Fed Signals Taper and Hikes Sooner – 5 Takeaways and 4 Insights for What’s Ahead

22 Sep. 2021 | Comments (0)

The spread of the Delta variant notwithstanding, FOMC participants are inching closer to removing the monetary policy punchbowl possibly as soon as the November meeting. We provide five key takeaways from the September Fed meeting and what it means for the C-Suite.

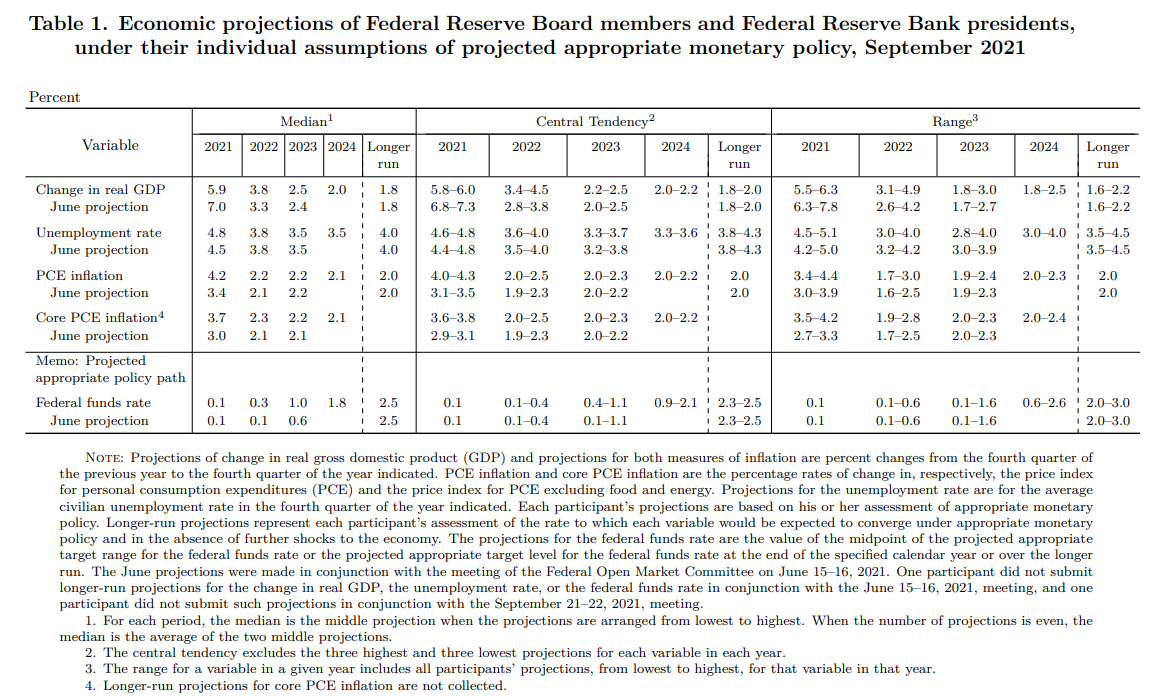

- Despite uncertainty caused by the spike in COVID-19 Delta variant cases, the Fed appears to be generally pleased with the progress of the US economic recovery. FOMC participants stated that economic activity and employment have continued to strengthen in the US, reflecting further progress on vaccines and strong policy (i.e., fiscal and monetary) support. Moreover, Fed Chair Powell confirmed that sectors affected by the pandemic generally improved, even though Delta has slowed some of the progress. Participants did dial down their expectations for 2021 real GDP growth (from 7 percent to 5.9 percent 4Q/4Q) and anticipated that the unemployment rate might land at 4.8 percent by December 2021 instead of 4.5 percent. Nonetheless, the revised forecasts are robust and project confidence that the US economy will continue to improve over the balance of the year. Indeed, the Fed’s Summary of Economic Projections (SEP) forecasts are consistent with those of economists from a September Bloomberg survey (GDP: 5.8 percent 4Q/4Q; Unemployment: 4.9 percent in 4Q 2021), as well as those of The Conference Board (GDP: 5.6 percent 4Q/4Q; Unemployment: 4.8 percent in 4Q 2021).

- FOMC participants raised expectations for inflation, stating that they have been greater and longer lasting than expected, but continue to believe that the drivers are largely transitory. Chair Powell highlighted bottlenecks in supply chains as a major factor in driving prices higher. Indeed, consistent with our own views, the bottlenecks may persist into 2022. The FOMC now projects that total and core PCE inflation will be firmer in 2021 – more in-line with consensus expectations, but there will only be minor overshoots of the 2-percent target in 2022 and 2023. This suggests that the Fed does not anticipate persistence of the current elevated levels of inflation. Importantly, the Fed still views consumers’ long-term inflation expectations to be in-line with the Fed’s 2-percent inflation goals, an important determination for not raising interest rates yet. However, Chair Powell reiterated that should these expectations rise by more than the Fed is comfortable with, then the Fed would act.

