Consumers Take a Breather in January after Having Stocked Up

14 Feb. 2025 | Comments (0)

Retail sales for January showed consumers pulled back sharply from a robust pace of spending at the end of 2024, which was likely driven by consumers stockpiling in anticipation of potential tariffs. Still, solid fundamentals, namely strong growth in personal income and healthy balance sheets, will likely lead consumer spending to improve in the remainder of Q1.

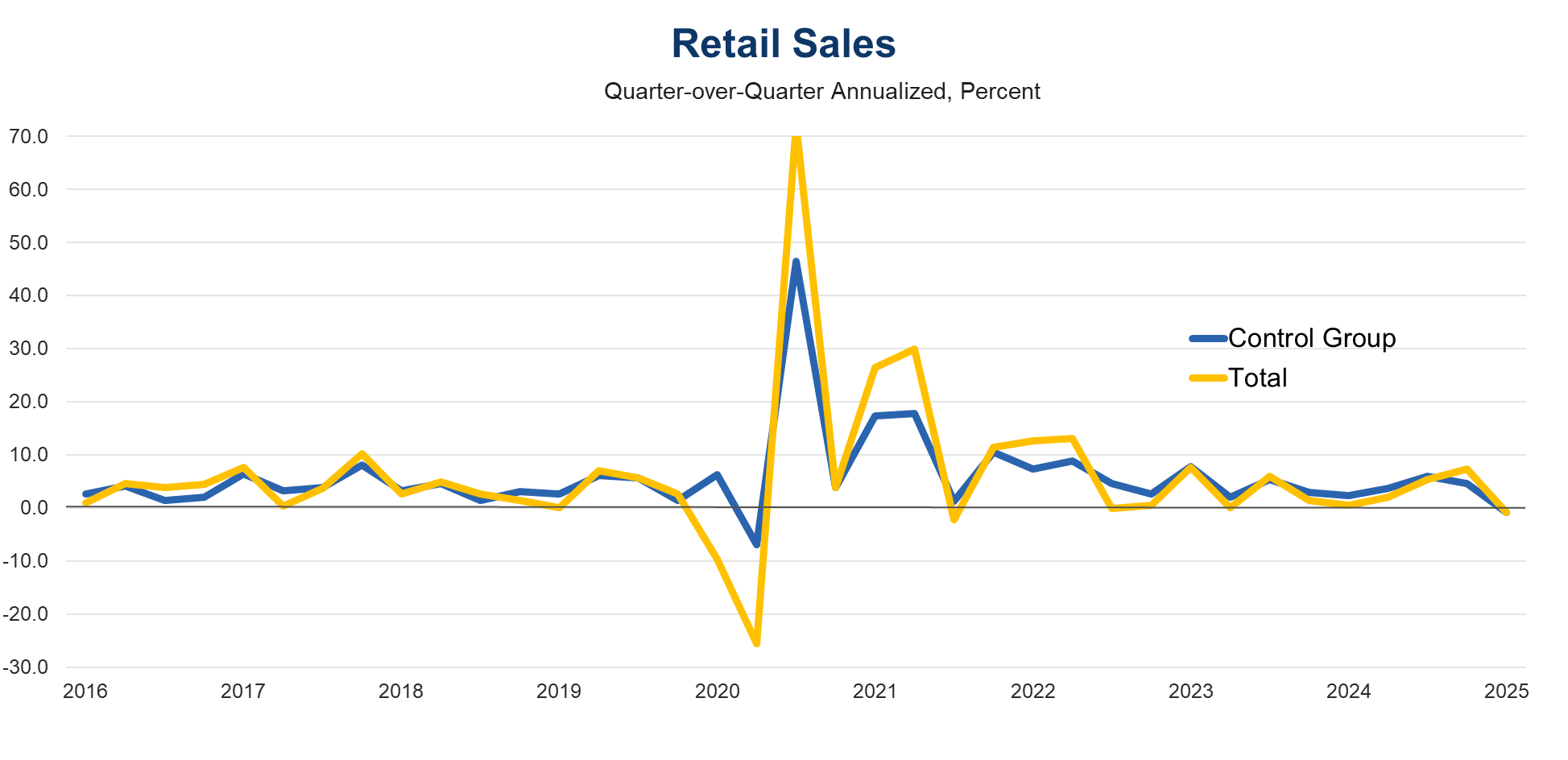

Figure 1. Retail Sales Plunge in January

Sources: Census Bureau and The Conference Board.

Trusted Insights for What’s Ahead®

- Despite the January pullback, we anticipate that strong consumption growth will continue into the beginning of the year, given the recent acceleration in consumer after tax, inflation adjusted income growth.

- While services consumption will likely remain solid, we estimate it will be less robust in real terms as the year progresses. This is because a larger portion of income will be diverted towards more expensive imported goods and necessity services, such as property and auto insurance.

- Continued health in the labor market and sticky inflation suggest the Fed may delay the next rate cut until later this year. We anticipate 25bp of cuts each in July, September and December, which would lower the federal funds rate target range to 3.50-3.75 percent by yearend.

Report Highlights

A broad-based retracement in retail spending may reflect some stockpiling behavior ahead of potential trade wars that borrowed strength from the beginning of the year spending.

Consumers may have anticipated price increases on the back of the proposed policies by the new administration and decided to stockpile ahead of time. While we think the January pullback will likely be reversed in February and March, we nonetheless estimate consumer spending growth will decelerate later this year, in line with overall slowing in economic growth.

Nominal retail sales came in much lower than expected, plunging 0.9 percent month-over-month in January. The consensus was for a 0.2 percent decline. Incorporating upward revisions to December (0.7 percent, up from 0.4 percent prior), the 3-month annualized rate showed a 0.8 percent decline in Q1 based on one month of data (see Figure 1 above). This is a sharp pullback from a 7.4 percent increase on the same basis registered in Q4. We think the data will normalize from this swing over the turn of the year in the coming months.

Control group sales, which exclude cars, gas, food services, and building materials and directly enter the calculation of GDP growth, declined at 0.9 percent annualized in Q1, significantly lower than a 4.6 percent increase in Q4.

Real retail sales, computed by deflating nominal sales by the consumer price index (CPI), plunged by a whopping 1.3 percent in the month, following robust increases of 0.4 percent in both November and December.

The largest declines were evident in auto and on-line sales. Spending on cars was likely, at least partially, affected by frigid weather in large parts of the country, while the pullback in on-line purchases follows robust holiday sales in the previous two months.

In a positive spin, restaurant sales – an incomplete but an early indicator of broader service spending dynamics – increased by 0.9 percent. This potentially suggests consumers continued to spend on discretionary services, even as inflation remains elevated.

-

About the Author:Yelena Shulyatyeva

Yelena Shulyatyeva is a Senior US Economist for The Conference Board Economy, Strategy & Finance Center, where she focuses on analyzing macroeconomic developments in order to better understand the…

0 Comment Comment Policy