2022 Salary Increase Budgets Are the Highest Since 2008

07 Dec. 2021 | Comments (0)

The November Conference Board Salary Increase Budget Survey portends a 3.9% jump in wage costs for firms in 2022, compared to 3% reported in April. This would mark the highest rate since 2008. Indeed, the swell in compensation expectations for next year reflects rising wages for new hires and inflation.

Due to high wage growth and inflation since April 2021, we fielded the Salary Increase Budget Survey again in November 2021. Salary increase budget refers to the pool of money an organization dedicates to salary increases for the coming year. Here are the key findings:

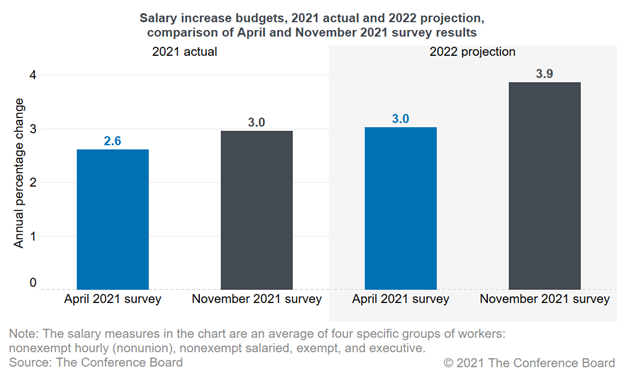

- Average 2021 actual total salary increase budgets jumped from 2.6 percent in the April 2021 survey to 3.0 percent in the November 2021 survey.

- Projections for 2022 salary increase budgets jumped almost a full percentage point from 3.0 in April to 3.9 in November.

- Growth in wages for new hires and accelerating inflation are the main causes of the jump in salary increase budgets. The November Salary Increase Budget Survey shows that almost half of respondents (46%) said that the increase in wages of new hires played a factor in salary increase budget estimates for 2022, and 39% said that increased inflation played a factor.

Tables with details by employment category, industry, revenue, and number of employees can be found here.

About the Salary Increase Budget Survey:

Since 1985, The Conference Board has surveyed compensation executives about two main components of compensation: salary increase budgets and salary structure movements. The Conference Board fielded the 2021 surveys in April and November and requested data for four employment categories: nonexempt hourly (nonunion), nonexempt salaried, exempt, and executive. 240 organizations completed the survey, which was fielded between November 8th and November 19th. More than half of respondents came from companies with more than 10,000 workers.

Salary increase budget refers to the pool of money an organization dedicates to salary increases for the coming year. It is strongly related to the typical raise a worker would receive in a given year. It is generally represented as a percentage of current payroll. The salary increase budget is calculated using a predetermined total percentage of base pay (excluding overtime, bonuses, etc.) and used for awarding merit or performance increases to individual employees. It may also be used for pay adjustments such as promotional increases.

Salary structure movement or adjustment refers to the changes (usually annual) to the salary structure of a compensation program. Organizations make these adjustments to the minimums, midpoints, and maximums of their pay ranges to account for changes in the cost of living and salary markets within a given industry.

Large increase in estimates for salary increase budgets

Chart 1 shows the difference in estimates for salary increase budgets between the April 2021 and November 2021 surveys. Projections for 2022 salary increase budgets jumped almost a full percentage point from 3.0 in April to 3.9 in November. Average 2021 actual total salary increase budgets jumped from 2.6 percent in the April 2021 survey to 3.0 percent in the November 2021 survey.

Chart 1 – Large increase in estimates for salary increase budgets between the April 2021 and November 2021 surveys

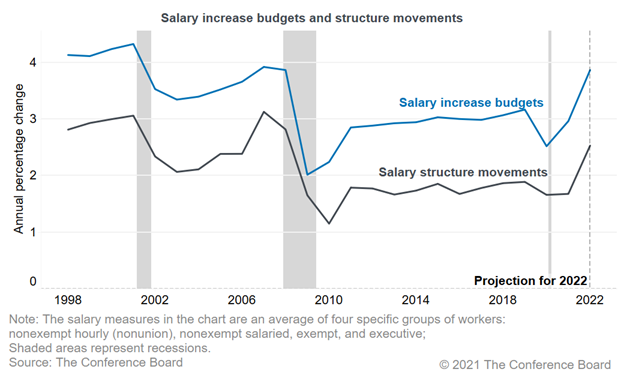

The survey also shows that projections of salary structure movements for 2022 increased as well. Chart 2 shows that salary increase budgets and salary structure movements are now much higher than any time since 2008.

Chart 2 - In 2022, Salary Increase Budgets are the Highest Since 2008

Why did estimates of salary increase budgets significantly increase between April and November 2021?

Faster growth in wages for new hires and accelerating inflation are the main causes of the jump in salary increase budgets in recent months.

Faster wage growth for new hires. Overall wage growth dramatically accelerated during the past 6-8 months. That increase is especially strong for workers under the age of 25 and for people who switched jobs in the past year. This suggests that much of the wage acceleration has been among workers who were recently hired. The faster wage growth of new hires has led to pay compression, which is when wage premiums for work experience shrinks. When more experienced workers feel that their pay advantage is no longer significant, they may seek new jobs in the tight labor market, which leads to high labor turnover of more experienced workers. Indeed, the quits rate is now the highest in recorded history. Employers faced with extensive departures of experienced workers will raise wages faster for current employees in order to maintain an effective workforce.

The November Salary Increase Budget Survey shows that almost half of respondents (46%) said that the increase in wages of new hires played a role in salary increase budget estimates for 2022.

High inflation. Between February-October 2021, the Consumer Price Index in the US increased by 7.8 percent annual rate, the highest since 1982. 39 percent of respondents in our survey said that the increase in inflation played a factor in their salary increase budget estimated for 2022.

The outlook for wages and salary increase budgets

It is likely that severe labor shortages will continue through 2022. During that time, overall wage growth is likely to remain well above four percent. Wages for new hires, and workers in blue-collar and manual services jobs will grow faster than average.

At the same time, there are no signs of inflation slowing down, and it may remain elevated in the coming months, increasing the need for cost-of-living adjustment.

In this environment, the upward momentum for salary increase budgets is likely to continue into early 2022. Salary increase budgets may be adjusted upwards in the coming months as more companies adjust their policies to account for the acceleration in wages and inflation. Many companies determined their salary increase budgets earlier in 2021, before the full extent of the pickup in inflation and wage growth was evident, and before they knew how much other companies would be raising salary increase budgets. In addition, wage trends for unionized workers tend to lag market wages. Therefore, an upward adjustment to wage growth of unionized workers is to be expected in the coming year.

A wage-price spiral—where higher prices and rising wages feed each other, leading to faster increases in both—may already be in the works.

In this context, the Federal Reserve may decide to raise interest rates more than the two hikes that the markets are currently expecting in 2022. This would slow GDP growth to below current expectations by economists (3.9 percent year-on-year, according to a Bloomberg Consensus Survey).

The rapid increase in wages and inflation are forcing businesses to make important decisions regarding their approach to salaries, recruiting, and retention. In particular, companies are likely to raise wages aggressively for their current employees or they will risk even lower retention rates. After being a non-issue in wage determination for several decades, sizable cost of living adjustments may be making a comeback.

At the same time, business leaders will have to decide how much they will pass the additional labor costs to consumers through price increases. That decision, relative to competitors’ strategies, could impact companies’ market shares.

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

0 Comment Comment Policy