Fed holds rates steady, but says more hikes possible

20 Sep. 2023 | Comments (0)

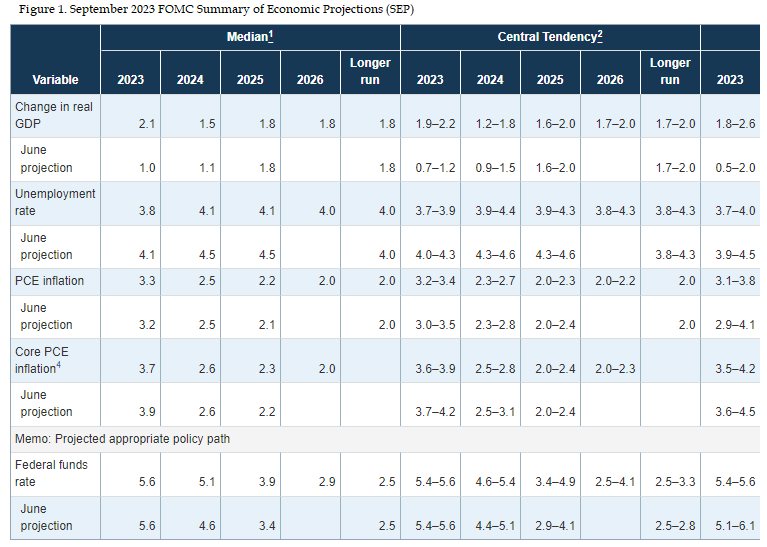

The Fed declined to raise interest rates today, as expected, but signaled that it may continue to tighten in the future. During the press conference, Chair Powell said that the majority of FOMC members think it will be appropriate to raise rates by an additional 25 basis points in either November of December, based on the Summary of Economic Projections (see Figure 1.) He said at this meeting the FOMC decided to hold rates in light of “how far we’ve come.” However, as Powell has said before each meeting in the future will be “live” and influenced by the totality of incoming economic data, as well as cumulative hikes and monetary policy lags.

On economic growth, Chair Powell said that GDP growth in 2023 has been stronger than most economists expected – including the Fed. He noted that a “soft landing” for the economy is still a primary objective, but that it was not necessarily their baseline expectation. He noted that the consumer has been the primary driver of growth this year, in part due to robust household balance sheets. He also emphasized that there is considerable uncertainty about the future and noted recent auto strikes, a looming government shutdown, energy prices, and student loan repayments as important factors for the future.

On inflation itself, Powell said that it remains too high but that progress is being made. He noted that inflation readings in June, July and August were especially encouraging. However, the SEP does not expect to see PCE inflation to fall to the Fed’s 2 percent target until perhaps the 2026. We, on the other hand, think 2 percent will be achieved around the end of 2024.

Finally, on the future of monetary policy Powell said that “as we go into next year, the time will come at some point to cut.” The Conference Board expects this to happen in Q2 2024. However, given that we are more optimistic about inflation getting back to target we expect more monetary loosening than the SEP’s 50 basis points of interest rate cuts.

What were the Fed’s actions?

After implementing 525 basis points in hikes since March 2022, the FOMC elected to hold the federal funds rate window at 5.25 – 5.50 percent in September. Doing so, they argue, will allow the monetary tightening that has already been implemented more time to weigh on the economy. Rates remain deep in ‘restrictive’ territory (anything above 3 percent). The Fed’s “hawkish pause” is likely a way to remain vigilant about inflation and keep market pricing for rate cuts from undoing the work done so far to cool the economy and address high prices. The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet, which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee.

What are the Fed’s expectations for the future?

The Federal Reserve’s September Summary of Economic Projections (Figure 1) anticipates better economic growth ahead than the June SEP. The FOMC projects 4q/4q 2023 GDP growth of 2.1 percent (vs. June SEP of 1.0 percent), 4q/4q 2024 GDP growth of 1.5 percent (vs. June SEP of 1.1 percent), and 4q/4q 2024 GDP growth of 1.8 percent (vs. June SEP of 1.8 percent). We largely agree with the Fed’s 4q/4q 2023 forecast, but expect just 0.7 for 4q/4q 2024 due to our projected recession early next year. The FOMC forecast for inflation was largely unchanged, with 4q/4q 2023 PCE inflation of 3.3 percent, 4q/4q 2024 of 2.5 percent, and 4q/4q 2025 of 2.2 percent. We forecast 2.9 and 2.0 for 4q/4q 2023 and 4q/4q 2024, respectively.

Importantly, the SEP projects that the Fed Funds rate will rise to 5.6 percent by the end of 2023, and then fall to 5.1 percent in 2024 and 3.9 percent in 2025. This implies one additional 25 basis point rate hike by the end of the year, which is consistent with The Conference Board’s projections. Regarding cuts next year, the SEP infers 2 rate cuts while we anticipate several more given our more optimistic inflation forecast.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy