Ukraine War Drives March CPI to 8.5% YoY

12 Apr. 2022 | Comments (0)

The Consumer Price Index (CPI) rose to 8.5 percent year-over-year in March, vs. an increase of 7.9 percent year-over-year in February. This key measure of consumer price inflation is now at the highest rate recorded since December 1981. Core CPI, which excludes volatile food and energy prices, rose by 6.5 percent year-over-year, vs. 6.4 percent in February.

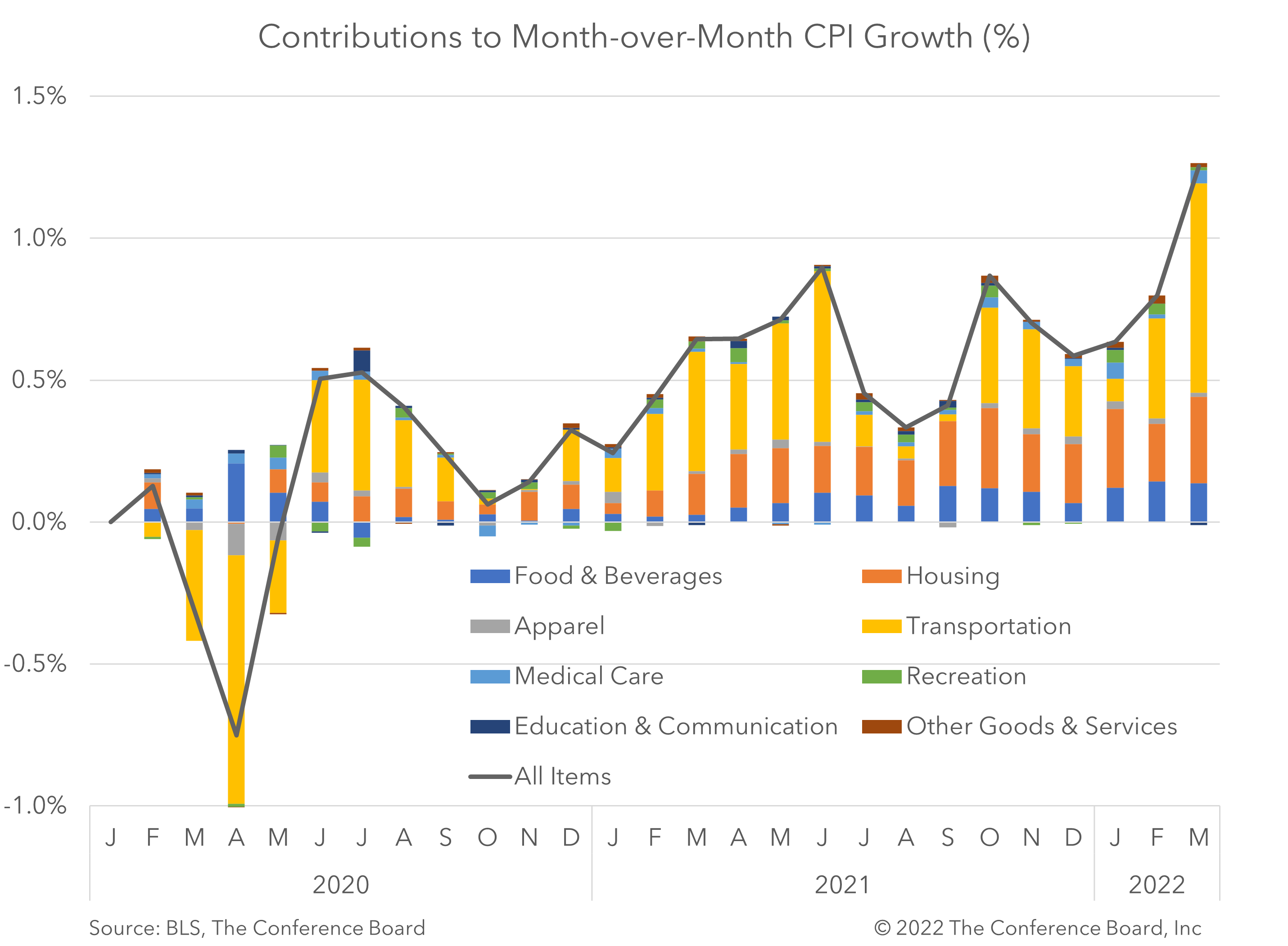

On a month-over-month basis, March CPI rose 1.2 percent, vs. 0.8 percent February. Meanwhile, March Core CPI rose 0.3 percent, vs. 0.5 percent in February. This large divergence shows that food and energy prices have become key drivers of inflation. Indeed, according to the BLS, gasoline prices rose by an astounding 18.3 percent from the previous month and accounted for over half of the increase in the monthly CPI. This was the largest monthly increase since June 2009. Meanwhile, food prices rose 1.0 percent from the previous month.

The March data demonstrate the extent to which Russia’s invasion of Ukraine has impacted global energy markets. In February, prior to the war, Brent crude oil prices hovered around US$91 per barrel before spiking to as high as US$127 per barrel in early March. While these prices have since moderated they remain above US$100 per barrel. Prices for other commodities, including grains and metals, have risen as well – though not as severely. Notably, the Core CPI measure decelerated from April to March, suggesting that inflation in other parts of the economy moderated. For instance, prices for durable goods fell 0.5 percent from the previous month. However, this trend may reverse over time as higher energy and food prices drive prices up in other parts of the economy. Additionally, pent up demand for in-person services may stoke inflation as well.

The inflation outlook is troubling and is directly tied to the conflict in Eastern Europe. A quick resolution to the conflict would help reverse the severity and duration of price increases. However, recent geopolitical trends do not suggest that peace is at hand. Additionally, a new COVID-19 outbreak in China (which is impacting manufacturing activity) may have an impact of global supply chains as well.

At present, our forecast for PCE inflation, which is similar to CPI, rises from a reported 5.5 percent year-over-year in Q4 2021 to a high of 6.6 percent in Q2 2022 and then falls to 4.2 percent in Q4 2022. We project that Core PCE inflation, which is similar to Core CPI, rises from a reported 4.6 percent year-over-year in Q4 2021 to a high of 5.9 percent in Q2 2022 and then falls to 4.4 percent in Q4 2022.

For more information about the economic disruptions associated with the Ukraine Crisis please see the Conference Board’s new Geopolitics hub.

-

About the Author:Erik Lundh

Erik Lundh is Senior Economist, Global at The Conference Board. Based in New York, he is responsible for much of the organization’s work on the US economy. He also works on topics impacting…

0 Comment Comment Policy