Payrolls Rise in April, But With Some Pockets of Weakness

05 May. 2023 | Comments (0)

Commentary on today’s U.S. Bureau of Labor Statistics Employment Situation Report

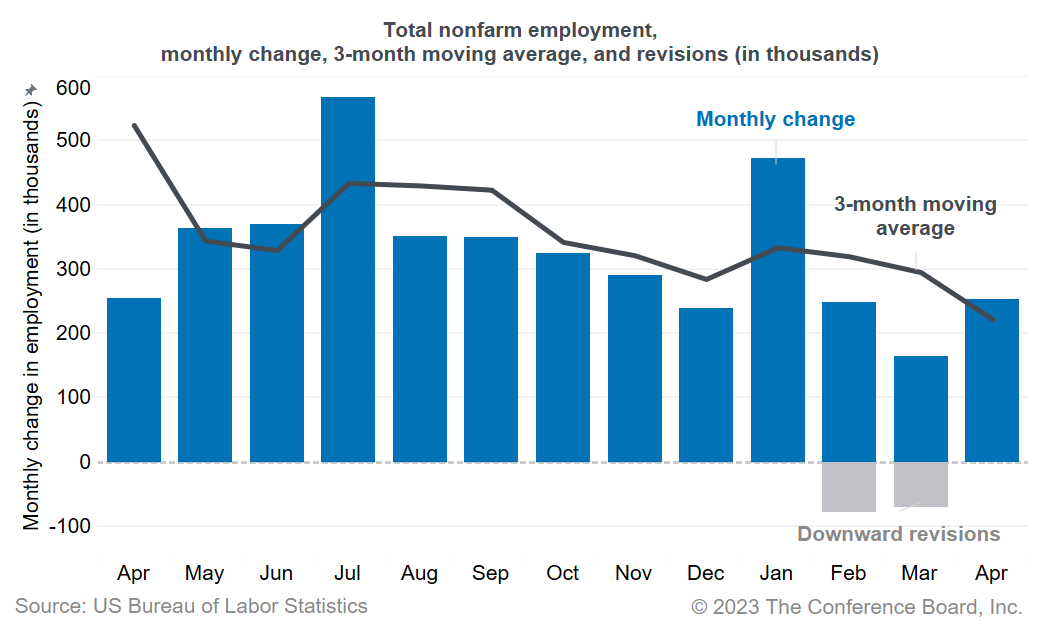

Today’s jobs report showed that the US labor market continues to grow, with 253,000 jobs added in April after an increase of 165,000 jobs (a downward revision) in March. Still, recent gains are less robust than those reported last year. Slowing job growth—combined with declines in job openings, voluntary quits, and hiring, as well as increasing layoffs from the JOLTS survey—suggests that the job market is cooling. Meanwhile, average hourly earnings growth ticked up to 4.4 percent in April, up from 4.3 percent in March. While wage growth by this measure is notably slower compared to the highs of a year ago, it is still elevated. Given continued payroll employment gains, persistent wage pressures, and elevated inflation, we continue to expect the Federal Reserve to raise interest rates one more time by 25 basis points in June.

Slowing Employment Dynamics

In the Household Survey, the unemployment rate continues to stay at historically low levels, ticking down to 3.4 percent in April from 3.5 percent in March. The labor force participation rate remained flat at 62.6 percent—still 0.7 percentage points below where it was in February 2020, adding pressure to labor shortages. The data continues to reveal that overall labor force participation is capped by falling participation among workers aged 55 and over, many of whom are retiring. By contrast, labor participation among prime-aged workers (25-54) is now slightly above the pre-pandemic 2019 level.

In the Establishment Survey, in-person service sectors continue to add jobs, with health care and social assistance adding 64,200 jobs and leisure and hospitality adding 31,000 jobs. These industries continue to struggle with significant labor shortages and are expected to continue hiring. Other notable sectors with material increases in April include professional and business services (+43,000), government (+23,000), and financial activities (+23,000).

Despite the high topline gains in April, the labor market shows some signs of cooling. April’s report revealed large downward revisions to February and March data. Total nonfarm employment was revised down by 149,000 for the two months combined with leisure and hospitality (−65,000) and professional and business services (−50,000) contributing to the bulk of the downward revision. After the revision, March 2023 was the slowest month for job growth since December 2019. The temporary help services industry, a leading indicator for job growth, lost 23,000 jobs in April and is down by 174,000 jobs since its peak in March of 2022. We expect layoffs to pick up in more industries. Our new Job Loss Risk Index projects that information services, transportation and warehousing, and construction are facing the greatest risk of layoffs this year.

We still forecast a recession to start in 2023 as the Fed continues to raise its target interest rate to bring inflation under control. The slowing economy will reduce labor demand. We expect the unemployment rate to rise to around 4.5 percent by the beginning of 2024. However, once we are out of recession, labor demand will likely recover quickly, and labor shortages are expected to be a long-term challenge for employers as the population continues to age.

-

About the Author:Selcuk Eren

The following is a bio of a former employee/consultant Selcuk Eren, PhD, is a Senior Economist at The Conference Board. He is an experienced researcher in labor economics with a focus on demographics…

0 Comment Comment Policy