Spending and Inflation Rebounded in January

24 Feb. 2023 | Comments (0)

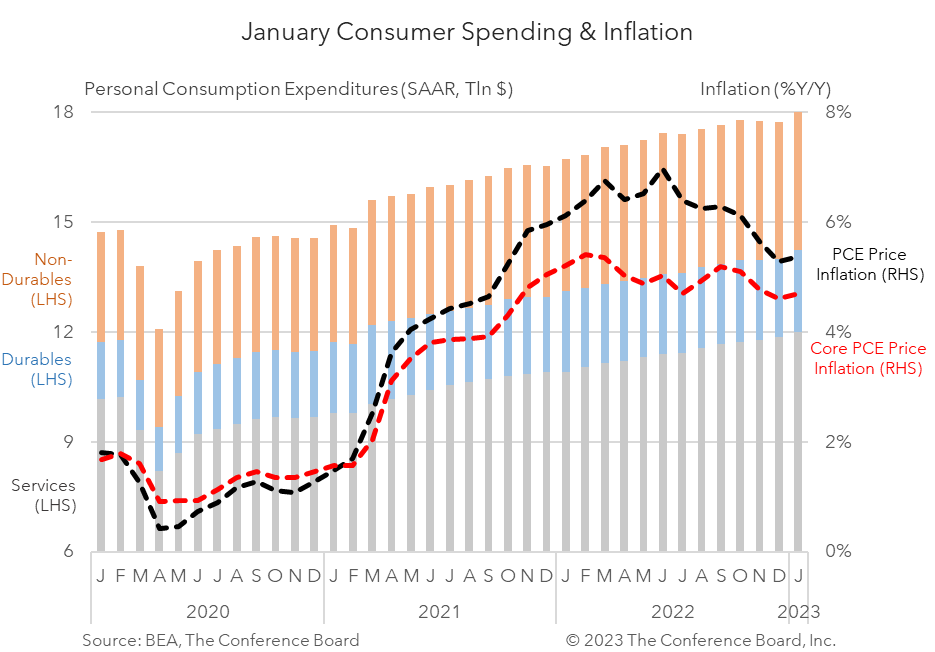

Following spikes in January Retail Sales and CPI data earlier this month, today’s Personal Income & Outlays data also rebounded. Real consumer spending rose by 1.1 percent month-over-month (m/m) following two consecutive months of contraction. Meanwhile, inflation metrics also intensified following months of cooling. Headline PCE price inflation rose to 5.4 percent from a year earlier and jumped to 0.6 percent in month-over-month terms. Core PCE price inflation also spiked. Personal incomes rose by 0.6 percent from the month prior, but were roughly flat in real terms.

Collectively, this report is consistent with other January data that also show a bump in economic activity. However, last month’s favorable weather was a factor that may have influenced consumer behavior. Regardless, the Fed will see these developments as counterproductive and may elect to raise interest rates higher than previous guidance suggested. We are increasing our Fed Funds forecast from two additional 25 basis point hikes to three additional 25 basis point hikes over the coming months. We do not expect the Fed to pivot until 2024.

Inflation

Headline PCE price inflation rose from 5.3 to 5.4 percent year-over-year (y/y) in January and core PCE price inflation (which excludes food and energy) rose from 4.6 to 4.7 percent y/y. On a month-over-month basis, both headline and core PCE inflation rose by 0.6 percent. Services continued to be a driver of overall inflation for the month, but prices for both durable and non-durable goods also spiked following several months of contraction.

Incomes

Overall personal income rose 0.6 percent m/m (in nominal terms) in January, vs. 0.3 m/m percent in December. However, the spike in month-over-month inflation kept the real growth rate roughly flat. Meanwhile savings rates rose to 4.7 percent of disposable personal income.

Spending

Personal consumption expenditure rose by 1.8 percent m/m (in nominal terms) in January, vs. -0.1 m/m percent in December. Spending on services rose by 1.3 percent m/m while spending on goods rose 2.8 percent m/m. However, after accounting for inflation, real consumer spending was 1.1 percent m/m in January with spending on goods rising 2.2 percent m/m and spending of services rising 0.6 percent m/m.

Note: nominal means non-inflation adjusted, while real means inflation adjusted.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy