Can consumer spending keep pace with a torrid US economy?

20 Aug. 2018 | Comments (0)

These are interesting times for the American consumer—and the US economic forecaster. On one hand, the key indicators continue trending at impressive heights:

-

-

-

-

- The economy grew more than 4 percent during the second quarter of 2018. We see that trend continuing with more than 3 percent growth during the second half of this year, before slowing in 2019.

- Consumer Confidence remains near 18-year highs, though we’ve seen consumers’ long-term expectations for economic growth moderate somewhat.

- The jobs market is still going strong—we project the unemployment rate will continue to drop through 2019.

- After years of widening income inequality, blue-collar workers are finally seeing higher wage growth than white-collars workers.

- Risk of near-term trade conflict with Europe has eased, but the China debate remains hot.

-

-

-

Yet consumer-facing businesses still need to ask some important questions: How is this sunny picture reflected in the actual near-term spending decisions of US consumers? And looking ahead, is consumer spending more likely to be the fuel that keeps a soaring US economy aloft—or the drag that is going to bring it back down?

Here are four early signals we’re seeing in the data.

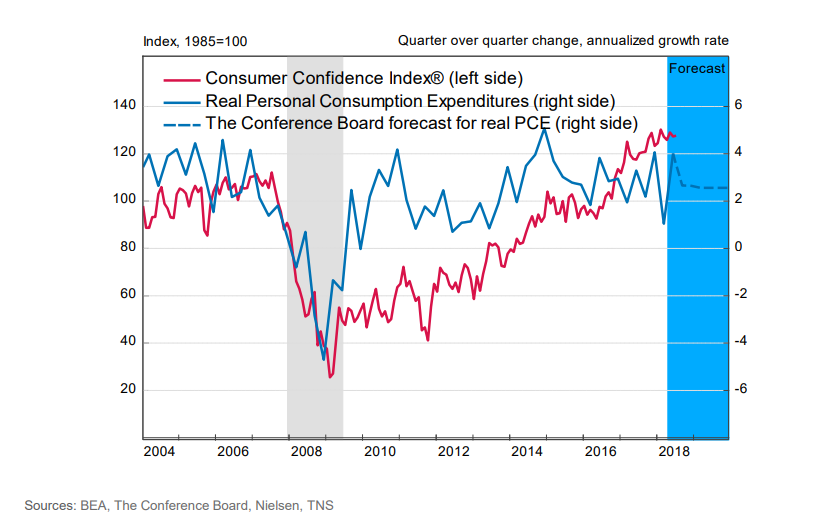

1. Consumer spending can't sustain its Q2 altitude but is likely to remain strong for some time ahead:

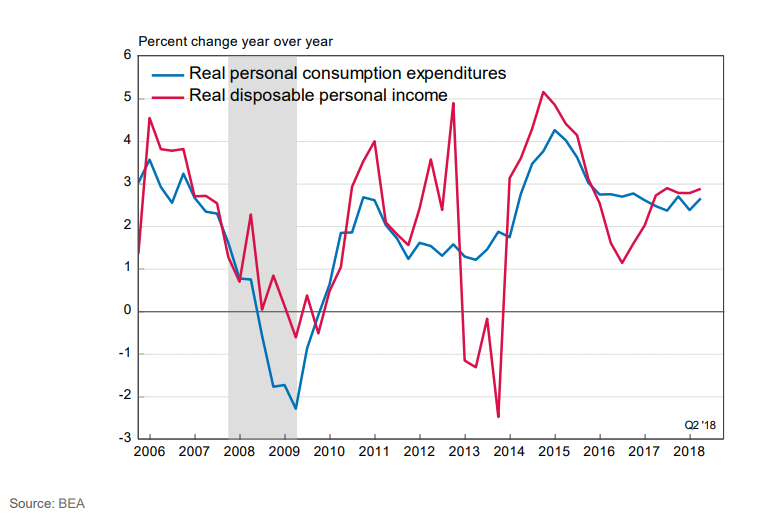

2. A strong job market and tax cuts have provided spending power to sustain strong consumption growth:

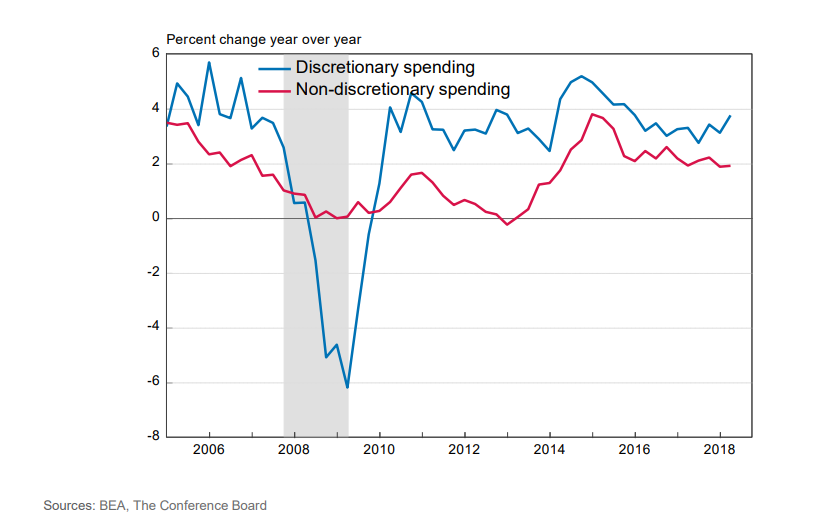

3. During times of strong spending growth, discretionary categories benefit most:

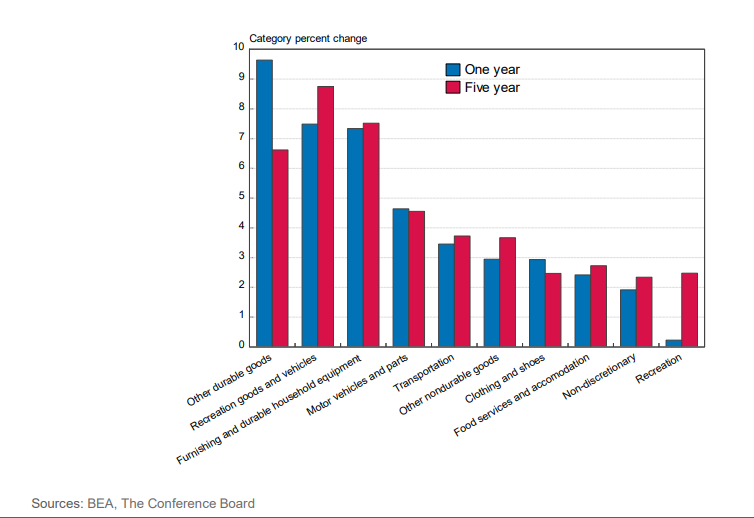

4. Durable goods and transportation services have been the key categories fueling recent consumption growth:

-

About the Author:Brian Schaitkin

The following is a biography of former employee/consultant Brian Schaitkin is a former Senior Economist in U.S. Economic Outlook & Labor Markets at The Conference Board. He is part of a team work…

-

About the Author:Sumair Sayani

Sumair Sayani is a Vice President at The Demand Institute and Nielsen. Sumair leads The Demand Institute’s delivery of key research programs.Prior to this role, Sumair led the Nielsen’s Pu…

-

About the Author:John Forsyth

John Forsyth is currently partner of Forsyth Insights LLC, a consumer insights boutique. He has worked in most industries, though he specializes in consumer goods/electronics, retail, and pharmaceutic…

0 Comment Comment Policy