Consumer Spending Fell Again in Dec, but Inflation Cooled

27 Jan. 2023 | Comments (0)

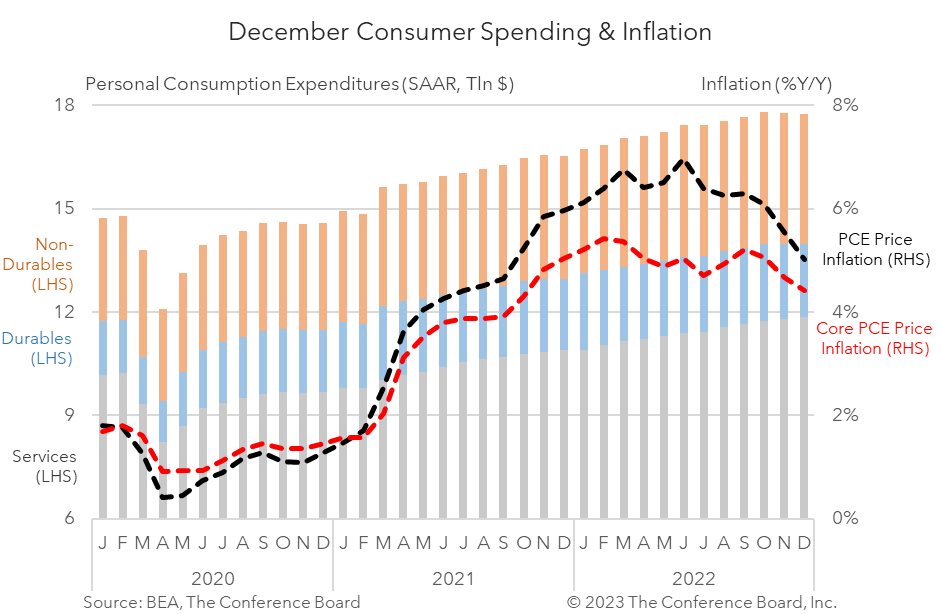

December Personal Income & Outlays data showed a cooling economy. Real consumer spending dropped by -0.3 percent month-over-month (m/m) – its second consecutive month of outright contraction. Meanwhile, inflation metrics continued to cool. Headline PCE price inflation slowed to 5.0 percent from a year earlier and cooled a touch in month-over-month terms. Personal incomes rose by 0.2 percent from the month prior. Collectively, these data will likely be interpreted by the Fed as a sign that monetary policy is working, and we expect it to hike by 25 basis points on February 1st following December’s 50 basis point hike.

Inflation

Headline PCE price inflation fell from 5.5 to 5.0 percent year-over-year (y/y) in December and core PCE price inflation (which excludes food and energy) fell from 4.7 to 4.4 percent y/y. On a month-over-month basis, headline PCE inflation rose by just 0.1 percent, but core PCE inflation rose by 0.3 percent (vs. 0.2 percent in November). While these readings remain well above the Fed’s 2 percent y/y target, progress is clearly being made.

Incomes

Overall personal income rose 0.2 percent m/m (in nominal terms) in December, vs. 0.3 m/m percent in November. Muted month-over-month inflation kept the real growth rate at about 0.2 percent as well. While real personal income growth was consistently negative in the first half of 2022, wage gains have been outpacing price increases for six consecutive months.

Spending

Personal consumption expenditure dropped by -0.2 percent m/m (in nominal terms) in December, vs. -0.1 m/m percent in November. Spending on services rose by 0.5 percent m/m while spending on goods dropped -1.6 percent m/m. However, after accounting for inflation, real consumer spending fell to -0.3 percent m/m in December with spending on goods falling to -1.6 percent m/m and spending of services rising 0.5 percent m/m. We expect personal consumption expenditure growth to fall deeper into negative territory in the coming months driving the US economy into a recession.

Note: nominal means non-inflation adjusted, while real means inflation adjusted.

-

About the Author:Erik Lundh

Erik Lundh is Senior Global Economist for The Conference Board Economy, Strategy & Finance Center, where he focuses on monitoring global economic developments and overseeing the organization&rsquo…

0 Comment Comment Policy