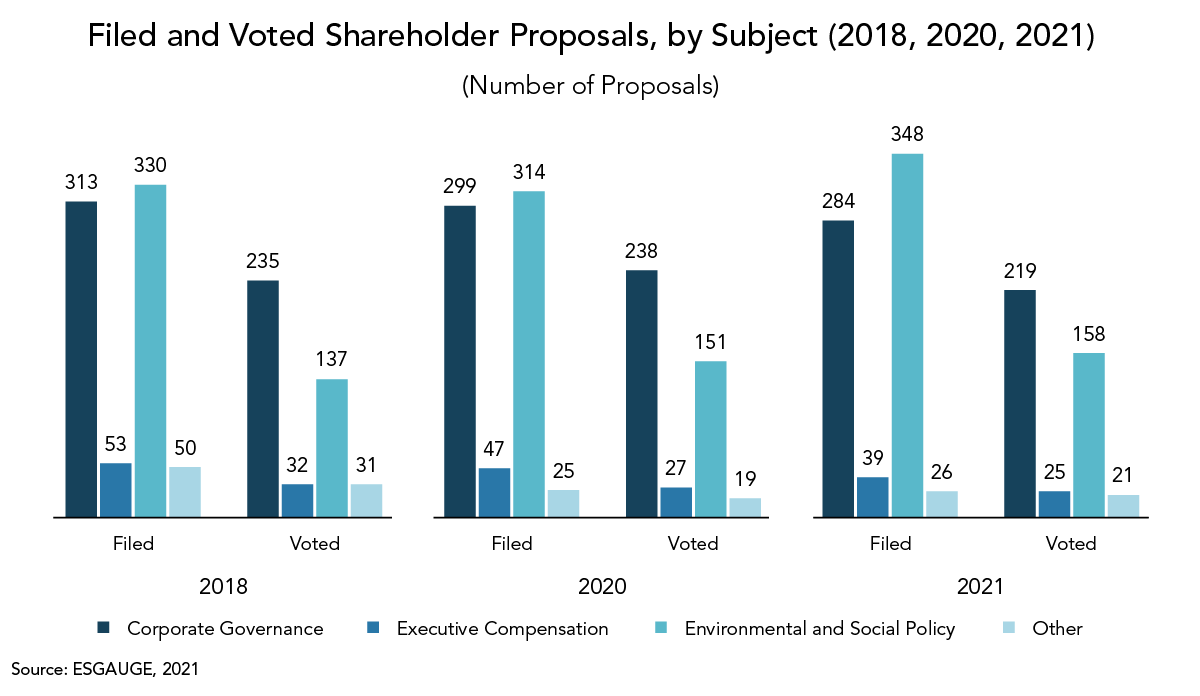

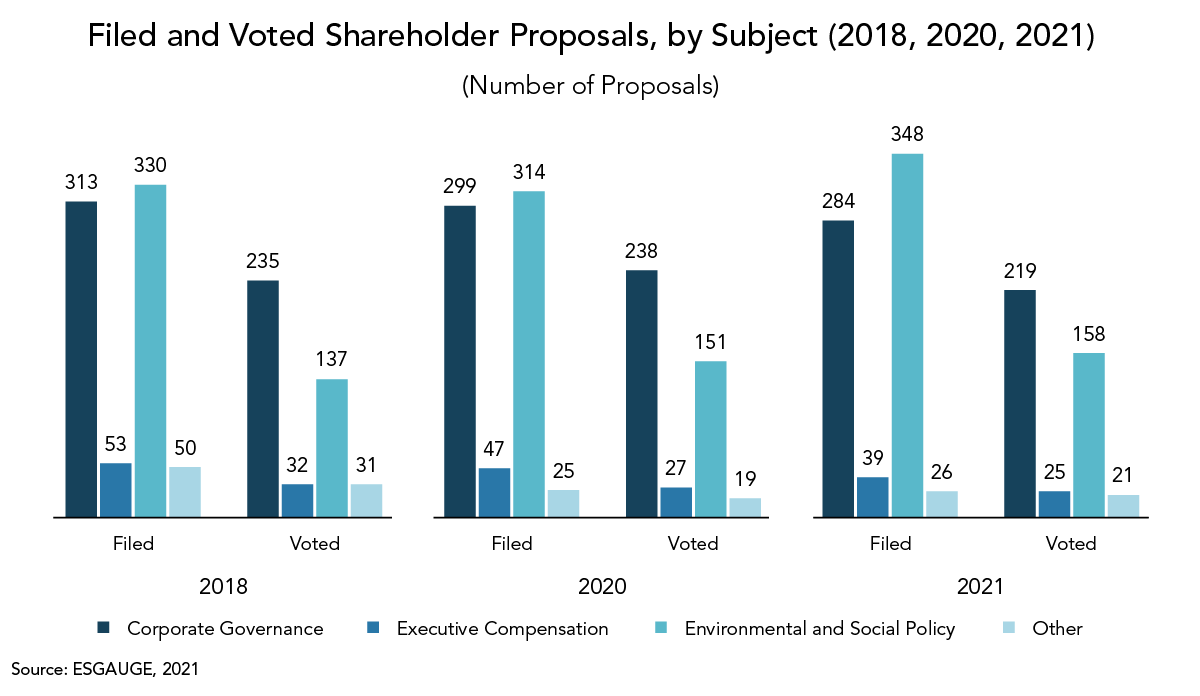

Fueled by a rise in “S” proposals on topics such as diversity and corporate purpose, the number of E&S proposals increased significantly in 2021.1,2 In the Russell 3000, during the first half of 2021, shareholders filed 348 E&S proposals and voted on 158 of them, compared to 314 filed and 151 voted proposals in the first half of 2020. While the number of E&S proposals grew, the number of filed and voted governance proposals (284 and 219, respectively) and executive compensation proposals (39 and 25, respectively) declined compared to 2020.

