Inflation eased again in November

13 Dec. 2022 | Comments (0)

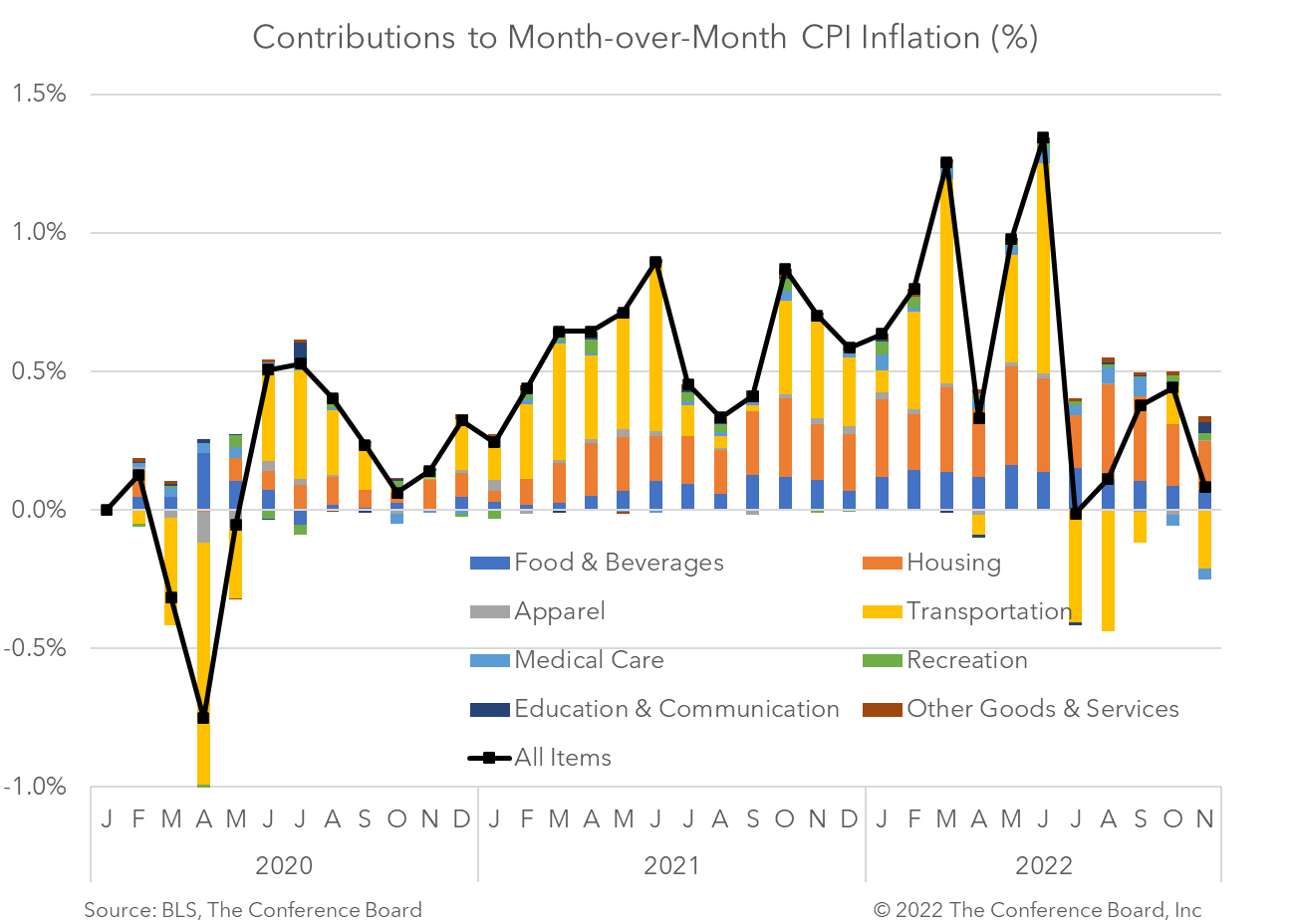

The headline Consumer Price Index (CPI) eased again in November along with Core CPI, which excludes food and energy. While this is welcome news, much work remains to be done to bring inflation down to normal levels. We expect additional interest rate hikes over the coming months and a recession early next year.

Insights for What’s Ahead

- These November CPI readings showed continued relief on inflation and are consistent with our forecast that topline year-over-year CPI peaked in Q2 2022. Still, the readings remain near multi-decade highs. The improvement in the headline reading was fairly broad-based, with many components showing moderating month-over-month price increases or even contractions. However, this progress was partially offset by rising shelter prices.

- We continue to expect the Fed to hike by 50 bp tomorrow, pushing the Fed Funds window to 4.25-4.50 by the end of the year, and then up to 4.75-5.00 percent in early 2023—deep into “restrictive” territory. Even with this degree of monetary policy tightening, key consumer price indexes, specifically the personal consumption expenditure deflator, will likely remain above the 2 percent target (we forecast 2.8 year-on-year) by the end of 2023.

- Borrowing costs will remain elevated in the near-term as the Fed battles inflation. These two forces will weigh on consumer spending and business investment over the next 12 to 18 months and will likely trigger a US recession. Anemic growth and elevated inflation before and after this recession will exhibit stagflationary characteristics.

November Inflation Highlights

Headline CPI slowed to 7.1 percent year-over-year in November, vs. 7.7 percent in October. In month-over-month terms this topline inflation metric slowed to 0.1 percent, vs. 0.4 percent the month prior. Many index components saw price gains moderate for the month, and some (including gasoline and used vehicles) saw prices decline. However, shelter price gains remained high.

Core CPI also moderated in November. The core index, which is total CPI less volatile food and energy prices, rose by 0.2 percent month-over-month in November, vs. 0.3 in October, 0.6 percent in September, and 0.6 percent in August. In year-over-year terms core CPI slowed to 6.0 percent from 6.3 percent in October.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy