April CPI may prompt another rate hike

10 May. 2023 | Comments (0)

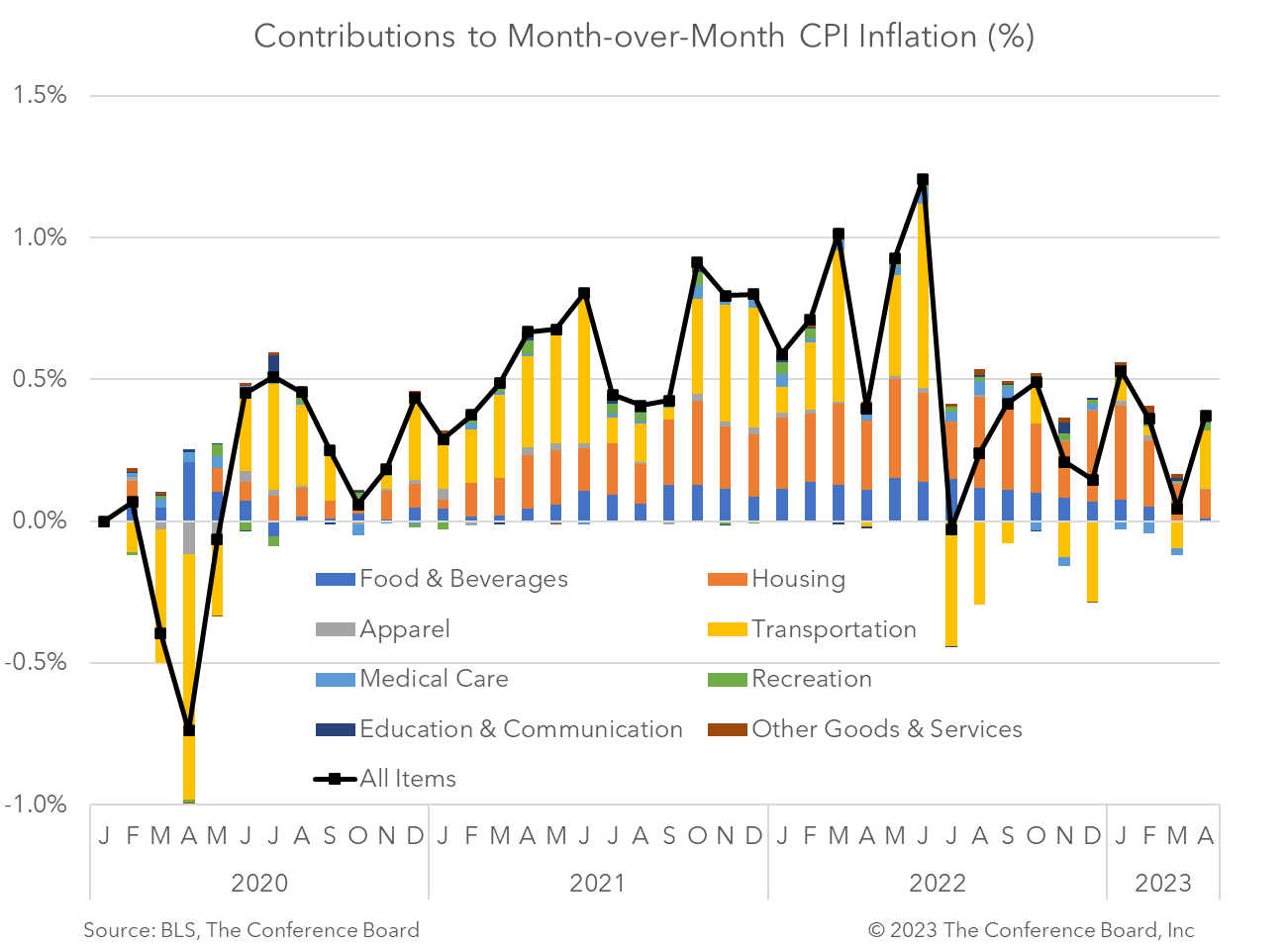

The April Consumer Price Index (CPI) showed that headline inflation rose 0.4 percent month-over-month (vs. 0.1% in March) and core inflation, which excludes food and energy, rose 0.4 percent month-over-month (vs. 0.4% in March). Year-over-year inflation rates for both the headline and core indices fell a tenth of a percent due to base effects. The CPI components were mixed for the month, with some increasing and some decreasing. Notably, shelter prices cooled somewhat but remained a major factor in this month’s inflation reading. We don’t believe these data show enough progress on inflation for the Fed to pause rate hikes in June.

Insights for What’s Ahead

April CPI data showed mixed progress across a variety of goods and services. For instance, food prices were flat for the month but energy prices rose. While shelter prices continued to cool in April this component still accounted for 60% of the inflation reported in the Core CPI. Further relief in this key component of inflation is on the way, but it will take time.

These data, in our view, show insufficient progress on inflation to rule out an additional 25 basis point rate hike in June. Indeed, this is our current forecast. However, May CPI data will be released the day before the next FOMC meeting concludes on June 14, giving the Fed an additional inflation data point to incorporate into its next decision. Regardless of whether an additional hike occurs, we expect the Fed to keep rates above 5 percent through the end of 2023 and into early 2024.

April Inflation Highlights

Headline CPI slowed to 4.9 percent year-over-year in April, vs. 5.0 percent in March. However, in month-over-month terms this topline inflation metric rose to 0.4 percent, vs. 0.1 percent the month prior. According to the BLS, the index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks and the index for gasoline. The energy index rose for the month and the food index was flat.

Core CPI, which is total CPI less volatile food and energy prices, slipped to 5.5 percent year-over-year in April, vs. 5.6 percent in March. The core index rose 0.4 percent month-over-month in April, as it did in March. As was the case with topline CPI, the increases in the core CPI was driven by shelter prices.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy