What If? The Government Shuts Down and/or We Hit the Debt Ceiling

01 Oct. 2021 | Comments (0)

The US Congress is currently locked in discussions on continuing to fund Federal government operations and whether to either raise or suspend the debt ceiling. We have been here before, and it has always worked out—with more or less pain along the way. Indeed, Congress has passed a Continuing Resolution (CR) to fund the Federal government through December 3, 2021. What if come December, we find ourselves on the brink once again? Also, what happens if we hit the public debt ceiling? We explore these possibilities and economic outcomes.

Insights for What’s Ahead

- If Congress comes to a timely and transparent agreement on the budget in December and debt ceiling within the next few weeks, then there should be no material implications on the current outlook for US GDP growth, employment, or global financial markets. Borrowing costs could be somewhat higher for the US over the next year if a period of uncertainty and angst were involved before reaching a resolution. In a worse scenario, these issues might be resolved, but investors may begin to look askance at US Treasury debt as they add to that drama the sizable amount of federal government debt presently and the ongoing risk of another debt ceiling impasse as revenues decline, outlays increase, and interest payments pile up over the next decade, raising political tensions in Washington still further.

- If Congress does not come to an agreement on appropriations, then businesses should expect a partial federal government shutdown that will slow economic activity at the close of 2021 and potentially into 2022. Indeed, not only will government contractors and entities linked to government operations suffer, but permits and patents will be delayed, having a ripple effect for a broader set of firms. Financial firms will also be negatively affected given lack of visibility on tradable data releases and possible delay in the Fed’s plan to taper QE.

- If Congress does not resolve the debt ceiling issue, then businesses should expect default. This would constitute a major hit to real GDP growth affecting government expenditures, consumer spending, and business investment. It would also roil financial markets, potentially sparking a global financial crisis. US borrowing costs might rise exponentially and investors might shun purchases of US Treasury debt. Moreover, US federal government efforts to fight the COVID-19 crisis would be hamstrung, further delaying the global economic recovery from the pandemic.

What are the two issues at hand?

- Budget Impasse: Starting at midnight, October 1, the federal government was poised to lose its authority to fund daily operations. This is because the government is funded through the end of the fiscal year, which closes September 30. Just hours ahead of the deadline, Congress passed a CR to fund the government through early December. However, in December, in the absence of a budget, Congress must pass additional legislation to continue funding of government operations or face a shutdown of “nonessential” agencies and “nonessential” activities within most agencies. The last time that Congress came to an impasse over this issue was in 2018. The shutdown lasted from December 22, 2018 to January 25, 2019.

- Debt Ceiling: Separately, but relatedly, the public debt ceiling is likely to be breached as soon as mid-October by the US Treasury’s estimates and as late as mid-November by a number of other estimates. The statutory debt limit was suspended through July under previous legislation, and since then, the Treasury has been using “Extraordinary Measures” to provide “headroom” under the ceiling. The Treasury is now saying that those options will be exhausted within weeks. At that point, the limit would be breached and a default on US sovereign debt would occur. This means that the US would not be allowed to issue debt to raise cash to finance government operations and finance the deficit. This has never happened before, and so the precise implications are unknown. Technically, it would not halt government operations, because existing law (assuming no shutdown) empowers the government to incur obligations. However, the government would not have the cash to meet is obligations. The uncertainty and confusion, not to mention the inability of the federal government to commit to paying its bills on time, could cause a seizing up of financial markets, which rely on the availability of US Treasury debt. Congress has four choices: 1) suspend the decision on the debt ceiling until a date in the future allowing continued borrowing; 2) raise the debt ceiling to a new level – which has not been done since 2012; 3) repeal (i.e., get rid of) the debt limit; or 4) allow a breach and default.

What are the policy scenarios regarding the federal government funding and debt ceiling debates?

Failing to enact at least a continuing resolution (CR) to fund government operations, and therefore to shut down the government, is perceived as bad politics. Over time, the portions of the government actually shut down have narrowed somewhat; but even so, there is dislocation for the public and a sense of mismanagement. However, it has happened, and fairly naturally has begun a “blame game” in which each side tries to assign the responsibility in the public mind to the other.

As the public mind is perceived to settle on one negotiating side to blame, shutdowns tend to come to an end as that side seeks a face-saving way out. Such an exit from the conflict could come even sooner if either side perceives a settling in the public mind in the final moments before appropriations expire.

The debt ceiling is a complex issue for mass messaging. People think of the debt ceiling as a device to constrain future spending, rather than as an acknowledgment of responsibility for spending that has already occurred under all past presidential administrations (through the obligation to service the accumulated debt from decades gone by). That has encouraged elected officials to try to use default as a political bargaining chip. In every past episode, cooler heads have prevailed in the end, although the Treasury came to a frightening flirtation with default in 2011 before a deal was struck. Thus, there is a tendency to wait until the debt limit comes close—but not too close. Whether today’s policymakers have become emboldened to get even closer to default than they did in 2011 is a question yet to be answered—and one that is important, given the other vulnerabilities of the economy, including the Delta variant and the fragility of supply chains.

What happens if Congress fails to fund the government?

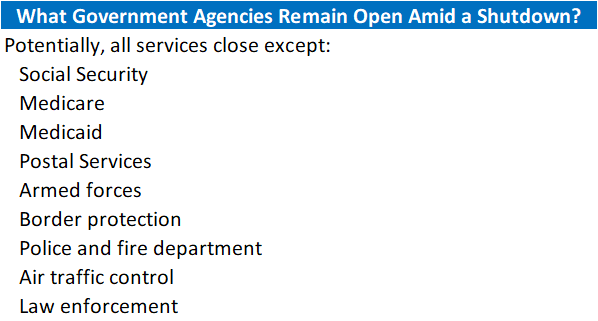

If a continuing resolution is not passed on December 3 to fund the government for several more weeks to allow for further negotiations, or in a better case scenario, an omnibus bill is passed to fund the government over a period as long as the remainder of the 2022 fiscal year, then there will be a federal government shutdown. If no appropriation bills are enacted into law, then there would be a “total” federal government shutdown; many government operations, with the exception of those related to the protection of life, property or safety (which would include the services necessary to process entitlement payments such as Social Security), would be halted. If the Congress were to pass some appropriations bills, but not all, then a partial shutdown would occur in only those agencies whose funding has lapsed. Government agencies have contingency plans in the event of a shutdown.

What will be the fallout of a shutdown?

Recent government budget impasses, even only partial shutdowns, are not without economic and financial market implications. Here we cite several negative externalities:

- Macroeconomic Harm – Inactivity at the federal government level leads to a hit to real GDP growth. During the 2018 federal government shutdown that lasted for five weeks, the Congressional Budget Office estimated that roughly 0.4 percentage point was shaved off of quarterly annualized GDP over the period. Private estimates of the shutdown effects suggested similar degrees of loss, potentially 0.1 percentage point from quarterly GDP growth for each weak of closures. This occurs because the government is not spending or investing on items outside of the designated essential activities. Moreover, businesses that service government entities and employees will be forced to shutdown as well. The impact this time could be somewhat more muted because many firms, especially in-person services, that support the government may be closed or operating at a more limited capacity due to the pandemic.

- Hit to Employment and Wages – Government employees will not be laid off, but will instead be placed on furlough. Their wages lost during the impasse have always been recouped. Importantly, entitlement program payments, including for Social Security and Medicare, would continue to be distributed. However, government contractors and other businesses that support government agencies (e.g., restaurants near a museum) might close temporarily. For hourly workers, this means lost wages and potentially a period of unemployment.

- IRS Woes – The IRS would continue to collect taxes. However, if the government shutdown lingers, then it could delay the start of the 2021 tax filing season, especially if IRS workers deemed essential decline to work. This happened during the 2018 shutdown. A delayed tax filing season start means that families and businesses dependent upon refunds and credits such as the EITC will have to wait longer to file and receive refunds. This also occurred during the 2018 shutdown. Another complicating factor is that shuttering of IRS operations might disrupt issuance of checks being sent to families with children as part of the pandemic stimulus.

- Data Blackout – A federal government shutdown of the federal statistical agencies that collect and publish economic data will require them to close their doors. Specifically, critical updates on public data, including on GDP (from the BEA), inflation (BLS), employment (BLS), and international trade (BEA), as well as high frequency surveys on pandemic conditions for households and firms (Census Bureau), will be delayed. This means that investors within financial markets who depend upon these indicators for trading and benchmarking purposes will be in the dark. This can cause volatility in financial markets, which have been relatively calm this year despite the persistence of the COVID-19 pandemic.

- Fed Tapering Delays – Lack of data might prompt the Fed to slow the course of Quantitative Easing tapering, which is highly likely to begin in November. The upcoming September employment report has special significance as Fed Chair Powell indicated that even a “reasonably good” reading on jobs would be enough to satisfy conditions for drawing down the $120 billion/month large scale purchases of US Treasury securities and Mortgage-backed securities starting in November. But if a shutdown were to occur in December, similar to financial markets, the Fed would also lack full visibility on the evolution of the US economy possibly causing officials to decline any material policy actions like continued tapering during the data blackout period.

What happens if the debt ceiling is not suspended or raised?

According to Treasury Secretary Yellen, the federal government’s debt limit must be raised by October 18 or the US faces the prospect of default. The CBO and private sector forecasts indicate that a breach might be delayed until as late as mid-November. The consequences of this unprecedented situation are unknown. But in all likelihood, if the debt limit is breached, payments for government services would be limited to the inflow of cash, the government would lose its authority to issue Treasury debt, and the US would go into default. Potentially the Treasury might have options including prioritizing government payments (e.g., principal and interest for government securities, Social Security payments, and veterans benefits), although it is unknown whether the Treasury’s payment systems have the capacity to sort among the many claims that come in from all federal agencies every day. Other options include even issuing IOUs sold and traded in private markets, or minting a trillion dollar platinum coin that is deposited with the Federal Reserve to fund obligations. However, these suggestions have largely been rejected by government officials as there are doubts over the feasibility and legality of these options.

In the event of a default, most likely one or more credit rating agencies would downgrade the US sovereign debt rating, which currently stands at or near AAA depending upon the agency. A lower credit rating could mean higher costs for borrowing for the US government when Treasury securities are offered for refundings. Even if the ceiling is not breached, there looms risk of a downgrade and souring of markets on US government debt. During the 2011 debt ceiling debacle, at least one rating agency downgraded the US’ sovereign debt rating, even though a breach never occurred. The Government Accountability Office (GAO) estimated that wrangling over the debt ceiling raised government borrowing costs by $1.3 billion in fiscal year 2011, with continuing incremental increases in costs in subsequent years. The GAO estimated that the 2013 debt ceiling impasse raised borrowing costs over the following 12 months by roughly $38 million to more than $70 million, depending upon the estimate. Not only are borrowing costs for the US government raised in the event of default, but investors might lose interest in US Treasury debt. US debt may no longer be seen as a “safe haven” asset as the full faith and credit of the US would be undermined. Any incremental loss of faith would have financial consequences.

A US government default may have direct implications for borrowing costs for US businesses as well. The creditworthiness of a government, or sovereign, has a direct impact on the perceived risk of any debt-instrument denominated in that sovereign’s currency. Typically, sovereign debt is seen as the least risky debt instrument in a given currency and the rating of this debt creates a ‘ceiling’ that sub-sovereign and private sector debt ratings cannot penetrate. In essence, no debt issued in a specific currency can be less risky than that of the sovereign’s debt – a ‘sovereign ceiling’. In the event that the US government defaults on its debt and its credit rating is downgraded there could be a cascade effect on all other US dollar denominated debt as well. Because of this, borrowing costs for US businesses may rise in the event of a US government default. It has been reported that some financial institutions are required to hold reserves in only the highest-rated securities—which raises an imponderable question of how those institutions—as well as the federal government and Treasury securities—would be affected if Treasury securities would be downgraded to a lower rating. More broadly, the ratings of other institutions and businesses that hold Treasury securities in reserve might suffer a knock-on effect if those Treasury securities in their reserves would be downgraded.

What are the global implications of US sovereign debt default?

A US default on its sovereign debt would also produce negative reverberations around the world. In the immediate aftermath, there would be a massive sell-off in financial markets that might lead to another global financial crisis. Importantly, investors that have been using US Treasuries as collateral for loans would be forced to swap out these securities for a higher quality of debt. Moreover, the sell-off and likely recession would weaken the US dollar. This would have negative implications for economies whose currencies are pegged to the dollar, potentially causing massive bouts of inflation in those markets. A significantly cheaper dollar would reduce the ability of US firms and consumers to buy goods and tradable services from abroad and would increase inflationary pressures, weighing on global trade and thereby global GDP growth. Meanwhile, cross-border transactions that are typically settled in US dollars would become more expensive if the contracts lack anti-default clauses.

Over the longer-run, foreign capital likely would flow away from the United States, as investors would be wary of investing in US Treasuries. This would be quite serious as some of the biggest purchasers of US debt are foreign governments, especially China. Also, the US dollar would run the risk of losing its status as the world’s “reserve currency.” This would lessen the United States’ influence globally, as the dollar is used to facilitate global trade, transactions, and operation of globalized financial markets, and would shake confidence more broadly, in the US’ ability to provide leadership on the world stage, given its problems at home.

-

About the Author:Dana M. Peterson

Dana M. Peterson is the Chief Economist and Leader of the Economy, Strategy & Finance Center at The Conference Board. Prior to this, she served as a North America Economist and later as a Global E…

-

About the Author:Joseph J. Minarik

The following is a biography of former employee/consultant Joseph Minarik is Senior Vice President and Director of Research at the Committee for Economic Development of The Conference Board (CED…

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

-

About the Author:Gurleen Chadha

Gurleen K. Chadha is a former Research Economist at The Conference Board. Based in New York, she was responsible for closely supporting the monthly US forecast and creating high-stake global macro-eco…

0 Comment Comment Policy