Strength in August retail sales data a mirage?

14 Sep. 2023 | Comments (0)

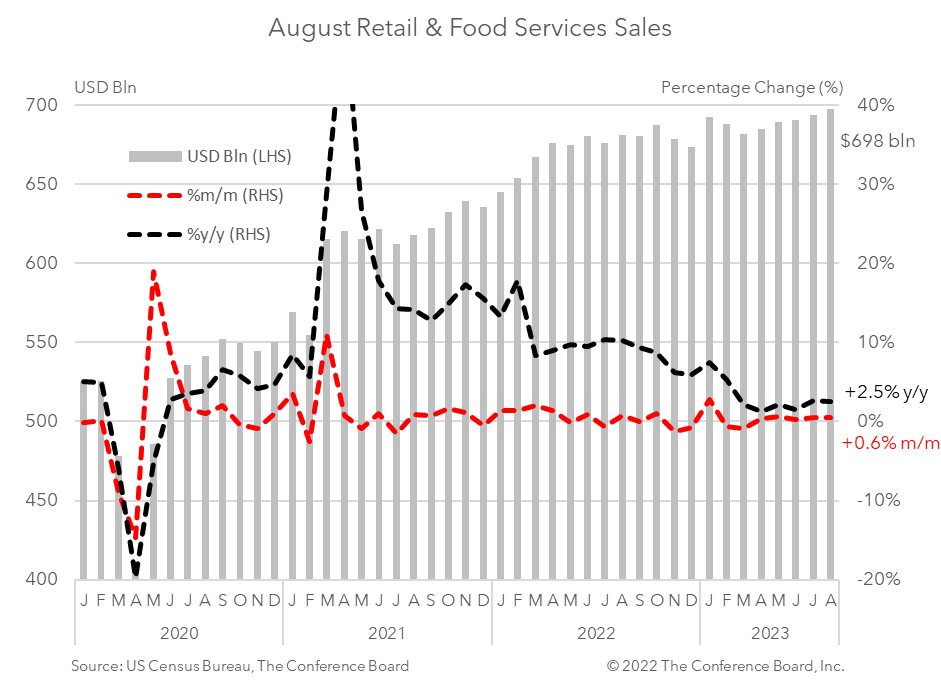

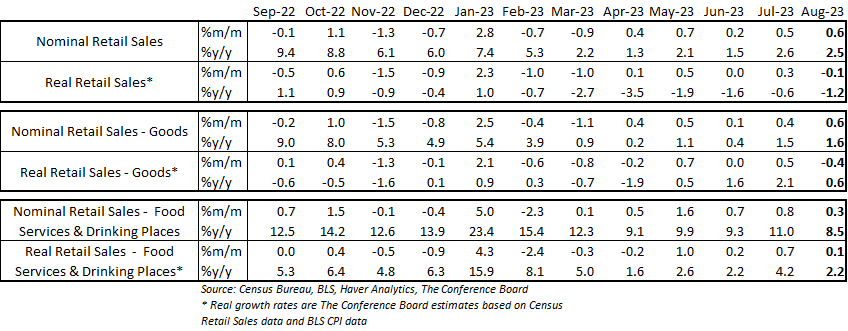

Retail sales rose in August in nominal terms, but contracted after adjusting for inflation. Consumer spending was up 0.6 percent month-over-month (MoM), well above the consensus expectation of 0.1 percent. However, adjusted for inflation, sales were -0.1 percent in the month.*

These data appear to show that some of the strength seen in retail sales may be waning. In addition to the contraction in real retail sales for August, there was a sizable downward revision to the growth rate in July. The corresponding real growth rate, according to our calculations, fell from 0.6% month-on-month to 0.3 percent month-on-month. These changes are consistent with the pull back seen in US Consumer Confidence in August. Consumer spending has been a key driver of economic growth this year. However, we are concerned that slowing income growth, mounting debt, falling savings, and other emerging factors could lead to a sustained pullback in consumer spending and drive the economy into recession in early 2024.

Regarding the drivers of retail sales this month: Consumer demand for goods rose 0.6 percent in August from the month prior in nominal terms. Spending on motor vehicles and parts rose by 0.3 percent in August from July, while retail sales excluding motor vehicles rose by 0.6 percent. Spending at gasoline stations rose 5.2 percent from the month prior due to large increases in oil prices. Building materials sales rose by 0.1 percent. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.1 percent from the previous month. Nonstore retail sales growth was flat from the previous month, the weakest rate seen since March. When adjusting goods spending for CPI inflation, the real growth rate was about -0.4 percent.*

Meanwhile, spending at food services and drinking places rose by 0.3 percent month-over-month in August. After adjusting for CPI inflation the real growth rate was about 0.1 percent.*

* Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy