December CPI Inflation Rises to 40-Year High

12 Jan. 2022 | Comments (0)

The Consumer Price Index (CPI) rose to 7.0 percent year-over-year in December, vs. an increase of 6.8 percent year-over-year in November. This key measure of inflation is now at the highest rate recorded since 1982. Core CPI, which excludes volatile food and energy prices rose to 5.5 percent year-over-year, vs. 4.9 percent in November.

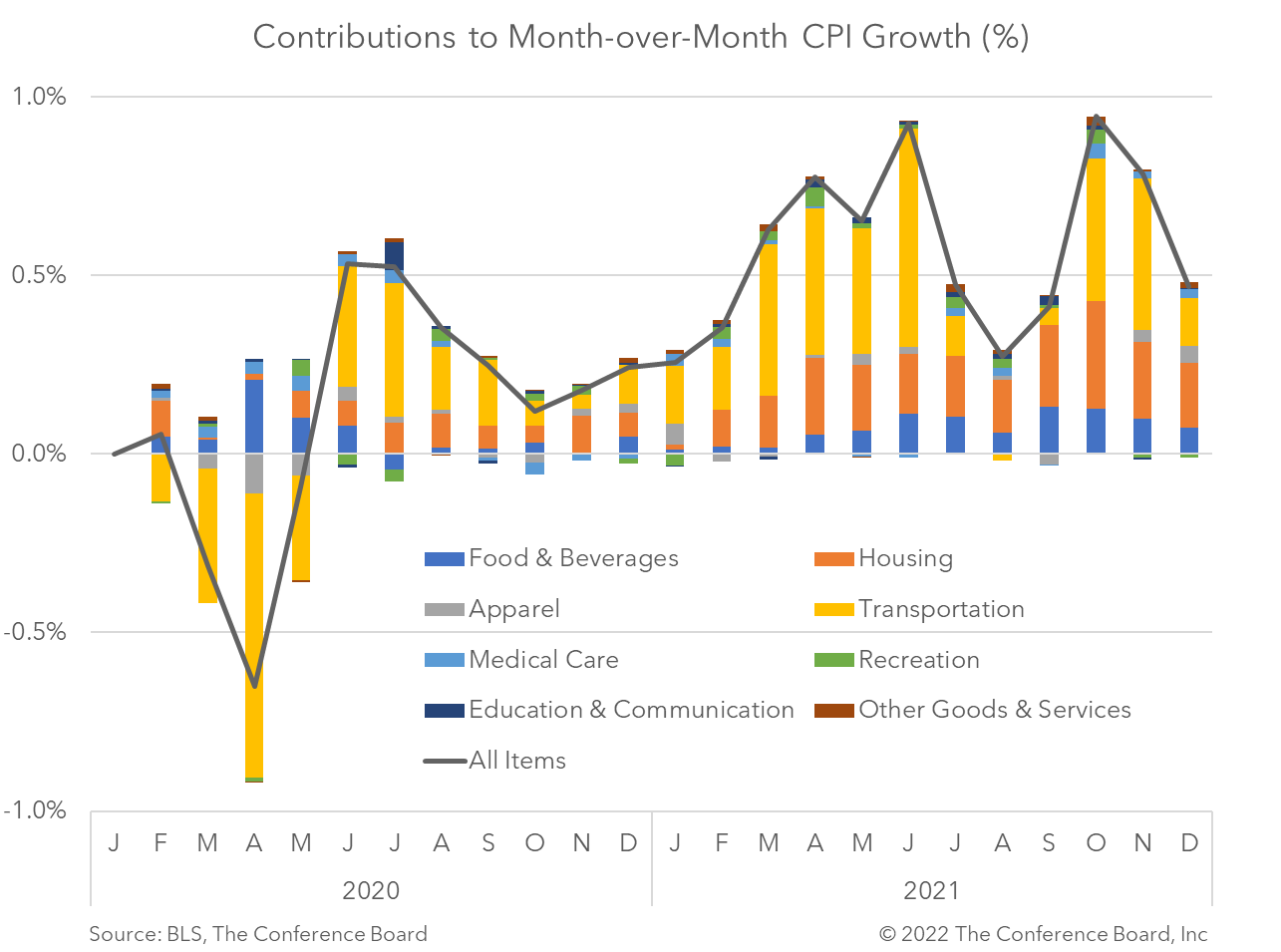

While the year-over-year rate increased for headline CPI, the associated month-over-month rate cooled for a second month (see chart). This shorter-term interpretation of the data remains quite high in historical terms, but suggests that some of the pressures underlying rapid price increases may be moderating. However, recent staffing and supply chain disruptions associated with the surge in COVID-19 Omicron infections may reverse this trend in early 2022.

Housing costs, up 0.44% month-over-month, rose less quickly than in November, but were the largest contributor to overall CPI growth in December. Rents, which were depressed during the worst of the pandemic continued to normalize, rising 0.39% compared to November. Owner’s equivalent rent, which is the rent a homeowner might receive if she rented her house and a 23 percent share of the CPI index, rose to 0.40% month-over-month. Meanwhile, prices for food at home were up 0.42% month-over-month (vs. 0.80 in November) , and the cost of energy, which includes gasoline and electricity, was down 0.39% month-over-month (vs. up 3.47% in December).

The Federal Reserve’s more hawkish tone on inflation remains appropriate. Presently, Fed guidance for 2022 includes the conclusion of QE tapering by March, three or four rate hikes, and potentially some modest runoff of the balance sheet. However, the extent of monetary policy tightening will depend importantly on 1) the evolution of the pandemic’s impact on GDP growth and inflation; 2) the response of businesses and consumers to reduced accommodation; 3) market reaction to tighter financial conditions; and 4) consideration of the effect on the US dollar – a proxy for the influence of Fed actions on other economies.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy