January CPI data show road ahead will be bumpy

14 Feb. 2023 | Comments (0)

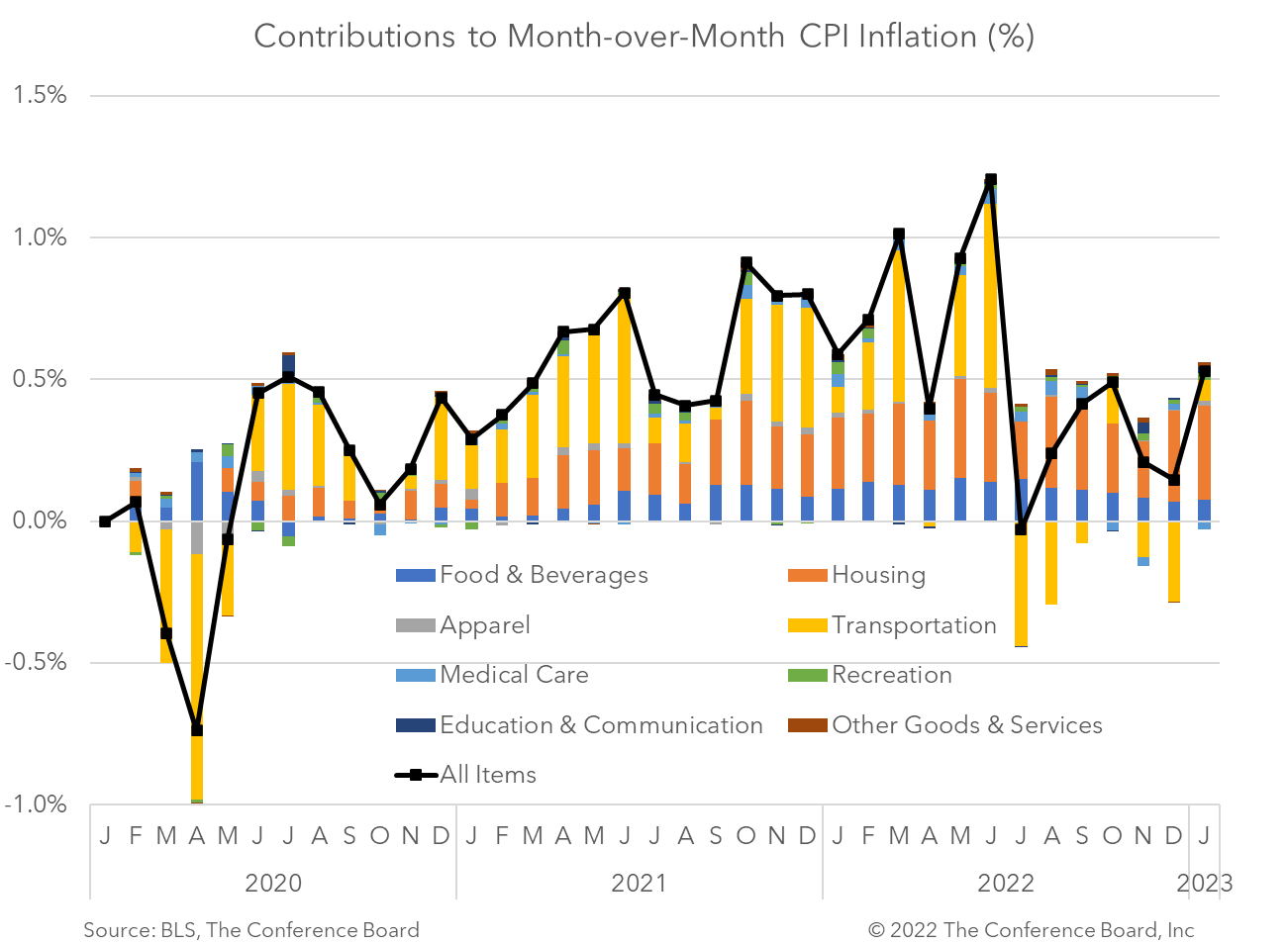

The January Consumer Price Index (CPI) showed that headline inflation increased by 0.5 percent month-over-month while core inflation, which excludes food and energy, rose again by 0.4 percent month-over-month. A spike in shelter prices, along with higher food and energy prices, were responsible for the uptick. Consequently, both total and core inflation remained sticky on a year-over-year basis in January.

Insights for What’s Ahead

- January CPI readings showed an unwelcome increase in inflation during the month. The notable increase in the topline month-over-month CPI was largely associated with continued increases in shelter prices. Fortunately, trends in new rent prices should help to quell this inflation driver in the months ahead—indeed Fed Chair Powell recently said that housing price relief was likely “in the pipeline.”

- Despite the elevated inflation, we continue to expect prices to slowly cool over the course of 2023 and 2024.

- These data do not suggest that the Fed will deviate from its stated goal of hiking interest rates at least two more times. We forecast two more 25 basis points hikes over the next two meetings. Additionally, the Fed will probably not consider rate cuts until 2024.

January Inflation Highlights

Headline CPI slowed to 6.4 percent year-over-year in January, vs. 6.5 percent in December. In month-over-month terms, however, this topline inflation metric rose to 0.5 percent, vs. 0.1 percent the month prior. This was the largest month-over-month increase since October. While the index for shelter accounted for nearly half of the monthly increase, the indexes for food and energy also significant drivers.

Core CPI, which is total CPI less volatile food and energy prices, slowed to 5.6 percent year-over-year in January, vs. 5.7 percent in December. The core index rose by 0.4 percent month-over-month in January, vs. 0.4 in December. While used car prices declined in the month and goods inflation has been slowing, prices for new cars, apparel, and appliances were higher in January. Among services, prices for restaurants and auto insurance continued to climb. Medical costs were also higher in the month.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy