Six Ways Boards Can Prepare for a Challenging Proxy Season

Buckle Up for a Bumpy Ride in 2022

Effective corporate boards, by virtue of their role and temperament, tend to view challenges as opportunities. That attitude is especially valuable today, as companies have been buffeted by the COVID-19 pandemic, social upheavals, the swing from recession to inflation, the collapse of supply chains, and now a war in Ukraine. All this is taking place against the backdrop of the shift toward multistakeholder capitalism; the growing focus on environmental, social & governance (ESG) issues; and the digital transformation of industries and the way we work.

The 2022 proxy season adds one more challenge (ahem, opportunity)—to the board’s list. This essay provides an overview of what to expect during this proxy season and offers six concrete suggestions for how corporate directors can prepare to make the most of it.

Insights for What’s Ahead

The 2021 proxy season was unprecedented, with record numbers of—and support for—shareholder proposals on environmental and social (E&S) issues and record support for governance proposals, especially at midsized and smaller companies. 2021 also saw growing opposition to director elections and a higher number of failed say-on-pay votes. 2022 promises to be more challenging in several respects:

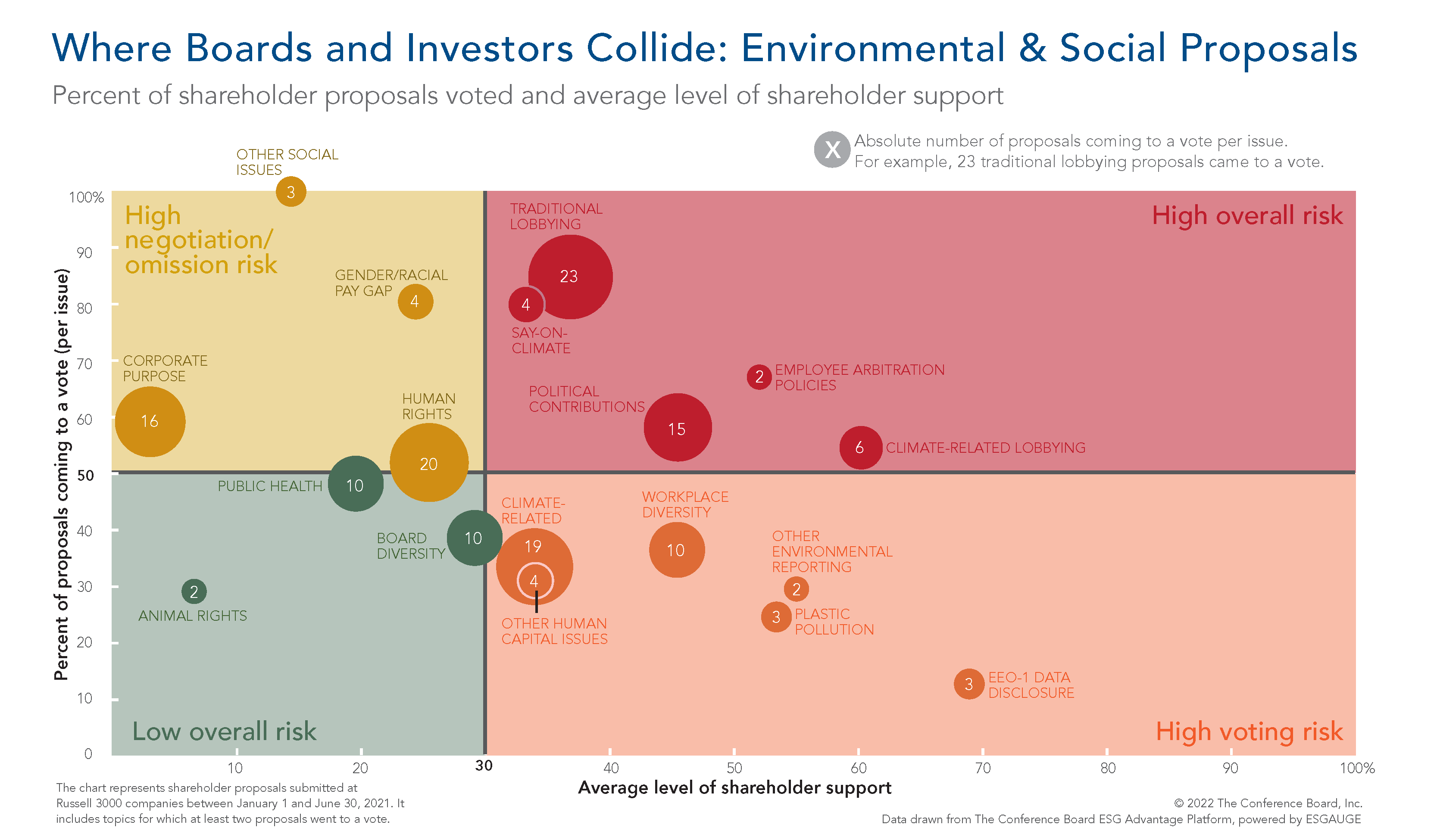

- Expect more E&S shareholder proposals—across all industries—to be submitted, come to a vote, and receive greater support. Emboldened proponents see less incentive to negotiate a withdrawal of their proposals (especially on topics such as lobbying, say-on-climate, gender/racial pay gaps, and racial equity/civil rights audits), and major institutional investors—pressured by their own clients on ESG topics—are increasingly willing to support such proposals. For example, shareholder proposals on climate passed at Costco (with 67 percent support), on plastics at Jack in the Box (94 percent), and on a racial equity audit (53 percent) and employee arbitration (50 percent) at Apple.

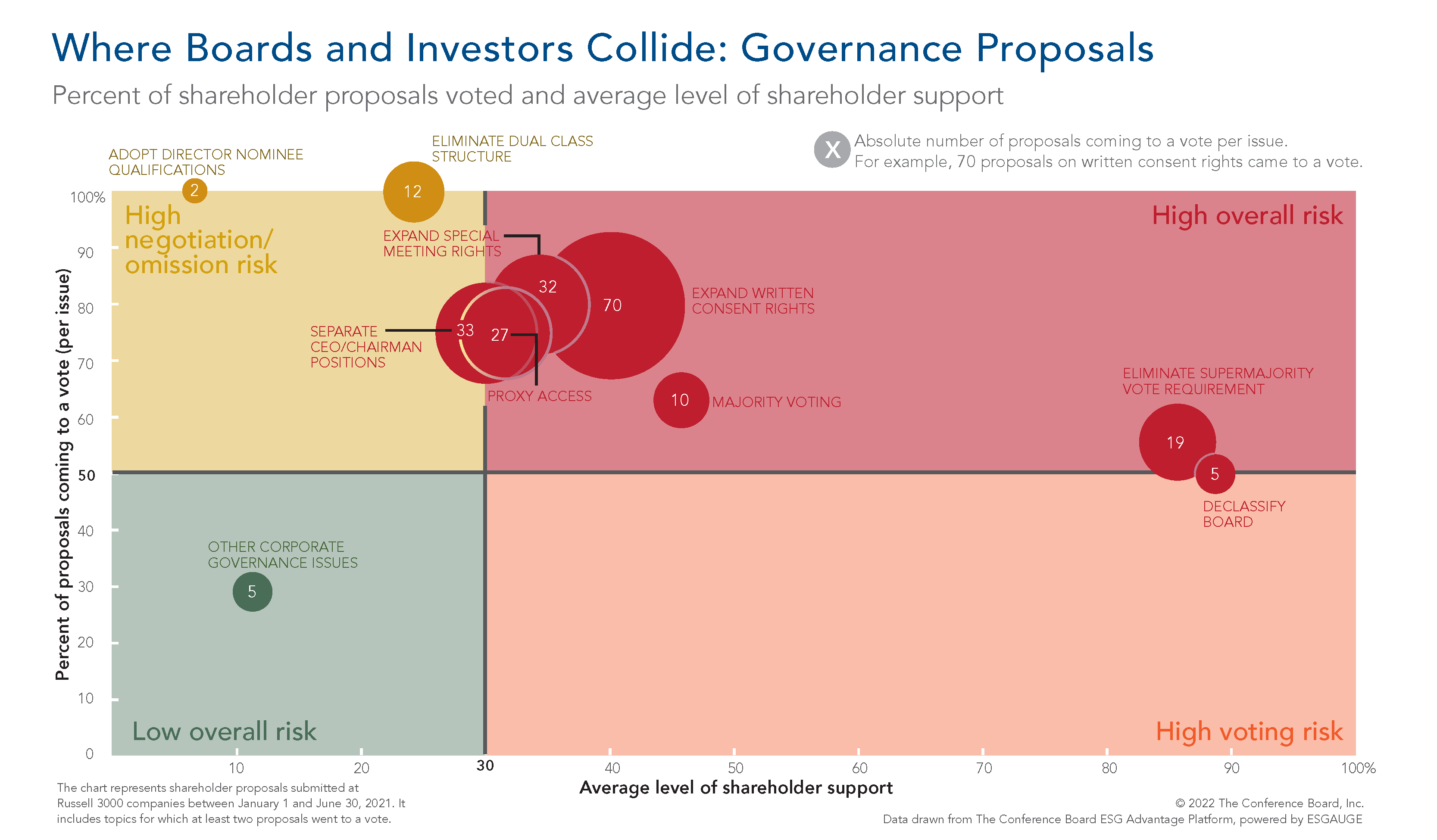

- The biggest source of tension between investors and companies may surprise you: corporate political activity. In 2021, shareholder proposals on political contributions, traditional lobbying, and climate-related lobbying were more likely both to go to a vote and to receive significant shareholder support than almost any other proposal types. Boards can expect a repeat, especially at companies where there is a perceived disconnect between their stated position on E&S issues and their political contributions and lobbying.

- Anticipate an even greater push on human capital management (HCM) topics, with a strong focus on diversity and increased attention to disclosure. Not waiting for SEC disclosure rules, investors are advocating for more diversity and disclosure not only through engagement but shareholder proposals. Expect this push to spill over into director elections, as proxy advisors and investors continue to make their voting guidelines relating to these issues more stringent.

- Expect a sustained push on climate issues as well as on broader environmental topics across all industries. Shareholder activism on environmental issues is likely to continue beyond shareholder proposals. Vote-no campaigns against directors are also likely to increase, as proxy advisors and investors have adopted policies to hold directors accountable for what they perceive as ineffective oversight of ESG issues, especially climate change.

- Corporate governance will continue to be a hot topic for shareholders, especially at smaller companies. While E&S proposals may get more media attention, shareholder proposals on governance topics receive the highest level of support at annual meetings among all ESG topics. Companies that are out of alignment with prevailing practices in areas such as supermajority provisions, written consent rights, the ability to call special meetings, staggered boards, and proxy access should be prepared to have such proposals pass—or come close to passing.

How Boards Can Prepare for the 2022 Proxy Season—and Beyond

There are six essential actions directors can take to prepare for this proxy season.

- Be(come) more educated on the ESG issues that tie to the firm’s main risks and opportunities. As the general counsel of a major US company put it: it is easy to feel overexposed, but undereducated, on ESG. A recent survey by The Conference Board of more than 120 executives (half of whom are from companies with an annual revenue of over $10 billion) finds that boards are far more effectively engaged with compliance and risk management than with ESG. Yet, major institutional investors expect boards to be fluent in ESG—and are holding individual board members accountable through director elections. Set aside time at a board meeting to ensure the board understands the company’s major ESG priorities and plans. Ensure that the board has an opportunity to meet on a regular basis with senior sustainability executives (at the median, boards of directors meet seven times per year), as well as has other opportunities for a deeper dive on key areas so that the company can take a deliberate, organized approach on each issue.

How well does your board engage the following areas?

- Focus on ESG through the lens of the company’s strategy. The board’s most powerful lever to drive an appropriate focus on ESG is through the strategic and business planning processes. This perspective helps to ensure that the company is focusing not just on risks, but on opportunities. And it ensures that the company has a compelling narrative to share with investors during this proxy season…and beyond. As with any aspect of a strategic planning exercise, the board should understand the company’s current position on ESG, where it wants to go, how it plans to get there, how it compares to peers, and whether and how it is addressing stakeholder expectations. While reviewing ESG disclosures is also a tool at the board’s disposal, it is far better that strategy should drive disclosure than the other way around, especially as many ESG initiatives that are within the board’s purview remain outside the ambit of SEC filings.

- Ensure the board’s own house is in order when it comes to ESG. Investors are acutely focused on whether boards have the right “G” for overseeing E&S issues. It’s clear that the nominating and governance committee has responsibility for areas such as board composition, leadership, and structure. But the allocation of oversight responsibilities for E&S issues varies by company. If the board has not done so already, ask management to analyze how the board’s governance policy and committee charters map against the firm’s major ESG priorities. Be sure the board knows where investors may see gaps in the board’s composition, structure, and processes for overseeing ESG—and know whether and how the company plans to close those gaps. In particular, companies may want to consider establishing a separate committee, even on a temporary basis, to help advance the company’s ESG agenda.

- Engage with major investors (old and new) on an ongoing basis, not justin response to a crisis or the prospect of a challenging annual shareholder meeting. Director engagement with leading shareholders is a better way to demonstrate board fluency in ESG than checking boxes in the skills and experience matrix in a company’s proxy statement. Meeting with shareholders requires directors to study up on investor policies. It also allows directors to solicit investors’ views on the company’s ESG performance and investors’ evolving thinking about ESG issues in general, which in turn can further enable the board to stay ahead of the curve. It’s important to think of director engagement as a year-round effort, not just limited to the proxy season or a brief autumn “off season,” when investors are hard pressed for time. At a minimum, offer key investors the opportunity to engage with a board member (e.g., the board chair or lead independent director) on ESG matters and let them decide whether to take the meeting.

- Evaluate the success of a proxy season based on the quality of shareholder engagement, not just on the number of shareholder proposals that go to a vote—or the support that such proposals receive. There may be little the company can do to negotiate the withdrawal of a shareholder proposal or to persuade shareholders to support the company’s position when it comes to a vote. In this environment, the quality of the dialogue that the firm has maintained with its major investors in the long term is more important than any vote on a precatory shareholder proposal this coming proxy season.

- Consider selectively endorsing or implementing shareholder proposals. In 2021, the four E&S proposals that received the highest levels of support were all endorsed by the company’s board. This approach has benefits: it signals both that the board understands the strategic opportunities in pursuing broader E&S objectives and that it is listening to its investors. And importantly, endorsing a proposal rather than negotiating its withdrawal by making specific commitments to the proponent may provide a company with some flexibility in implementing the proposal. Another approach is for the company to implement the proposal ahead of the vote—on its own terms and within its own strategy—to demonstrate responsiveness to shareholder concerns. Investors may be less willing to support a proposal if it’s already implemented. Ultimately, boards will need to consider the proposal, its proponent, and the precedent set by endorsing some but not all proposals in deciding whether to endorse, negotiate the withdrawal of, or preemptively implement a proposal.

Institutional investors are a leading force in driving two fundamental shifts in the landscape for US corporations—the focus on ESG issues and the shift toward multistakeholder capitalism. By taking the six actions above, boards can not only prepare themselves for the upcoming proxy season, but also better position the firm to navigate these major shifts in the corporate landscape—and thereby continue to turn challenges into opportunities.

2022 Proxy Season Preview and Shareholder Voting Trends was produced with ESG analytics firm, ESGAUGE, in collaboration with Russell Reynolds Associates and Rutgers University’s Center for Corporate Law and Governance.