- FOMC participants remain constructive on the US economic outlook in 2022 and beyond. Participants raised GDP forecasts for 2022 and 2023, and continued to anticipate above-potential (~1.8 percent) growth in 2024. Indeed, some of the upgrades in estimates reflected likely anticipation that some of the recovery that would have happened this year absent the rise of the delta variant is pushed into next year. Potentially, the upgrade also reflected continued strength in the US expansion as the pandemic comes under control.

- The Fed is coming closer to believing that its dual mandate has been met, warranting the beginning of QE taper likely before end-2021. Policymakers outlined in the monetary policy statement that if progress towards the goals of maximum employment and price stability are met, then moderation in the pace of asset purchases (i.e. Quantitative Easing) may soon be warranted. Chair Powell said that the inflation goal has been more than met, and that the maximum employment test may be deemed to have been met by the November 2021 meeting. Indeed, a “reasonably good” employment report in September would be enough for Powell himself and potentially other FOMC members to agree that that the full employment mandate has been met. Powell stated that some FOMC participants already believe the full employment mandate has been achieved. Moreover, once taper of the $120 billion of large-scale asset purchases begin, the process might extend through the middle of 2022. That pace could be adjusted to be slower or faster depending upon economic conditions.

- Some FOMC participants now anticipate the first rate hike in 2022 instead of 2023, but tapering timing does not carry a direct signal of liftoff. In addition to the strong signal that taper is close at hand, the ‘dot plot,’ which shows FOMC participants’ estimations of when rate hikes will occur, shifted forward. Whereas in the June SEP the majority of FOMC participants anticipated two rate hikes in 2023 with an end-2022 fed funds rate of 0.50 to 0.75 percent, now nine of 18 participants anticipate one rate hike in 2022, raising the rate to 0.25 to 0.50 by end 2022. There would be another two or three hikes in 2023, and three more hikes in 2024, leaving the fed funds rate at 1.75-2.00 percent (midpoint of 1.8 percent in the SEP) by end 2024. This would still be a fairly accommodative stance compared to historical rates. These estimates are by no means an official forecast, but they suggest that members are more comfortable with the state of the US expansion and labor market healing, and potentially less comfortable with the intensity of inflation. Still Powell continued to decouple the timing of the end of tapering with the start of rate hikes, reiterating that there is a higher threshold of economic improvement required for rate hikes than for tapering QE.

Insights for What’s Ahead:

- Businesses should expect higher inflation (e.g., input costs and wages) for somewhat longer as the Fed is declining to raise interest rates in the very near term. Indeed, interest rates are a blunt instrument and the Fed does not desire to upset a robust expansion to address what it views as a temporary spike in inflation. The FOMC’s inflation projections, along with our own, suggest that consumer prices may remain elevated into 2022 as the pandemic continues to stoke demand for goods and labor and disrupt supply chains, but settle back near the 2-percent target by the end of 2022.

- Meanwhile, as a nod to the strength of the US economy presently relative to 2020, the Fed is willing to reduce support for specific asset classes by cutting its Treasury and Mortgage-backed securities purchases. Tapering will reduce the pace of expansion of the Fed’s balance sheet and lessen financial stability risks associated with a sizable balance sheet. Indeed, QE has contributed to asset price inflation, most notably the steady gains in the stock market, and in some cases excessive investor risk taking. Still if the Fed does not communicate the pace of tapering effectively, then there could be another “taper tantrum” where long-term interest rates spike, weighing suddenly on the economic expansion.

- Businesses should expect interest rates to start rising faster than what economists were anticipating heading into the meeting. A September 10 Bloomberg survey of 45 economists projected the first rate hike to occur in 2Q 2023. Now that first hike may be shifted forward into 2022. Interest rate sensitive industries, including insurance companies and pension funds, should benefit from higher rates, while construction, real estate, and any heavily indebted firms may come under pressure.

- Still higher interest rates should not halt the economic expansion if the Fed continues to communicate changes in policy well in advance of any action. Both the Conference Board and the Fed expect robust economic activity over the next three years and continued decline in the unemployment rate. Cooling of inflation pressures next year should also support growth as interest rates tick up to a level that would still be considered tame relative to history.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

0 Comment Comment Policy