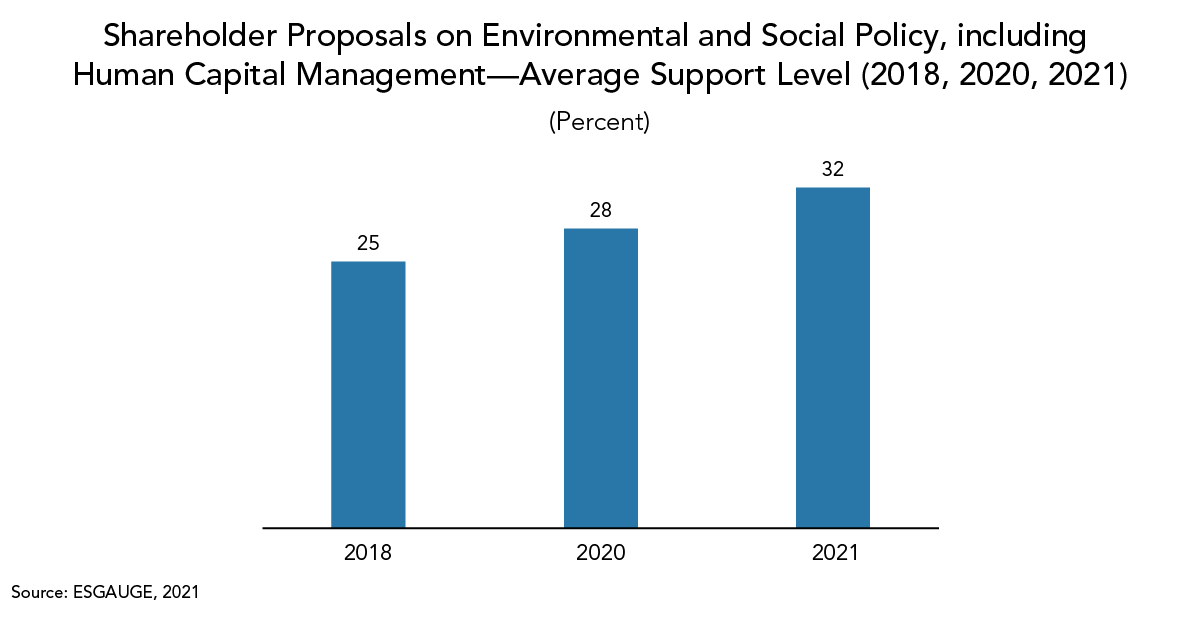

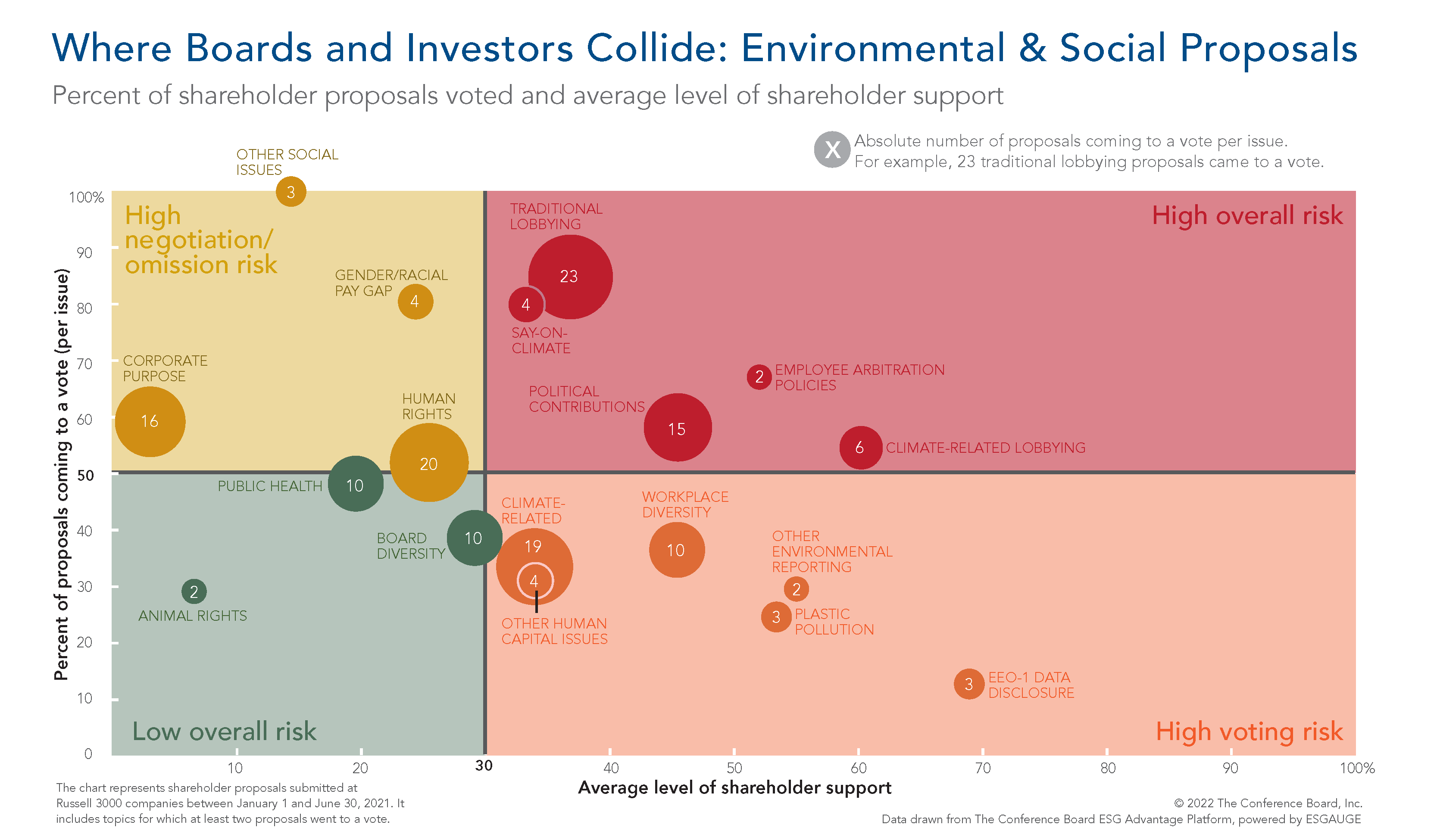

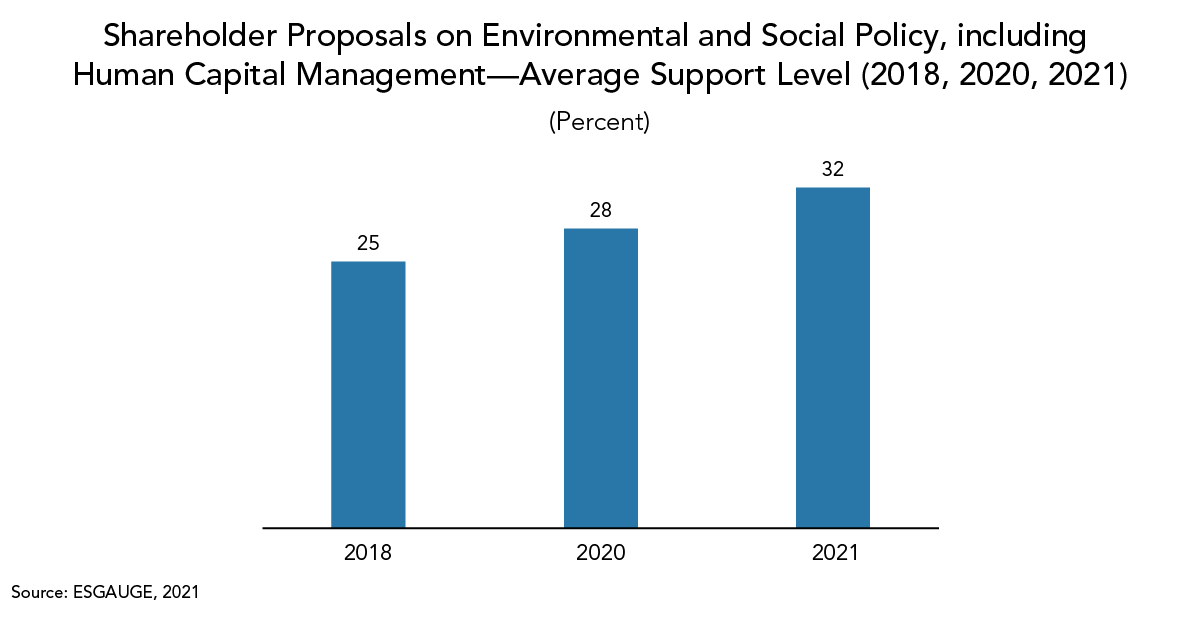

E&S proposals received unprecedented support in 2021, with some proposals receiving majority support for the first time. Support for E&S (including HCM) proposals averaged 32 percent (compared with 28 percent in 2020 and 25 percent in 2018).

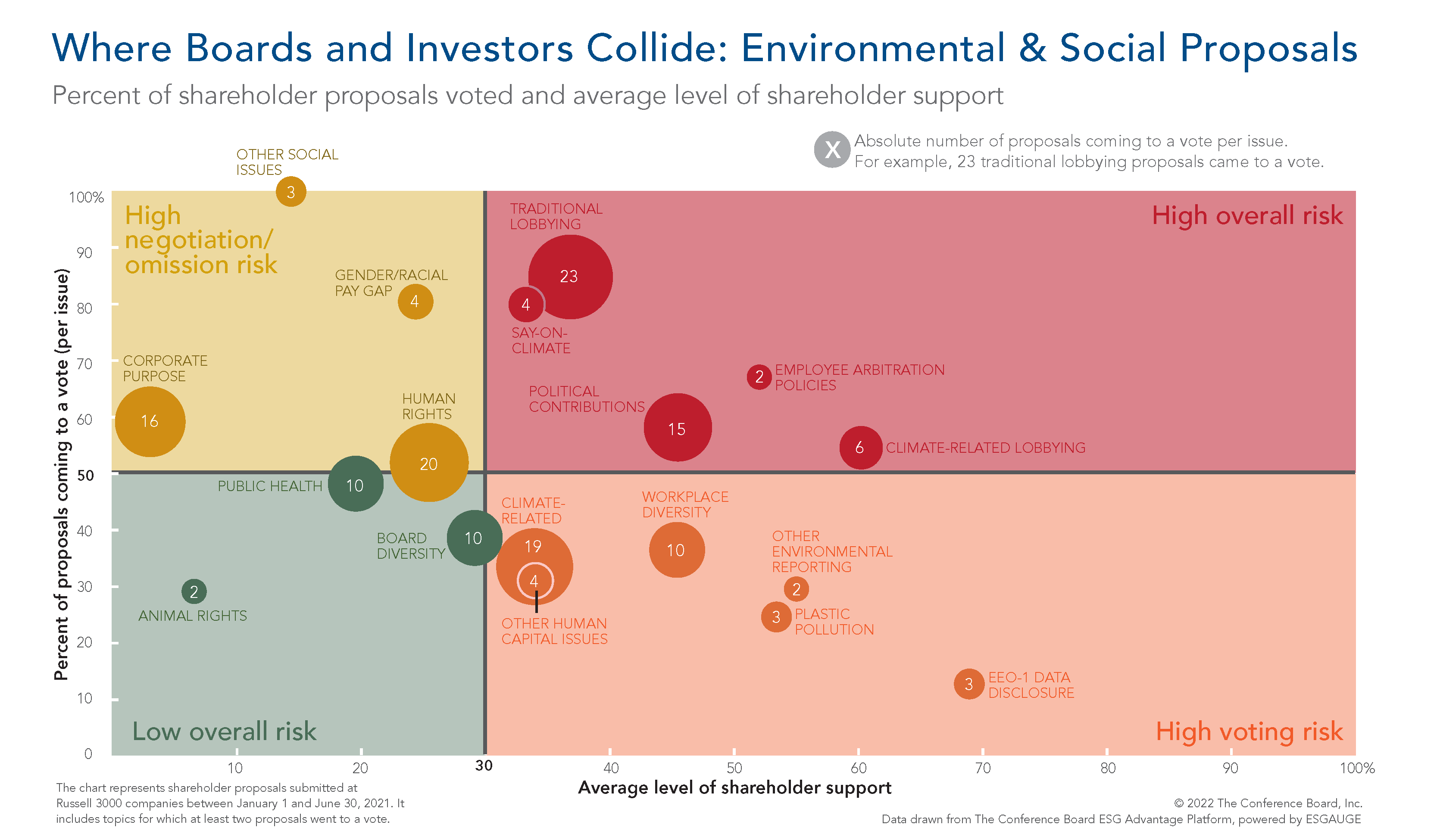

- Average support was highest for HCM proposals (39 percent versus 23 percent in 2020), with average majority support for proposals on EEO-1 data disclosure (69 percent) and employee arbitration (54 percent).

- Support for environmental proposals averaged 37 percent versus 30 percent in 2020, with average majority support for proposals on environmental (other than climate or plastic-related) reporting issues (55 percent) and plastic pollution (53 percent).

- Average support for social proposals (excluding HCM) remained relatively flat (28 percent in 2021 versus 29 percent in 2020), but proposals on climate-related lobbying received average majority support for the first time (61 percent).

Consistent with previous years, E&S proposals saw relatively high withdrawal levels, with 35 percent of such proposals withdrawn in the examined period (representing 84 percent of all withdrawn proposals) versus an average withdrawal level of only 5 percent (representing 10 percent of all withdrawn proposals) for governance proposals.3 This indicates management’s willingness and success in negotiating the withdrawal of E&S (rather than governance) proposals by making specific commitments to the proponent. On some issues—especially diversity and environment related (other than say-on-climate)—proponents often have ongoing discussions with companies, and they submit proposals as a catalyst to further discussion rather than to achieve the specific action called for in the proposal, so both sides are prepared to constructively address these issues.

E&S proposals also saw higher omission levels (20 percent, representing 53 percent of all omitted proposals) than governance proposals, most frequently under the “ordinary business” exception of SEC Rule 14a-8(i)(7) or because the company had already substantially implemented the proposal, and omission was permitted under Rule 14a-8(i)(10). In comparison, governance proposals saw an average omission level of 17 percent (representing 38 percent of all omitted proposals).

| |

Impact of SEC’s Staff Guidance on the omission of certain types of shareholder proposals

On November 3, 2021, the SEC issued Staff Legal Bulletin (SLB) No. 14L, which reverses previous SLB Guidance with respect to no-action letter requests that seek no-action relief from the Staff to exclude shareholder proposals on the basis of Rule 14a-8(i)(7) and Rule 14a-8(i)(5).

Rule 14(a)-8(i)(7)— “Ordinary Business”

- Significant Social Policy Exception: Staff will no longer focus on determining the nexus between a social policy issue and the company but will instead focus on the social policy significance of the issue that is the subject of the shareholder proposal. In making this determination, the Staff will consider whether the proposal raises issues with a broad societal impact. Proposals that the Staff previously viewed as excludable because they did not appear to raise a social policy issue of significance for the company may no longer be viewed as excludable under Rule 14a-8(i)(7).

- Micromanagement: Staff will focus on the level of detail and granularity sought in the proposal and may look to well-established frameworks or references in considering what level of detail may be too complex for shareholder input. Proposals that request short time frames to produce reports or tie proposed reports to specific environmental or social targets or frameworks may now not be excludable under the ordinary business exception on the basis that they seek to micromanage the company.

Rule 14a-8(i)(5)— “Economic Relevance”

- SLB No. 14L provides that companies may not exclude proposals that raise issues of broad social or ethical concern solely on the basis that the issue is not economically relevant to the company (i.e., relating to operations that account for less than 5 percent of the company’s total assets at the end of its most recent fiscal year, and for less than 5 percent of its net earnings and gross sales for its most recent fiscal year).

The Guidance will make omission of certain E&S proposals more challenging for companies, which could encourage shareholders to file more such proposals. However, since many proposals for the upcoming proxy season had already been filed when the Guidance was issued, it will not likely have a significant impact in the first half of 2022. But expect it to have a more meaningful impact in the second half of 2022 and the 2023 proxy season, with more E&S proposals going to a vote.

|

|

In some instances, companies also endorsed E&S proposals: the four E&S proposals that received the highest levels of support in the first half of 2021 were all endorsed by the company’s board, including the proposal on Scope 3 emissions at General Electric.

| Shareholder Proposals on Social and Environmental Policy—Highest Support (2021) |

|---|

| Company Name | AGM Date | Business Sector | Proposal Brought By | Topic | For % | Against % | Abstain % | |

|---|

| Bunge Limited (BG) |

5/5/21 |

Consumer Staples |

Green Century Funds |

Environmental |

98.4% |

1.1% |

0.5% |

| General Electric Company (GE) |

5/4/2021 |

Industrials |

As You Sow |

Environmental |

96.6% |

2.0% |

1.4% |

| Wendy's Company (WEN) |

5/18/2021 |

Consumer Discretionary |

Franciscan Sisters of Allegany, NY |

HCM (other) |

94.3% |

4.7% |

1.0% |

| International Business Machines Corporation (IBM) |

4/27/2021 |

Information Technology |

Nia Impact Capital |

Diversity & inclusion |

92.5% |

5.6% |

2.0% |

| First Solar, Inc. (FSLR) |

5/12/2021 |

Information Technology |

Undisclosed |

Diversity & inclusion |

90.7% |

8.7% |

0.5% |

| Union Pacific Corporation (UNP) |

5/13/2021 |

Industrials |

New York State Common Retirement Funds |

Diversity & inclusion |

85.6% |

13.4% |

1.0% |

| Badger Meter, Inc. (BMI) |

4/30/2021 |

Information Technology |

Undisclosed |

Diversity & inclusion |

83.2% |

14.3% |

2.5% |

| DuPont de Nemours, Inc. (DD) |

4/28/2021 |

Materials |

Scott M. Stringer |

Diversity & inclusion |

82.3% |

16.0% |

1.8% |

| Union Pacific Corporation (UNP) |

5/13/2021 |

Industrials |

As You Sow |

Diversity & inclusion |

80.6% |

18.4% |

0.9% |

| Netflix, Inc. (NFLX) |

6/3/2021 |

Communication Services |

Myra K. Young |

Political contributions |

80.3% |

19.3% |

0.5% |

| |

An option for companies to consider: selectively endorsing shareholder proposals

Even as the environment around E&S proposals in general is becoming more contentious, boards endorsing shareholder proposals may become more common, especially on environmental and HCM topics that are likely to pass or where boards feel they are already taking significant actions—and making progress—toward achieving the stated goals. There are benefits to this approach: it demonstrates that the company both listens to its investors and sees the strategic opportunities in pursuing broader environmental and social goals. Endorsing a proposal rather than negotiating its withdrawal by making specific commitments to the proponent may provide a company with more flexibility in implementing the proposal. Ultimately, the decision to negotiate or to endorse a shareholder proposal should take into account the proposal, the proponent, and the precedent set by endorsing some proposals but not others.

|

|

How CEOs can prepare their boards for what promises to be a contentious season

The 2022 proxy season will assuredly be challenging, but CEOs and their management teams can take several steps to prepare their boards:

Start planning now to proactively involve directors in shareholder engagements and on an ongoing basis—not only in response to a crisis. Many institutional investors expect board members to talk about E&S, as well as G subjects, so ensure directors can demonstrate that they are fluent in ESG issues.

- Make sure board members are well versed in the firm’s main ESG risks and opportunities, and how the company compares to peers.

- Educate directors on the ESG issues their key investors care about most—and prepare them for the different expectations investors may have on some of these issues.

- Prepare directors for in-depth engagement meetings with investors by conducting mock meetings with tough questions.

Examine institutional investors’ proxy voting guidelines now to make sure proxy statement disclosures (and other communications) address the issues their key investors care about.

- Take major institutional investors’ policies into account when preparing the proxy statement and ask them about their views on your firm and their evolving thinking about E&S issues in general during the “off season.” If you wait until their voting guidelines are issued, it may be too late for the board to take action that can be reflected in the proxy statement.

Despite the challenges that the COVID-19 pandemic presents in building and maintaining relationships, companies should plan to ramp up ongoing engagement efforts with institutional investors. There are still opportunities for constructive dialogue, even though both companies and investors are pressed for time. Be mindful that more investors 1) are becoming interested in ESG; 2) are expanding their stewardship teams; 3) have significant turnover; and/or 4) include portfolio managers in engagements, so you will want to educate these “new faces” on their approach to ESG.

- Engage your major investors—old and new—not just during the regular “proxy season” but also during “off season” engagement calls to let them know what ESG issues you’re focusing on, why you’re focusing on those issues, and what your plans are.

Expand engagement strategies to reach audiences beyond their major institutional investors. Investors’ upstream clients are increasingly interested in ESG—and are making their voices heard.4 And retail investors, who are becoming more influential but don’t always have the same focus as their institutional counterparts, need to be educated as well. Bringing these stakeholder groups along on the company’s ESG journey is therefore pivotal.

- Implement processes for identifying emerging trends with different stakeholder groups and adopt engagement strategies for each group. While some stakeholders might prefer formal communication, others might prefer to engage through public channels.

- A retail-facing strategy can help promote retail investors’ participation in the proxy voting process, so companies may want to gain access to retail investor data to better understand who their retail investors are, what their sentiment and voting behavior is on key issues, and where and how they can best engage and educate them on ESG issues (e.g., on social media or digital trading platforms, online finance communities, or through retail investor events).

Alert the board that a new (and possibly more intense) wave of E&S proposals is coming—and with it a higher chance of negative votes from traditionally supportive investors. Make sure the board knows which proposals are likely to pass unless it commits to fulfilling them to the letter; this can prevent the board from being surprised or blindsided.

- Emphasize to the board that a successful proxy season is no longer about minimizing the number of proposals that go to a vote. Instead, a successful proxy season is measured by the more qualitative judgment of whether the firm has maintained a constructive ongoing dialogue with the firm’s major investors, which is more important than any vote on a precatory shareholder proposal.

**********

This brief is part of a suite of seven reports: 2022 Proxy Season Preview and Shareholder Voting Trends (2018-2021). Visit conferenceboard.esgauge.org/shareholdervoting to access and manipulate our data online.

[1] The data and figures in this report and all six supplemental briefs represent shareholder proposals submitted at Russell 3000 companies in the first half of 2021, 2020, and 2018. About 90 percent of shareholder meetings at Russell 3000 companies take place in the first half of the year, and this cutoff point also allows easy comparisons with our prior-year shareholder voting benchmarking reports.

[2] Proposals on corporate purpose typically ask the board to approve or take steps to amend the firm’s certificate of incorporation (and bylaws if necessary) to become a public benefit corporation in light of the CEO’s endorsement of the Business Roundtable Statement of the Purpose of a Corporation.

[3] Proponents may voluntarily decide to withdraw the proposal they submitted with a company before the proxy statement is officially filed. Omission of a proposal, on the other hand, often happens against the proponent’s will. Rule 14a-8 of the Securities Exchange Act of 1934 permits a company to exclude a shareholder proposal from its proxy materials if the proposal fails to meet any of several specified requirements. If a company wants to omit a proposal, it submits a letter to the SEC asking for no-action relief from the staff.

[4] Noteworthy is BlackRock’s recent move, starting in 2022, to allow institutional investors in some of its index strategies in the US and UK to cast proxy votes in line with their own values and goals: “Working to Expand Proxy Voting Choice for Our Clients,” BlackRock, October 7, 2021.