July CPI Shows Continued Progress on Inflation

10 Aug. 2023 | Comments (0)

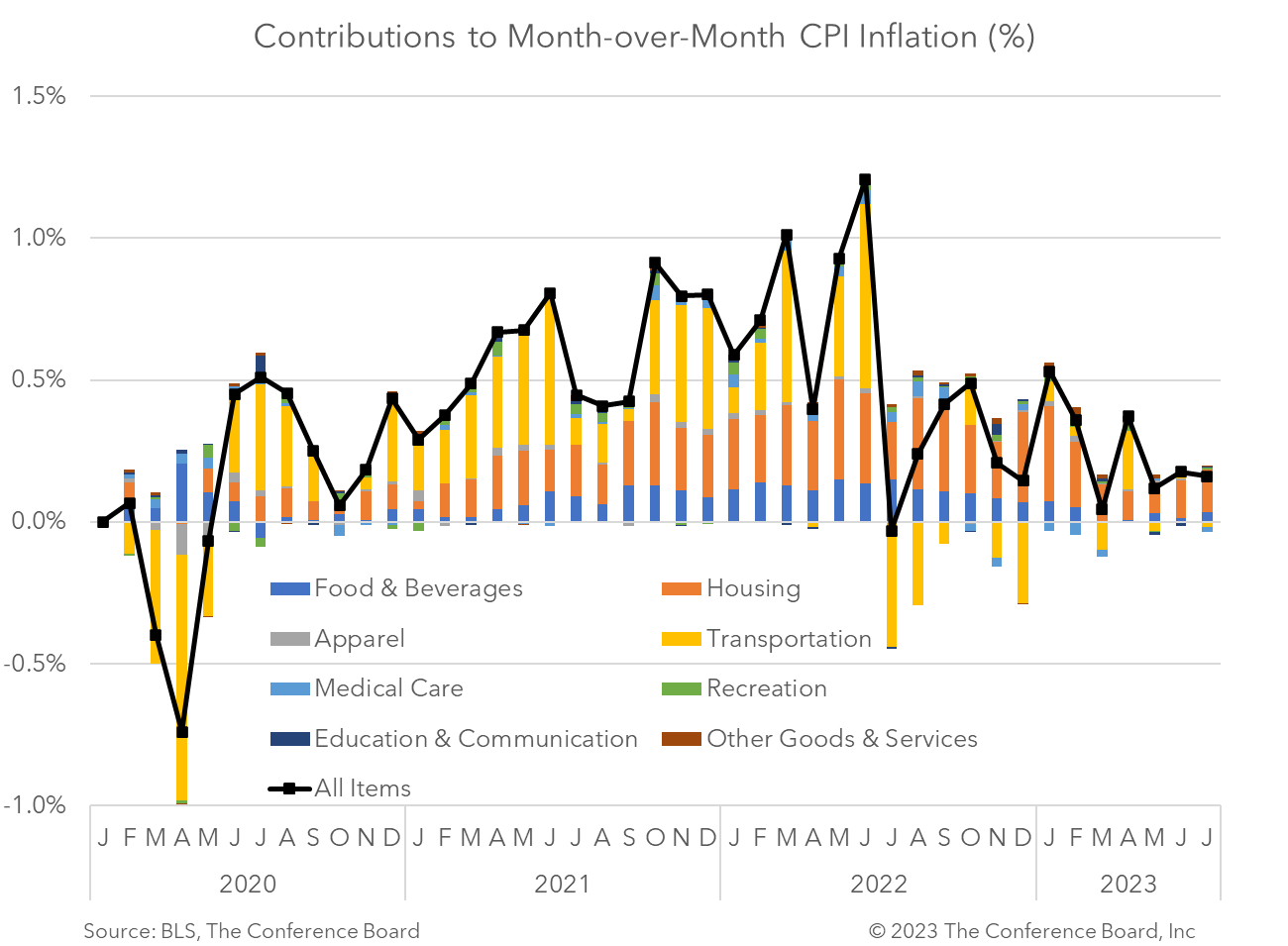

The July Consumer Price Index (CPI) showed that inflation rose 3.2 percent from a year earlier, sharply lower than the peak of 9.1 percent in mid-2022, but up from 3.0 percent in June. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.7 percent in July from a year earlier, the slowest pace since late 2021 and down from 4.8 percent in June.

Base effects drove the topline CPI higher this month—not a reacceleration in inflation. Indeed, month-over-month topline and core CPI rates were both unchanged from June. Inflation data for both June and July are encouraging and indicate that the Fed is seeing some of the results of its monetary tightening campaign. While shelter prices remain elevated and are keeping the overall CPI from cooling further, we expect this to occur over the coming months as new rent prices work their way into the CPI data.

In month-over-month terms, topline CPI rose by 0.2 percent in July, vs. 0.2 percent the month prior. According to the BLS, the index for shelter accounted for 90 percent of this increase. The food index rose by just 0.2 percent for the month and the energy index rose 0.1 percent. Core CPI rose 0.2 percent month-over-month in July, vs. 0.2 percent in June.

The path to the Fed’s 2 percent target is likely to be a long and bumpy one. It is achievable, in our view, but not until late 2024. In an effort to cool inflation and tight labor markets further, we expect the Fed to hike rates one final time later this year. We don’t expect to see rate cuts until perhaps Q2 2024.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy